cemagraphics

By Ed Tom

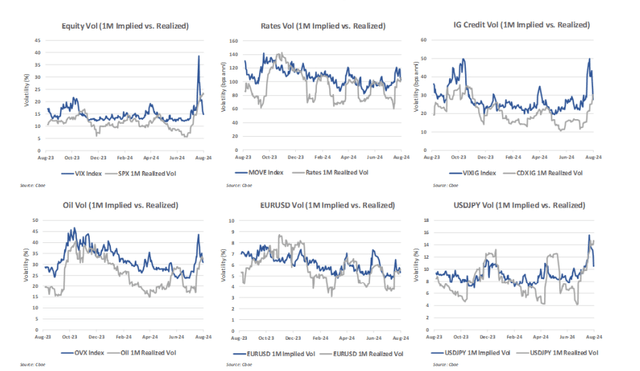

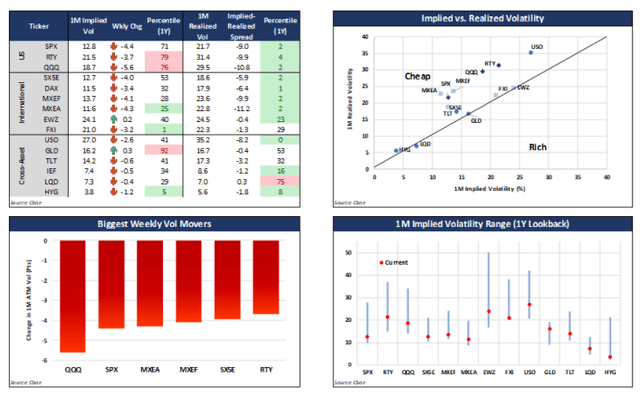

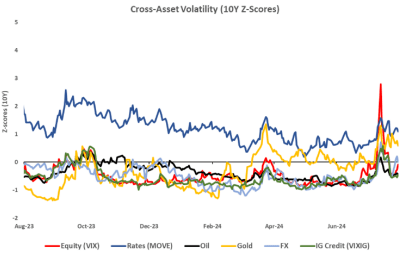

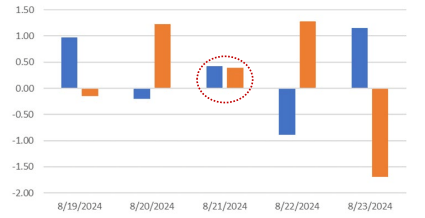

Cross-Asset Volatility: Cross-asset implied volatilities were mixed and mostly little changed following Jackson Hole as traders shifted away from inflation concerns towards the evolving “data-dependent” employment outlook to gauge the timing and pace of Fed rate cuts. The rates market was little surprised by Powell’s speech and accordingly, the probability for rate cuts going into year-end has remained relatively stable pre vs postconference while interest rate volatility declined slightly. (MOVE Index -3 nms to 105 bps vol.) The increased likelihood of US rate cuts, however, has continued to fuel an unease in the FX markets, causing FX vols to bounce back to 94th percentile highs as the USD continues to plummet to one-year lows against the major global currencies.

Exhibit 1: FX Volatilities Rise as USD Plummet Continues

Source: Cboe

Equity Volatility: The three most actively traded US broad market benchmarks decoupled from their respective volatility counterparts last week as quantified by the following week-over-week changes:

• S&P-500® Index +1.45%, The VIX® Index +1.06 pts

• Russell 2000℠ Index +3.58%, RVX Index +1.85 pts

• Nasdaq-100 Index® +1.09%, VXN Index +1.17 pts

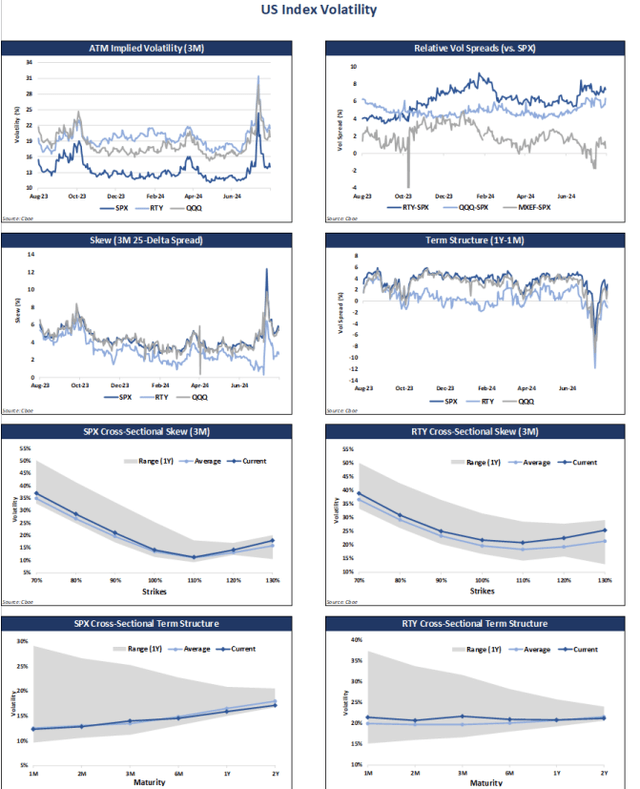

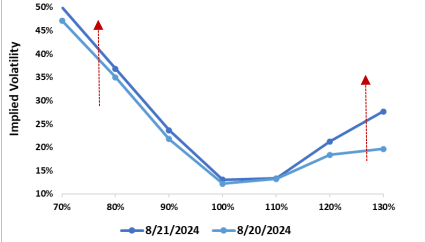

In most cases, this counterintuitive and relatively unusual occurrence is primarily caused by a repricing of risk and manifests as a lift in the entire equity volatility surface. The main cause of last week’s decoupling, however, was likely precipitated by a bid for both upside and downside convexity (i.e., deep out the money options) in the days leading up to Jackson Hole.

This phenomenon can best be illustrated by examining the behavior of the S&P implied volatility skew as it evolved from Aug 20 to Aug 21 during which the S&P Index rallied 0.42% but the VIX Index (VIX) rose by 0.39 pts (see Exhibit 2). As shown in Exhibit 3, while the S&P volatility surface as represented by at-the-money implied volatilities lifted slightly as the market rose, what drove the increase in the VIX, RVX, and VXN indices was the bid for the DOTM wings of the skew. We currently observe this bid for convexity in all standard expiry contracts for S&P, R2000, and NDX volatility surfaces leading into the November US Presidential elections. During the last 2 trading sessions, at-the-money implied volatilities have been “behaving normally” and have traded sticky strike as per the repriced skew surface.

Exhibit 2: S&P Index Up, VIX Index Up …

Skew: The net effect of the increased demand for convexity has been a 0.5% vol pt steepening in short-dated (1M, 25-delta) SPX skew. This steep skew (82nd percentile high) is in turn likely to stabilize vol of vol as we head into the long Labor Day weekend.

Exhibit 3: … Due to a Bid for the Wings of the Skew

Source: Cboe

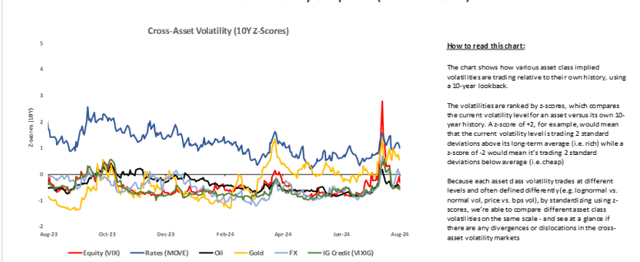

Cross-Asset volatility monitor

Cross Asset Volatility Snapshot (10Y Lookback)

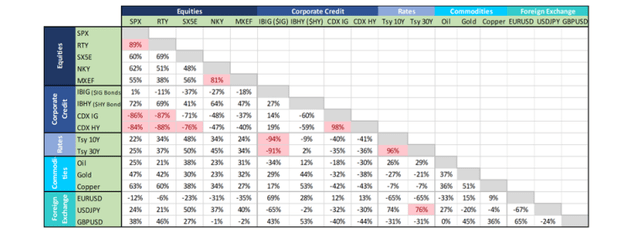

Cross Asset Correlation Matrix (1M)

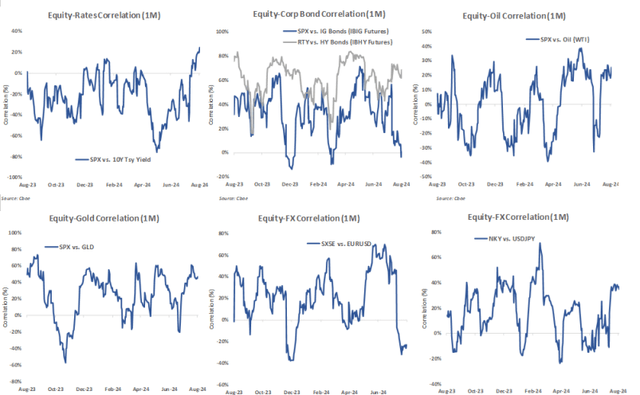

Cross Asset Correlation Analysis

Macro Equity Volatility

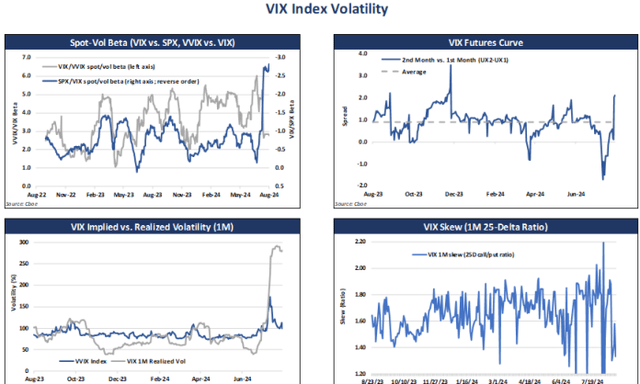

VIX Index Volatility

US Index Volatility

Disclaimers:

The information provided is for general education and information purposes only. No statement provided shouldbe construed as a recommendation to buy or sell a security, future, financial instrument, investment fund, or otherinvestment product (collectively, a “financial product”), or to provide investment advice.

In particular, the inclusion of a security or other instrument within an index is not a recommendation to buy, sell,or hold that security or any other instrument, nor should it be considered investment advice.

Past performance of an index or financial product is not indicative of future results.

The views expressed herein are those of the author and do not necessarily reflect the views of Cboe GlobalMarkets, Inc. or any of its affiliates.

There are important risks associated with transacting in any of the Cboe Company products or any digital assetsdiscussed here. Before engaging in any transactions in those products or digital assets, it is important for marketparticipants to carefully review the disclosures and disclaimers containedat: https://www.cboe.com/us_disclaimers/

These products and digital assets are complex and are suitable only for sophisticated market participants. Incertain jurisdictions, including the United Kingdom, Cboe Digital products are only permitted for investmentprofessionals, certified sophisticated investors, or high net worth corporations and associations.

These products involve the risk of loss, which can be substantial and, depending on the type of product, canexceed the amount of money deposited in establishing the position.• Market participants should put at risk only funds that they can afford to lose without affecting their lifestyle.

© 2024 Cboe Exchange, Inc. All Rights Reserved.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.