PM Images

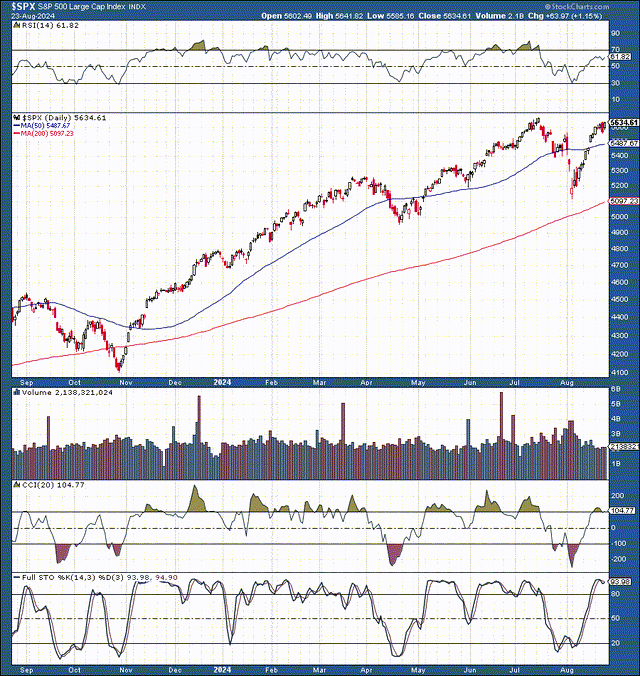

The S&P 500 “SPX” (SP500) has had an excellent rebound, recovering most of its losses from the grizzly selloff in July and early August. We discussed staying calm during the market panic and that the early August capitulation-style selling was a buying opportunity instead of a sign to sell. Another fascinating element was the VIX, jumping to its highest level in years on news of a possible growth scare.

The SPX: 1-Year Chart

SPX (StockCharts.com | Advanced Financial Charts & Technical Analysis Tools)

The SPX became highly overheated and needed to cool off. It went through a textbook technical 10% correction and then experienced a sharp V-shaped recovery. Also, we should consider that many market-leading stocks became significantly overbought after the late 2023 and 2024 rally.

Therefore, we needed most stocks to pull back technically and have their frothy valuations reset as well. Now that we’ve seen considerable corrections and valuation adjustments in many market-leading companies, we can focus on the factors that could propel stocks to new ATHs in H2.

The Fed’s transition to a more accessible monetary policy is a substantial catalyst for higher stock prices. However, we also need inflation to continue moderating without transitioning into deflation. The labor market must avoid deterioration, and corporate profits must stay in line or exceed the consensus estimates. We also need the AI growth engine and other pockets of the economy to continue expanding.

This constructive economic dynamic could enable the current bull cycle to continue expanding, leading the SPX and other major averages to new ATHs. Due to the solid fundamental backdrop and the improving technical image, I am adjusting my year-end SPX target slightly to 6,200 from the 6,000-6,200 range.

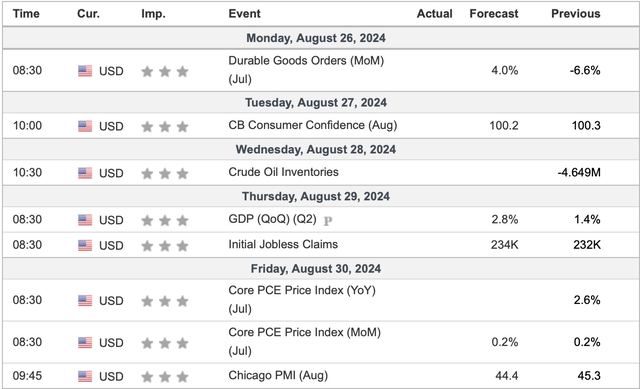

Crucial Data Week Ahead: Core-PCE Friday

Data (Investing.com – Stock Market Quotes & Financial News)

We have a heavy economic data week. We kick off Monday with durable goods orders. On Tuesday, we will get another gauge of the consumer via the CB consumer confidence reading. On Wednesday, the market will receive the oil inventories. We will get the Q2 GDP reading on Thursday, and most importantly, on Friday, the market will receive the crucial inflation reading (core-PCE).

We need these crucial data points to remain around the estimates (not significantly lower). Since the market anticipates at least a 25Bps rate cut in September, “bad news” is not considered good news anymore. The greatest threat to market stability now is the risk of economic deterioration, which could lead to a recession instead of the soft landing scenario we want.

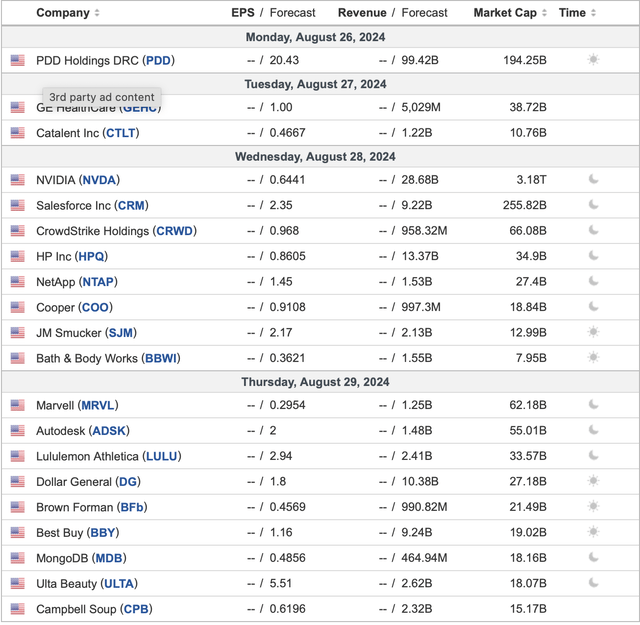

Nvidia’s Earnings Are On Deck

Earnings (Investing.com – Stock Market Quotes & Financial News)

While the broader earnings season is behind us, one of the most critical earnings announcements (possibly ever) is on deck. Nvidia (NVDA) is set to report its highly anticipated earnings after the bell on Wednesday. The primary reason why this earnings report is so crucial is that it should provide an essential glimpse into the AI market’s growth.

Nvidia has been and continues to be the AI leader, and we must see an excellent earnings announcement with solid guidance to justify the continuation of the momentous AI run. In addition to Nvidia, other interesting reports will come from PDD Holdings (PDD), Salesforce (CRM), and CrowdStrike (CRWD) this wee

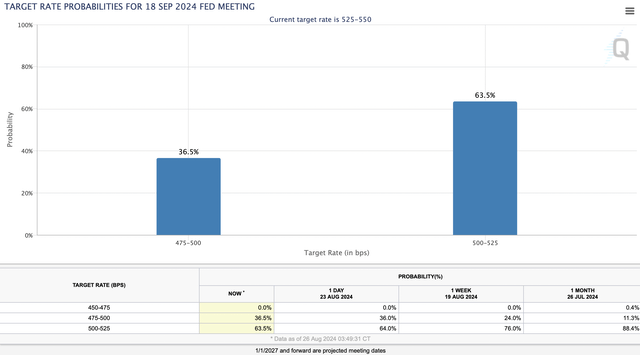

September Is Almost Here

Rate probabilities (CMEGroup.com)

September is approaching swiftly, and there is no more debate on whether there will be a rate cut next month. Instead, the discussion now is whether it will be 25 or 50 Bps. While there is about a 64% probability we will see only a 25 Bps cut, there is about a 37% chance that the Fed will cut by 50 Bps. In my view, the initial cut is less important.

The critical takeaway is that the Fed is embarking on an easing policy that may implement various tools and may last for years. There is also a considerable probability that the Fed will have to “tolerate” higher inflation, likely well above its 2% target rate, as the easing cycle progresses.

Ultimately, this dynamic should be favorable for stocks and other risk assets as there should be more liquidity in the market, which will lead to economic expansion and improved growth. Moreover, the excess capital should look for a favorable place to flow into, and high-quality stocks likely provide a much better alternative than low yielding bonds and other low yielding investment vehicles, especially considering the likely higher inflation environment the economy could be in the coming years.

Multiples Could Continue Expanding

Often, I hear the argument that multiples are so high that stocks must be on the edge of a cliff. However, this may not be the case. We should look at the big picture, as it depends on what kind of economic environment we are considering here. For instance, when looking back on the 2021 bull market peak period, we witnessed relatively high valuations, with the market heading into a tightening cycle and a possible recession.

Whether we had a recession recently is debatable, but we clearly saw a substantial economic slowdown, which was due to high inflation and the tightening monetary policy from the Fed. Therefore, due to slower growth and lower earnings, multiples contracted, and many stocks declined by 30-50% or more during the 2022 bear market.

I say it is debatable because we saw two consecutive quarters of negative growth in 2022. Yet, for whatever reason, it was not called an “official recession.” Moreover, if we had excluded additional government spending, the decline would have been substantially worse, especially in Q2 2022. This dynamic, technically, constitutes a shallow recession, and the additional government spending can be perceived as a GDP manipulation tactic. Nonetheless, you can’t fool the market, which is why we had about a one-year-long bear market in stocks.

Now, we have a much different market dynamic. Instead of being at a low in the interest rate cycle and around a high point relative to inflation, the market is at a high in the interest rate cycle and is likely around a low point relative to inflation. This dynamic implies that growth should improve and could increase considerably as more liquidity and confidence return to the market. Thus, we could see multiples expand, leading to substantially higher stock prices in future years.

Currently, the SPX has a forward P/E ratio of about 23, and the Nasdaq 100 is around 30. While this may appear high relative to historical standards, historically, the Fed is not about to embark on a potentially massive easing cycle, and historically, bonds and other investment vehicles made sense relative to stocks.

Owning 2-3% yielding bonds may not make much sense if inflation is around 3-4% in future years. Therefore, more capital should flow toward stocks, likely enabling multiples to expand. Due to this constructive dynamic, I’ve adjusted my year-end SPX target to 6,200 from a previous 6,000-6,200 range.