Vincent Besnault

Over the past decade, experiential real estate has become more attractive to real estate companies, in large part due to the threat of e-commerce. Online retail has caused brick-and-mortar centric businesses to enhance the in-store experience and improve customer engagement.

Some examples include cleaner store layouts, in-store loyalty perks, in-store events, customer feedback stations, and technology to streamline the BOPIS (buy online, pick up in-store) experience.

Experiential properties tend to be unique. Rather than a fungible property that could serve the needs of multiple retailers, experiential properties are often customized with a specific industry in mind.

Examples include zoos, museums, movie theaters, car washes, and golfing ranges. These properties are experiential and cannot be duplicated online, but normally have the disadvantage of being a custom build and not easily leased to tenants in other retail sectors.

So experiential properties can be a double-edged sword. A good example of this is movie theaters that have yet to fully recover from the pandemic.

But on the flip side, a property can be so unique that it has exclusivity and becomes practically irreplaceable. A good example of this is Caesars Palace on the Las Vegas Strip.

When it comes to experiential real estate, I think the gaming industry is the ultimate category. Online gambling has picked up steam recently, but the experience of going to an iconic casino in Atlantic City or Las Vegas cannot be duplicated online.

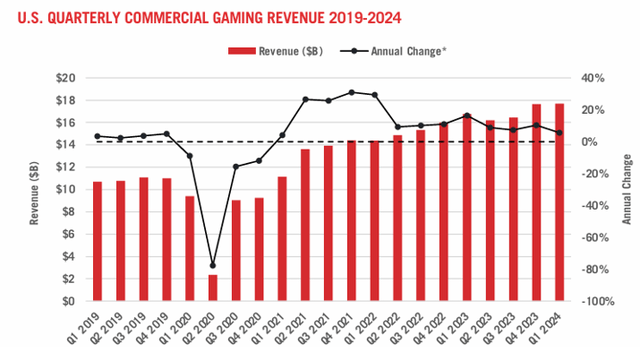

According to the American Gaming Association (“AGA”), revenues combined from land-based casinos, online gaming, and sports betting reached $17.67 billion in 1Q-24, which represents a 5.6% year-over-year increase. 1Q-24 was the 13th consecutive quarter with year-over-year growth and marks the highest grossing quarter in the history of the U.S. commercial gaming industry.

Today, I want to look at a couple of real estate investment trusts, or REITs, that are primarily focused on gaming properties. In addition, we examine one well-known REIT that has been investing in the gaming space over the last several years.

Gaming and Leisure Properties, Inc. (GLPI)

GLPI is an internally managed gaming REIT that was formed as a result of a spin-off from PENN Entertainment (PENN) in 2013.

The company specializes in the acquisition, financing, and management of properties leased to gaming operators on a long-term, triple-net basis. Triple-net lease arrangements are beneficial to the landlord because the tenant is responsible for most property expenses, including taxes, insurance, and maintenance.

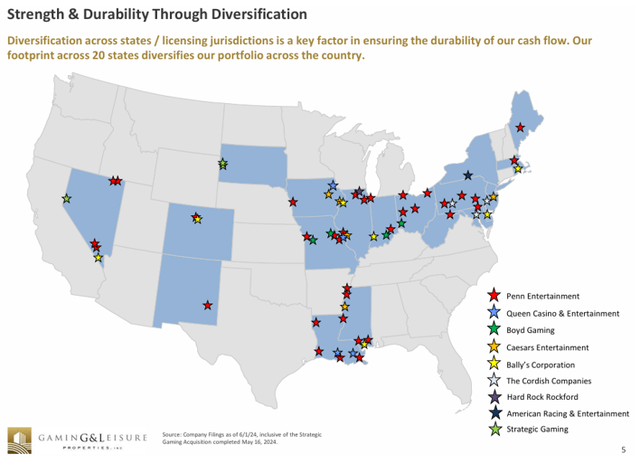

GLPI has a market cap of approximately $13.6 billion and a 29.3 million SF portfolio comprising 65 gaming properties, 6.4 thousand acres of land, and nearly 15,000 hotel rooms across 20 states. The company is the first publicly traded REIT in the U.S. to focus exclusively on gaming properties and currently owns the largest number of gaming assets in the country.

Some of the company’s leading properties include:

- Ameristar Black Hawk (#1 casino in Colorado)

- Ameristar Kansas City (#1 casino in Kansas City)

- Ameristar St. Charles (#1 casino in St. Louis)

- Hollywood Casino at Penn National Race Course (#1 casino in central PA)

- Ameristar Vicksburg (#1 Casino in Central Mississippi)

- L’Auberge Baton Rouge (#1 Casino in Baton Rouge).

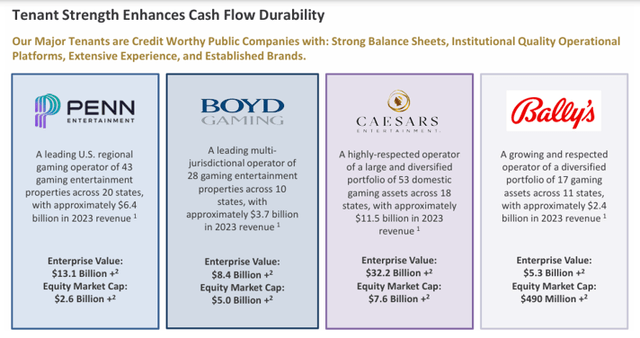

The gaming REIT has high tenant concentration but receives 87% of its rent from companies that publicly report their financials. Additionally, it collected 100% of its rents during the pandemic, which displays the strength of its tenants.

Some of its largest tenants include PENN Entertainment, Boyd Gaming (BYD), Caesars Entertainment (CZR), and Bally’s Corp. (BALY).

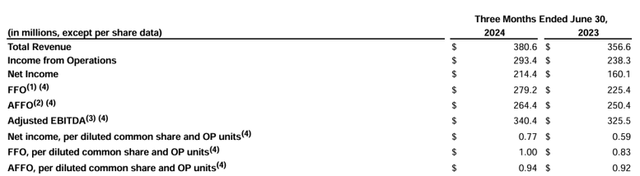

GLPI released its 2Q-24 operating results in July and reported total revenue during the quarter of $380.6 million, compared to total revenue of $356.6 million in the second quarter of 2023.

Funds from operations (“FFO”) during the quarter was reported at $279.2 million, or $1.00 per share, compared to FFO of $225.4 million, or $0.83 per share in 2023. Adjusted FFO, or AFFO, was reported at $264.4 million, or $0.94 per share, compared to AFFO of $250.4 million, or $0.92 per share in 2Q-23.

Additionally, the company increased its AFFO guidance for 2024 to range between $3.74 and $3.76 per share, which at the mid-point would represent year-over-year AFFO per share growth of 2%.

The company has had a cross-over investment grade status since 2018 with a BBB- credit rating from S&P Global and a Ba1 from Moody’s. It has done an excellent job deleveraging its balance sheet over the past several years, with its net debt to EBITDA ratio improving to 4.5x in 2023, compared to 6.3x in 2018.

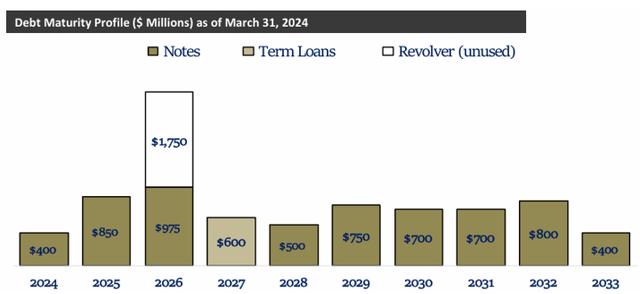

The company’s debt maturities are well-staggered and all of its debt is unsecured. Most importantly, it can easily meet its interest payments with a EBITDA to interest expense ratio of 4.27x.

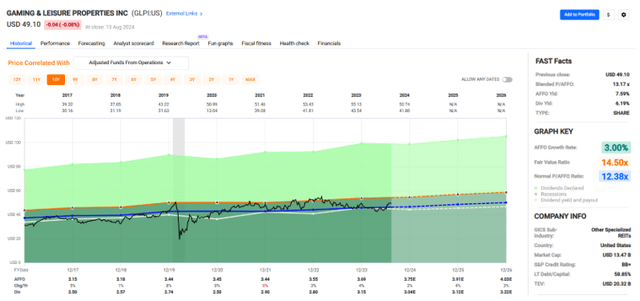

Since 2017 the company has had an average AFFO growth rate of 3.00% and an average dividend growth rate of 4.98%. Analysts expect consistent and steady growth with AFFO per share projected to increase by +2% in 2024, by +4% in 2025, and then by +3% in 2026.

GLPI pays a 6.19% dividend yield that is covered with a 2023 AFFO payout ratio of 85.37% and the stock is trading at a P/AFFO of 13.17x, compared to its average AFFO multiple of 12.38x.

We rate Gaming & Leisure Properties a Buy.

VICI Properties Inc. (VICI)

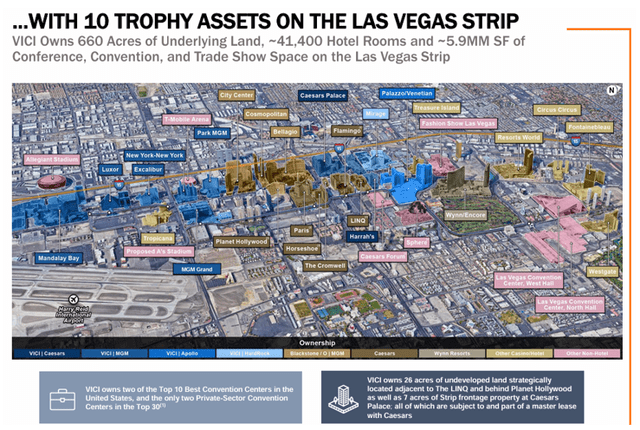

VICI is an experiential REIT with a focus on gaming, entertainment, and hospitality properties. Its portfolio includes 93 assets which includes iconic trophy properties such as The Venetian, Caesars Palace, and MGM Grand, all three of which are located on the Las Vegas Strip.

The company has a market cap of approximately $33.1 billion and a 127 million SF portfolio made up of 54 gaming properties and 39 other experiential properties located across the United States and Canada.

VICI’s 39 other experiential properties (non-gaming) are primarily bowling alleys that it acquired from Bowlero in 2023.

The company’s 54 core-gaming properties contains more than 4.0 million SF of gaming space and features over 60,000 hotel rooms, roughly 500 restaurants, bars and nightclubs, and approximately 6.7 million SF of convention & meeting space.

VICI owns gaming properties across the U.S., but its core market is Las Vegas where it owns properties such as Mandalay Bay, Excalibur, Harrah’s and Luxor. Additionally, the company owns 26 acres of land next to Planet Hollywood as well as 7 acres adjacent to Caesars Palace.

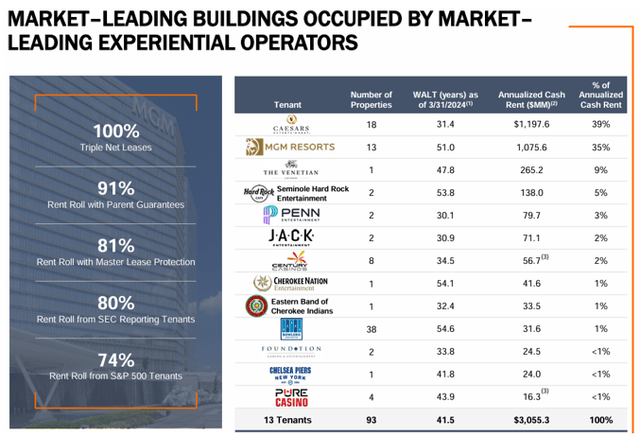

Like Gaming & Leisure Properties, the company structures its leases on a triple-net basis and has high tenant concentration. VICI has 13 tenants, but roughly 74% of its annual rent is generated by Caesars and MGM Resorts.

Although VICI has high tenant concentration, its tenants are very well capitalized and have extremely long lease terms, with a weighted average lease term of 41.5 years when including all renewal options.

To illustrate the strength of VICI’s tenant base, the gaming REIT has enjoyed an 100% occupancy rate and has collected 100% of its rent since it was formed in 2017.

VICI released its 2Q-24 operating results in late July and reported total revenue of $957.0 million during the second quarter, compared to revenue of $898.2 million in the same period last year, representing a year-over-year increase of 6.6%.

FFO during 2Q-24 came in at $741.3 million, or $0.71 per share, compared to FFO of $690.7 million, or $0.69 per share in the second quarter of 2023 while AFFO was reported at $592.4 million, or $0.57 per share, versus AFFO of $540.4 million, or $0.54 per share in 2Q-23.

The change in AFFO on a per-share basis represents year-over-year AFFO growth of almost 6%.

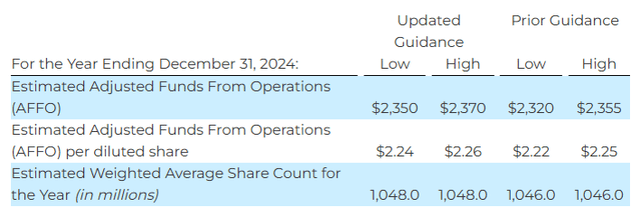

VICI also increased its 2024 guidance for AFFO per share to range from $2.24 and $2.26 per share. At the mid-point, AFFO per share expected in 2024 represents a year-over-year increase of roughly 5%.

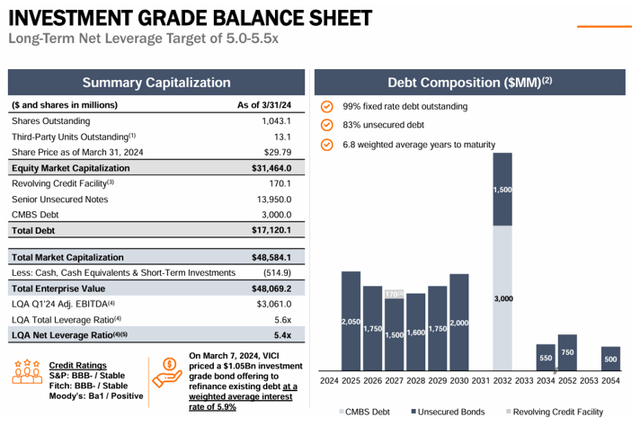

The company has an investment grade balance sheet with a BBB- credit rating and solid debt metrics including a net leverage ratio of 5.4x, a EBITDA to interest expense ratio of 4.25x, and a long-term debt to capital ratio of 40.60%.

VICI’s debt is nearly 100% fixed rate and 83% unsecured. The company’s debt maturities are well-staggered with a weighted average term to maturity of 6.8 years, and it reported roughly $3.4 billion in liquidity at the end of 2Q-24.

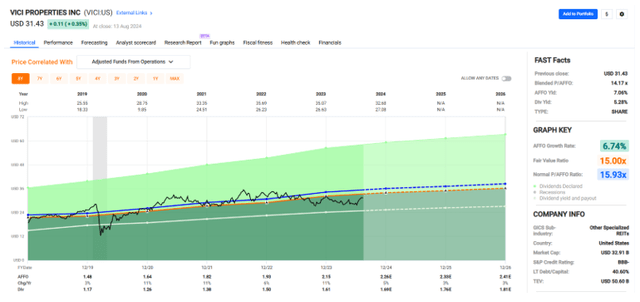

Since 2019 the company has delivered an average AFFO growth rate of 6.7% and an average dividend growth rate of 10.1%. Analysts expect AFFO per share to increase by 5% in 2024, and then increase by 3% in both 2025 and 2026.

VICI pays a 5.28% dividend yield that is well covered with an 2023 AFFO payout ratio of 74.88%. The stock is currently trading at a P/AFFO of 14.17x, compared to its average AFFO multiple of 15.93x.

We rate VICI Properties a Buy.

Realty Income Corporation (O)

Realty Income, aka The Monthly Dividend Company, is well known for its vast portfolio of retail properties that are located across all 50 U.S. states, The U.K., Spain, Italy, Portugal, France, Ireland, and Germany. However, the net lease REIT has been expanding into the gaming space over the last several years.

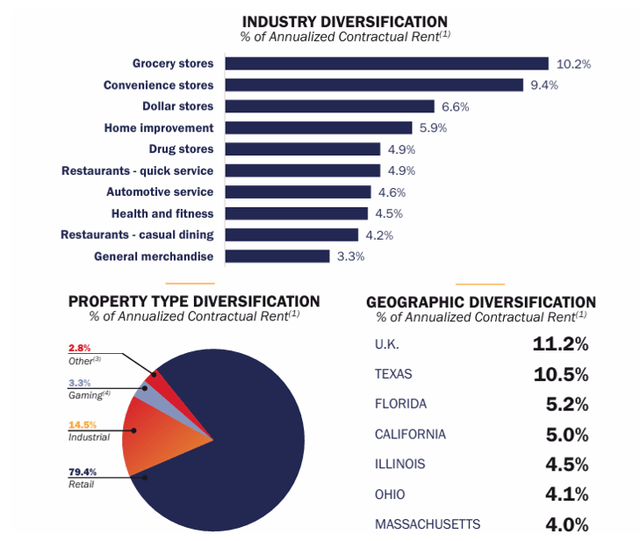

After its recent acquisition of Spirit Realty, the company’s portfolio is still largely composed of retail properties, which make up 79.4% of its contractual rent. However, it has been apparent that O has been attempting to diversify its portfolio across several new verticals.

Industrial is the company’s 2nd largest property type and makes up 14.5% of its portfolio, while gaming is the company’s 3rd largest category and makes up 3.3% of its portfolio.

Realty Income has a market cap of approximately $52.5 billion and a 335.3 million SF portfolio comprising more than 15,000 commercial properties leased to over 1,500 tenants operating in 90 industries.

When Realty Income was formed in 1969 and went public in 1994, online retail did not exist. As online retail gained momentum, the company countered the threat by targeting retail properties used in defensive industries that are value orientated (dollar stores) or properties used in industries that provide essential goods and services (grocery stores).

Currently, the company’s largest industry is grocery stores, which makes up 10.2% of its contractual rent, followed by convenience and dollar stores which make up 9.4% and 6.6%, respectively.

At the end of the second quarter, O reported physical occupancy of 98.8% and a weighted average lease term (“WALT”) of roughly 9.6 years.

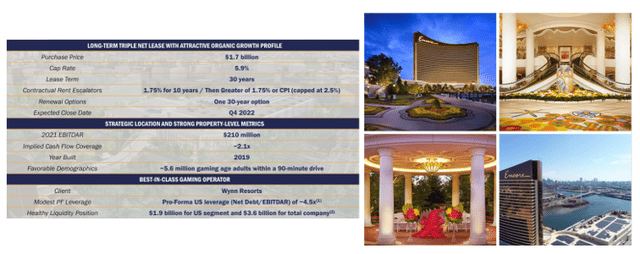

In 2022, the company announced it had entered into a sale-leaseback agreement with Wynn Resort to acquire Encore Boston Harbor Resort and Casino for $1.7 billion at a 5.9% cash cap rate. The lease is structured as a triple net lease with annual escalators for a 30-year term.

The property totals 3.1 million SF and includes 671 luxury resort accommodations, 71,000 SF of convention space, and 210,000 SF of casino space. Additionally, the property has more than 2,700 slot machines,185 gaming tables, 15 food and beverage outlets, and roughly 10,000 SF of retail space.

The gaming property is well-positioned as it is the only casino property in the Boston metro area and is near major landmarks including Assembly Row (2 miles (3.22 km)), Harvard University (3 miles (ca. 5 km)), TD Garden Center (3 miles (ca. 5 km)), Boston Logan International Airport (5 miles (ca. 8 km)), and Fenway Park (5 miles (ca. 8 km)).

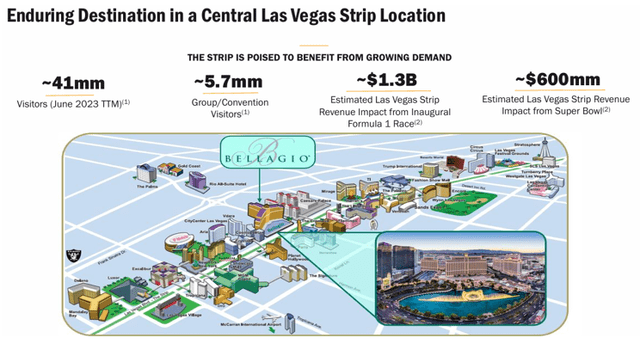

More recently, the company announced its $950.0 million investment in the Bellagio Las Vegas that consists of $300 million of common equity for a 21.9% indirect interest in the property and $650 million in yield-bearing preferred equity.

The property is operated by MGM Grand and is subject to a triple net lease with 26 years remaining on the term. Additionally, the company was able to benefit from in-place debt with an average fixed rate of 3.67% and a term to maturity of 6.2 years.

The property totals 8.5 million SF and has 3,933 suites and guestrooms, 200,000 SF of convention space, and 157,000 SF of casino space that includes 1,284 slot machines and 151 gaming tables. The property also features 19 restaurants and 32 retail outlets.

As of its most recent update, both Wynn Resort and MGM Grand were included in the company’s top 20 tenants, with Wynn making up 2.1% of its contractual rent and MGM Grand making up 1.2%.

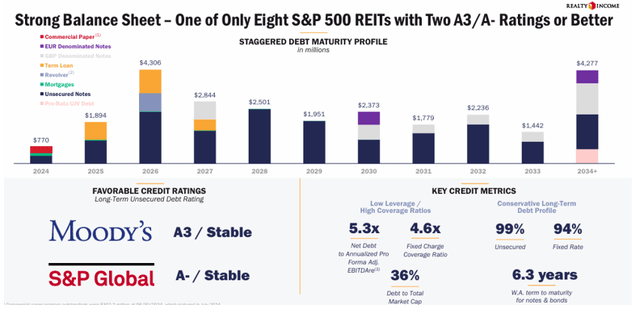

Realty Income has an investment grade balance sheet with an A- credit rating from S&P Global. The company has strong debt metrics including a net debt to pro forma adj EBITDAre of 5.3x, a long-term debt to capital ratio of 40.97%, and a fixed charge coverage ratio of 4.6x.

The company’s debt is 99% unsecured, 94% fixed rate, and has a weighted average term to maturity of 6.3 years.

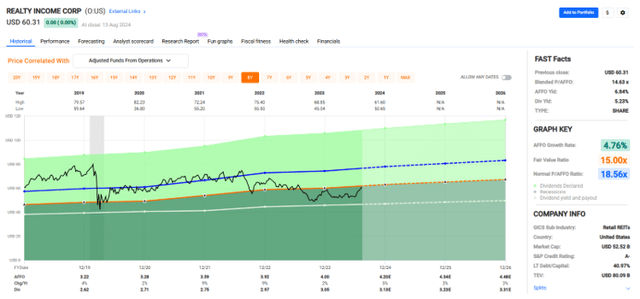

Since 2019 the company has had an average AFFO growth rate of 4.76% and an average dividend growth rate of 3.76%. Analysts expect AFFO per share to increase by +5% in 2024, and then to increase by +3% in both 2025 and 2026.

Currently, O pays a 5.23% dividend and its stock is trading at a P/AFFO of 14.63x, compared to its average AFFO multiple of 18.56x.

We rate Realty Income a Buy.

In Closing

With strong balance sheets and a positive growth outlook, these three gaming REITs are my favorite experiential REITs. Despite their recent uptick in share price, these companies remain attractively valued and have a place on my Buy list.

Thank you for reading and commenting!