BraunS

This article was co-produced with Wolf Report.

It’s one of “those things” when a company you’ve been waiting for to become cheap finally becomes cheap.

This is what happened to both Agree Realty Corporation (ADC) and Realty Income Corporation (O).

While neither REIT has yet recovered in full, we do believe it’s time to point a few things out when it comes to both of these investments and what can be expected of them in the future.

While there’s no saying when they will “go down” again (because they will at some point), we believe that what can be established clearly here is that when they were cheap (and for ADC, for instance, we mean below 15x P/AFFO), they were “too cheap” for what they offered.

We also believe that contributors here at iREIT® + HOYA cannot be blamed for not “emphasizing” this undervaluation enough.

At times, it seemed to me that every second article and piece we worked on had some connection to Realty Income, Agree Realty, or both of them.

But again, there was a reason for this.

Because when ADC actually yielded over 5.4%, and O briefly was over 6%, there were hardly any opportunities in the market that could be called even close to as appealing as those.

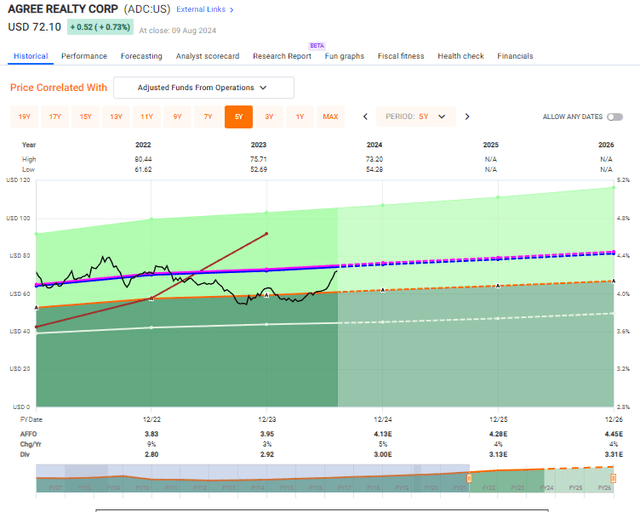

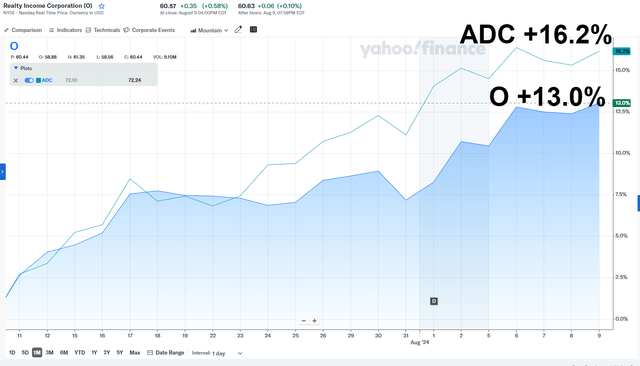

And despite these companies climbing (especially ADC, take a look below), it can still be argued that they could be buyable.

You are, undoubtedly, however, now coming in on the “first floor” on these, by which we mean they’re…sort of appealing. They’re no longer amazing buys — especially ADC.

Realize that investors such as us who have, for over a year at this point, recognized this degree of undervaluation, had a long time to really fill up on both of these companies.

So, let’s update you on these two blue-chip REITs…

Agree Realty and Realty Income — A lot to like about these companies, but not as much anymore

Out of the two businesses, Realty income is the one with any “oomph” left.

ADC is already reaching territories where we have sort of “backed off” a bit, and would be careful about investing for one simple reason — valuation.

The company is still extremely qualitative, but at a yield of sub-4.2%, we have better alternatives to invest.

Why are we so heavily invested in both of these businesses?

Quite simply, security, cash flow, valuation, and income.

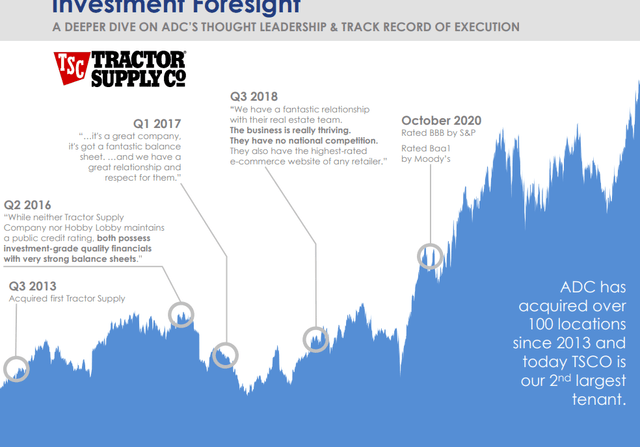

Agree Realty is one of the most consistently profitable, well-managed triple-net Retail REITs that exist — at least in our opinion. The company became one of the early movers in the omnichannel retail market and has been growing ever since.

One example is its relationship with Tractor Supply (TSCO) here, but it can be mentioned with other examples as well.

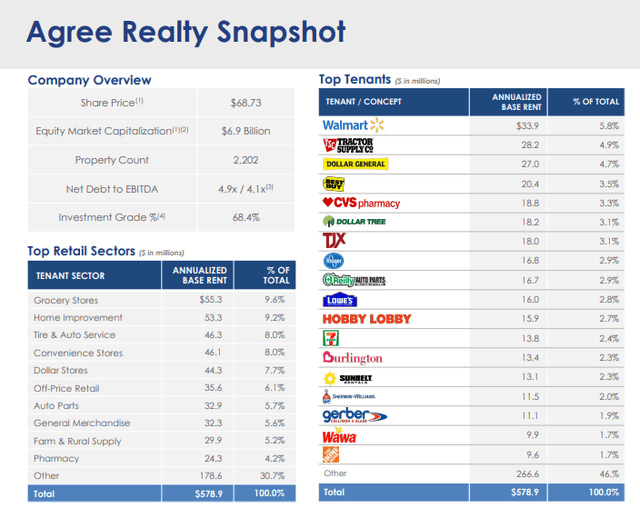

One of the few disadvantages for ADC was its initial, and still current, exposure to Walgreens (WBA), which is probably one of the riskiest tenants the company still has.

The concentration at one point was almost 30%.

Think about that for some time — 30% WBA exposure.

But it is now down, as of 2024, to around 1%.

This shows you skilled management — because this has not been a sudden “dumping” of exposure, but a concerted effort over a period of over 10 years.

The company was, in fact, below 10% as early as 2017, and during that time many still viewed Walgreens positively (including us).

It goes to show you that management knows what it is doing because Walgreens was recently reduced to a BB-rating by S&P Global.

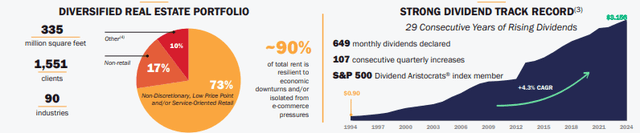

Agree Realty was also the first net lease REIT to issue forward equity, it has the lowest cost of pref equity at 4.25% (net lease REIT history) and is an extremely conservative capital allocator.

Its current portfolio is very well diversified — WBA no longer cracks the top tenants, and the company’s leverage is below 5x net debt to EBITDA.

As we mentioned in other articles, it also has a ground lease portfolio to add to its already attractive qualities, with proof of value creation in several instances.

ADC continues to invest in omnichannel, recession-resistant industries and assets, without moving into the PE segment.

We’ve said it before, Realty Income is a lot bigger and has the scale — but ADC has a better quality.

That’s not to say that Realty is in any way unattractive, and with its scale, it can tolerate more downturns and problems than ADC can, but we view ADC as more qualitative than O.

We’re therefore not surprised that ADC has climbed higher than O, and the upside for the company is now close to a “Hold.”

Realty Income is still somewhat attractively priced. It’s no longer superb, but it’s certainly “good.”

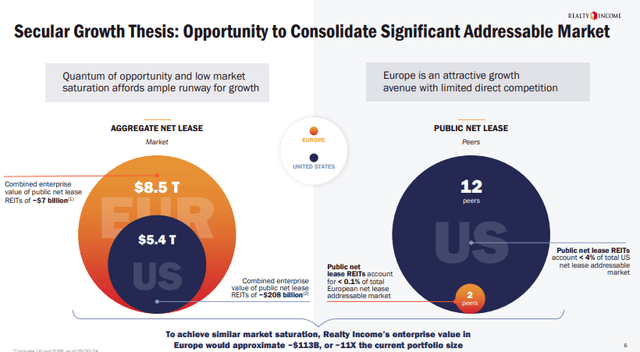

And unlike ADC, O is actually the global leader of the Net lease, with over $70B worth of EV, more than 10x that of ADC.

The company makes almost as much in an ABR as ADC’s market cap, and is one of very few A-rated REITs from both Moody’s and S&P Global.

With 55 years of operating history and over 35% of rent from IG-rated clients, it’s stable due to size and operating specifics in a way that few businesses can even come close to matching.

It may literally be one of the most boring investments you can make – but in this case, boring is great.

It’s a very solid income and “salary” investment, and even if the company’s growth slows down even more than it already has, at most, we believe we’ll see a change in premiumization for the company.

The company’s recent results have only confirmed its long-term upside, with significant capital allocation at an initial cash yield of almost 8% on average, with more and more capital going to the international segment as well.

AFFO jumped 6% YoY in 2Q, and guidance is affirmed.

Neither O nor ADC offers any “surprises” as far as things go, and anyone who complains about O’s lack of safety only needs to look at occupancy — almost 99% for a $70B+ portfolio, which is absolutely stellar.

Growth is slower to come by for O — there’s no denying this.

As some other REITs have done, O has been shifting to other more novel sectors and approaches to try to find continued growth — and this is not necessarily a positive. Now the company’s eyes have turned to Europe for this.

The company is also focusing on Data centers and gaming as growth verticals in the US — which we consider to be questionable segments.

In short, the company’s new operations and markets are things we actually discount.

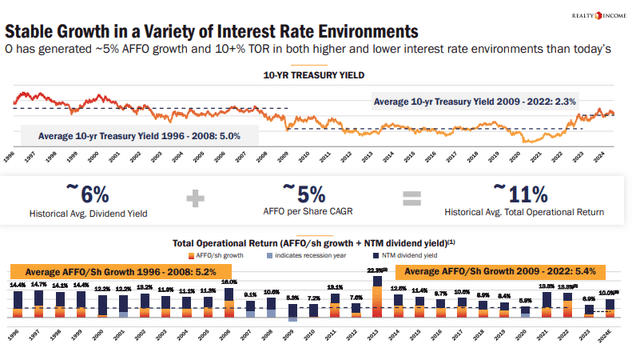

We want to be clear with our assumption that we do not expect Realty Income to grow as much as it has been historically — not even with Europe and with these new segments included.

At most, we expect 3-5% out of this company, and this definitely means we should reduce premiumization.

The market is already doing this.

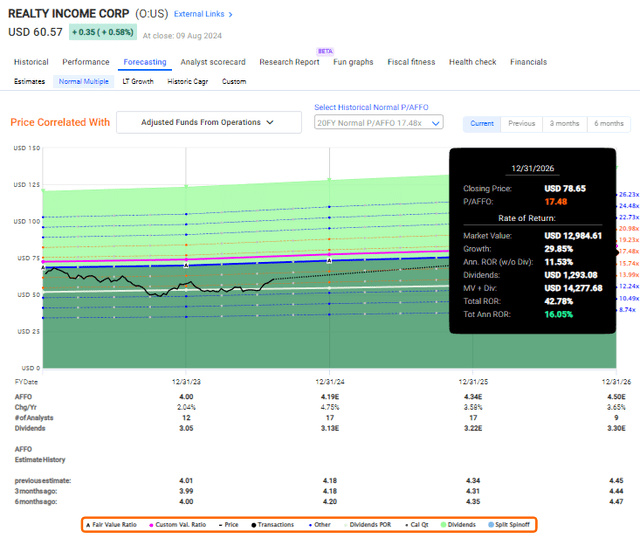

20-year average AFFO is close to 18x, while 2-year is now below 17x, and trending towards 15-16x if we go even shorter.

There could be a resurgence when interest rates drop, but we do not believe we’ll see 21-22x+ P/AFFO for this company again.

Realty Income is undoubtedly one of the safest REITs you can invest in.

It’s also likely, as we believe it, to continue to pay dividends in one form or another for a long time. No company is immune from targets, of course, and we would sell Realty Income for the right price (though that price would be at around 21-22x P/AFFO), but this is one we intend to hold until that very “cent” in the price.

Realty Income has proven consistency and growth throughout multiple rate environments for the past 20 years. It has seen ups and downs.

And it has also proven, in the past, that despite unfavorable macro/interest rate spreads, its investment spreads persist even in a rising interest rate environment.

While Realty Income at heart is riskier than ADC due to how it means to grow, and some portfolio assets that it still has (and also what verticals and sectors it’s moving into in Europe), we would still say that the company’s scale and fundamentals make an investment here possible.

Combine this with the company valuation, and O is investible whereas ADC, in our view, no longer really is.

Let us show you what we mean.

Realty Income Valuation — An upside where ADC has very little

So, conservatively, we want to forecast O at something like a 17-19x P/AFFO. 19x at most — but preferably closer to 17x to stay conservative.

The company has recovered, but hasn’t recovered in full yet — we believe there’s more that the company can revert to here, and the 20-year trends would agree.

As you can see, at $60 per share, the company still fulfills our 15% or more per year, inclusive of dividends, at a conservative valuation.

For that reason, the company is a “BUY.”

17.5x P/AFFO, or an implied share price of around $80/share, is also the “most” we would say the company is conservatively worth here.

In fact, if we move over $85/share, we would start looking at rotation targets, and our current must-rotate target for Realty is about $90/share, which comes to above 20.5x P/AFFO, approaching that 21x.

This could be subject to revision depending on how the company does, of course.

So, O still has an upside — but it isn’t even close to the 23-25% annualized that it had when it was trading below $55/share.

ADC’s prospects, meanwhile, are looking decidedly meager here.

If we assume a 17.5-19x P/AFFO here, your upside begins at around 7.5% per year inclusive of a 4% dividend yield (not enough), and goes up to around 11.7% per year at 19.3x P/AFFO.

That’s still not enough for us to consider this company attractive here, and this is the reason that we’re rating this company a “Hold” at this time, our first thesis change for ADC in over a year’s time.

With this thesis change, only one of these companies still deserves to be considered a “Buy.”

It goes to show you that when quality is on sale — you buy.

This has also, in some ways, happened to the apartment REIT sector, where we also invested heavily when the companies were cheap.

It rarely feels completely “safe” or “good” to invest when something is down or crashing.

Even experienced investors feel that when things are low, what if they go even lower?

That’s one of the hardest things that we have to overcome in value investing.

What we do these days is to pick the undervalued “gems” that we find, buy them, and then wait for the market to realize the value, and to “polish” these.

ADC is at a stage where we would no longer view it as a diamond in the rough, but a gemstone that’s already now recognized by the broader market.

Realty Income is, once again, on the way there.

You still have the opportunity to add at a good upside, but it may be gone soon enough.

Our thesis for Realty Income here is as follows.

Thesis

- Realty Income is one of the most qualitative investments in the entire REIT space. We can’t think of anything much more qualitative or safe than this one. While there are many opportunities that do provide a higher, realistic upside, there are very few that offer risk-free-beating dividend yields with the potential for a reversal at such safety.

- Realty Income has a PT of $70/share, giving it an upside of at least 8-10% here, and potentially much, much more.

- Realty Income is a “BUY.”