Reaching financial independence and becoming a millionaire before the age of thirty?! While this path requires several years of ruthless saving, smart investing, and unwavering discipline, there’s no reason why YOU can’t enjoy financial freedom and attain the lifestyle you want!

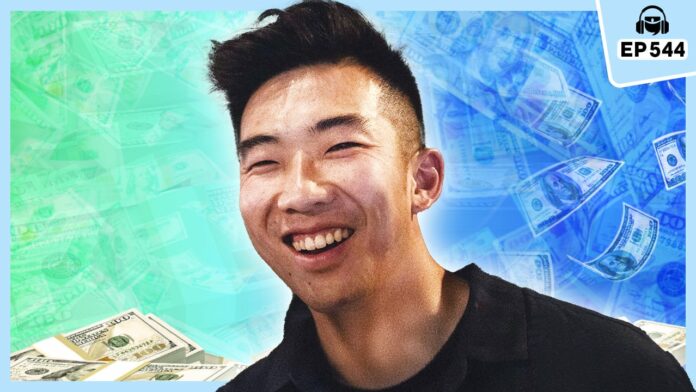

Shortly after graduating from college with over $50,000 in student loans, Franklin Zheng found himself working a grueling, eighty-hour-per-week factory job. Fortunately, it was also around this time that he discovered BiggerPockets and decided to try his hand at real estate investing. He started attending local meetups, where he learned that simply getting in the same room with other investors presented all kinds of opportunities. It wasn’t long before Franklin had found his future investing partner, and in just FIVE years, he has built a cash-flowing real estate portfolio of thirty-eight units, as well as a business that has allowed him to leave his W2 job and travel the world!

In this episode of the BiggerPockets Money podcast, you’ll get a glimpse of what it takes to achieve financial independence and amass a one-million-dollar net worth. Make no mistake—it’s not easy. Franklin will be the first to tell you that the last five years have been filled with all kinds of successes, challenges, and failures. But if he can do it, YOU can, too!

Mindy:

Delayed gratification comes with some sacrifice, but it can be a powerful victory. Today’s guest will show how hard work and a bit of pain will change your financial trajectory. Hello, hello, hello and welcome to the BiggerPockets Money podcast. My name is Mindy Jensen, and with me as always is my rockstar co-host, Scott Trench.

Scott:

Thanks, Mindy. Great to be here. You are in the right place listening today if you want to get your financial house in order because we believe that everybody can achieve financial freedom no matter when or where you’re starting, even if you’re just entering your first job or starting to get more serious about that financial journey.

Mindy:

Today we’re joined by Franklin Zang, a recent PHI achiever who took his learnings from places like BiggerPockets and engineered his way from the dreaded night shift to financial independence all before he reached 30 years of age.

Scott:

That’s right. We’re going to hear how one meetup changed his entire financial future. Why asking questions is a strength if you’re starting out, and how he and his business partner have harnessed their superpowers to help fuel their work optional lifestyle. Franklin, welcome to the BiggerPockets Money podcast.

Franklin:

Thank you. Pleasure to be here.

Scott:

We’re so excited to have you here. Franklin, can you just tell us where you are right now and what your last 24 hours have looked like?

Franklin:

Yeah, I’m actually in Paris right now. Last 24 hours. I hopped on a flight, didn’t get any sleep, landed in Paris, met up with a friend, got dinner. Now I’m sitting here at my friend’s apartment and recording this podcast with you guys.

Scott:

Awesome. And what are you doing in Paris?

Franklin:

I am just digital nomad. I guess that would probably be the best way to describe it.

Scott:

Awesome. So is it fair to say that your fire journey, your digital nomad journey has just begun because you crossed a key financial milestone and the adventure has just begun, or will it maybe begin tomorrow when you get some sleep?

Franklin:

Yes, I think that’d be accurate. I mean, the whole process of building this business has spanned the last six years, so I don’t know. It’d be right to say that it just began, but I guess in terms of the whole digital nomad, freedom to be wherever I want part and exploring the world part, I would say yeah, that kind of starts right now.

Mindy:

Okay, so let’s address the elephant in the room. How old are you? Where were you living? What was your job before you quit and how much money were you making? So I threw four at you.

Franklin:

So I’m 29 years old. I was living in Orange County, California. I was a mechanical engineer and I started at a 70 5K base salary and over the span of my engineering career, I capped out at 130 5K for my W2.

Scott:

And you have a net worth of over a million dollars today, is that right?

Franklin:

Yeah, that’d be accurate.

Scott:

Franklin, can you tell us where your money journey begins? I want to hear exactly how it started and how you got here with those extraordinary numbers behind underpinning this conversation.

Franklin:

So I guess my journey starts right after college. So I went to college at UCSB for mechanical engineering. I got my master’s and then I just went to work at a full-time job. First job I got was for this company out in Irvine, and it was a company that we tested semiconductor chips. Basically when I got hired, the department I was in was still small and the project was pretty important. So the culture for the engineering department at the time was pretty startupy, which means they relied on a few people to wear a lot of hats and do a lot of work. So they threw me in a factory out in Asia and there was a small team I was in to keep the systems running out there. And in the beginning I was working like 80 plus hours a week. I would have to work the graveyard shift. Sometimes there’d be weeks where I didn’t see the sun, no Saturdays and no Sundays. And I remember the longest shift I ever worked was a 26 hour shift where I went in at 8:00 AM and then I didn’t leave until 10:30 AM the next day. So it was pretty tough, but the silver lining was that it made me realize that I did not like this line of work and I needed to find a way out asap.

Scott:

And what year was this? How long did this pattern continue for?

Franklin:

So this was in late 2017, early 2018, so it was about six years ago, and that lasted about a year or a little more than a year before I was able to switch into a less demanding office

Scott:

Position. And Frank, were you able to graduate with no debt? What was your financial circumstance before moving into this terrible job situation?

Franklin:

No, I had debt, so my family was low income, so we did get some grants and I got some student loans, but I did get a scholarship and I ended up with a little over 40 K in student debt.

Scott:

You’re working this job making $70,000 a year, working 12 hour a days, nights, weekends, all of those types of things. Do you have high, are you at least having low expenses? Is housing and stuff covered for you so you’re able to just sock away all that cash or what does that look like on the expense side during this period?

Franklin:

Yeah, I was able to really, really minimize my expenses. So even though I did live in Orange County, because that’s where my company was, I moved to Orange County just to work there, which is kind of an expensive area. I was able to negotiate with my landlord for a pretty good deal at the time. So I was kind of basically living in an attic. It was one where my bed was right under where the attic slopes upwards, so if I sat up on my bed, my head would hit the ceiling. But the benefit to that was I was able to negotiate a really good rate and then also I felt like I didn’t need to have, I was out of the country most of the year anyways, so I didn’t need to be paying that much for a really nice apartment or anything like

Scott:

That. So Franklin, you got low expenses, okay, income, but great expense profile, at least Orange County. What are you doing with your cash and do you know this moment in time, can you tell us about what was happening? Was it a moment in time or was it a process where you’re like, I got to get out and I’m going to start learning about financial independence? Can you describe that for us?

Franklin:

I already knew a little bit about the power of compound interest, so at the time I was already maxing out my 401k maxing out my HSA, and I was still putting whatever other savings I had into an account which I would use for my future real estate investments. I knew that wasn’t enough to really get out of my job or get out of the situation I was in because that was my first job and it was such a grueling experience in the beginning with the field service. I felt that for some reason I felt that every other job I would take in the field would be the same thing almost, even if that’s not necessarily true, that’s what I felt in the moment. So I really, really had a desperate need to want to just break out of that cycle. So because of that, I already knew I had to save a lot, so I was saving a lot, but then I was looking for more powerful methods to be able to break free of that cycle. And so eventually I stumbled into real estate. I stumbled into Brandon Turner’s book on rental property investing. I think that was the first book that he put out. And that book, it really lit a fire under me because it pointed out well, it gave me a lot of practical steps to start on and it showed me that it was possible it was possible to actually do what I wanted to do.

Scott:

Franklin, quick question here. When did you determine your goal, your FI number?

Franklin:

Yeah, so I was listening to BiggerPockets of money at the time and there was a lot of talk about the 4% rule, and so I basically just took that, applied it to what I thought was a decent living in my area at the time, which is maybe $60,000, and that came out to maybe 1.5 million in net worth, and that was the goal I tried to achieve by 40.

Scott:

Awesome. Well, we want to hear more about how Franklin and his job motivated him to hit this $1.5 million net worth number and sneak peek. I think you already know that Franklin has gotten there well before then. We’re going to hear how he got there so quickly after the break.

Mindy:

Welcome back to the show. We were just talking with Franklin about his fine number and how he arrived at what he felt was the goal for his financial independence number before he was going to retire. Franklin, how did you go about achieving this? You discovered what your number was.

Franklin:

So the first year I was just learning, listening to the podcast while walking on the way to the factory floor. That’s important because it was a huge plus to be able to speak the lingo while conversing with people in the field because if you don’t know what anything means, it kind of projects that anyone who might be willing to work with you is going to have to spend some time babysitting you or teaching you from scratch. But even if you’re completely new to the game and you can keep up and understand the conversations and ask good questions, then people see that even though you’re new, you have energy and potential and you have initiative on your own. And that’s so important if you want experience people to believe that you can bring something to the table. So I spent the first year just learning, working these hours.

I was learning whenever I could. The other part I was doing was analyzing deals. I took a spreadsheet from somewhere on the BiggerPockets website and I modified it for my purposes and I started analyzing random listings out of state. By the way, I knew I wanted to invest out of state because I can’t afford anything in California on my salary, and I saw that out in the Midwest and other places. There were a lot more deals that were affordable on my income. So I remember taking Zillow data at the time to crunch the best rent to price ratio to find which area I was going to be investing in, and that’s also why I picked up David Green’s book on long distance real estate investing, but nothing was penciling in even out of state, and I was stuck in a little bit of analysis

Scott:

Paralysis. By the way, I just want to chime in there with a shameless plug here because that’s been such a popular request and people want to get that data about where the cashflow is. If you go to biggerpockets.com/resources, you can download a document spreadsheet that we update every couple months with the top 100 cashflow markets in the country. So that’s now a new resource that’s available for everyone there. Updated for 2024, so sorry, click plug there for bp.com, biggerpockets.com/resources. Go ahead Franklin.

Franklin:

So find cashflow, a little bit of analysis paralysis, and then I remember, I don’t remember if it was branded, but I think it was David. It was when they were co-hosting the main podcast, but one of ’em said on the show, Hey, if you are stuck in analysis paralysis, you don’t know what the next step is, here’s the next step. Just go to a real estate meetup and then go to a real estate meetup and then see what happens, talk to people and network with people and see what happens. So I took that to heart because I didn’t know what else to do. So I went to this local meetup in my area and first time I went, I met, I networked with some people, mixed results, same thing. Second time I went. I will say that because I was kind of the curious, I was genuinely curious about other people’s deals and how they were able to make deals, cashflow and what they were doing with their business, how they were doing value ads so that I could learn from them, that I did catch the eye of some experienced people in that meetup.

I was kind of just raising my hand asking questions during the presentations and stuff. And then people, I remember there was a couple of different people who noticed me. One was a land broker who wanted to, he was interested in doing self storage deals out in Joshua Tree, and he saw that I was kind of young and energetic and curious, and he was like, Hey, we should do a deal together in self storage or something like that.

What I really learned from that is if you’re genuinely curious, you’re genuinely passionate about the subject and you bring the energy. There’s people who are experienced in that field who are looking for people like you, people who can help bring some sweat equity in exchange for some mentorship or some experience or stuff like that. So those are good experiences. That guy, he was a really cool guy, but that partnership kind of ended up fizzling out, and it wasn’t until maybe the third or fourth time I went to that meetup that I met my partner Layton, my business partner Layton, who I’ve been working with for the last six years, and it’s like a partnership made in heaven. Me and him work really well together. We match each other’s strengths and weaknesses perfectly. We basically talked for three hours during that meetup and just clicked and we were like, Hey, Leighton was like, Hey, we should do a deal together. And I was like, heck yeah, right?

Scott:

So love this. The meetups and these networking events can completely change your life and they’re casual and typically free. This was a free meetup for real estate investors in your local area.

Franklin:

I did have to pay a little bit.

Scott:

How much did you have to pay?

Franklin:

It was like 20 bucks. It was like It was, yeah, small entry fee and you get fed, you get some charcuterie.

Scott:

Those are the best types of meetups, right? It’s free or this very nominal fee that just says, okay, I can actually plan ahead and count on people arriving, maybe get a drink or a little bit of food with the ticket. Those are the things that really can just totally change your life as a real estate investor. And another, plug biggerpockets.com/meetups has a list of tons of these things all around the country, many of which are exactly like that.

Franklin:

Yep, exactly. That 20 bucks was the best 20 bucks I’ve ever spent. 20 bucks is nothing for you consider that an investment into a huge milestone in your real estate investment career. It’s really nothing. So I totally agree. Yeah, so basically after I met my business partner, we clicked really well and he already had some experience investing in the Midwest area because that’s where he grew up and he had 10 or 11 properties at the time and he was like, Hey, if I find we find a deal, I’ll send it to you and then if you like it, maybe we can partner together. And I was like, definitely. And so shortly after he sent me a deal and it was a lawyer’s office out in the Midwest, and I took the numbers on the OM and then I plugged it into my little sheet and I was like, oh my goodness, it’s crazy.

This is impossible. I’ve never seen this crunching. My little Zillow listings that I’ve just been doing for practice, the cash flow numbers were amazing. And so I was like, Hey, we got to do, let’s do it. I’m on board. And so we did it. We formed our little partnership and then we went and purchased it. We half, half, 50, 50, and then we delegated our responsibilities. It just was a natural fit. All the stuff that he liked to do, either didn’t want to do or just wasn’t good at and he was really good at. And then the things that he didn’t like to do, I just happened to like to do and was good at. So he was doing all the operations, I was doing the bookkeeping, the financial analysis, things like that. And yeah, the first deal, actually on paper, the cashflow numbers looked amazing.

It actually didn’t turn out as we thought it pretty much cash neutral. And then after one and a half years we exited the property, but we got a little fortunate. And then the property did appreciate, even though we had I think more vacancy than when we purchased it, but we did make a decent profit just off of the appreciation on that one. But the important part, I guess the more important part than the profit to that deal was that we proved that we worked really well together, and so we built that trust, we built that rapport. So yeah, after that we just, anything in the future, we could hit it stronger basically. Yeah.

Mindy:

I wanted to point out that on a first deal with a new partner that you don’t really know all that well, breaking even is absolutely perfect. I heard you say that you were renting to attorneys and attorneys are not a protected class, and I use attorneys a lot, but I would never rent to them. I’m wondering what your experience is renting to these attorneys. Did that have anything to do with you exiting the property after a year and a half?

Franklin:

Yes it did because they weren’t just lawyers, they were divorce lawyers, so not the sunniest bunch went to visit the property after we first acquired it. We drove, we were supposed to land, I think in north Texas, but we got rerouted to south Texas because of a storm and we had to end up driving all night. So we drove all the way there to Kansas from Houston. We had an appointment early in the morning to meet with the tenants, but we were a little bit unkempt because we were driving all night and running on no sleep. And when we came in, we’re both relatively young at the time. I was 24 and my business partner was maybe a little over 30, and all the lawyers were in suits and they were like, who are these young kids from California who are now our landlords? And so they were giving us a little bit of a tough time.

We were really trying to be good landlords. We asked ’em, Hey, what can we do to improve the property or make it a better working environment for you? We actually did keep their rents below market because we wanted them to be happy and we wanted them to stay, but they gave us a tough time. I think they ended up appreciating us in the end when we exited, but in the beginning, I don’t blame ’em for trying to get the most out of their lease. When we sent them the first lease extensions, they came back with all these amendments that they wanted us to agree with. Everything was crossed out and they were like, no, we demand this and this and this. So it was tough. There was one guy we really liked. A lot of the others gave us a tough time, but we don’t blame him. But we did end up breaking even on the cashflow. It was a lot of stress. And after that we said, no more class C rent by the room office building ever again. The good thing was me and my partner build up a lot of report and trust and mutual respect, and that helped us to move forward with our other deals.

Mindy:

So it’s a home run because you found a business partner, you recognized that you would work well with him, you understood what you didn’t want after experiencing it and you didn’t lose money. So that is a grand slam home run, in my opinion for a first time deal with a partner that you don’t really know. We are going to take a quick break and when we come back, we’re going to talk about how you were able to set your business goals and build a portfolio while working full-time and what superpowers you were able to leverage to grow so quickly right after this quick break.

Scott:

Welcome back everybody. Franklin was just telling us about his first deal in an office property investment that broke even from a cashflow perspective. Franklin, can you tell us how the deal went from an equity growth perspective and how you began building your wealth towards financial independence?

Franklin:

We did not cashflow. We did break even on the cashflow, but when we sold it, we made a pretty good chunk of money, which we use 10 31 into a dollar general, and that Dollar General is generating us some pretty good cashflow right now.

Scott:

Franklin, let’s talk about this. When did you buy the property?

Franklin:

It did help a lot. Yeah, it did help a lot. The partnership was, I think I would say that’s the main part of it because the cashflow from the Dollar General was great, but the thing that really boosted our business was the single family homes. So that was more, less a direct result of the office, but more direct result of the We work well together part of it.

Scott:

Okay. Let’s spend one minute just going through the numbers. What’d you buy it for? What’d you sell it for? Net neutral cashflow, 10 30. And then let’s talk about the 10 31 exchange deal and the single family rentals and focus rest of the time on that.

Franklin:

Okay, so we bought it for $181,000, and then when we exited, we sold it for, it was close to two 15. That’s what I remember. It was close to two 15, so we 10 31 that into a Dollar General. And that Dollar General was a really good deal because we had a rockstar agent working with us at the time, and then my business partner told her, Hey, can you please call all the owners of Dollar Generals in this vicinity and see if they’re willing to sell? And she was able to pull through for us and found us a really, really, really good deal. And so we leapt on that. When we sold our office building, we took the proceeds and we put it towards that Dollar General, and it’s been a pretty good cashflow booster for us ever since.

Scott:

Can you give us rough, kind of rough picture about how much you were able to 10 31 exchange into this and how much cashflow the property produced or produces?

Franklin:

Yeah, so all the proceeds pretty much went, they have to go to the new property. And so whatever the profit was, let’s say 2200 15,000, around 29, $30,000 of it went into the down payment for the Dollar General. And that Dollar General, it was close to half a million dollars. We put a 20% down on it. So we covered the rest from our savings after putting in the 10 31 proceeds from it.

Mindy:

Was this a purchase of a franchise or are you buying the property that they’re renting out from

Franklin:

You buying the property that that franchisee is renting out from us.

Mindy:

Okay. Okay,

Scott:

Great. This is a triple net investment property. What was your cashflow on this deal after debt service? So

Franklin:

It’s not a true triple net. I want to clarify. It’s a double net plus, we’re responsible for some other maintenance items like the landscaping roof structure. Obviously if we’re talking about cashflow with the maintenance budget for the roof structure and landscaping and after debt service, it comes out to about 528 bucks and 60 cents a month cashflow after debt service.

Scott:

So let’s keep rolling and walk through what happens next. How do you build up your rest of your real estate portfolio and what does that look like? What does that journey look like?

Franklin:

Yeah, so after that, we decided, me and my business partner, Layton decided that we were going to go back into single family homes. He’s done a lot of ’em before meeting me, and we both agreed that it was a really good asset to try to stock up on. And so basically we ended up after that Dollar General, we ended, we still dabble in commercial CRE here and there, but we ended up buying a couple of SFRs after that. The first one we bought with just a down payment, and then we just expected it to cashflow after putting in a down payment. But the one after that, we decided to bur it and we were really successful in burring that one.

And after that successful bur we were just like, we’re just going to bur all of them. So me and my business partner, we call a particular prospect a unicorn if we’re able to bur it, take all the money out that we put in completely, right? So the total cash outlay is less than zero and it cashflow is more than a hundred bucks a month. At the time, that was our criteria for a unicorn cashflow. Right now these days, we accept little less cashflow just because the interest rates are higher to pull the trigger. But at the time, that was our criteria quantitatively to pull the trigger. And then my business partner, Layton, he’s really familiar with the market, and so he does a qualitative check too. So combine the qualitative and quantitative check, and after that, I think you have a pretty well, it’s been proven for us so far, it’s been working well for us that that combination has served us really well in filtering out what deals are good for us.

Mindy:

Are you still finding unicorn deals?

Franklin:

It’s been tough. This last year we had a couple that we projected to be unicorns and we pulled the trigger and then the actual numbers came out and they were off the Mark A. Little bit. But yeah, because of when we started, the rates were less than 4% or just around 4% now. And we only to clarify, we get commercial loans because we have more than 10 investment properties. So we don’t do Fannie Mae, Freddie Mac conforming loans, but at the time we were getting really low, really good rates on those. Nowadays, since rates are higher, we had to take concessions on the cashflow if we wanted to keep buying.

Scott:

What market are you in for these single family homes that you’re burring?

Franklin:

We have ’em scattered in the Midwest.

Scott:

So all these single family rentals are in the Midwest. You’re burring remotely out of state?

Franklin:

Yes, all out of state.

Scott:

Can you give us an illustrative example of a deal, right? Maybe one of the ones that you’ve tackled recently, whether it’s worked out or not, how are you finding these in 2024 and still making this work when I think that’s impossible these days is what they

Franklin:

Say. Here’s an example. So we bought this place over 119,000. We spent about 6,000 to renovate it. This one, we identified that it was underpriced, and then when we purchased it, it got it, just a little bit of makeup on it. It reappraised at 141, but we got 119,000 back, $119,850 back. So this wasn’t a unicorn. It’s harder, harder to get unicorn nowadays, but we ended up just outlaying 5,000, which wasn’t so bad. So out of pocket for the whole property was about 5,000, and we’re cash flowing about 72 bucks a month on that

Mindy:

One. Yeah, so I will agree with you that a hundred units in one and a half years is a big stretch goal, unless you just have piles and piles of cash, even with the burr, the burr process takes some time. So Burr stands for buy, rehab, rent, refinance, repeat. So you’re buying a house, you’re rehabbing it and renting it out, and then you’re refinancing it to pull out some or all of your money so that essentially you are $0 into the property, which is what it sounds like you were doing with the unicorn property. How many units do you currently have?

Franklin:

We have 38 total units.

Scott:

Are they all single family?

Franklin:

No, not all single family. We have 36 single family, two active commercial properties.

Scott:

All these are in this Midwestern market, right?

Franklin:

Yes. They’re all in the Midwestern market.

Scott:

So actually lemme pull back, lemme see if I can summarize the situation. As I understand, you got started five and a half years ago, making $70,000 a year and pretty terrible work environment. You saved your pennies, obsessed over real estate investing, met a partner, broke even, but used that partnership then to get into this Dollar General store and then now the 36 single family rentals and one additional commercial unit over the last four years. And during that same time, I presume you continue to live fairly frugally progressed your career to up to $130,000 a year in annual income. Were there any other key leverage points in your finances that we should know about to understand your success so far? Or are those the main themes? Did you have a side hustle for example?

Franklin:

I want to say those are the main themes. As for the side hustle, we were always thinking of what else we can do with the business, or I guess I’ll talk a little bit more about that later, but that didn’t really start until afterwards. So I guess, yeah, I guess that was pretty much it. Aggressive savings and then really both of us put a lot of effort into our real estate.

Scott:

Yeah. Awesome. Now, again, today, literally today, some of the benefits from a lifestyle perspective of this five and a half year period of self-sacrifice, aggressive risk taking and expansion for your business are going to start paying off here. What is next? What does the next year or two look like for you and what are you looking forward to here?

Franklin:

Yeah, so I’m looking forward to one, traveling and kind of living on a budget while traveling and working while traveling. And then the cool part about the business is that I didn’t like working a nine to five, but the business is getting pretty fun for me at least. And so I am really looking forward to growing both the investment portfolio with my business partner and also working on our new business with Layton Gemstone Commercial Mortgage. So we’re helping a lot of people find commercial loans right now, and that’s been pretty exciting for us. So looking forward to that.

Scott:

Just a quick tip on that one, right? We’ve compiled list of hundreds of lenders around the country at biggerpockets.com/lenders to help begin that search. You should start there. Call up a bunch of those folks and then continue down the list and look for other folks as well in that pursuit here. I think that’s fantastic advice, and I had never heard that before today, that you’re absolutely right. It’s very obvious now that you’ve said it, but that is an enormous competitive advantage in today’s market, right? If there’s that much variance among these lenders.

Franklin:

Exactly. Especially when you’re trying to find, say the unicorns, we’re looking for higher LTV on our purchases because we don’t make a lot, the two of us, we didn’t make that much money from our W2 jobs. If we wanted to expand aggressively, then we needed to get 85 LTV right off of some of our purchases. We couldn’t just settle for 80, and so we needed to call everybody. But yeah, anyways, he had this list of thousands of lenders and their rates

Scott:

Thousands.

Franklin:

We now have thousands. So Texas alone has over 700 banks and credit unions headquartered there, and that’s not counting the branches. But yeah, the spreadsheet ended up nucleating our other business Gemstone commercial mortgage. So right now we’re spending a lot of time on it, helping others to find competitive commercial non-conforming loans. We also spend a lot of time on our other business too, because remember, it’s not completely passive When you have the amount of properties that we have, which is 38 right now, even though we do utilize property managers, it’s not completely passive. I do a lot of bookkeeping, financial analysis, and latent does probably even more work on the maintenance and operations because the portfolio is just so large.

Mindy:

Are you a mortgage broker?

Franklin:

Yes.

Mindy:

You get paid to help people find non-conforming mortgage loans.

Franklin:

I always recommend that everybody, when they’re looking for a deal and they’re looking to finance it, is to call as many lenders as they can in the area that they’re trying to lend in. I would recommend don’t contact 2, 3, 4, contact 10, 15, 20 lenders because there’s so much variance in what lenders can give you. That’s how you’re really going to get your best rate. People don’t want to do that if you don’t want to go through all that work. It is a lot of work. What we do is we provide that service for you, so we’ll help you call contact all those lenders and bring you what deal we think is best for you.

Mindy:

So at what point, what was your financial position when you decided I can leave my W2 and focus on real estate full time?

Franklin:

So we were generating not a huge amount of cashflow from our properties, but a pretty decent chunk, right? So the initial goal, like I mentioned, was like 60,000 passive, and that’s just for myself. It didn’t quite reach that in terms of the real estate investment portfolio. It was a little more than half of that, at least for myself. But that combined with I had $35,000 in savings, and also we started to get clients from our commercial mortgage business, which we had just started, but we were already getting a lot of interest and we already got a lot of some leads from that. We decided with that projected income and the $35,000 or so of cashflow from the rental properties, it was okay. Keep in mind, I still consider myself more lean fire, so I do have to keep my expenses in check. And one thing that the travel does allow me to do is it does allow me to keep my expenses low depending on where I’m traveling.

And we do because we pay for a lot of expenses with business credit cards and stuff. We do turn a lot of credit card points, and that helps pay for some of my travel. So that offsets some of that cost. I think the most important thing for me was the work-life balance that I had right after I finished school was completely awful. And while I was in hell, my friends were all, they were taking a year off after school to go on these big trips. They were going to New Zealand, they were going to Africa, south America, and they came back with all these stories of them just living it up and I guess without any baggage that comes with work and the daily grind and stuff. But for me, I felt like, wow, I really wanted to do that too, and I never got a chance to do that.

But I heard a quote on a podcast about this book, the Regrets of the Dying, and they had mentioned that people on their deathbed what they usually regret, I regret that I took that risk or I regret that I did something. It’s usually I regret that I’ve always wanted to do something and I never actually ended up doing it. And so that stuck with me a little bit because I’ve always wanted to all these things and the security of having a job and the security in knowing that you’re going to get a paycheck every month was hard to let go of, but I needed to if I wanted to do some of these things. That’s part of the reason why financial independence is important to me that I really wanted to do this year was shoot a bow off of a horse in Mongolia. I’m a big history geek. Mongolian history is one of my favorite parts. Yeah, I want to do that. I want to shoot a bow off a horse in Mongolia, so hopefully I get to do that this

Scott:

Year. Well, Franklin, thank you so much for coming on the BiggerPockets Money podcast. Congratulations on the huge real estate portfolio, the Millionaire status, the financial freedom, and I hope that you’re able to just realize a magical journey over the next year or so, reaping the rewards of that and continuing to build your business as a digital nomad. So thanks so much for sharing it and inspiring a lot of people.

Franklin:

Thank you, Mindy and Scott. Appreciate you having me.

Mindy:

Thank you Franklin, and we will talk to you soon.

Scott:

Alright, that was Franklin Zang Millionaire through real estate investing at 29 and now traveling the world. Mindy, this is why we do this. So wonderful that BiggerPockets was a small part of his journey and just wonderful to see the huge success that he’s had here. He took action and attended meetups, didn’t spend 10 K on some fricking mastermind course, but spent 20 bucks to attend a meetup and met a business partner. That changes life. And this is where I want to shamelessly plug BiggerPockets again, is because you go to biggerpockets.com/meetups, there are tons of meetups, almost all of which are free. A couple have that $20 entrance fee that are being put on by various people. Two, you go to biggerpockets.com/resources and you can download all of the top 100 cashflow markets in a spreadsheet completely free. And third, you can go to biggerpockets.com/lenders and interview all the lenders care to take a look at. Again, also completely free. So those are three super easy steps you can take today if you’re trying to repeat some of the success that Franklin has had here. And I think it’s just a wonderful example of just taking action on the obviously correct things and getting going. What’d you think, Mindy?

Mindy:

I absolutely agree with you, Scott, except for the part where you said we’re a small part of his success. He took the advice of going to a meetup, met his business partner, and now is this huge success. So I would say we’re like 98% of his success, Scott.

Scott:

Alright, fine. We’ll take all the credit for it on there. We just take a fee of I think 50% of his wealth for all that success. So he can just write us a check for I think $750,000.

Mindy:

Yes, and Franklin, it’s J-E-N-S-E-N. You can just write it out to Mindy Jensen. I’ll be sure to share with Scott. I promise.

Scott:

No, he obviously did it all. We’re super happy. Yeah, we’re super happy that some BiggerPockets content was inspiring, but congratulations to Franklin and to anyone else that’s accomplished similar success. And if you’re looking to get started in real estate, those are three super easy, obviously correct things to get going on today.

Mindy:

Yes, super easy, but also you have to actually do the work. I think that we need to highlight, Franklin not only went to an event, but he didn’t meet his business partner at the first event and he went back again, and then he went back again. I think he said it was the third or fourth time that he went to this event that he met this partner and they hit it off. They started talking. If you’re not going to the events, you’re not going to meet the people that are at the events. If you’re not in the BiggerPockets forums, you’re not going to be able to ask questions in real time of people who are doing it all the time. That’s another one that I’m going to throw out, biggerpockets.com/forums. The bottom line is if you want to invest in real estate, if you want to become a real estate millionaire, you’re going to have to put in the work.

So not only did he take the advice from the real estate show, he put it into action by actually attending. He went back again. He decided to connect with somebody. He made a partner with somebody who had all of the things that he didn’t, and he brought to the table all of the things that the partner didn’t have. I can’t tell you how many times I’ve seen people who are like, oh yeah, I’ve got a lot of money and I don’t have any time to run the real estate investments. So I met a partner who also has a lot of money. Well, that’s not a real good partner. Then you need somebody bringing to the table what you don’t have. So it sounds like this is a really successful partnership and I’m super excited for his future because when you can find a partner that meshes well with you, you’re kind of going to take over the world pretty soon. The earth is going to be called Franklin. Instead,

Scott:

Just draft a partnership agreement, please. That spells out what will happen in the event of the partnership. Terminating

Mindy:

Absolutely key. Alright, scotch, we get out of here.

Scott:

Let’s do it.

Mindy:

That wraps up this episode of the BiggerPockets Money podcast. Of course, he is the Scot Trench and I am Mindy Jensen saying, got a swish goldfish.

Outro:

BiggerPockets money was created by Mindy Jensen and Scott Trench. This episode was produced by Eric Knutson, copywriting by Calico Content, post-production by Exodus Media and Chris Nickon. Thanks for listening.

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds. Thanks! We really appreciate it!

Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Check out our sponsor page!

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.