rgaydos

Note:

I have covered Imperial Petroleum Inc. (NASDAQ:IMPP) previously, so investors should view this as an update to my earlier articles on the company.

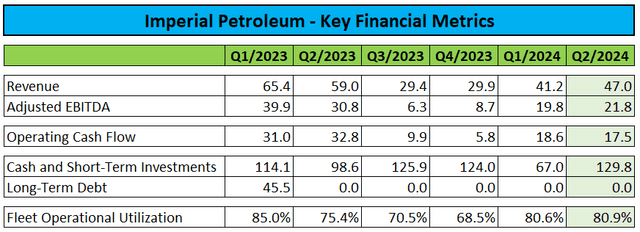

On Tuesday, Imperial Petroleum reported decent Q2/2024 results with stable fleet utilization and consistent cash generation:

Company Press Releases

The company ended the quarter with $129.8 million in cash and liquid investments. Imperial Petroleum continues to have no debt.

Subsequent to quarter-end, the company received $39 million in cash from spin off C3is Inc. (CISS) as consideration for the Aframax tanker Afrapearl II.

According to management’s statements in the press release, Imperial Petroleum’s current cash balance “stands close to $190 million“:

In Q2 24 we managed to turn a typically weak seasonal period to our second most profitable quarter thus far, as we generated a net profit of $19.5 million.

Our excellent performance was mostly leveraged by our product tankers that were strategically situated West of Suez where market for these vessels remained tight.

We enjoy recurring profitable quarters a very strong cash base which currently stands close to $190 million and as we repeatedly stress, zero leverage. This gives us plenty of flexibility to grow further.

We remain significantly undervalued as our market capitalization is even lower than our cash but are confident that gradually we will see an appreciation to our share price, driven by our recurring strong results.

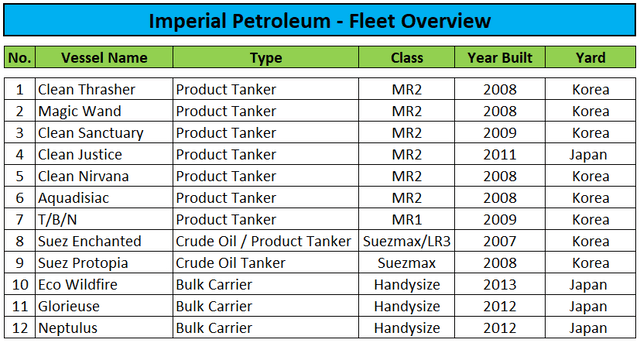

Last week, the company took delivery of the 2012-built handysize drybulk carrier Neptulus from related party Brave Maritime, with delivery of a 2009-built MR product tanker expected late in Q4. In combination, Imperial Petroleum will pay $38.35 million to Brave Maritime.

Upon delivery, the company will own a fleet of seven MR product tankers, two Suezmax tankers and three handysize bulk carriers with an estimated value of well above $300 million:

Company Press Releases

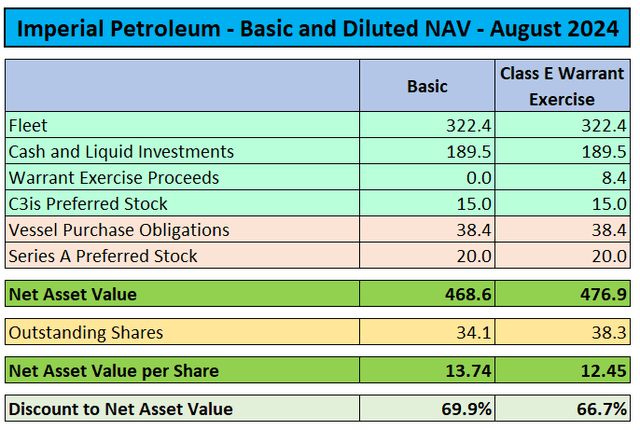

During the quarter, the company issued 900,000 new common shares upon the exercise of Class E Warrants for net proceeds of $1.8 million. Subsequent to quarter-end, Imperial Petroleum issued another 3.4 million shares as a result of additional warrant exercises for estimated net proceeds of approximately $6.8 million.

Outstanding shares increased by almost 15% thus largely offsetting fleet value appreciation and higher cash balances:

Company Press Releases / Regulatory Filings / Value Investor’s Edge

Assuming full exercise of the company’s remaining Class E Warrants, diluted net asset value (“NAV”) per share calculates to $12.45.

The company continues to trade at a large discount to NAV, likely due to the lack of shareholder capital returns and its history of pursuing growth at the expense of massive common shareholder dilution.

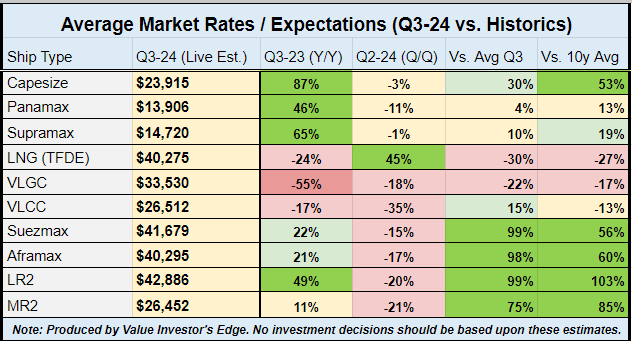

Please note that Q3 is likely to be a weaker quarter, with average MR product tanker charter rates currently down more than 20% sequentially and most recent spot fixtures well below $20,000:

Value Investor’s Edge

With the majority of the company’s tanker fleet trading in the spot market, Imperial Petroleum’s third quarter results are likely to be impacted quite meaningfully. For my part, I wouldn’t be surprised to see Adjusted EBITDA declining by up to 40% on a sequential basis.

That said, some seasonality in tanker charter rates should not surprise investors and without a near-term end to the Ukraine war and/or Red Sea disruptions, rates are likely to pick back up in Q4.

On the flip side, with product tanker orders at 18-year highs, investors should be wary of increased supply over the medium term.

In addition, I would expect related party dealings to continue, with the company likely to buy additional vessels from entities affiliated with the family of CEO and controlling shareholder Harry Vafias.

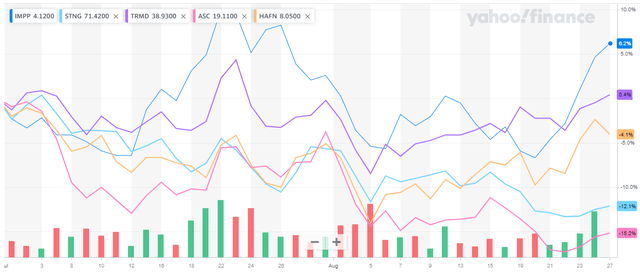

Despite the weaker charter rate environment and ongoing lack of shareholder capital returns, shares have held up well since the beginning of the quarter, particularly when compared to some of the company’s much larger competitors in the product tanker space like Scorpio Tankers (STNG), Ardmore Shipping (ASC), TORM (TRMD), and Hafnia (HAFN):

Yahoo Finance

Given the company’s tainted history and ongoing lack of shareholder capital returns, Imperial Petroleum’s common stock remains only suited for speculative investors.

However, income-oriented readers might want to take a closer look at the company’s 8.75% Series A Cumulative Redeemable Perpetual Preferred Shares (IMPPP) which I have discussed in a separate article earlier this year.

Bottom Line

Imperial Petroleum’s fleet continued to perform well in the second quarter, but dilution from warrant exercises resulted in net asset value per share remaining basically unchanged on a sequential basis.

At current share prices, the company is trading at a 35% discount to its stated cash and liquid investment balance, with market participants not assigning any sort of value to Imperial Petroleum’s fleet.

For now, I am reiterating “Buy” rating with an unchanged price target of $6 which is based on an approximately 55% discount to my $13 diluted net asset value per share estimate by year-end.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.