jetcityimage/iStock Editorial via Getty Images

Introduction

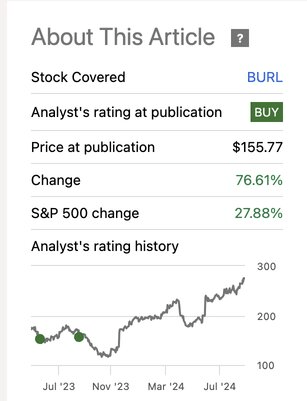

In continuation with our coverage on Burlington (NYSE:BURL), the stock has performed handsomely over the last year and since the publication, despite a short-term blip given the strength in its underlying business model.

Seeking Alpha

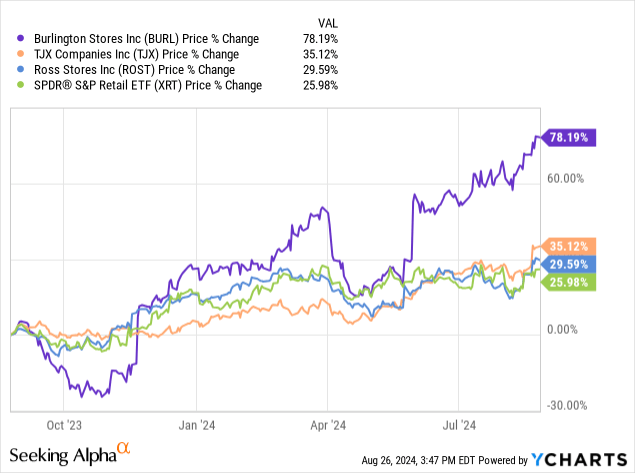

In fact, the company has significantly outperformed its peers by a wide margin as the pessimism due to short-term weakness along with management’s prudent conservatory guidance leading to a huge valuation gap (as a result of perceived underperformance) and as the earnings caught up, the share prices soared through.

Following the strong run-up, we revisit the stock ahead of their quarterly results scheduled pre-market on Thursday, August 29.

Investment Thesis

We believe Burlington has shown strong traction in its ability to execute and deliver solid performances after several years of underperformance. Given its shift to branded segment, driving better foot traffic and value to trade down shoppers has enabled them to post better than expected comp growth and regain momentum. In addition, supply chain efficiencies due to management’s focus on cost-efficient off price model in transporting goods and freight tailwinds has enabled them to unlock margin growth. We believe the company is poised to deliver stellar Q2 numbers and post another beat and raise quarter. Reiterate Buy with a target price of $375.

Recent Performance

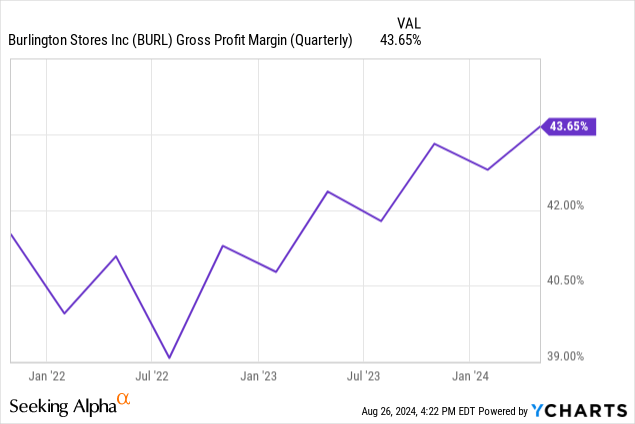

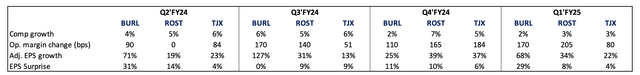

Recapping its Q1 performance, BURL delivered a solid all-round performance, with its comp sales growth of 2% above its guidance of 1% (compared to Ross’s 3% and Marmaxx’s 2% growth) demonstrating the consumer’s continued search for value. Merchandise margin remained solid, up 90 bps YoY, driven by lower markdown costs as it leveraged product sourcing costs for the first time since 2021. This combined with tailwinds from freight expenses enabled the company to expand its gross margin by 120 bps YoY to record highs since several quarters. Strong gross margins coupled with tight SG&A expense enabled the company to deliver a robust EPS beat at $1.35, up 68% YoY, and significantly above the guidance of $0.95-1.10 and consensus expectations pegged at $1.05.

Q2 Expectations

We believe the company will likely beat the expectations and guidance for Q2 on the back of solid organic growth and foot traffic. Placer data shows that there has been an acceleration in foot traffic to ~9% in Q2 from 6% in Q1. Management in their Q1 call guided for flat to 2% comparable sales growth and their cautious stance of not calling out the March / April traffic as a trend going forward as that could be the case of consumers increasing their spends due to tax refunds. Given the performance of other off-price retailers along with the foot traffic data, we model the comp growth could likely come in around 3% mark, above the guidance and the consensus estimate. Management noted that clearance headwinds which accounted for ~200 bps drag in Q1 comp sales is likely to abate through the end of Q2 driven by management’s focus on better branded mix in stores which further provides comfort on management’s ability to beat the guidance.

On the margin front, the company guided for 30 – 50 bps improvement in EBIT margins on the back of 30 bps negative impact due to expense shift flowing through from Q1 and tailwinds from freight and product sourcing. We believe the freight tailwinds will likely continue throughout FY2025 as the company negotiated domestic contracts and contracts on ocean rates are largely covered through in H1 would likely drive a 15 bps (~$1.5M lesser impact than Q1) improvement in Q2. On the full-year front, it guided for EBIT margin to increase by 40 – 60 bps. We expect the company will likely be at the top end/ beat margin guidance, driven by lower clearance sales and better brand mix.

The combination of strong comp growth and robust EBIT margins would lead to the company beating its EPS guidance again to ~$1.0 for Q2 (guidance of $0.83 – $0.93). This will enable BURL to raise their full-year guidance by an equivalent amount of beat in Q2, with new guidance likely to be $7.5 – $7.85 range.

Comparison with off-price retailers

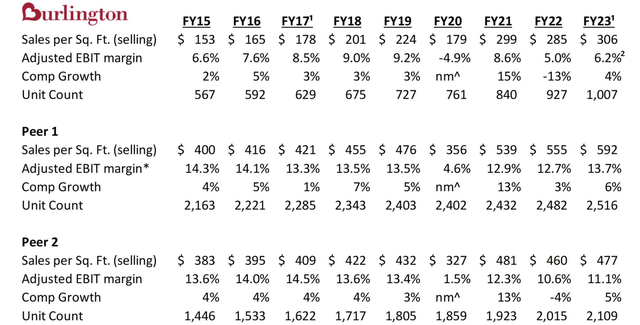

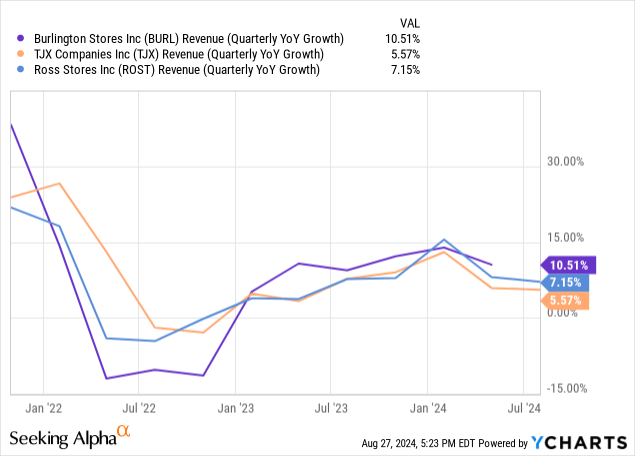

Burlington lagged performance since the pandemic against the off-price retail peers Ross Stores and TJX, leading to a huge valuation gap. Sales growth lagged as a result of their focus on the consumers with incomes of around $50,000 bore the brunt of rising inflation, however, as the pressures eased their quest for value brought them back to the department stores.

As a result, the performance improved with the company able to beat or match the peer performance over the past several quarters while significantly beating the estimates, leading to a re-rating of the shares.

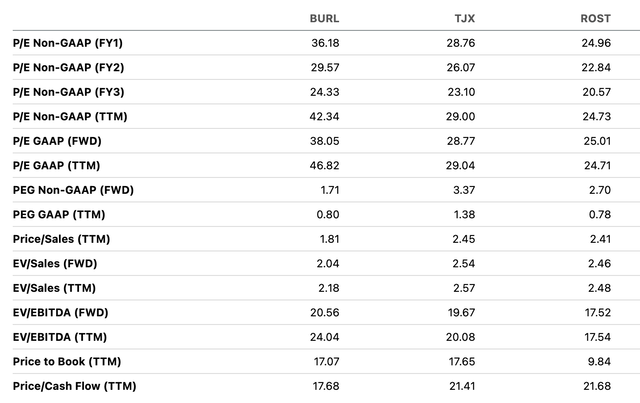

Company financials, Seeking Alpha

Valuation

We compare Burlington with other off-price retail peers Ross Stores (NASDAQ:ROST) and TJX Companies (NYSE:TJX). We believe, given BURL’s growth potential, the valuation has to be done on a PEG basis to capture the upside value towards growth. On PEG basis, BURL is relatively undervalue at just 0.75x compared to ROST and TJX trading at 2.7x and 3.4x respectively. We believe BURL can achieve 25% EPS growth over the next three years on the back of a solid track record of execution, grabbing market shares and economy turning in with consumers continuing to search for value. Given BURL’s long term P/E average of 33x and applying a 25% growth rate, the implied PEG comes out to be 1.3x, lower than the consensus estimate.

We believe as a #3 off-price retailer with significant productivity, in-line performance with peers and strong opportunity on the branded side along with relative undervaluation on PEG basis warrants a Buy rating. We ascribe a 40% discount to its peer average which would imply a PEG ratio of 1.8x and considering the EPS of $7.75, at the top end of its current guidance, we ascribe a target price of $375.

Risks to Rating

Risks to rating include

1) Market headwinds leading to economic contraction can have a detrimental impact on BURL’s low-income consumers, which can lead to deterioration in sales growth, as observed during 2022

2) Product sourcing and merchandise margin has not been the strongest suit for BURL and while the company has been able to execute well leading to gross margin uplift, however, failure to continue can lead to contraction in gross margins

3) Lack of inventory availability and its inability to provide better value deals to its customers can have an impact on basket size and ticket growth

4) Any changes in taxation or other regime changes post the elections can have an adverse impact

5) Increase in promotional environment and competition from other traditional and specialty retailers along with off-price retailers can impact sales and operating margins

Final Thoughts

Burlington had been lagging its peers for most of its part historically with sales per square almost half of the peers along with lower comp growth and total units providing significant productivity opportunity.

In addition, total unit count is only half of the other two peers, which also provides significant whitespace opportunity to grow and expand. We believe the company’s focus on value driven by branded mix would continue to enable them to unlock market share growth in the off-price retail and overall retail segment. Given it is still catching up to its larger peers, we believe the company is in a sweet spot within the off-price retail segment and poised for its next leg of growth.