jetcityimage

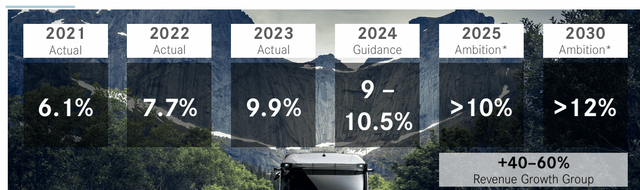

Daimler Truck (OTCPK:DTRUY), the largest manufacturer of trucks and buses in the world, has been a publicly traded company only for 3 years. Since it was spun off from Mercedes, the company committed to closing the gap with the industry leaders and achieving a double-digit operating margin. Well, FY 2023 closed and Daimler Truck’s return on sales was 9.9%, up 220 bps YoY. Unit sales reached 526k units and revenues were €55.9B. Margin expansion has been steady from 2021 to 2023 and should continue to reach the 2030 ambition of 12%.

Daimler Truck Investor Presentation

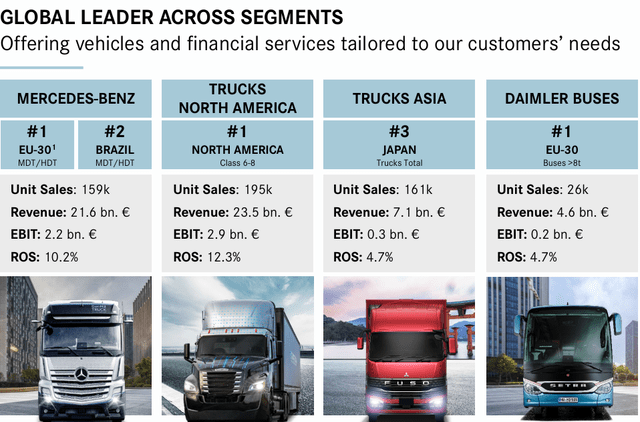

The company leads in medium-and-heavy duty trucks in Europe and is number one in North America for class 6-8 trucks, thanks to its two brands Freightliner and Western Star. This market is the largest one for Daimler Truck and the most profitable, as well, with a RoS of 12.3%.

Daimler Truck Investor Presentation

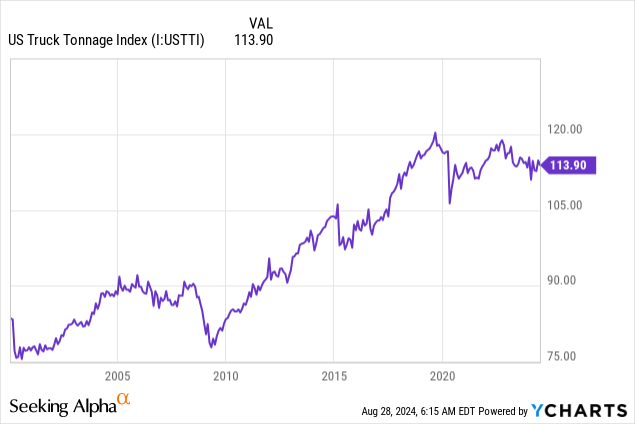

Considering truck tonnage has been increasing in the U.S., we should not think truck manufacturers will run out of business anytime soon.

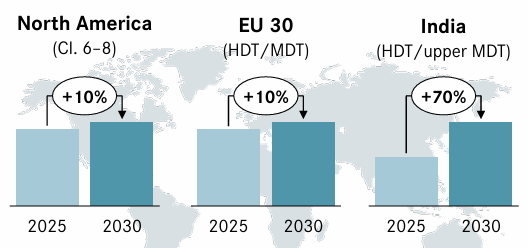

Core markets such as North America and Europe, though showing some softness recently, are still expected to grow 10% from 2025 into 2030, while India should report a 70% growth by 2030.

Daimler Truck Investor Presentation

Daimler Truck is also involved in autonomous solutions and schedules its market entry in 2027.

Thanks to its enhanced profitability, Daimler Truck has already initiated a dividend and buyback policy, with a dividend payout expected to be between 40% to 60% of net income, supported by a buyback program of up to €2B. By July 2024, €0.9B had already been executed, leaving over 50% of the program to be ended by August 2025.

The company’s balance sheet earns solid ratings: A- from S&P Global and A3 from Moody’s.

One of its main goals by 2030 is to grow its services, following what its main peers such as PACCAR (PCAR) and Volvo Group (OTCPK:VLVLY) have been doing. The former, in particular, earns over 20% of its revenues from services. Daimler Truck being rather new as a standalone company still has ample room to adjust its operations to the best standards of the industry. As a result, we can expect more room for margin expansion compared to its two most profitable competitors. The goal is to increase by 50% its service revenues from 2025 to 2030, with 60% of these coming from service contracts and spare parts.

However, we should also be aware of what is currently going on in the market after the post-pandemic frenzy.

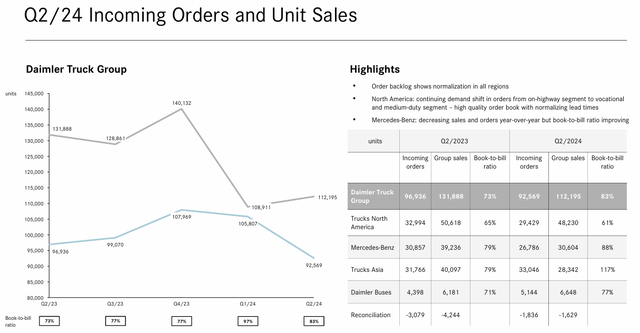

Plain and simple: demand is normalizing. The overall book-to-bill ratio is below 100%. To be precise, the group reported 83% meaning that for every 100 vehicles sold, only 83 new orders come in. Only Trucks Asia has a book-to-bill above 100% at 117%. However, sales in Asia have been rather sluggish in recent years so it is enough to see a small uptick north to have a nicer ratio. Trucks North America, on the other hand, reported 61% which means the market is slowing down quickly. Since this is Daimler Truck’s most profitable market, we should expect the sales mix of the next few quarters to drag down Daimler Truck’s margins.

Daimler Truck Q2 2024 Earnings Presentation

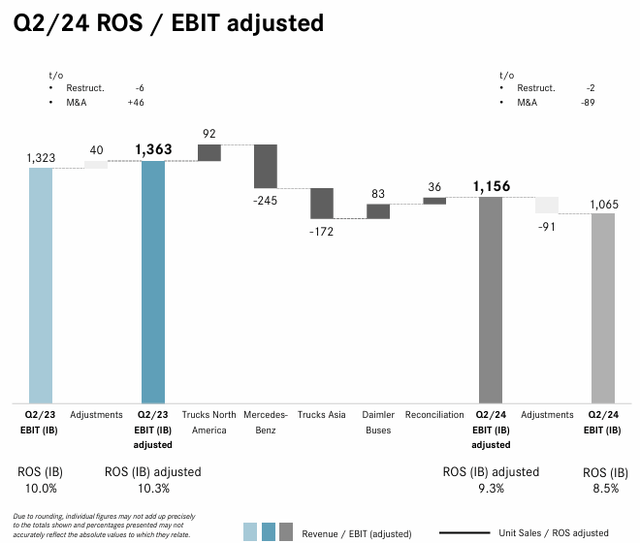

In Q2 2024, revenues were down 4% YoY to €13.3B. The company’s EBIT took a big hit and was down 22% to €1.08B. FCF of the industrial business was negative by €285M vs. positive €382M reported in the year before.

The YoY EBIT bridge shows the negative impact of volume and price mix, with Mercedes-Benz and Trucks Asia dragging down the most the company’s RoS. North America, on the other hand, still flexed its pricing power. However, with the sharp decrease in orders, I don’t expect this to continue for long.

Daimler Truck Q2 2024 Earnings Presentation

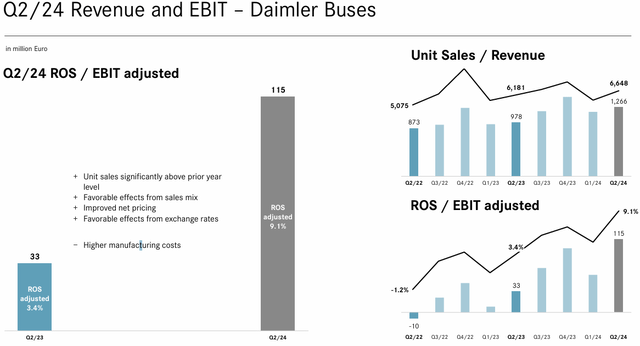

Positive news came from Daimler Buses, which is usually a very low-margin business. Here things are recovering well, and the pandemic seems well behind for tour operators and similar. Orders are picking up and the company can benefit from net pricing, resulting in a big jump from a RoS of -1.2% in Q2 2022 to a positive RoS of 9.1% in Q2 2024.

Daimler Truck Q2 2024 Earnings Presentation

Daimler Truck enjoys no insulation from a softening market and just like its peers had to report a downward revision of its 2024 guidance. Revenues will be below € 55B and the company’s EBIT will see a “significant decrease”. This means, according to the company’s definition, a decrease below 15%. Sales are expected to be below 480k units, while the previous guidance had as its lower range boundary 490k units. RoS is then projected to be between 8% to 9.5% with FCF around €2.8B.

Currently, the stock trades at €34.3 in Frankfurt and is down €13.3 from its 52W high of €47.6. The company’s fwd PE is 9 and its P/S is 0.5.

This shows one thing: investors don’t value Daimler Truck’s sales a lot because of their volatility and low visibility on margins and returns. Paccar and Volvo all have above a 1. This is because of their revenue mix, supported by a strong service business. So, if Daimler Truck successfully grows its services, then we could see its sales double or close the gap, leaving ample room for an upside.

The same is true for its earnings. Both Volvo and Paccar trade at a fwd PE above 12. This means Daimler Truck can increase its multiple by at least 33% to come close to the trading range of its peers.

What does this lead to?

Daimler Truck is no short-term bet. The upcoming reports will bring lower results and the stock may feel some pain. But Daimler Truck can be a very reasonable bet as a turnaround play. Part of this has already been accomplished, which makes us think the company can carry it out thoroughly to position itself as part of the two profitability leaders.

Currently, I am not willing to rate it as a buy due to poor market conditions and expectations, but I would keep the stock on my watchlist for 2025.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.