jetcityimage

Dollar General Corporation (NYSE:DG) is the largest discount retailer in the U.S. with 20,022 stores in total. The company released its weak Q2 result on August 29th, lowering the full year financial guidance. The stock price plummeted by nearly 30%. The weak consumer demand, particularly among low-income households, may continue to pressure Dollar General’s growth. However, after the stock’s sharp decline, I think the stock price has returned to a more realistic level. I am initiating Dollar General stock with a Buy rating and a one-year target price of $100 per share.

Poor Consumer Sentiments

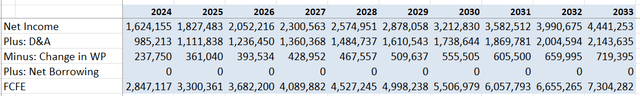

As shown in the chart below, Dollar General’s same store sales (SSS) grew by only 0.5% during the quarter. As communicated over the earnings call, 60% of the company’s sales come from households earning less than $35,000 annually. The current weak job market and high-interest rates have created significant financial challenges for Dollar General’s core customers.

Dollar General Quarterly Results

I believe Dollar General will continue to face weak demand for their discretionary products in the coming quarters for several reasons:

- The company conducted a survey among their customers, revealing that 30% of customers have at least one credit card that has reached its limit, and 25% anticipated missing a bill payment in the next six months. With the current high-interest rate, their core customers are likely to encounter financial difficulties in the coming months.

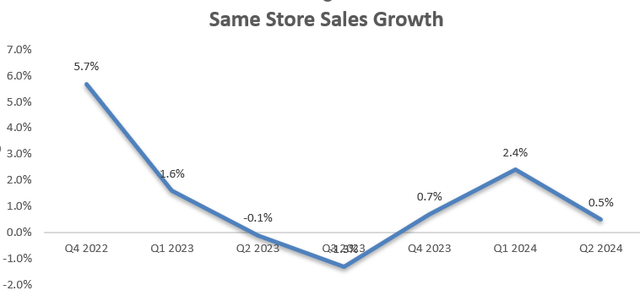

- As depicted in the chart below, Dollar General delivered only 0.2% SSS growth in FY23, indicating high-interest rate has already posed significant growth challenges for the company. Dollar General has around 20% of revenue exposed to discretionary product categories, such as home products and apparels. In FY23, revenue from home products declined by 7.2%.

Dollar General Quarterly Results

- Over the earnings call, the management indicated an increase in promotional activities due to the financial difficulties faced by retail customers. The heightened promotions suggest that the overall retail industry is facing challenges, with inventory destocking becoming a major priority for retailers.

Initiatives During the Downturn

Despite the softness in core customers demands, Dollar General has been implementing several initiatives to improve their financial condition and operations:

- Supply Chain: Dollar General has made significant progress in optimizing their distribution capacity. The company announced to close 12 temporary facilities by FY24. Meanwhile, they built two new distribution centers in Arkansas and Colorado. The optimization of distribution networks can potentially reduce the distribution miles and accelerate delivery time to stores in the future.

- Inventory Reduction: Dollar General has focused on improving inventory management, with an 11% decline in total inventory on a same-store basis. The company is using promotions to reduce their consumable and discretionary products. While these promotions will affect the company’s margin, they will help speed up inventory turnover and improve financial conditions.

- SKU Optimization: Dollar General aims to reduce around 1,000 SKUs by the end of the year, Additionally, off-shelf displays went down by 25% year-over-year, with a target of 50% reduction by FY24. The SKU optimization could potentially help the company better manage their inventory level and retail floor space.

Outlook and Valuation

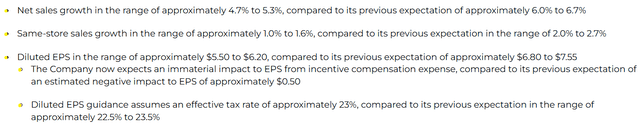

Due to the poor results, the company has lowered the full-year guidance for both top line and bottom line, as detailed below:

Dollar General Quarterly Results

I am considering the following factors for Dollar General’s growth:

- Over the past 7 years, Dollar General achieved an average of 4% in SSS growth and 5.8% in store footage growth. It is evident that Dollar General will deliver a relatively weak growth rate in FY24 due to the current high-interest rates and weak labor market. I project the company will only generate 1.3% growth in SSS for FY24. I think the Fed is likely to cut interest rate this September, which should gradually improve the financial conditions for low-income families starting in FY25. Therefore, I forecast that Dollar General’s SSS will return to 4% from FY25 onward.

- Store expansion has been a major growth driver for Dollar General recently. With only 20,022 stores currently, they still have a considerable runway for future expansion. I estimate store growth will contribute 5% to the overall topline growth, aligned with their historical average.

As such, I calculate Dollar General will deliver 6.3% growth in total revenue in FY24, followed by a recovery to 9% growth from FY25 onwards.

Due to the high promotion activities, Dollar General is likely to face strong challenges in gross margin in FY24. I calculate the company’s gross margin will decline by 50bps in FY24. However, thanks to their supply chain and distribution network optimizations, I forecast a 10bps margin expansion in SG&A expenses.

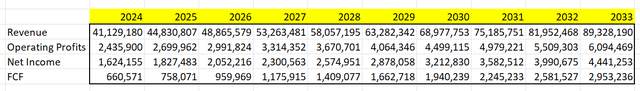

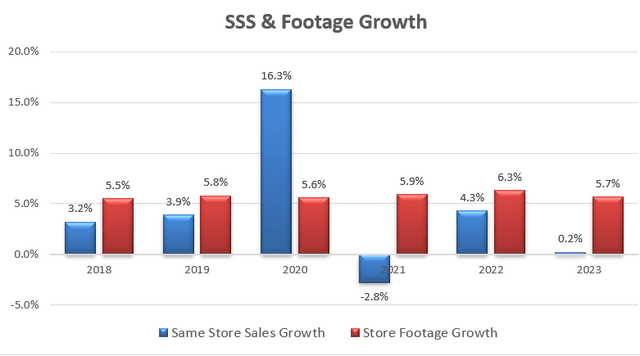

With these assumptions, the discounted cash flow (“DCF”) summary can be found as follows:

I calculate the free cash flow from equity (FCFE) as follows:

The cost of equity is calculated to be 9.4% assuming: risk-free rate 3.8%; beta 0.8; equity risk premium 7%. Discounting all the future FCFE, the one-year target price is calculated to be $100 per share, as per my estimates.

Downside Risks

- Debt Leverage: Dollar General exited the quarter with 3x adjusted debt to adjusted EBITDA, which is relatively high compared to other retailers. While the company has committed to lowering their debt leverage in the future, the current weak consumer sentiment is likely to impact the company’s ability to reduce their debt level.

- Political Tensions Between China and U.S.: Dollar General imports around 4% of their purchases directly from other countries, including China. Furthermore, many of their domestic suppliers source products from China. The rising geopolitical tensions between China and the U.S. might potentially affect Dollar General’s global supply chain and increase distribution costs.

- Rising Labor Costs: The current labor cost inflation is higher than the management had previously anticipated. Unlike other companies, Dollar General may not be able to pass the rising costs on to their end customers. After all, the company is just a dollar store operator, and their customers are likely to be sensitive to price increase.

End Note

I think the current stock price has already factored in the weak same store sales growth anticipated in the near future. I favor the company’s efforts to enhance their supply chain and expand margins over time. Therefore, I am initiating Dollar General with a “Buy” rating and with a one-year target price of $100 per share.