guvendemir

Thesis

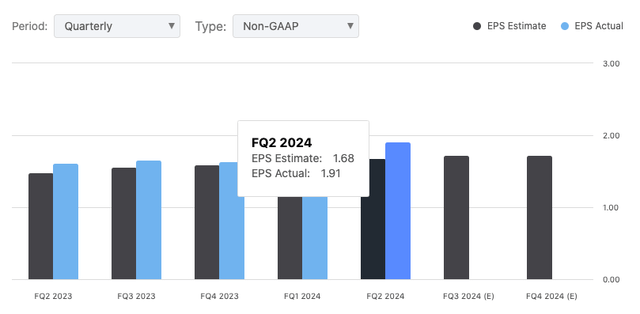

Essent Group Ltd. (NYSE:ESNT) recently dropped its Q2 2024 results, and they look solid: they reported GAAP earnings per share (EPS) of $1.91, which beat estimates by $0.22, and revenue came in at $312.94 million, exceeding projections by $4.61 million. In my analysis, I argue that despite headwinds, Essent Group’s smart risk management and strong dividend policy make them a solid play in the mortgage insurance space.

About

Essent Group Ltd. is a Bermuda-based holding company in housing finance. They started in 2008. The company focuses on private mortgage insurance, reinsurance, and related services. In a nutshell, their mortgage insurance helps protect lenders from borrower default, thus, making mortgage loans more accessible in the U.S. housing market.

ESNT: 2Q24 Investor Presentation

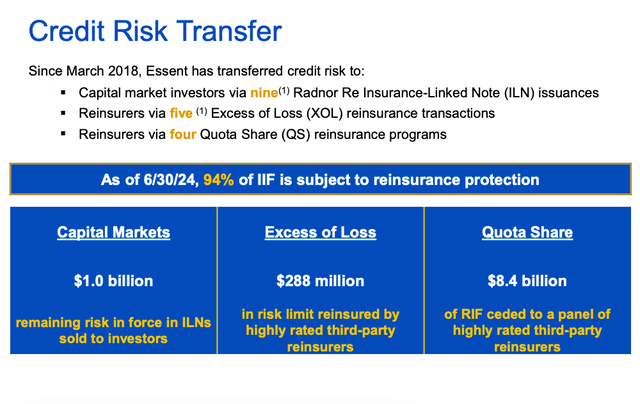

Since March 2018 (see chart above), Essent Group Ltd. has offloaded a lot of credit risk and they did this with nine Radnor Re Insurance-Linked Notes (ILNs), shifting $1 billion of risk to investors. They also made five Excess of Loss (XOL) deals, transferring $288 million of risk to top-rated reinsurers.

To strengthen their risk management, Essent set up four Quota Share (QS) reinsurance programs. These programs let them hand off $8.4 billion of risk to top-rated reinsurers. As of June 30, 2024, 94% of their insurance in force is covered by reinsurance.

Here’s a quick breakdown of their services:

Private Mortgage Insurance (PMI): Essent’s PMI protects lenders if a borrower defaults. It lets lenders offer mortgages to more people, especially those with smaller down payments. The insurance covers part of the loan, lowering risk for lenders and keeping the mortgage market stable.

Reinsurance: Essent plays in the reinsurance market, spreading risk across different financial entities. They help other insurers manage their risk. Essent Guaranty, a subsidiary, issues mortgage insurance-linked notes to transfer risk to investors.

Related Services: Apart from PMI and reinsurance, Essent provides title insurance and settlement services. The former is always important for buyers to obtain a clear property title to ensure the legitimacy of who is selling the house and to rule out any legal disputes. The latter helps smooth the mortgage transaction process, especially for loan originators (e.g., real-estate agents and mortgage brokers), by expediting the appraisal review and improving customer service and the real-estate purchase process.

Industry Fundamentals

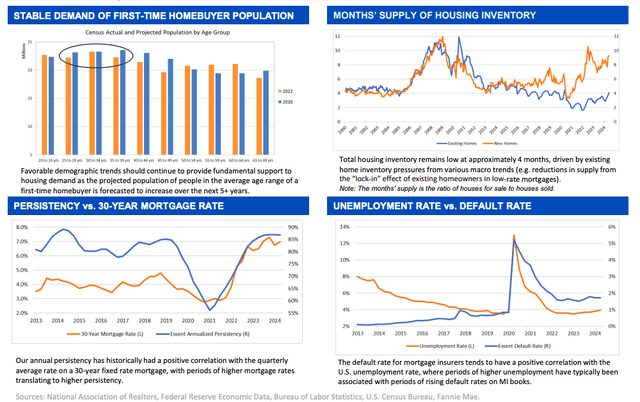

ESNT: 2Q24 Investor Presentation

- Essent Group Ltd is operating in a tight market with some power slipping out of its hands. Sales of existing homes are stagnant, with a few months of inventory on the market. Homeowners are stuck on low-rate mortgages and not selling.

- Additionally, Essent’s mortgage insurance business is directly tied to these industry trends. They have observed a direct correlation between mortgage rates and policy persistency: when interest rates are high, homeowners refinance less, keeping policies in place longer. This mirroring of market trends is likely to continue as mortgage rates remain the focus of the housing market.

- Demographic trends are a major driver of Essent’s housing demand, which in turn is a key driver of Essent’s business. The number of potential first-time homebuyers in the US is projected to continue to increase over the next five years, which will help to ensure steady demand for housing. This in turn will likely be supportive of the longer-term supply of Essent’s mortgage insurance products.

- Essent has to monitor macroeconomic risks such as the U.S. unemployment rate. Historically, higher unemployment rates meant more defaults on mortgages. As the economy and job markets change, risk management will help Essent cope with rising defaults in its portfolio.

Market Performance

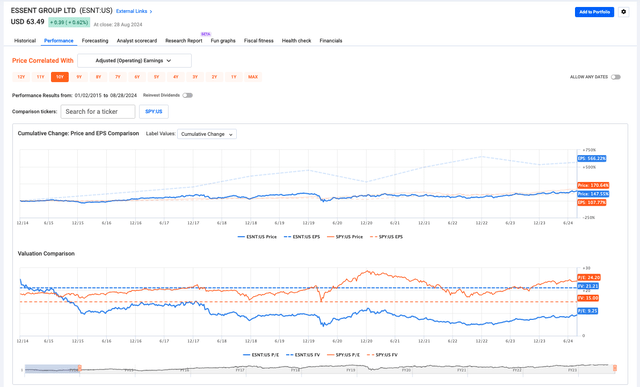

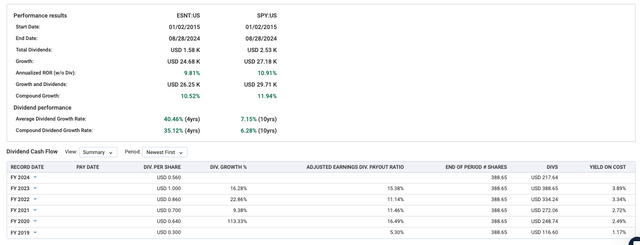

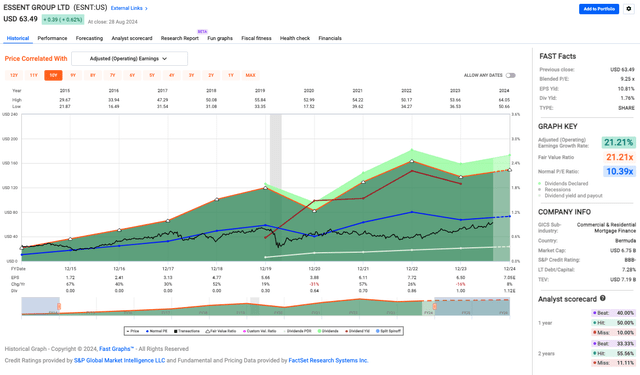

Incidentally, Essent Group’s stock price was $25.73 in January 2015 and $63.49 by August 2024 for an admirable annual return of 9.81%, although still a bit short of the S&P 500’s (SP500) 10.91% over the same period.

Their dividend play is good, though, and they were increasing the dividend, average annual increase of 40.46% over the past four years; compound growth rate 35.12% which is way above what you see in the S&P 500.

But with this much growth, I wonder if they are over-extending themselves, not to mention the over 113% dividend increase in 2020, may be banking on roaring earnings. But for now, those payout ratios look modest, such as 15.38% in 2023, but we’ll need to keep an eye on earnings to make sure they can keep covering these big dividends. If you are seeking dividends, Essent Group looks like a candy bar, but if you’re more about growth, you might notice it’s lagging a bit behind the S&P 500.

Peer Performance

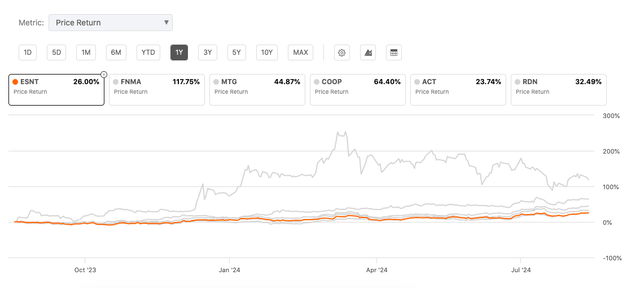

ESNT clocked a one-year price return of 26.00%, sitting mid-tier among its peers. FNMA topped the chart with a 117.75% spike, while ACT nipped at ESNT’s heels with 23.74%. Essent Group did edge out ACT and RDN but couldn’t keep up with FNMA, MTG, and COOP.

Essent Group Ltd. Ratings

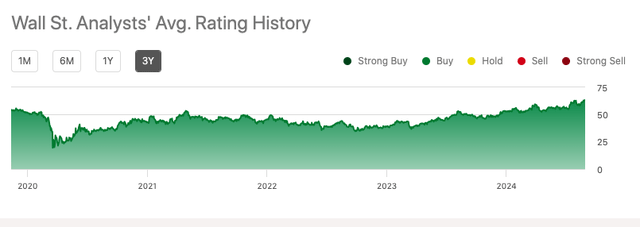

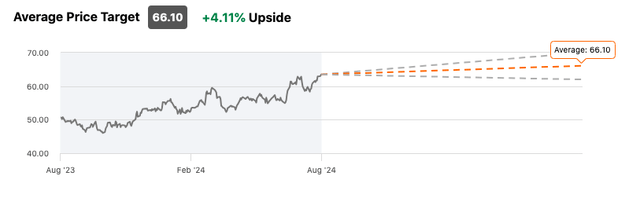

For the past three years, Wall Street analysts have been overwhelmingly bullish on ESNT. However, even with an average weighted “Buy” rating on the stock, the consensus calls for a very modest 4% price target from here.

Essent Group’s Q2 2024 Highlights

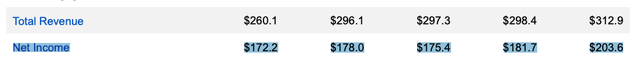

Essent Group Ltd., recently reported its financial results for Q2 2024 on Aug. 02, 2024. Net income amounted to $204 million versus $172 million (up 18.6%) announced last year.

ESNT: 2Q24 Investor Presentation

Diluted earnings per share (EPS) amounted to $1.91 versus $1.61 in Q2 2023. Return on equity (ROE) came in at 15%, which shows decent profitability.

Its US portfolio of mortgage insurance rose 2% to a level of $241 billion, while the company also maintained a steady rate of about 87%, showing stable premium revenue. And despite economic headwinds (challenges like rising interest rates making homes less affordable, political uncertainty affecting mortgage regulations, and inflation putting financial strain on borrowers, which could increase the risk of defaults), Essent’s statistic of 90% cure rate after a year (representing the number of defaults it has successfully managed to reverse) is cause for celebration.

Since we’re talking about “headwinds,” or that is increasing headwinds down the road, CEO Mark Casale confidently asserts that his company is equipped to face economic challenges. During the earnings call, he stated (emphasis added):

I think we’ll perform quite well through it….I mean, at the end of the day, we’re a cat (catastrophic) business. Our cat happens to be a severe economic recession. And so that’s the — when we think about that, we don’t think about the moderate losses, we’re well prepared for that from a capital balance sheet liquidity. It’s those significant stress that we want to make sure that we’re well prepared for.

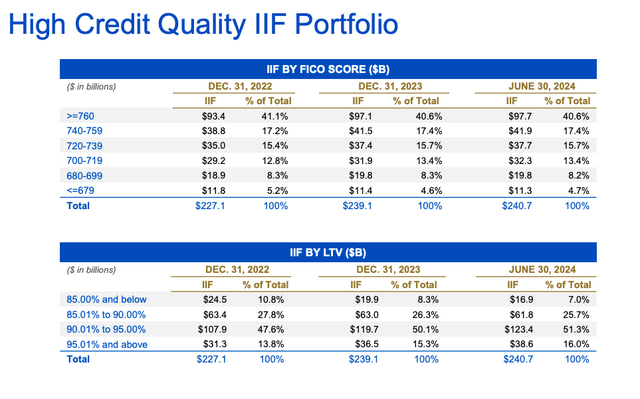

Weighted average FICO score is 746, representing strong credit quality. Original LTV is 93%.

ESNT: 2Q24 Investor Presentation

Net investment income increased 8% to $56.1 million, reflecting higher yields and a higher average balance for Essent’s investments. Default rate dipped slightly for Essent’s US mortgage insurance portfolio, which was 1.71%, reflecting improved credit performance.

Investment yields are up to 3.8% this quarter from less than 2% in 2021 – a very congenial environment for investment income. GAAP equity stands at $5.4 billion, and there is $1.3 billion of excess loss reinsurance available.

Lastly, the company stuck to its solid dividend policy I brought up earlier, paying out $29.6 million in dividends this quarter. They can also pay an extra $329 million in ordinary dividends for 2024. Overall, management feels that the market outlook looks good, thanks to those aforementioned favorable demographics and limited housing supply, which should support home prices.

ESNT Valuation

Looking at Essent Group Ltd.’s blended P/E ratio of 9.25x, the stock seems undervalued compared to its normal P/E of 10.39x which, once we examine risks and headwinds below, might create a nice opportunity for value investors. The earnings yield of 10.81% caught my eye since, in today’s market, where fixed income options can be shaky due to interest rates, this yield is fairly significant. Plus, the dividend yield of 1.76% I’ve already mentioned several times gives that steady income, which is attractive for those looking for reliable cash flow.

Furthermore, with an adjusted earnings growth rate of 21.21%, this indicates to me solid operational efficiency, and the fair value ratio of 21.21x suggests the market might not fully recognize its earnings potential yet. And finally, the long-term debt to capital ratio of just 7.28% supports the idea that Essent is handling its leverage smartly.

Risks & Headwinds

There are some challenges for Essent Group, though. Operating costs are higher, with underwriting and operating expenses up to $56 million, as well as $12.9 million spent on title operations, which could hurt profits in the near future. The Title business is also in a control phase, which means that infrastructure and investment into the business will take precedence over quick profits, which could have a dampening effect on growth. While there were great numbers overall, the mortgage origination market is a challenge for the company as there are not great opportunities for growth considering the low origination volumes.

Competition for loan insurance business remains intense, and there appears to be a risk of margin pressure moving forward, despite strong industry discipline of late. Essent’s recent senior note offering effectively increases the company’s debt-to-capital ratio to 8.5%, indicating increased leverage—although it’s not something I’m overly concerned about. In the end, Essent, like others in this industry, will live or die by its ability to perform against external economic trends, including volatility of the housing market, not to mention secular changes in interest rates and so on.

Lastly, a couple of final points to cap things off: anticipated lower mortgage rates could enhance affordability and stimulate demand, thereby boosting NIW and improving results. Overall, the company estimates that, driven by demographics and immigration, the mortgage insurance market in total will grow from $1.5 trillion to potentially $2 trillion in the near future, offering significant upside for the company.

ESNT Rating

Essent Group Ltd is a “Buy” pick: great balance sheet, nice earnings growth, attractive for income investors given its dividend policy, good outlook (more first-time buyers and generally more mortgages should mean more mortgage insurance…), and it’s trading under its historical P/E, making it a value-investor bargain.