EschCollection

Introduction and Background

Today, Li Auto (NYSE:NASDAQ:LI) released its earnings for the second quarter. I wrote on this stock back in May, and I thought it was going to reach its lowest point in the second half of the year since I could see the management was making the required corrections to their BEV error and turning its attention back to its REEV (or “Range Extended Electric Vehicle”) product lines. When Li’s most recent product, the L6, the most reasonably priced one Li had ever introduced, first received excellent feedback from consumers, I believed the worst was about to go behind.

Recent Performance and Market Position

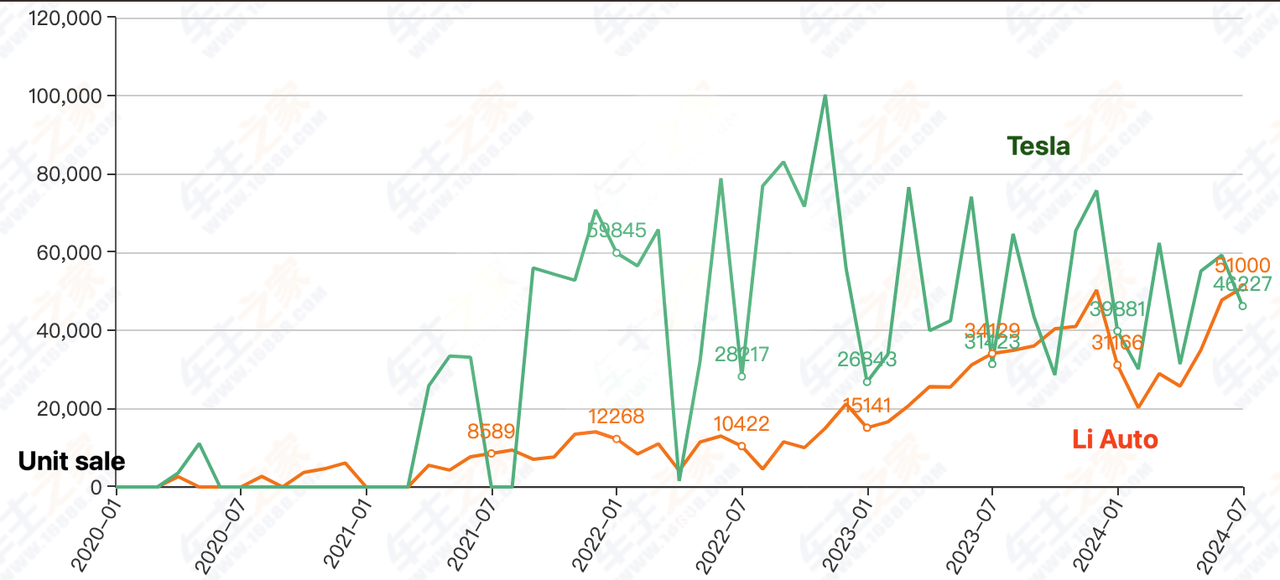

After a few months, Li had demonstrated its ability to innovate and execute, regaining its top spot on the Chinese leaderboard for new energy SUV sales while also quickening the pace of increase in unit sales. This implies that the company has a strong brand and has effectively increased its market penetration in lower-tier pricing. In July 2024, Li Auto’s unit sales exceeded Tesla China’s (NYSE:TSLA), according to Autohome. (see chart below)

Unit Sale by brand (Autohome)

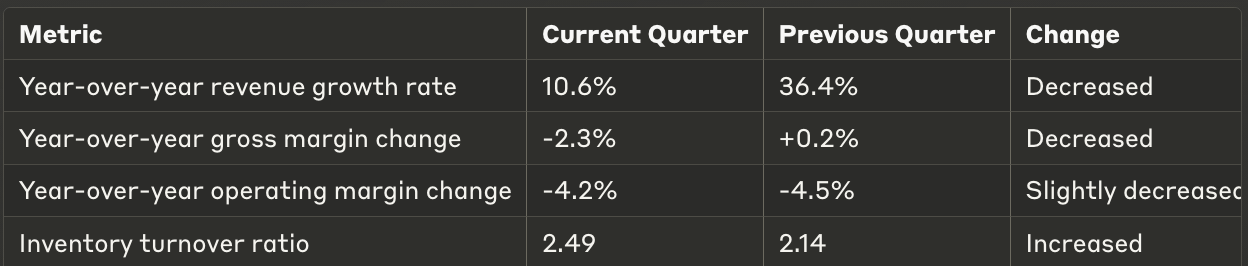

Despite a slower pace of revenue growth and lower margins as a result of a mistake on Mega, the company managed to retain an operating profit of 1.5% in Q2 and increased its inventory turnover ratio from 2.14x to 2.49x.

Q2 and Q1 comparison (From Li’s filing and edited by the author)

This is a better result than I had anticipated. Following their blunder in Q1, the company’s stock price experienced a sharp decline, plunging over 50% from its peak in March. As a result, I predict that Li will have a large loss this quarter. In the worst case, the company would require some time to adjust its inventory position and recover in Q42024 or Q12025. Nonetheless, starting in Q3, management predicted an acceleration of growth in revenues, unit sales, and improved margins. Leveraging its operating expenses as a result of high L6 unit sales was the driving force behind this. Therefore, things are turning around very quickly.

Valuation and Future Outlook

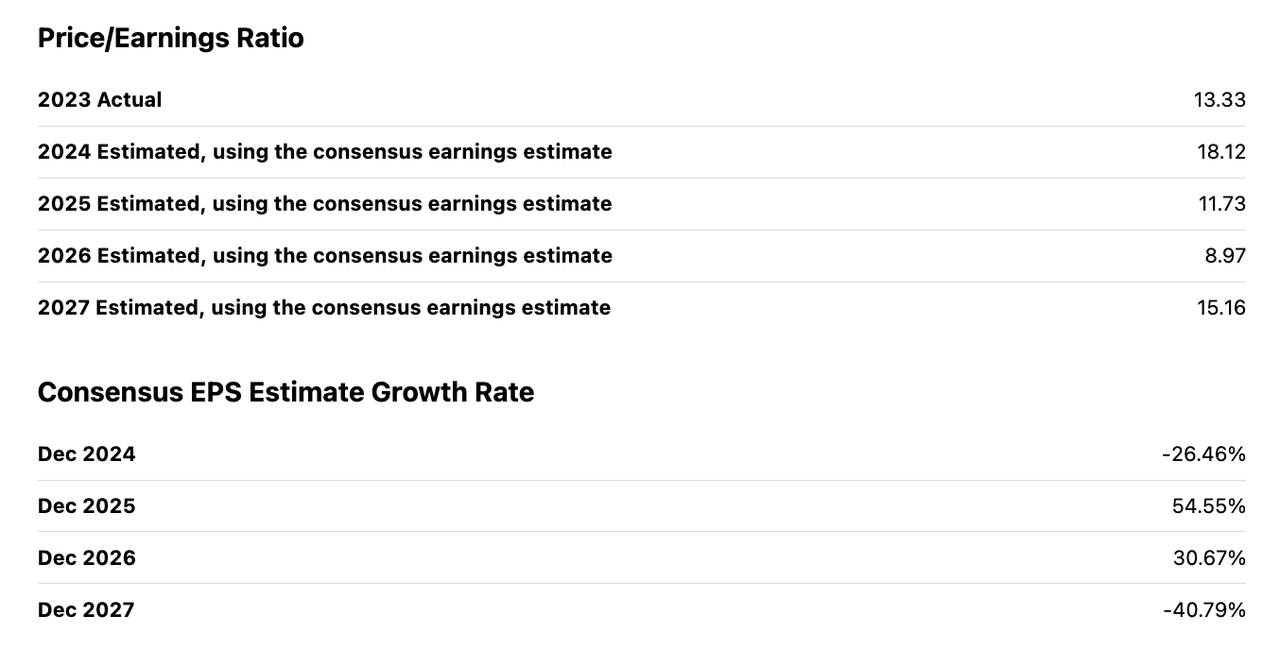

According to Seeking Alpha, Li Auto’s stock had a forward 2024 P/E ratio of 18.1x. Analysts predicted that EPS would fall by 26% in 2024 and then increase in 2025.

P/E ratio (Seeking Alpha)

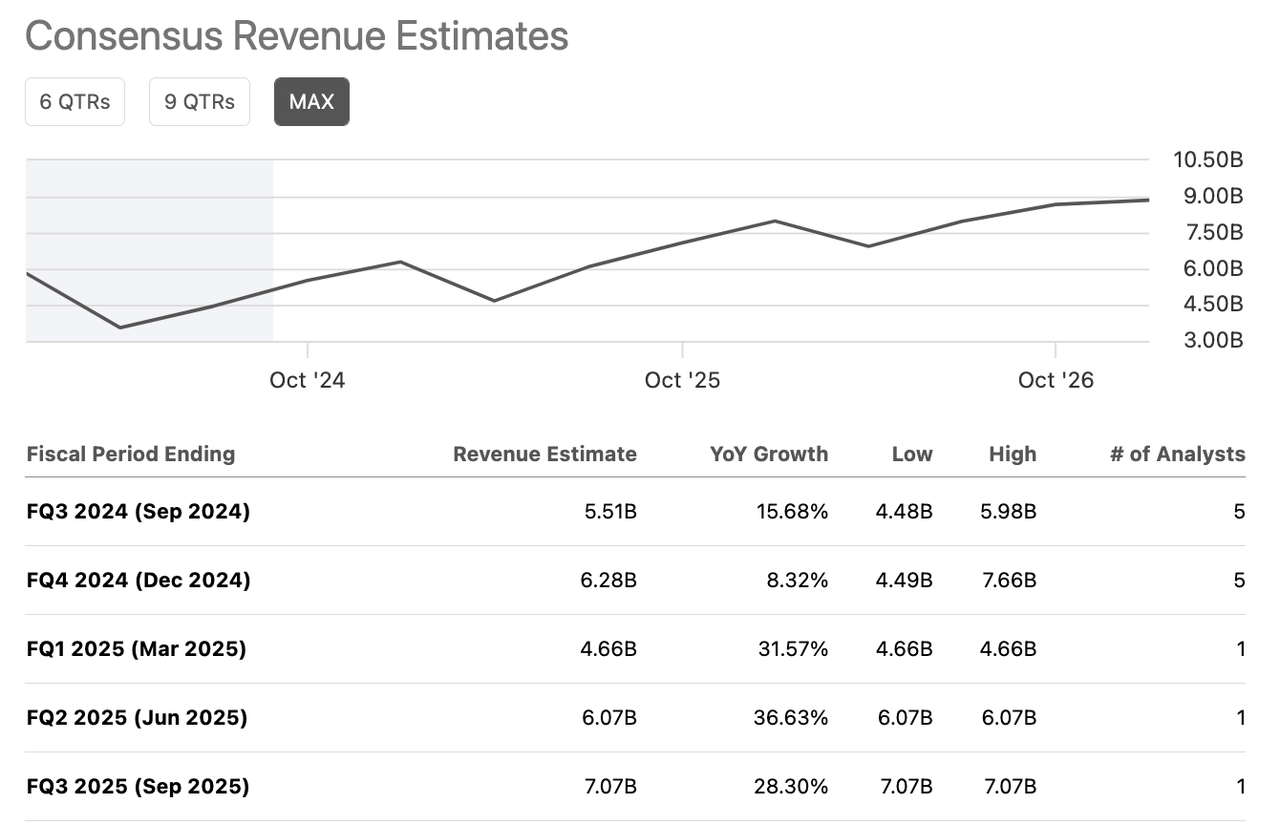

Consequently, in Q3 and Q4, even though analysts anticipate that the company’s revenues will increase, its EPS should decrease. Analysts did anticipate a new peak for its EPS in 2025, though. The worst case scenario, therefore, is that the stock price of the company will bottom in Q1 2025 and reach a record level in 2025, meaning a 145% upside. My DCF model estimates valuation to be $49.2 per share or a 160% upside. Because of this, the upside potential is considerably more alluring than it was when I first covered it.

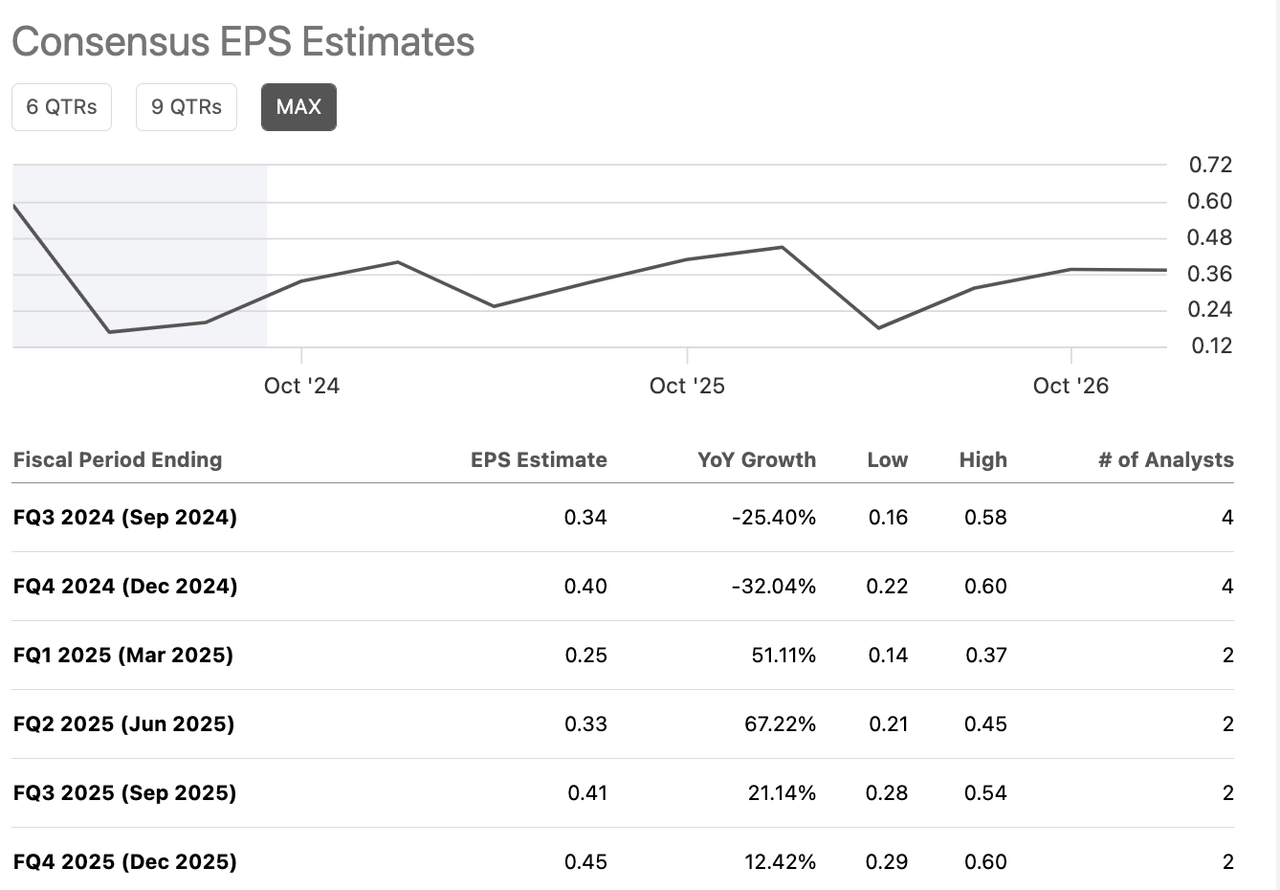

EPS growth (Seeking Alpha)

Revenue growth (Seeking Alpha)

Investors should wait two more quarters if all goes according to plan before we see the light at the end of the tunnel; in my opinion, the wait will still be worthwhile.

Risk Factors

Competitive Landscape

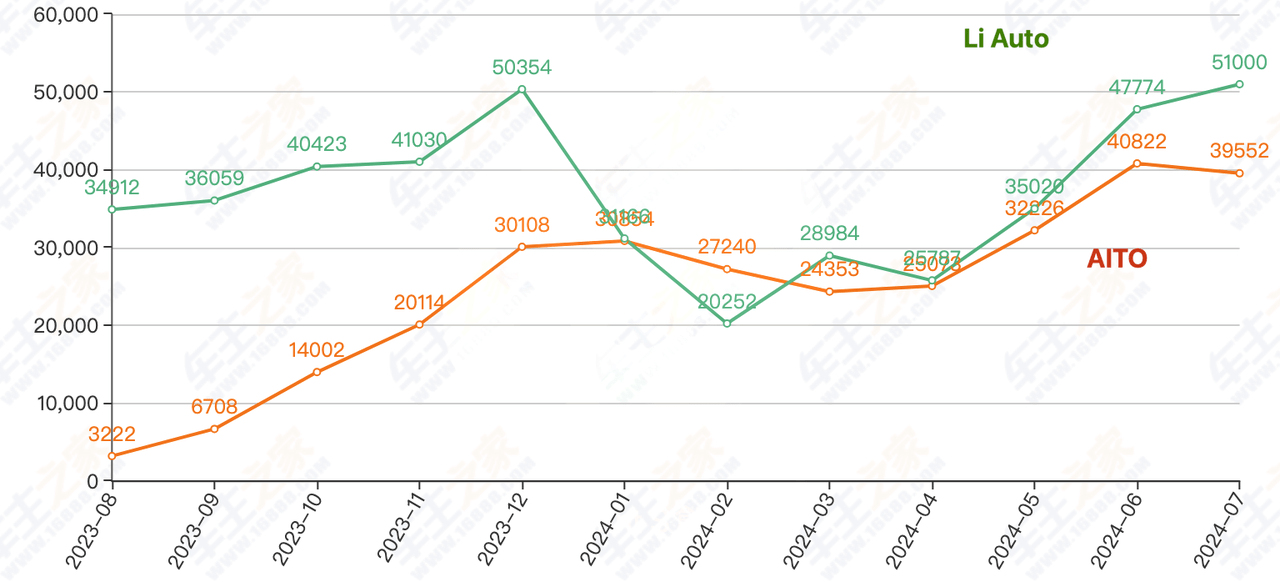

One thing to keep in mind, though, is that the REEV sectors are seeing more competition. Even while Li continues to lead this industry, up-and-coming talents like AITO are pursuing it. Seres Group, a publicly traded company that is listed on the China Shanghai Exchange, is the owner of the brand AITO. AITO and Huawei work together on operating systems. In terms of AITO model design, Huawei is a leader as well. AITO became Li’s formidable rival by using Huawei mostly for autonomous driving systems. Following the partnership, AITO’s unit sales rapidly increased and are currently near Li.

Unit sale (Autohome)

However, Li had made significant investments in its autonomous driving technology, known as NOA. Li’s NOA at least works well, although some internet reviews claim it isn’t the greatest in China. Additionally, 99% of its consumers used NOA. This implies that the feature is helpful to its users. Li may not have the best NOA for its vehicle, but at least it is competitive in the autonomous race field. Additionally, Huawei claims that AITO lost an estimated RMB 30,000 while selling its car. This shows that the surge in AITO’s unit sales might not last. As a result, Li might still have a significant margin edge over competitors.

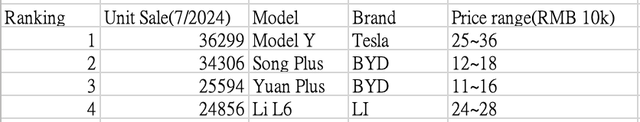

Other notable competitors in the new energy SUV market are BYD and Tesla.

Unit Sale (Autohome)

Model Y continues to outsell L6 in terms of unit sales, even if Li’s overall unit sales exceed those of Tesla. Tesla’s gross margin was 18% in Q2 2024, which was a little less than Li’s 19.5%. Li therefore continued to have a margin edge over Tesla.

As a result, I believe that BYD may be Li’s best competitor because it can produce batteries and can offer cars for far less money than Li. Li L6 performs better than Song Plus and Yuan Plus, despite this. Song Plus and Yuan Plus accelerate from 0 to 100 kilometers per hour in 8.5 and 7.3 seconds, respectively, lower than L6 at 5.4 seconds. L6’s size was bigger than the two as well. Li’s NOA system additionally led to BYD. As a result, in my opinion, Li is still quite competitive when compared to BYD.

Conclusion

Overall, I appreciate how quickly Li’s management addressed their errors. Li’s management was able to navigate through the crisis thanks to its outstanding execution skills and vision. Li now holds a dominant position in the new energy SUV market. Li still had more room to grow in terms of penetration, even if the country’s weak economic outlook and fierce competition could pose harm to Li’s business. Li’s stock has significant upside potential and is expected to rise in the second half of 2024 or at the latest in Q1 2025. Compared to when I first covered the company, the stock price was lower. Since Li has already made it through its most difficult quarter, I think the risk has now decreased. As a result, I think the risk-return profile is more attractive. I therefore raise my rating from buy to strong buy.