Michael Vi

Investment Thesis

Okta (NASDAQ:OKTA) delivered a reasonable result for its fiscal Q2 2024 earnings. The problem here is that its guidance points to substantial deceleration in its revenue growth rates.

As it stands right now, investors are having to pay 25x next year’s non-GAAP EPS for a business with current remaining obligations growing at decidedly low double digits and potentially less, with fiscal Q3 2024 guided to about 9% to 10% growth.

Altogether, this is a stock that’s no longer a high-growth name. Thus, simply put, investors will no longer be willing to put a high-growth premium on this stock. Therefore, I now rate this stock a hold.

Rapid Recap

Back in February, I said,

[…] even though [Okta’s fiscal Q4 2023] results were good, there are still some pesky points that bother me.

But they don’t bother me enough to keep my hold rating on this stock. Therefore, I’m upwards revising this stock to a buy.

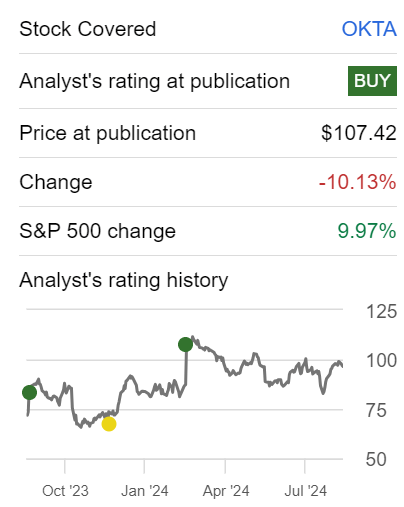

Author’s work on OKTA

As you can see above, I recommended this stock at $107, only to now sidestep this name. That’s a very bad call on my part!

But I refuse to compound my mistake now by doubling down on my thesis. Given these results, investors are not going to reward this stock with a premium valuation. It’s important to recognize these results for what they are, rather than we wish them to be.

Okta’s Near-Term Prospects

Okta provides identity and access management solutions, helping organizations securely manage and control access to their applications and data.

Its products ensure that the right people have the appropriate access to technology resources, whether it’s employees logging into internal systems or customers accessing digital services.

Okta’s platform integrates with various software and applications, making it easier for companies to manage user identities.

In the near term, Okta’s financial outlook is somewhat cautious. Okta noted the challenging macroeconomic environment and highlighted its remaining performance obligations that point toward 9% to 10% growth for the quarter ahead.

Furthermore, Okta’s strategy of expanding its product offerings and focusing on large enterprises, particularly within the Global 2000, is holding up its revenues and drove record operating profitability in fiscal Q2 2025, but I wonder if that’s enough?

Given this context, let’s delve into its fundamentals.

Guidance Shows That Deceleration is Set to Continue

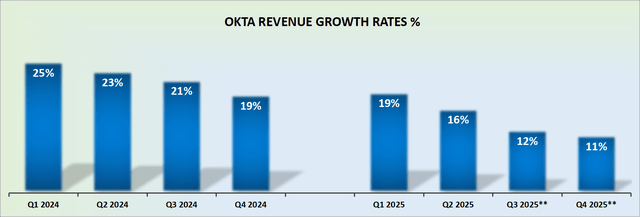

OKTA revenue growth rates

Okta upward revised its guidance by less than 1%. The takeaway is shown in the graphic above. Not only is Okta’s revenue growth rates continue decelerating into the back half of 2024, but more importantly, investors are now potentially eyeing up low single-digit growth rates.

In practice, this means that Okta is no longer a growth company. And investors should not price it as such.

Secondly, and equally important, Okta’s fiscal Q3 2025 guidance points to its current remaining performance obligation growing by approximately 9% to 10%. This implies that there’s no room for Okta to upward revise its revenues until its bookings pipeline improves.

More concretely, until investors can see that its current remaining performance obligation improves beyond the low double digits, investors are going to look beyond Okta’s narrative and instead focus squarely on its underlying profitability, with a lot more focus. With this in mind, let’s now discuss its valuation.

OKTA Stock Valuation – 25x Forward Non-GAAP EPS

Okta’s balance sheet holds approximately $1.2 billion of net cash (including marketable securities). This means that roughly 8% of its market cap is made up of cash (including marketable securities). That’s the good news.

Now, the issue is the following. Okta guides for about $2.70 of non-GAAP EPS for this fiscal year. Given that we are more than halfway into this fiscal year, it makes sense to think about fiscal 2026.

On this front, let’s say that as Okta struggles to grow its revenues, it strikes to grow its profitability such that next year it succeeds in growing its bottom line EPS by 20% year-over-year to $3.24. Although, keep in mind that this figure is substantially higher than what analysts presently expect.

Nevertheless, this implies that including the sell-off in its share price on the back of its fiscal Q2 2025 earnings results, Okta is priced at 25x forward non-GAAP EPS. At this valuation, there are plenty of stocks that have fewer hairs and cleaner narratives. I can’t support Okta’s valuation.

Further Risks to Consider

On top of that, Okta faces significant challenges in the near term, particularly from the rationalization of software spending by organizations, which could impact its future pipeline of revenue.

Additionally, the competitive landscape is intense, with Microsoft (MSFT) being no pushover. Microsoft’s integrated approach, bundling identity management with its broader software ecosystem, poses a serious threat to Okta’s market share.

To stay competitive, Okta must innovate further and provide a better value proposition to system integrators if it wishes to regain market share.

The Bottom Line

Reflecting on Okta’s current valuation, I find paying 25 times next year’s non-GAAP EPS is not compelling.

The company’s revenue growth is slowing significantly, and its forward guidance suggests more deceleration ahead. While Okta’s fundamentals, such as a strong cash position and increasing profitability, are positive, they don’t justify the premium valuation given the competitive pressures and the potential for low single-digit growth.

It’s clear that Okta is no longer the high-growth stock it once was. For now, I’ll step back, as Okta’s prospects seem to have “logged out” of the high-growth narrative.