BlackJack3D

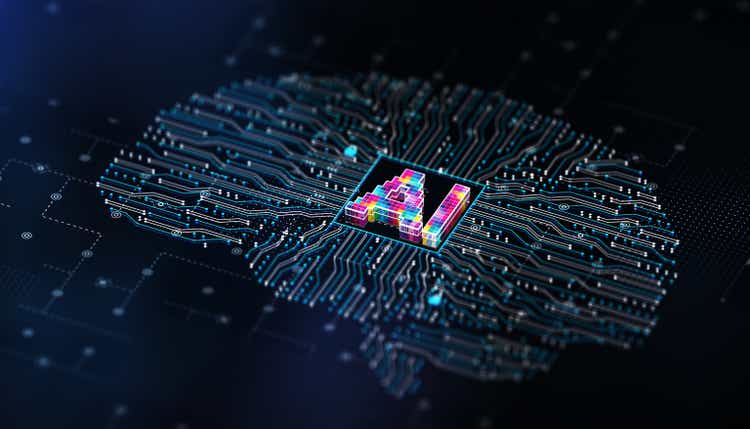

It’s been a volatile 2024 so far for shares of Super Micro Computer, Inc. or “Super Micro” (NASDAQ:SMCI) (NEOE:SMCI:CA). In tandem with NVIDIA Corporation or “Nvidia” (NVDA), the high-performance server and storage solutions provider has been widely viewed as a prime beneficiary of ballooning investments into generative AI.

Yahoo Finance

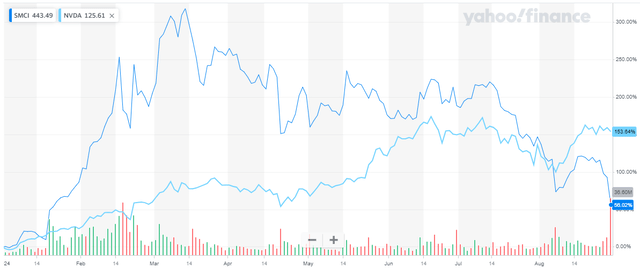

Indeed, sales have skyrocketed in recent quarters, but related working capital requirements have resulted in materially negative cash flow.

In addition, the company has been experiencing margin issues as of late which are expected to persist in the near term.

Company Press Releases / Regulatory Filings

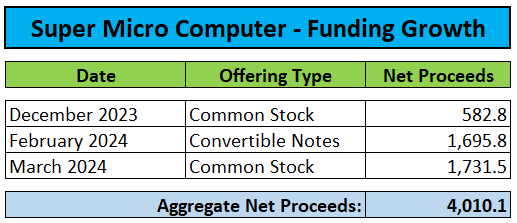

To ensure sufficient liquidity, Super Micro has accessed the capital markets several times between December 2023 and March 2024.

In aggregate, the company has raised more than $4 billion in net proceeds from a combination of equity and convertible debt offerings:

Regulatory Filings

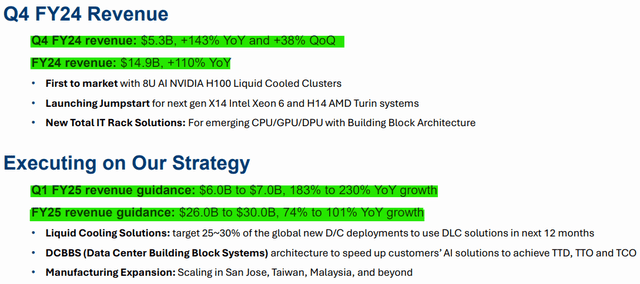

While Super Micro finished FY2024 with $1.67 billion in cash and cash equivalents, expectations for further exponential growth will likely require the company to raise additional funds in the not-too-distant future:

Company Presentation

However, before accessing the capital markets again, management will likely have to prove that the company’s internal controls are adequate and effective:

SAN JOSE, Calif., August 28, 2024 – Super Micro Computer (…) today announced that it expects that it will not timely file its Annual Report on Form 10-K for the fiscal year ended June 30, 2024 (…) and expects to file a Notification of Late Filing on Form 12b-25 with respect to the Annual Report on August 30, 2024.

SMCI is unable to file its Annual Report within the prescribed time period without unreasonable effort or expense. Additional time is needed for SMCI’s management to complete its assessment of the design and operating effectiveness of its internal controls over financial reporting as of June 30, 2024.

SMCI has not made updates to its results for the fiscal year and quarter ended June 30, 2024 that were announced in SMCI’s press release dated August 6, 2024.

At least in my opinion, the delay has likely been caused by Tuesday’s damning report released by high-profile short-seller outfit Hindenburg Research which contained a plethora of allegations with regard to the company’s accounting practices.

After learning about the Hindenburg Research report, Super Micro’s auditors likely declined to sign off on the company’s annual report without management addressing allegations of improper revenue recognition and circumvention of internal controls.

To be perfectly honest, I wasn’t exactly impressed by the Hindenburg Research report at first glance which, at least on the accounting front, appeared to be mostly a rehash of past revenue recognition issues.

Market participants didn’t seem too concerned either as shares ended Tuesday’s session down less than 3% after selling off more than 15% in pre-market.

However, Wednesday’s disclosures are a major red flag. Given allegations of improved revenue recognition dating all the way back to 2020, it could take several months or even quarters for the company to work through the numbers.

As a remainder, it took Super Micro several years to address revenue recognition issues originally discovered in 2017. The inability to file timely financial statements with the SEC resulted in Nasdaq delisting the company’s common shares in August 2018.

With the assistance of external forensic accountants, Super Micro filed restated financials with the SEC in 2019 and managed to relist on Nasdaq in early 2020.

Should the company’s auditors and management indeed discover renewed revenue recognition issues, Super Micro might very well be required to again restate years of financial statements.

For my part, I do not expect the company to file its annual report on form 10-K within the automatic 15-day grace period. Given the company’s history, auditors will likely require a deep dive into revenue recognition procedures which could take several months or even quarters.

In the meantime, substantial cash usage is likely to continue. Even at the lower end of management’s FY2025 revenue guidance, Super Micro will likely require additional capital in early 2025 at the latest point.

Without audited financials, accessing the corporate debt markets doesn’t look like a viable option. Even an equity raise might be difficult as underwriters are not likely to expose themselves to potential legal risks.

Under a best-case scenario, management will conclude that Super Micro’s internal controls are adequately designed and effective within the next two weeks. Should auditors sign off on the annual report, the company would be able to file the 10-K within the 15-day grace period.

However, for the reasons discussed above, I do not expect this to be the case.

At this point, Super Micro appears to be caught between a rock and a hard place. The company needs additional capital to fund exponential growth, but might not be able to access the capital markets in the near term.

Given the risks associated with a potentially protracted accounting review, investors should consider moving to the sidelines.

Bottom Line:

Following the surprise delay of Super Micro Computer’s annual report on form 10-K, investors would be well-served to prepare for a potentially protracted accounting review as auditors are not likely to sign off until management has proven that internal controls are adequate and effective.

However, this might require working through the company’s financial statements all the way back to 2020.

In the meantime, elevated cash usage is likely to continue. Based on management’s FY2025 revenue guidance, I would expect negative free cash flow of up to $3 billion. As a result, Super Micro Computer will likely be required to return to the capital markets in early 2025.

However, without audited financials, this could become a difficult exercise.

Given the uncertainties and risks associated with a potentially protracted accounting review, investors should consider moving to the sidelines.