sankai

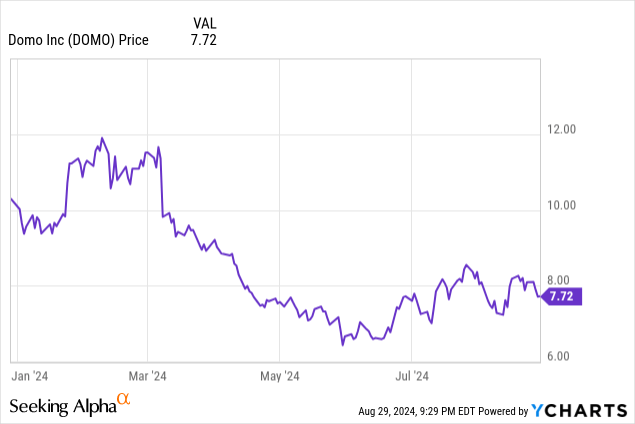

The Q2 earnings season has continued to be a friendly one for out-of-favor tech companies that have been racking up recent declines. Domo (NASDAQ:DOMO) is one of the most recent beneficiaries: this software company, best known for its business intelligence products that help companies visualize their enterprise data, jumped nearly 5% after reporting Q2 results: which, surprisingly, featured a worsening of the company’s growth metrics. Meanwhile, since bottoming in the low $6s in late May, the stock has rallied more than 20% – which, to me, signals an auspicious time for holders of this stock to sell, especially as macroeconomic clouds darken for the back half of this year.

I last wrote a neutral note on Domo in May, when the stock had just broken above the $7 mark. At the time, I had argued that the risks coming from Domo’s slower growth rates were offset by the hopes from Domo’s switch to a consumption-focused billings model. Since then, however, shares of Domo have rallied while Q2 results came in quite weak, with decelerating growth rates plus receding margins. With all of this in mind, I’m downgrading Domo to a sell rating.

The single merit to Domo, and what I view as its only “upside risk,” is that the stock is trading cheaply – after the recent run-up. At post-earnings share prices near $8, Domo commands a market cap of just $305.9 million. After we net off the $60.9 million of cash and $113.5 million of debt on Domo’s latest balance sheet, the company’s resulting enterprise value is $358.5 million.

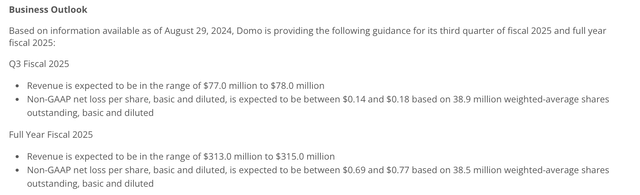

Interestingly, Domo has reinstated its full-year guidance after reporting Q2 results (after withdrawing it earlier in Q1). The company is now expecting $313-$315 million in revenue (or a -2% to -1% decline) – we note this is lower than the company’s initial $315-$323 million range prior to the company withdrawing this outlook.

Domo outlook (Domo Q2 earnings release)

Meanwhile, for FY25, Wall Street analysts are expecting Domo to return to meager growth – but only barely, with consensus pointing to $316.9 million in revenue, up 2% y/y. This puts Domo’s valuation multiples at 1.1x EV/FY25 revenue.

That being said, there are a number of fundamental red flags here that more than explain that lower valuation:

- Billings and revenue are no longer growing. BI is “nice to have,” but not a “must have.” In this environment, where IT budgets are being cut, Domo implementations and deal closings are likely to get delayed.

- Incredibly sharp competition in the BI space. Amid weaker appetite for enterprise software installations, larger players like Tableau/Salesforce and Microsoft Power BI, which are packaged as part of other “mission-critical” software products, may prevail.

- Software companies that can’t grow also can’t become profitable. In fact, Domo’s operating margins have started to weaken. Cost cuts can only do so much, but Domo’s lack of top-line growth will rob it of the economies of scale it needs to hit profitability.

- Domo has limited liquidity and more debt than cash. An unexpected downturn in new deals or a sharp decline in renewals may put Domo into a pinch if it is forced to raise additional capital. Equity capital will be dilutive for Domo in this market as its stock sits well below pandemic-era highs, and debt capital will come at a huge interest cost that Domo may not be able to handle.

In my view, given weak Q2 results, it’s a good time to sell and move on.

Q2 download

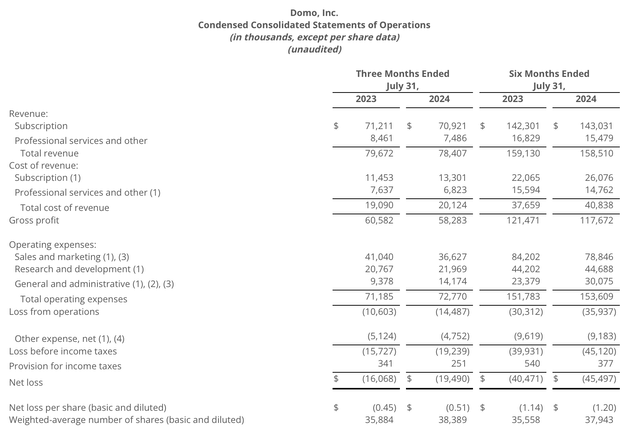

Let’s now go through Domo’s latest quarterly results in greater detail. The Q2 earnings summary is shown below:

Domo Q2 results (Domo Q2 earnings release)

Domo’s revenue declined -2% y/y to $70.9 million, which decelerated three points relative to 1% growth in Q1. Note here that Domo insisted on switching to a consumption-based business model (where customers are billed based on usage, rather than a fixed per-head monthly subscription fee) under the pretense that it would revive growth rates and encourage upsells. We acknowledge that this eventuality may take several quarters to play out, but so far, we aren’t seeing any positive impacts here.

Worse yet: we note that the company’s billings clocked in at only $68.6 million, down -3% y/y. On both a nominal and growth rate basis, Domo’s billings lagged behind revenue. As seasoned software investors are aware, billings is often the best forward-looking representation of a company’s growth trajectory, so this is quite a poor signal for Domo.

It’s also worth noting that the company is undergoing a number of executive leadership changes as well. The company will be replacing its CFO with a company insider (currently an SVP of Finance) at the end of Q3. It’s also promoting a new President of Worldwide Field Operations as well as a new Chief Revenue Officer – two transitions that may disrupt sales/account executives and ultimately impact client relationships.

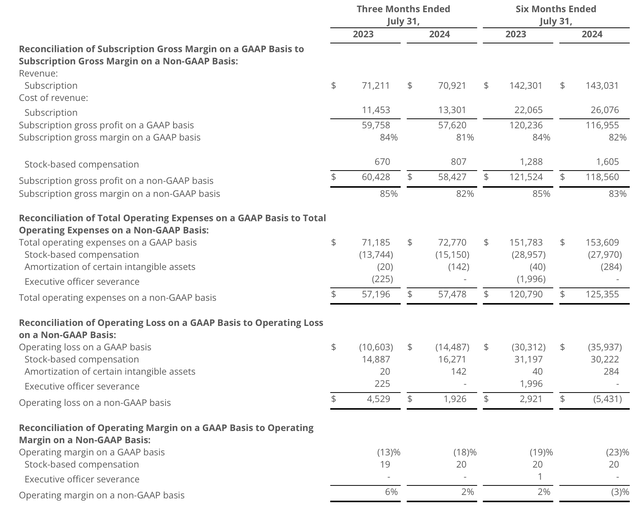

Making matters even more bleak, despite Domo’s contraction in growth rates, the company is not compensating for this with better profitability. As shown in the chart below, the company’s pro forma operating margins declined four points y/y to just 2%.

Domo operating margins (Domo Q2 earnings release)

Forget about Domo ever hitting a “Rule of 40” threshold (defined as revenue growth plus pro forma operating margins) – the company’s -2% revenue decline on top of just 2% pro forma operating margins gives the company a Rule of 40 score of precisely zero.

Key takeaways

Domo is cheap, but it’s cheap for a reason: actually, many reasons. The company has started to see revenue and billings decline despite an intentional change to its sales model. The company is crushed by competition from much better name brands in software, while executive leadership turnover doesn’t give us much confidence in continuity, either. In my view, it’s time to drop Domo and invest elsewhere.