NoDerog

Nordstrom, Inc. (NYSE:JWN) is a major consumer discretionary fashion retailer in North America selling apparel & other accessories, beauty products, and home goods online and in stores. With a market cap of around $3.5 billion, it sits on the edge of being a small-cap and a mid-cap stock, but that doesn’t mean Nordstrom is small. JWN employs around 54,000 people and has 370 stores with over 26.5 million gross store square footage.

The stock has suffered from being primarily a brick-and-mortar retailer in an increasingly digital world. As a result, the stock has fallen over -65% in the past ten years, settling in the $18 to $22 range in 2024. JWN recently released its Q2 2024 earnings report, providing some key updates on its fundamentals following operational restructuring to address profitability issues.

Earnings

At the top line, Nordstrom reported net sales growth of 3.4% YoY in Q2 2024, a solid expansion in revenue and much higher than the -10.1% YoY reported a year ago. The sales gain was in line with analyst expectations and was boosted by the performance of the Nordstrom Rack segment, which saw net sales increase 8.8% YoY. Net sales growth benefitted from the favorable timing of the Anniversary sale in Q2 2024 vs. last year. Management estimated that it added about 100 bps to sales growth and that comp sales were up 1.9% YoY with Nordstrom Rack comp sales up 4.1% YoY. Additionally, digital sales saw growth of 6.2% YoY and were also positively impacted by the Anniversary Sale.

Overall, the revenue trends look healthy in a tough macro environment. In the last three quarters, JWN has posted slight revenue beats but has been mostly in line with expectations and shows that it is expanding its physical and digital segments with a good level of success.

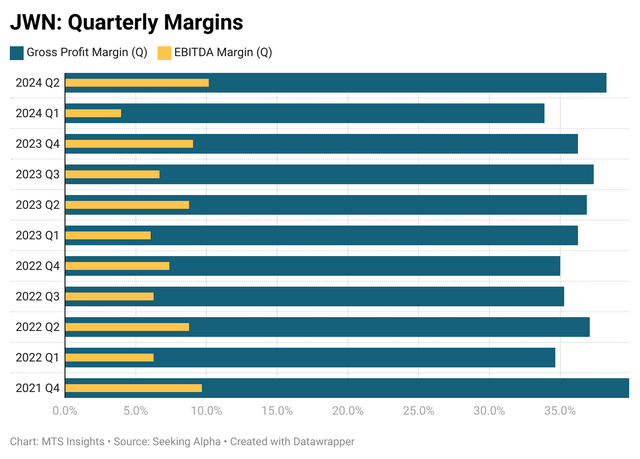

The market-moving news was in JWN’s profitability numbers, which took analysts by surprise. At the highest level, gross profit margin came in at 38.34% which is the highest reported quarterly gross margin since Q1 2022 and on a TTM basis is the second highest since Q3 2022. Nordstrom’s margins were put under significant pressure in the post-pandemic inflationary period when supply chains became a major concern for retailers. Gross margin reached a post-pandemic low of 35.49% (TTM basis) in Q1 2023.

After the start of 2023, Nordstrom moved through a period of restructuring to optimize operations and enhance profitability. This included the closing of its Canadian stores as all 13 stores were said to be losing money and a readjustment of supply chains. Both incurred significant temporary charges, $309 million for the Canadian wind in the first half of 2023 and a $54 million supply chain asset impairment charge in Q2 2024, but both also appear to have benefitted profitability more than analysts expected.

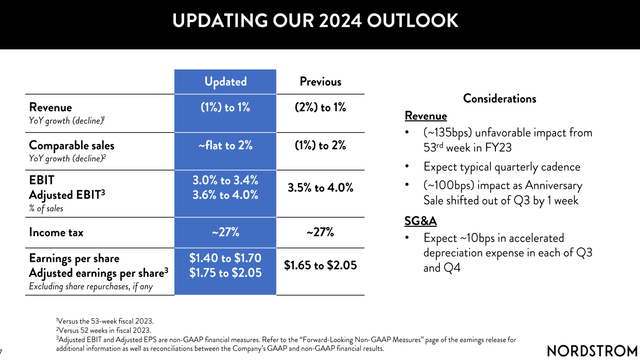

Nordstrom Q2 2024 Earnings Presentation

The consensus for EPS of $0.73 in Q2 2024 was smashed by $0.23 after actual EPS, which was adjusted to account for the supply chain charge of $54 million, came in at $0.96. JWN’s adjusted EBIT margin was 6.4% in Q2 2024, up from 5.3% in Q3 2023. All of these, if taken as signals and not noise, point to operational improvements that will increase cash flows in the future.

Management seems to believe that this quarter’s results were not a temporary bright spot, as it updated its full-year outlook with a more optimistic outlook. Not only does the outlook anticipate flat to low growth in comp sales, bringing up the lower bound on the previous outlook’s range. It also sees slightly higher midpoints for full-year adjusted EBIT margin, from 3.75% to 3.80%, and adjusted EPS, from $1.85 to $1.90. This improved outlook combined with better-than-expected Q2 results was the reason JWN’s shares surged in post-market trading.

Despite the optimism surrounding profitability in the Q2 2024 report, there might be some reasons to be cautious moving forward. JWN’s recent growth has been through its off-price Nordstrom Rack segment while the performance of its primary Nordstrom brand stores has been significant. In Q2, Rack reported a better increase in sales (8.8% YoY) while the Nordstrom segment barely grew (0.9% YoY), and that has been the case for the past few quarters now. The nature of Rack, offering goods below regular retail prices, means that margins are likely to be thinner in that business which has the potential to put downward pressure on overall firm profitability. JWN has committed itself to expanding Rack and using that segment to drive growth despite the risk to margins.

So far in FY24, JWN has opened 11 stores, with plans for 21 more store openings through Fall 2025. All of them are Nordstrom Rack stores. In the last year, JWN has added 215,000 gross store square feet through the addition of 22 Rack locations and the closing of 1 Nordstrom store.

Macro Environment

The main concern for retailers over the next 1-2 years will be the macro environment. In the last few months, there has been a noticeable uptick in the unemployment rate, and the weekly readings of initial jobless claims have started to print readings reminiscent of a softening labor market. Consumer spending looks to be holding up a bit better, however, with retail trade sales still growing by about 2.6% YoY in July, including a 2.5% YoY increase in JWN’s key segment, clothing and clothing accessories. CEO Peter Nordstrom discussed his view of consumer health during the Q2 conference call, suggesting that strength in the Anniversary Sale in the outerwear and sweater categories “bodes well for the fall” as these two segments are key in seasonality trends. Nordstrom also noted that his confidence was bolstered by “success in women’s apparel” which is a massive category for them.

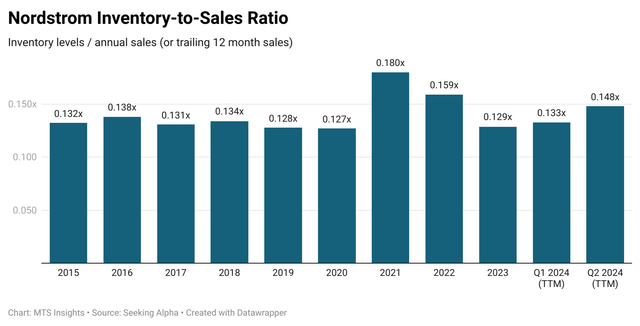

We can look at a more concrete measure of consumer activity compared to Nordstrom’s expectations by tracking the inventory-to-sales number. Before the pandemic, inventory level relative to annual sales is typically around 0.13x with some minor deviations. During the pandemic, the ratio was particularly volatile as initially sales were hampered by lockdown policies, causing some inventory bloat, but Nordstrom eventually worked through that period to normalize stockpiles. In 2023 and the twelve months leading up to Q1 2024, the inventory-to-sales ratio seemed to be back to normal. Now in the most recent reported quarter, there was a strong pickup in inventories relative to sales to 0.148x, topping all pre-pandemic metrics. This can be linked to an 8.3% YoY increase in inventory in Q2 2024 (compared to a 3.4% YoY increase in sales).

While that large inventory build can be partly explained by JWN looking to add several new Rack stores in FY24, it still looks a bit awkward when considering that there was a favorable impact from the Anniversary Sale in 2024 vs. 2023. I expected a smaller inventory build on a YoY basis because JWN had more days of the Anniversary Sale to look forward to in Q3 2023 than what the company will see in Q3 2024. In the conference call, CEO Nordstrom pointed out that inventory growth in Q2 2024 “was higher than we typically like” but insisted that there was “an increase in newness and a commensurate decline in clearance and aged inventory.” While he expects the sales-to-inventory spread to improve, there is an increasing sense that we have reached the peak of consumer spending. Wells Fargo’s latest August 2024 US economic outlook points out that “consumption growth is set to moderate over the remainder of the year amid weaker income growth.”

Essentially, the analysis concludes that as the labor market continues to ease, disposable income growth is expected to taper off as well. The inventory build and macro outlook leave Wall Street analysts concerned as well. A Morgan Stanley analyst points out that if sales fall short of expectations, excess inventory could become a threat to margins as JWN will have to work through stockpiles in a “highly promotional environment.”

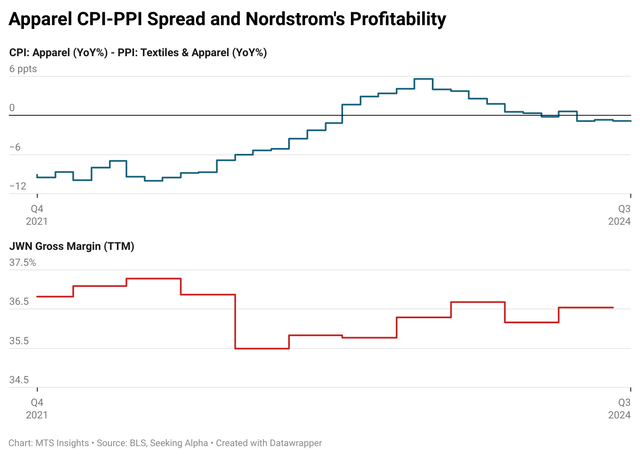

We can also look at a broad view of margins in Nordstrom’s primary product category, clothing, using producer and consumer price indexes. Over the last two years, it looks like JWN’s gross profitability has lagged the spread between apparel CPI annual growth and apparel PPI annual growth, a rough estimation of how margins have changed in that industry. JWN’s gross margin increased from a low in Q4 2022 as inflationary pressures moved down the supply chain to the consumers.

In 2023, the positive CPI-PPI spread may have helped JWN’s profitability increase. But as goods inflation has come down, and apparel producer price growth has caught up, profitability has remained stagnant. We are now going into an environment where PPI growth is outpacing CPI growth in Q3 2024, which suggests the positive margin prints in Q2 2024 earnings could be challenged.

Peers and Valuation

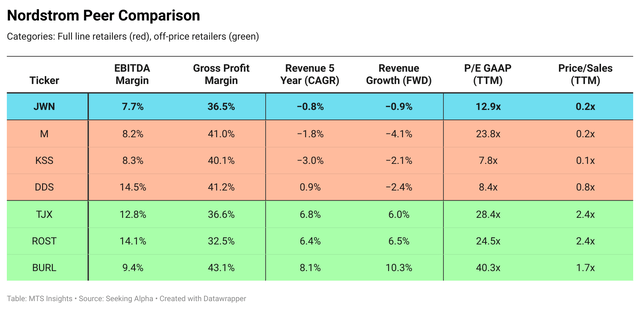

Retailers selling apparel and other home goods are a competitive group, so it is important to know where JWN stands among its peers. In this analysis, we’ll look at a mix of off-price retailers, Burlington Stores, Inc. (BURL), Ross Stores, Inc. (ROST), The TJX Companies, Inc. (TJX), and full-line stores, Dillard’s, Inc. (DDS), Kohl’s Corporation (KSS), Macy’s, Inc. (M), as Nordstrom has its hands in both worlds. However, as noted earlier, management is backing the strategy to expand the Rack segment and become a majority off-price retailer going forward.

Let’s address profitability first because it is one of the key fundamental statistics for JWN. Compared to the full-line retailers, JWN’s gross profit margin is about 350 to 450 bps below where this group is and that carries over into EBITDA margins that are also lower in comparison. However, this is in part because it prioritizes Rack. When looking at off-price competitors, JWN’s gross profit margin is about in line with TJX (the largest firm in this niche) while it underperforms BURL and outperforms ROST. On the other hand, when looking at the EBITDA, JWN moves to the bottom of the group in terms of profitability.

Regarding the top line, JWN’s revenue growth over the last three years and its forward revenue growth are more closely aligned with the malaise that is evident in the full-line retailer group. On the other hand, off-price retailers have seen much stronger revenue growth in the past five years and are expected to continue to grow at similar rates in the year ahead.

Based on these trends, it seems obvious why Nordstrom wants to move forward with a focus on Rack. Analysis from Consumer Edge also pointed out this sharp divergence between full-line growth and off-price growth. Using data from May to July 2023, it indicated that all income groups’ consumer spending at full-line retailers was falling quickly, while off-price growth was more mixed. This was largely impacted by inflationary pressures, causing shoppers to look for more discounts and save money when other areas of their lives were getting pricier. So not only are off-price stores growing in good economic environments, but they are also surviving in conditions where consumers are weaker.

From a valuation perspective, JWN sits between its cheaper full-line peers and its more expensive off-price peers, with a P/E ratio of 12.9x (on a TTM basis). The market values the latter type of retailer more because these firms typically have more versatility in the retail space. The trend is similar when looking at how the market values each firm’s revenues. In this comparison, JWN is more similar to the full-line peers, with price-to-sales ratios all below 1.0x. On the other hand, the off-price group is seeing the market offer around $2 for each single revenue dollar.

Conclusion

While Q2 2024 earnings look like a turnaround in JWN’s operational efficiency, it’s not clear if it’s a signal and not just noise. The growth of Rack is the main source of optimism and seems to be the plan for the future, but that will likely put pressure on margins going forward. In the very near term, macroeconomic headwinds are probably going to make things even more complicated. The large YoY inventory build in a quarter where the Anniversary Sale was a boon to sales growth is concerning to not just analysts but also management. The transition to off-price retailing, which is becoming a more popular way of shopping for consumers, may be a successful revitalization of the company, but JWN is not there yet.

Other peers in the competitive sector offer better profitability and growth. For that reason, I am issuing a SELL rating for Nordstrom, Inc. until I can see more data in the upcoming quarters.