Dragon Claws

This article was written by Kody Kester.

One of the quotes that most aptly applies to my investing philosophy comes from the late renowned economist Paul Samuelson, who said:

“There is something in people; you might even call it a little bit of a gambling instinct… I tell people investing should be dull. It shouldn’t be exciting. Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

I couldn’t agree more with Samuelson. At its core, good investing is dull and uninspiring. It’s merely buying ownership in various businesses across economic sectors at sensible valuations and holding them as revenue and earnings move higher each year.

Consistently investing in quality businesses can’t help but lead to steady wealth building. In my view, no investments represent the spirit of Samuelson’s quote more than water utilities for a few reasons.

- Everybody needs water.

- There is not and never will be a substitute for it.

- Investments in water infrastructure modernization can support higher water utility rates in the future.

This is why I own two water utilities in my portfolio and cover many more here on Seeking Alpha. SJW Group (NYSE:SJW) is one such water utility that I recently covered.

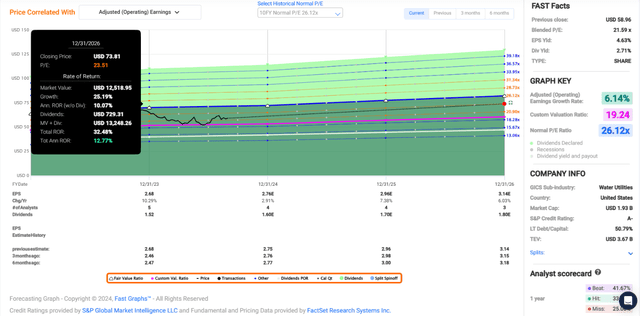

When I initiated coverage with a buy rating in June on The Dividend Kings and iREIT®+Hoya Capital, I liked SJW’s expanding customer base and earnings growth outlook. Its track record as a Dividend King also appealed to me. I also appreciated the A-rated balance sheet. Lastly, shares were a solid value as well.

Following the release of SJW’s second-quarter earnings last month, I’m reiterating my buy rating. The company’s path to 5% to 7% annual adjusted diluted EPS growth remains reasonable. SJW’s balance sheet is also strengthening.

As I will explain, I am increasing my fair value estimate. So even though shares have rallied since my last article, the valuation remains compelling here.

The Growth Story Is Intact

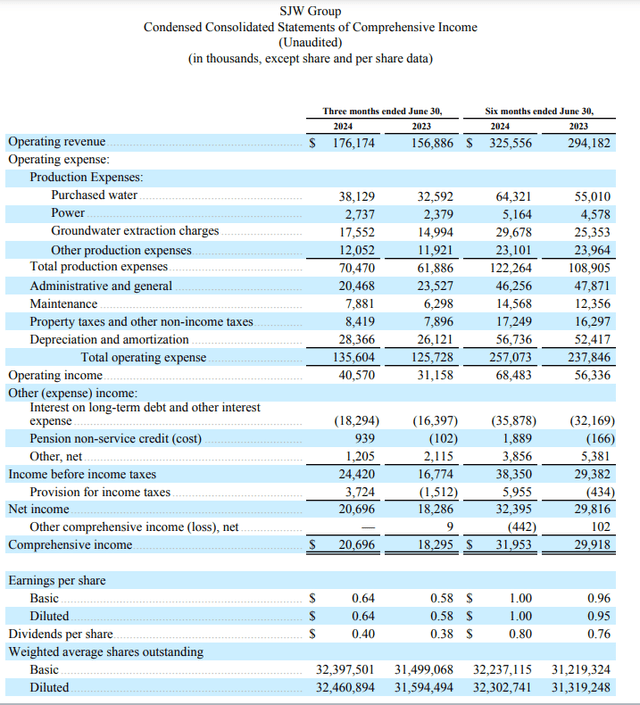

SJW Q2 2024 Earnings Press Release

On July 24th, SJW shared its financial results for the second quarter ended June 30. The company’s operating revenue surged 12.3% year-over-year to $176.2 million in the quarter. That came in $10.2 million ahead of the Seeking Alpha analyst consensus during the quarter.

This topline growth for the second quarter was driven by a few different catalysts. Higher rates in California contributed, as did greater customer usage in the state due to the end of California’s mandatory water conservation requirements last April. Third and finally, customer growth in Texas also played into this double-digit topline growth.

SJW’s adjusted diluted EPS rose by 13.8% over the year-ago period to $0.66 during the second quarter. This topped the analyst consensus by $0.08 for the quarter.

The utility limited the increase in its total operating expense to just 7.9% in the second quarter. This helped its non-GAAP net profit margin expand by 40 basis points to 12.1% during the quarter. Overall, these factors lead to adjusted diluted EPS growth exceeding operating revenue growth for the quarter.

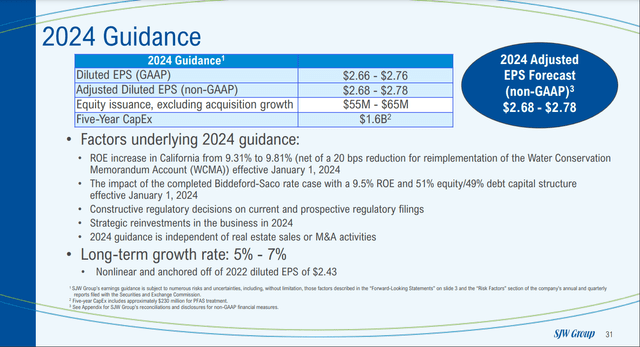

SJW August 2024 Investor Presentation

SJW reiterated its guidance to fall between $2.68 and $2.78 in adjusted diluted EPS for 2024. That equates to somewhere between flat earnings to 3.7% growth for the year. The FAST Graphs analyst consensus is on the higher end of the utility’s range at $2.76. The ROE increase in California by 50 basis points and strategic reinvestment in the business this year are tailwinds driving these growth assumptions.

Beyond 2024, SJW’s growth outlook is going to heat up. The FAST Graphs analyst consensus for 2025 expects adjusted diluted EPS to rise by 7.4% to $2.96. For 2026, another 6% growth in adjusted diluted EPS to $3.14 is anticipated.

Adjusted diluted EPS will accelerate from 2024 because of recent rate case activity. Due to regulatory lag, SJW is having to bear some brunt of higher expenses this year.

The San Jose Water subsidiary reached a constructive settlement agreement for its 2025 to 2027 General Rate Case with the Public Advocates Office on August 19th. This is the California Public Utilities Commission’s independent consumer advocate.

The company will be authorized to invest $450 million in capital expenditures for the next three years. This was most of the $540 million that the utility requested and better than the initial $299 million from Cal Advocates.

In the next three years, SJW’s annual operating revenue from this agreement will rise by $53 million. Given its size, this is a solid boost to operating revenue.

The final decision on the most recent General Rate Case from the Connecticut Public Utilities Regulatory Authority or PURA went into effect on July 1. This will bring a $6.5 million annualized operating revenue increase, with the potential for additional operating revenue. PURA authorized another $3.9 million of unrecovered expenses to be recovered.

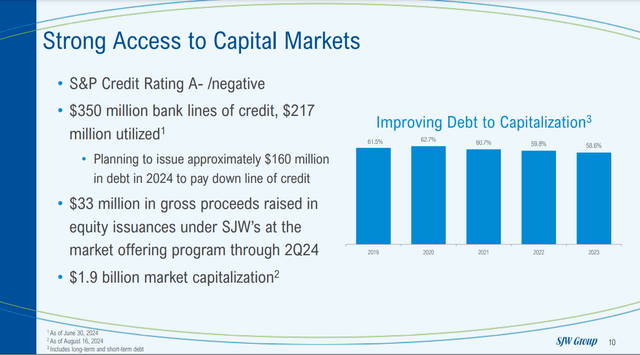

SJW August 2024 Investor Presentation

On the balance sheet front, SJW is doing fine. The company’s debt-to-capitalization ratio of 54.9% as of June 30 is marginally better than the 55.3% ratio in the year-ago period. More importantly, it’s significantly improved versus the 61.5% ratio in 2019. That’s enough to earn an A- credit rating from S&P.

This provides the company with the low cost of capital that it needs to fund its $1.6 billion in planned capital spending over the next five years. That should support 5% to 7% annual adjusted diluted EPS growth in the years following 2026.

(Unless otherwise sourced or hyperlinked, all details in this subhead were according to SJW’s Q2 2024 Earnings Press Release, SJW’s Q2 2024 10-Q Filing, and SJW’s August 2024 Investor Presentation.)

Fair Value Is Nearing $70 A Share

The 9% gains of SJW in the last couple of months have tripled the S&P 500 index’s (SP500) gains in that time. Still, I believe that the utility remains a decent value.

SJW’s shares are priced at a current-year P/E ratio of 21.3 per FAST Graphs. For perspective, that’s less than the 10-year average P/E ratio of 26.1.

When I last covered SJW, I was quite conservative with my fair value multiple. I assigned a fair value multiple of just 20.9, which was two standard deviations under the 10-year average P/E ratio.

This was based on my assumption that interest rates would remain meaningfully above the same 10-year average that bid up utility valuation multiples as investors sought income. This accounted for my much lower fair value multiple.

Now, it seems interest rates in line with the 10-year average will be back soon enough. Morningstar thinks that the federal funds rate will be between 1.75% and 2% by the end of 2026. That would be equivalent to the 10-year average federal funds rate of roughly 1.8% per Macrotrends.

Fundamentally, SJW’s growth prospects are holding up. The forward annual adjusted diluted EPS growth outlook of 6.1% is better than the 10-year average growth rate.

This is why I’m revising my fair value multiple to one standard deviation under the 10-year average P/E ratio. That equates to a fair value P/E ratio of 23.5.

The calendar year 2024 will be 67% complete by the end of this week. That means 33% of 2024 and 67% of 2025 is yet to come in the next 12 months. This gives me a forward 12-month adjusted diluted EPS input of $2.89.

Applying my fair value multiple to this earnings input yields a fair value of $68 a share. Compared to the current $59 share price (as of August 29th, 2024), this equates to a 14% discount to fair value.

If the utility meets the growth consensus and reverts to fair value, it could have a 32% cumulative upside through 2026.

Expecting Many More Years Of Dividend Growth

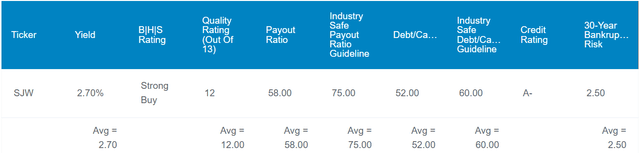

Dividend Kings Zen Research Terminal

SJW’s forward dividend yield of 2.7% is 100 basis points under the sector median yield of 3.7%. This is what’s behind the D+ grade from Seeking Alpha’s Quant System for the metric.

SJW compensates in other areas, though. The company’s EPS payout ratio is set to be in the high 50% range in 2024. This is comfortably less than the 75% EPS payout ratio that rating agencies desire from the industry, per The Dividend Kings’ Zen Research Terminal. That’s enough for the Quant System to justify a B+ grade for dividend safety.

The sustainability of this payout also positions SJW to extend its streak of 56 consecutive years of higher dividend payments to shareholders. This is quintuple the sector median streak of 10.2 years. That’s adequate for an A+ grade from the Quant System for overall dividend consistency.

Thanks to its positive earnings outlook and modest payout ratio, the Quant System anticipates 5.5% annual forward dividend growth in the years ahead. That is just above the sector median of 5.3% and enough for a C+ overall dividend growth grade.

Risks To Consider

SJW is a quality utility. That said, it does still face risks to the investment thesis that are worth noting. No new risk factors are outlined in the company’s most recent 10-Q Filing. So, I’ll just touch on the risks from my prior article.

Unsurprisingly, the biggest risk to the utility is regulatory. In 2023, the company derived 57% of its total regulated net income from California and 34% from Connecticut. The remaining 9% was split rather evenly between Texas and Maine.

SJW did just benefit from a relatively constructive rate case outcome in California. If rate case outcomes in its two biggest states aren’t constructive moving forward, that could make it challenging for the utility to meet its growth targets.

SJW’s geographic concentration also raises the risk of natural disasters interrupting its business operations for at least the near term. The greater risk is the long-term fallout from any particularly devastating wildfires, hurricanes, or earthquakes. The damage inflicted on the utility’s infrastructure could be greater than its commercially insured amounts. This could result in diminished future earnings capacity.

Finally, the continuity of SJW depends on factors that are beyond its control. Any significant droughts in California, especially, could restrict its water supply and adversely impact the company’s operating results and fundamentals.

Summary: Risk-Adjusted Total Return Potential Remains Attractive

In my opinion, SJW is one of the lower-risk investments in the equity universe. Its business model as a regulated water utility isn’t free of risk, but it has enabled rather predictable growth for quite a while. Otherwise, its ongoing half-century dividend growth streak wouldn’t have been possible. The utility’s payout ratio is also quite secure. SJW’s financial positioning also affords it an A- credit rating from S&P.

The utility is also trading at a moderate discount to fair value.

Put together, that could translate into almost 13% annual total returns through 2026. That’s appealing for a Dividend King, so I’m maintaining my buy rating here.