To qualify for the best credit cards, your credit score typically needs to fall in at least the good or better range. On the FICO scale, that’s 670 to 799. That might lead you to believe that an exceptional credit score (800 or above) would get your foot in the door of any credit card you wanted. That’s what I thought, and I was dead wrong.

Since becoming more passionate about credit cards about five years ago, credit card companies have rejected my application several times. In that timeframe, my credit score has rarely dipped below 800.

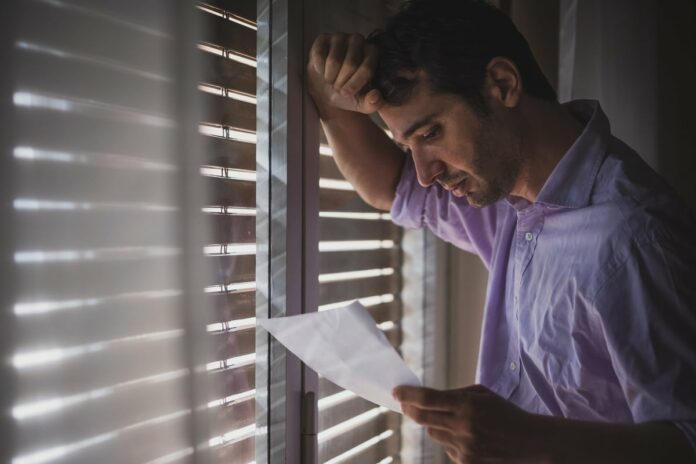

In retrospect, the reasons I got rejected make sense. But in the moment, the following three took me by surprise.

1. Insufficient proof of income

This was one of my first rejections. And, honestly, it could have been avoided.

Basically, I had applied for a Wells Fargo credit card but wasn’t rejected immediately. Later, I got a letter that asked me to give proof of income. I had just quit a full time job to start freelancing. I had no copies of old tax forms and no longer had access to my employee email where links to those digital forms existed.

To be sure, I could have just called my old employer and asked for a copy of my W-2. That probably would have been sufficient. But I really don’t like talking on the phone, and besides — I left that employer for a reason.

Hoping the card issuer would cut me some slack, I sent in the income pages from my filed tax return. As you can imagine, this didn’t work and I had to move on from that card. Since then, I keep copies of my 1099s, though no credit card company has asked for proof of income since.

2. Too many recent accounts

I could be wrong, but I think every credit card enthusiast gets this rejection at some point.

I got one last year (and another this year!). Last year, I was applying for an American Express card, one that worked exceptionally well with my spending. But unfortunately, I had opened several credit cards before applying for this one — a bit too many for American Express’ tastes. It didn’t even look at my application closely: A letter wasn’t needed, as I was denied instantly.

This was before American Express added its “Apply With Confidence” feature. Nowadays, this feature does a soft pull on your credit to see if you meet certain basic requirements before initiating a hard inquiry on your credit. You’ll get a pre-approval (or you won’t get one), which isn’t an approval per se, but increases your chances of getting one.

Applying for too many credit cards in a short period will increase your chances of getting denied.

A credit card company might mistake you for a card churner (or properly identify you as such). Or it might have internal rules for how many recent accounts you’re allowed to have opened.

A safe approach is to wait three to six months before you apply for a new credit card. Easier said than done — look who’s talking, right? — but if you don’t want to amass rejection letters, then slow and steady wins the race.

3. A change in my address

This wasn’t my rejection; it was my wife’s. But since I kinda, sorta pressured her into applying for this Citi credit card, I can also claim it as mine, too.

We recently moved from Portland, Oregon to Newark, New Jersey, so I can attend Rutgers University in the fall. A few weeks after we moved, we started budgeting for new furniture. I figured since we were going to spend money anyway, we should get a new credit card to earn a welcome bonus.

The first red flag was that she wasn’t approved immediately. My wife doesn’t open as many new cards as me, so this had me concerned.

When we got the rejection letter, it said that certain identification information couldn’t be verified. That sort of confused us, though we guessed rightly it had to do with our move. My wife’s credit report likely reflected our old address, which contradicted what was on the application. Even though we called the reconsideration line to explain this, CitiBank didn’t reverse the rejection.

That last one kind of stung. But if there’s one thing I’ve learned about these rejections, it’s that you can always reapply later. We’re going to wait a few months before applying for the Citi card. Until then, we can still rely on our current credit cards to earn rewards on every purchase.