Flashpop/DigitalVision via Getty Images

Guess?, Inc. (NYSE:GES) brings a proven business model tested in many markets outside the United States since 1981. The company is making relevant effort to enhance its ecommerce activities, and recently reported acquisitions like that of WHP Global and rag & bone. In my opinion, the financial figures reported in the last decade, which included positive net income growth and FCF growth, are the best indication of future business success potential. With very conservative assumptions about future free cash flow, a simplistic discounted cash flow about GES implies significant upside potential in the stock price. In my view, directors inside GES know well that the company appears undervalued at close to $21 per share. In 2024, the company bought its own shares at close to $34 per share.

GES, And My Assumptions With Regard To Future Strategy

Founded in 1981 and incorporated in Delaware, GES designs, markets, and licenses apparel and accessories for men, women, and children.

In my view, further investments to leverage the infrastructure and the company’s capabilities could enhance future net sales growth. In the last annual report, the company announced investments in productivity, brand extension, category expansion, new licensees, and wholesale partners. In my opinion, these efforts will most likely bring FCF growth. Besides, further investments in promotional activities, collaboration with influencers, and other go-to-market activities could accelerate brand relevancy of existing brands’ Heritage, Millennials, and Generation Z.

With regard to the company’s ecommerce activities, in my view, ongoing digital expansion will most likely continue to drive net sales growth. The company appears to invest significantly in new tools and platforms to expand the digital business segments. It is also worth noting that the company appears to receive information about ongoing fashion trends, valuable feedback from customers, and smartphone applications. I assumed that these efforts will most likely bring a competitive advantage over smaller competitors.

Our Americas Retail segment also includes our directly operated retail and other marketplace websites in the U.S., Canada, Mexico and Brazil. These websites operate as virtual storefronts that, combined with our retail stores, provide a seamless shopping experience to the consumer to sell our products and promote our brands. They also provide information about fashion trends and a mechanism for customer feedback while promoting customer loyalty and enhancing our brand identity through interactive content online and through smartphone applications. Source: 10-k

Acquisitions Could Bring New FCF Growth

Considering the state of the balance sheet and the recent acquisition of WHP Global, I would be expecting that new inorganic growth could accelerate the free cash flow line. The addition of new stores could also bring net sales growth coming from new and existing customers in those locations. In this regard, it is worth noting that the company added 36 stores thanks to the acquisition of Rag & bone.

On April 2, 2024, the Company and global brand management firm WHP Global completed the previously announced acquisition of New York-based fashion brand rag & bone. Source: 10-QAs a result of our acquisition of the operating assets of rag & bone, we acquired 36 stores, consisting of 34 stores in the United States and two stores in Europe. Source: 10-Q

Net Income, And FCF Growth Seen In The Last Decade

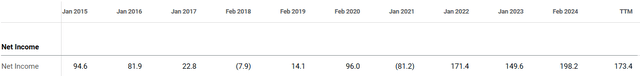

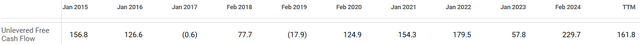

I think that the market did not really take into account the increase in net income growth reported in the last ten years. In the last ten years, net income almost doubled, which I think proves that GES’ business model is working pretty well. Investors may also want to have a look at the company’s unlevered free cash flow reported in the same time period. FCF increased in the last ten years, and the figures were almost always positive.

Source: Seeking Alpha Source: Seeking Alpha

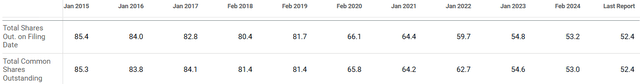

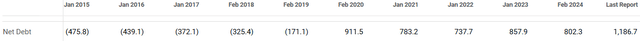

Other interesting financial figures to take into account that seem quite beneficial are the company’s reduction in the total amount of shares outstanding.

In my opinion, a lower share count will most likely lead to increases in the company’s equity valuation. I do not appreciate that the company’s net debt increased significantly from 2013 to 2024.

However, the company appears to be making significant capital expenditures and reporting many new stores. As a result, if free cash flow growth continues to trend north, in my view, the implied stock fair valuation will most likely trend higher.

Cheap Valuation, And Competitors

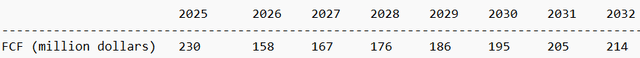

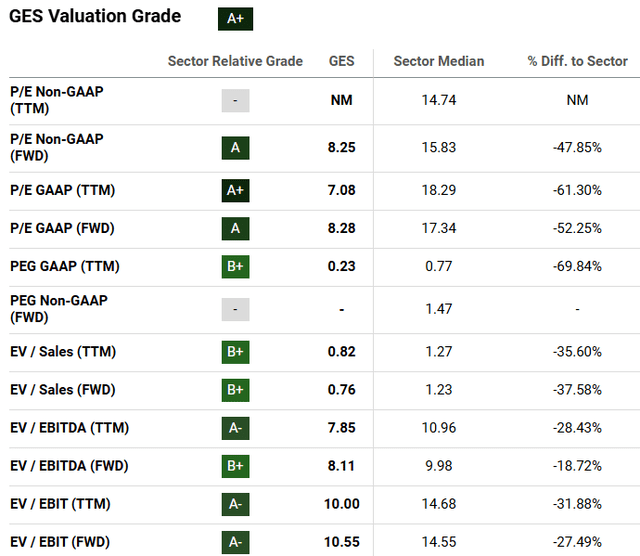

Based on previous free cash flow growth, store count growth, and other assumptions with regard to the increase in future capital expenditures, I made very conservative forecasts about free cash flow growth from 2025 to 2032. I also assumed a WACC of 6%, which is not far from the WACC used by other analysts. Besides, I used exit EV/2032 Forward FCF of about 11x, which, I think, is not far from the trading multiples reported in the sector.

Source: Seeking Alpha

The results obtained included total enterprise value of $2.59 billion and a target price close to ~$27 per share. Given the current stock price, in my view, there is significant upside potential in the stock valuation.

- NPV of FCF: $1027 million

- NPV of 2032 TV: $1569.49 million

- Total EV: $2596 million

- Net Debt: $1186.7 million

- Equity: $1410 million

- Shares Count: 52.4 million

- Target Price: ~$27

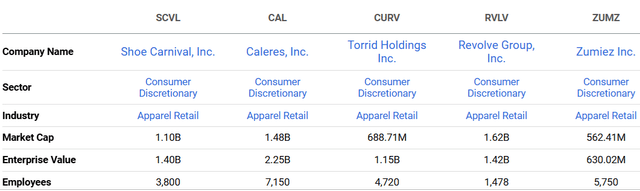

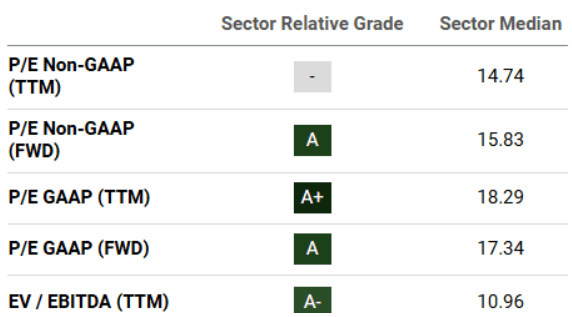

The company appears to trade significantly undervalued as compared to competitors. Shoe (SCVL), Caleres (CAL), Torrid (CURV), Revolve (RVLV), and Zumiez (ZUMZ) report a median Ev/ TTM EBITDA of close to 11x. Besides, the sector median forward PE GAAP is close to 17x.

GES reports an Ev/ TTM EBITDA of 7x, and the forward PE GAAP is close to 8x. In my view, new acquisitions, investments in productivity, brand extension, and efforts to enhance its ecommerce activities could push the company’s stock price to more logical price marks.

Stock Repurchases Could Enhance The Demand For The Stock

In 2024, GES recently authorized a new stock repurchase program for up to $200 million. The company had another stock repurchase program, but GES acquired a number of shares equal to the amount authorized by the Board of Directors.

On March 25, 2024, the Board of Directors authorized a new $200 million share repurchase program (the “2024 Share Repurchase Program”). Repurchases under the 2024 Share Repurchase Program may be made on the open market or in privately negotiated transactions, pursuant to Rule 10b5-1 trading plans or other available means. Source: 10-Q

In the past, the company acquired 0.3 million shares for up to $10.3 million, so GES purchased shares at close to $34 per share. Today, we can buy shares at a price mark that is significantly lower than $34 per share. In my view, companies usually buy their own shares when they are quite cheap.

During the three months ended May 4, 2024, the Company repurchased 0.3 million shares under its 2024 Share Repurchase Program at an aggregate cost of $10.3 million. Source: 10-Q

Risks

New store designs, new product designs, marketing campaigns, or new acquisitions could fail. As a result, the company’s return on investment or net sales growth could be lower than expected. In addition, changes in fashion trends or changes in the taste of existing or new clients could also lower future net sales growth, and may also affect future net income growth. Under these circumstances, if equity researchers lower the expectations about the company, in my view, the stock price could decline significantly.

The company makes a large part of its total income outside the United States. Hence, in my view, an increase in trade regulations for companies from the United States could lower future net income growth. The company could also have difficulties in bringing the CFO made outside the United States to the U.S. In this regard, GES offered the following explanations.

A significant portion of our product sales are generated outside of the U.S. In fiscal 2024, approximately 77% of our consolidated net product sales was generated by sales from outside of the U.S. Source: 10-k

The current political landscape has introduced greater uncertainty with respect to future income tax and trade regulations for U.S. companies with significant business and sourcing operations outside the U.S. Source: 10-k

GES reported that a significant part of the company’s suppliers is located in China. Given previous tensions between the United States and China and tariff related risks, in my opinion, GES could suffer from increases in the total amount of taxes. As a result, shareholders could suffer from lower net income growth, which may also lead to lower stock price increases.

While we have been reducing our dependency on China sourcing, particularly for our U.S. business, and mitigating tariff-related risks, the ongoing economic conflict between the U.S. and China has resulted in increased tariffs being imposed on goods we import from China. Source: 10-k

The company may also suffer from increases in taxes in many jurisdictions because GES does operate in many countries. In particular, the European Union and the OECD recently prepared the Base Erosion and Profit Shifting “Pillar 2” guidelines, which propose an increase in the global minimum tax up to 15%. GES reports holdings in many jurisdictions, which may be affected by these new propositions. As a result, I think that the company may suffer an increase in taxes paid globally.

Additionally, the Organization for Economic Cooperation and Development has released certain guidelines, including the Base Erosion and Profit Shifting “Pillar 2” guidelines. The OECD Pillar 2 guidelines address the increasing digitalization of the global economy, re-allocating taxing rights among countries. The European Union, many other member states and various other governments have adopted, or are in the process of adopting, Pillar 2, which calls for a global minimum tax of 15% to be effective for tax years beginning in 2024. Source: 10-k

GES could suffer significantly from new inflation or increases in the price of certain input costs, which could make manufacturing more expensive. In particular, increases in the price of cotton, certain chemicals, or dyes besides an increase in shipping costs because of increase in the price of oil could also lower future net income growth.

My Take

With many years in the business and operations in many countries, GES continues to deliver positive net income and FCF growth. In my view, the company already proved that its business model is sustainable in many jurisdictions. Hence, I would expect new FCF growth driven by new countries and markets all over the world. It is also worth noting that the company’s geographically diversified business profile could bring certain net sales stability in case of a global recession. In addition, given ongoing inorganic efforts, like the acquisition of WHP Global and Rag & bone, and the total amount of cash in hand, I would expect store growth count driven by new acquisitions. Finally, in my view, the ecommerce activities and new partner alliances could also be a net sales driver. With all this in mind and the new stock repurchase program announced in 2024, I would be expecting stock price increases in the coming future.