Michael Vi

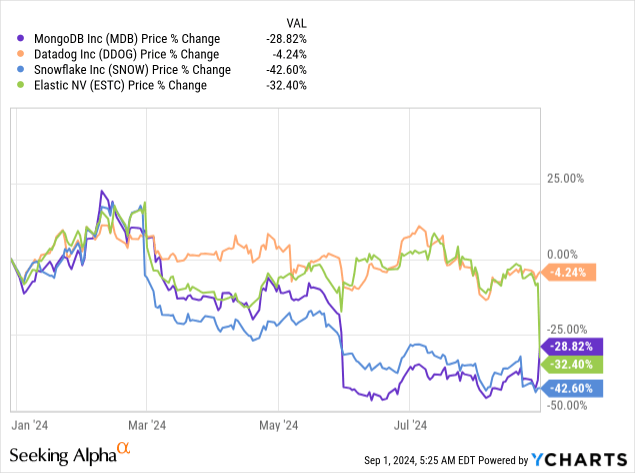

MongoDB, Inc. (NASDAQ:MDB) stock has been falling sharply over the last months fueled primarily by general skepticism around whether AI will have an actual positive impact on software companies in the near future. In fact, the stock price has plummeted 50% from its February highs, and MDB’s peers have experienced a similar fate. However, MongoDB’s strong Q2 results and positive guidance revision seem to have proved skeptics wrong, which might be an inflection point for the company. Therefore, the stock remains a Buy.

Quick recap and the market’s disillusionment

In my previous article on MongoDB, I gave the stock a “cautious Buy” rating based on the following factors:

- MongoDB’s unique approach in the database market makes it a promising company in the age of AI.

- The corporation’s product developments, like Vector Search, position it for further growth.

- MDB’s history of exceeding revenue and earning expectations, coupled with a more reasonable, compared to peers, valuation made it a compelling buy.

Since that article, the stock has decreased about 45%, or 36% when taking the post-earnings surge into account. MDB’s software peers have demonstrated a similar trend, as the market became increasingly skeptical about whether the AI enthusiasm around software-focused companies is justified.

However, the recent round of earnings has shown that MongoDB might be positioned better than its peers. Thus, Snowflake Inc. (SNOW) dropped almost 16% after releasing its latest quarterly results last week, and just yesterday, Elastic N.V. (ESTC) dropped 25% after reporting lower customer commitments impacting revenue.

MongoDB reports strong Q2 results and raises guidance

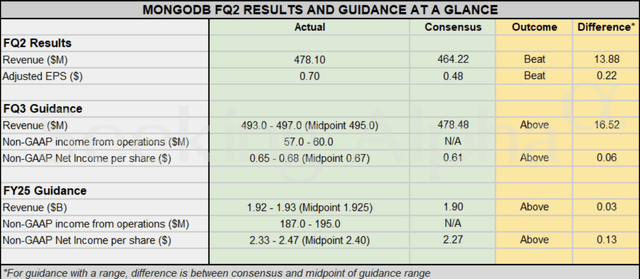

On August 29, MongoDB reported its Q2 FY2025 results, beating on top and bottom lines significantly. The revenue for the quarter came in at $478.1 million, which was almost $14 million higher than the market’s consensus and represents a 12.8% increase year-over-year. The EPS beat was even more substantial-$0.7 actual vs. $0.48 expected by the market.

While MongoDB’s Q2 revenue growth might not seem that astonishing, a deeper look shows there are a lot of positives in the report, and the full-year outlook improvement is a favorable addition.

First of all, zooming in on the revenue, MongoDB’s Atlas (the company’s database service) revenue grew a solid 27% in the quarter. This is the core source of revenue for the company, and it now represents 71% of total sales, compared to just 63% in the same quarter last year.

Atlas’ growth makes the revenue growth figure more comparable to Snowflake’s 29% revenue increase in the recent quarter and explains MDB’s valuation better than the headline number. With MongoDB Atlas’s increasing share in total revenue and its continued strong growth, we can expect the company’s overall sales to inevitably return to higher expansion rates soon. To illustrate, if Atlas continues to grow at least 30% year-over-year, MongoDB can still demonstrate more than a 20% sales increase next year even if non-Atlas revenue stagnates.

While non-Atlas revenue was down 13% year-over-year in this quarter, the company explains this primarily by the “difficult compare” in Q2. Non-Atlas revenue includes the licensing component, and MongoDB had several “large multi-year partnership” deals in Q2 last year; the revenue for these contracts is recognized upfront under accounting rules. As the impact of this one-time licensing revenue recognition fades, MongoDB’s non-Atlas revenue should normalize over time, also contributing to a return to much higher overall revenue growth for the company.

Moreover, MongoDB’s ARR expansion remained a strong 119% in the quarter. This is just slightly lower than Snowflake’s famously high expansion rate, which was 127% during the same period. Revenue expansion also means that MongoDB now has significantly more customers with at least $100,000 in ARR-2,189 in Q2 this year vs. 1,855 in the year-ago period. These customers are especially valuable since, over time, they become increasingly less likely to switch to any other service provider, as, drawing from my experience working in the field, data migration is an especially complex and expensive process.

High expansion rates allow software companies to increase their revenue over time even without adding new customers. However, MongoDB still increased its customer base significantly in Q2. The company ended the quarter with 50,700 total customers, which is 13% higher than in Q2 last year. Importantly, the number of customers also increased sequentially by 1,500, which should reduce the fears of stagnation during more difficult (in terms of macro environment) times.

Financially, one of the positives is MongoDB’s strong gross margin of 73%. Even though this number is about 2 percentage points lower than a year ago, it is also explained by the lower share of high-margin licensing revenue we discussed above. To compare, Snowflake’s gross margin was 67% in the latest quarter.

In addition, the company kept its operating expenses under control, continuing to invest in research and development-operating expenses went up by 14.6%, driven mostly by a 19% increase in R&D. MongoDB also ended the quarter with $2.27 billion in cash and short-term investments and just $1.15 billion in debt in the form of convertible notes, and no new debt was issued during the quarter. This should reduce the risks for investors in case MongoDB faces any operational difficulties in the future.

Guidance

On top of the strong quarterly performance, MongoDB raised its Q3 and full-year guidance. The company now expects $1.92-1.93 billion in revenue in FY 2025, with 2.33-2.47 in non-GAAP EPS. This is significantly higher than the previous consensus and might become a substantial catalyst for the shares in the short term.

During the earnings call, the company explained updated guidance for three reasons:

- Stronger Atlas consumption in Q2, which resulted in a higher baseline and higher ARR for the second half of the year;

- Increased Enterprise Advanced [EA] consumption;

- Higher operating margin (10% at the midpoint) due to strong Q2 performance and increased revenue outlook.

Negatives and concerns

Despite MongoDB’s generally solid Q2 report, we should still note some negative or just concerning points regarding the company’s financials.

For instance, MongoDB increased its sales and marketing spend by 13% in the quarter, which represents the same percentage increase as revenue. Ideally, sales and marketing growth rates should be below revenue growth to demonstrate that the increase in sales is not “artificially” driven by extensive marketing efforts. In MongoDB’s case, this is not a particularly significant concern given that S&M remained at the level of 63% of gross profit, and the core Atlas revenue grew 27%. To compare, Snowflake increased its sales and marketing expenses by about 20%, spending 69% of gross profit.

Additionally, the company had a negative $4 million in free cash flow in the quarter, even if the number is closer to break-even compared to the negative FCF of $27.3 million a year ago. Snowflake’s adjusted non-GAAP FCF margin was 8%, according to the management.

Finally, similar to many modern tech companies, MongoDB’s stock-based compensation remained high in the quarter, increasing by another 12% year-over-year. While this does not present an immediate issue, it will inevitably lead to share dilution over time.

AI growth should extend from hardware to software soon

The current AI infrastructure spending is heavily concentrated on hardware, with companies like NVIDIA Corporation (NVDA) experiencing massive revenue growth of 100-200% year-over-year. This is primarily because robust infrastructure is the first essential need to manage and process the vast amounts of data generated by AI applications. Despite this boom in hardware, AI-driven growth has not yet impacted software companies significantly, which was confirmed by MongoDB during the earnings call:

AI continues to be an additional long-term opportunity for our business. At the start of the fiscal year, we told you that we didn’t expect AI to be a meaningful tailwind for our business in fiscal year 2025, which has proven accurate. Based on recent peer commentary, it seems that the industry now mostly agrees with this view. Companies are currently focusing their spending on the infrastructure layer of AI and are still largely experimenting with AI applications.

However, this spending on AI infrastructure will inevitably translate into increased demand for AI software, especially data and database solutions. AI generates vast amounts of data that need to be stored and processed, inevitably leading to higher consumption of software solutions. As a result, software companies are poised to capitalize on this trend thanks to the mostly consumption-based sales models, ultimately driving substantial revenue growth in the near future. Therefore, I believe MongoDB should be able to sustain its history of 30%+ revenue growth in the future. From the earnings call:

Inference workloads will come and should benefit MongoDB greatly in the long run, but we are still very early and the monetization of AI apps will take time. AI demand is a question of when not if, and our discussions with customers and partners give us increasing conviction that we are the ideal data layer for AI apps for a number of key reasons.

Valuation

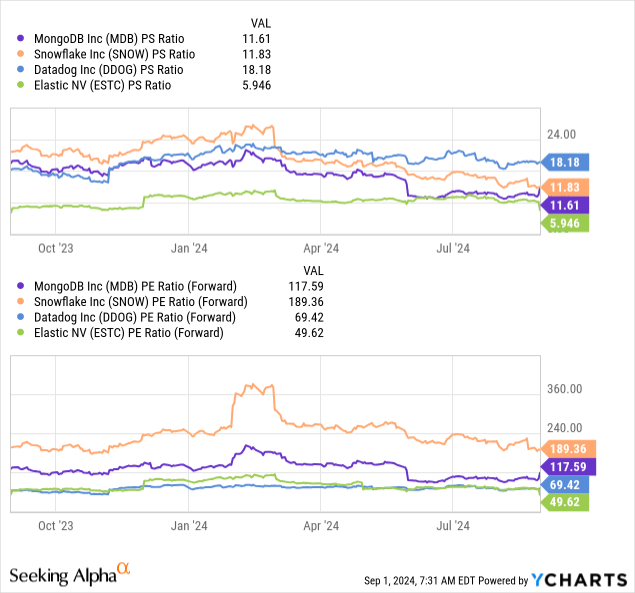

Regarding MDB’s valuation, there are no significant changes from my previous thesis. The stock is not exactly cheap, especially after the post-earnings surge. However, the valuation is largely better or in line with the industry standards. MDB trades at one of the lowest P/S ratios and a P/E that is 1.5 times lower than that of Snowflake. These multiples might look even better when the market adjusts the estimates.

Therefore, the statement from my previous article can be reiterated here:

Yet, taking into account its consistent 30% revenue growth over multiple years, outpacing many software peers, and its track record of regularly beating EPS expectations by a substantial margin, MongoDB’s valuation seems more reasonable, warranting a cautious Buy recommendation.

Key takeaways

Software stocks have had a weak year so far. However, there are signs that the bottom might be in, and MongoDB’s strong Q2 results and raised guidance suggest that the company might be at an inflection point. MongoDB Atlas’ notable performance might help the company return to 30%+ revenue growth sooner than many might expect. And with AI growth inevitably spilling over to database companies, the future remains promising. Although MDB’s valuation is rather premium and there may not be many short-term catalysts aside from estimates adjusting to higher guidance, the stock remains a buy for the mid-to-long term.