Talaj

Investment Thesis

C3.ai (NYSE:AI) is set to report its fiscal Q1 2025 earnings after the close on Wednesday. The stock’s expectations have deflated in the past several weeks, but I don’t believe this is a good opportunity to buy the dip pre-earnings.

Even though there are clearly positive aspects, such as a well-placed company with a mighty compelling narrative, and a balance sheet that’s debt-free, I nevertheless argue that investors’ expectations are already too high.

All in all, I make the case that paying 7x forward sales for C3.ai leaves investors with no margin of safety. In short, investors paying $24 per share will in time look back to this stock as a high price to aspire towards.

Rapid Recap

On the back of its fiscal Q4 2024 earnings results, as the stock was soaring, I wrote an analysis that said,

[…] the business is already priced at 9x sales. How much more multiple expansion are investors hoping to get for a business that, for every $4 of revenues, burns through about $1 dollar of non-GAAP losses?

Furthermore, I believe that its path to profitability is still a few years away. Consequently, I remain neutral on this stock.

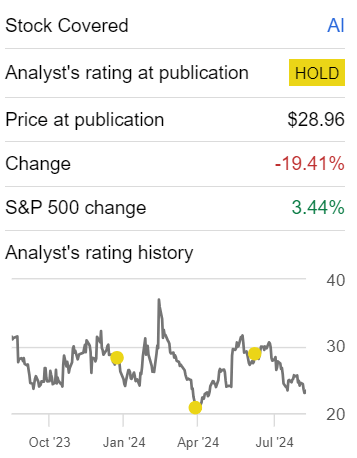

Author’s work on AI

At the time, this was a really tough contrarian call to make. I argued that investors should not chase AI higher. And true to form, the stock has since my call moved lower. And I believe that its near-term prospects won’t fare much better. Best avoid this stock at $24 per share.

Why C3.ai? Why Now?

C3.ai is a software company that specializes in providing enterprise AI applications. These applications are designed to help large organizations use AI to improve their operations, such as predictive maintenance and supply chain optimization.

C3.ai focuses on ready-made applications rather than the underlying infrastructure or AI models. This makes it easier for companies to adopt AI without needing to build everything from scratch.

Furthermore, one of the key drivers of growth is its C3 Generative AI suite, which has generated significant interest across various industries. For example, with close to 50,000 inquiries in the last quarter and expectations to surpass 90,000 inquiries this quarter, this product is set to become a major growth engine for C3.ai.

As more companies seek scalable AI applications, C3.ai’s offerings in this space are expected to provide it with a solid foundation and runway for strong growth rates in fiscal 2025.

Given this context, let’s now turn to discuss its fundamentals.

Revenue Growth Rates Should Improve, With A But…

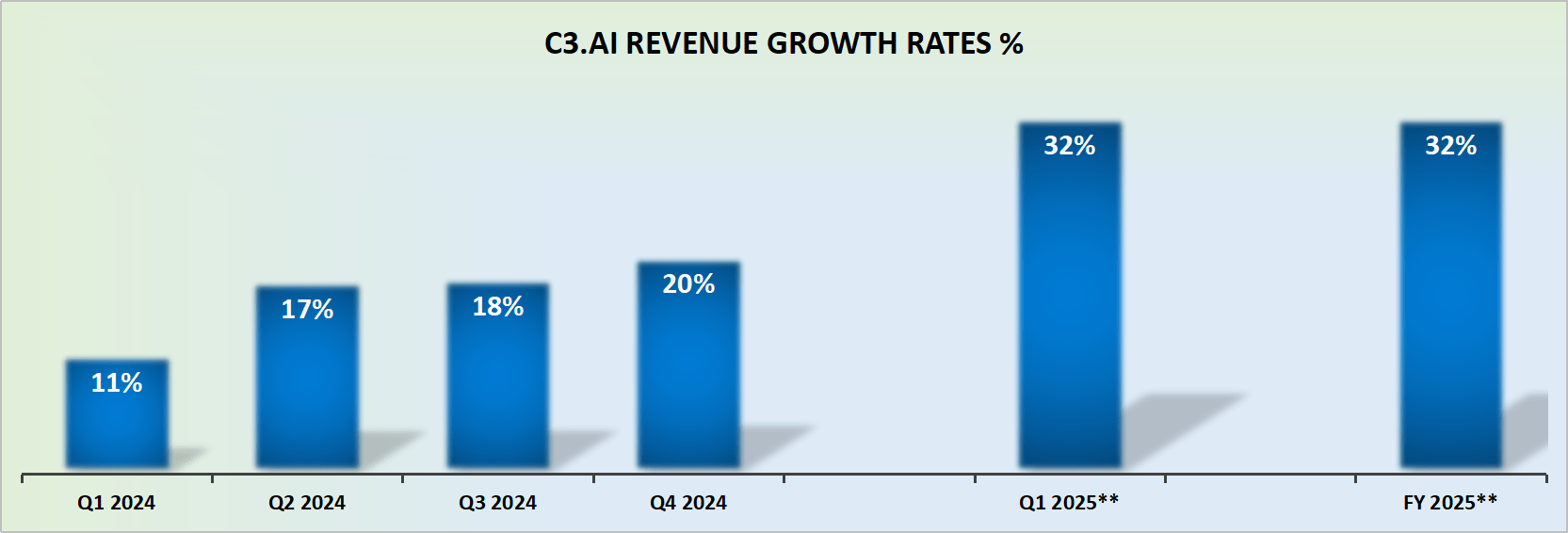

AI revenue growth rates

C3.ai seeks to be seen by investors as a well-placed, pure-play growth story. A secular growth story able to deliver more than 30% revenue growth rates. However, the problem here is that the AI narrative has already run its course.

Investors are now looking beyond a tell-me story to a show me story. Simply put, what investors want to see is large beats on its revenue line, and guidance being raised every quarter of the year. After all, that’s how growth stories unfold.

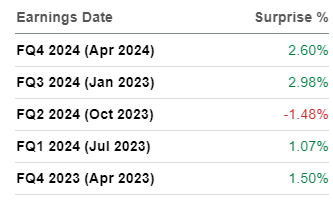

And yet, with that in mind, note the size of C3.ai’s revenue beats while this whole AI boom has taken place in the past year and a half:

SA Premium

C3.ai’s revenue beats have often been in the low single digits, apart from one quarter, where C3.ai actually missed the mark on analysts’ expectations, see above. In short, I argue that this stock’s expectations are too high for the fundamentals it delivers. With this thesis in mind, let’s now discuss its valuation and how it compares with other high-growth businesses.

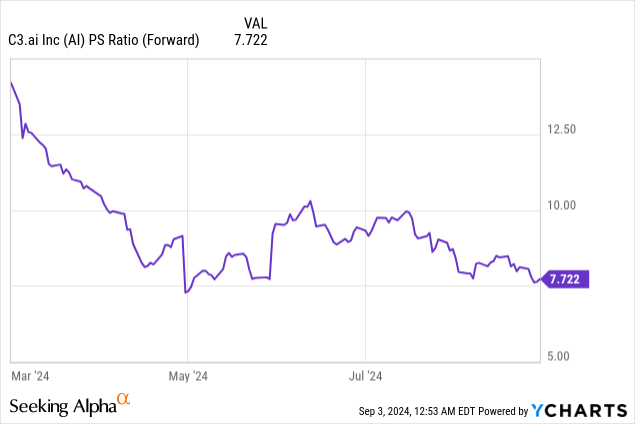

AI Stock Valuation — 7x Forward Sales

I believe that when C3.ai reports its fiscal Q1 2025 results on Wednesday after the close, its total cash and marketable securities position will stand at approximately $735 million. Given that C3.ai holds no debt on its balance sheet, this implies that approximately 25% of its market cap is made up of cash. This undoubtedly preserves the intrinsic value of the company and stops its share price from sliding lower too aggressively.

That being said, consider investors’ expectations.

Investors are willing to pay around 7x forward sales for C3.ai, a business that in the best-case scenario in the coming years will burn through about $80 million of free cash flow, and deliver investors with about 17% non-GAAP operating margins.

At this same multiple to sales, investors can look elsewhere in SaaS land. For example, my personal favorite at this same valuation, is SentinelOne (S). Although, I will quickly note that I believe that SentinelOne is likely to be on a path to $100 million of free cash flow in the next twelve months. The same cannot be said about C3.ai for quite some time yet.

Another comparison could be MongoDB (MDB); however, even then, the business is already substantially profitable.

Consequently, I struggle to see how investors can possibly be pleasantly surprised when expectations are already so high heading into this earnings result? They can’t be positively surprised, and they very likely won’t be.

Additional Risks to Think About

Despite its revenue growth, C3.ai faces significant challenges as it transitions to a consumption pricing model, which has led to a reduction in the average contract value, which will impact the predictability of its long-term revenue growth rates.

I’ve provided this argument numerous times over the years. Companies that move to consumption models are putting themselves on the opposite side of the table to their customers.

It’s like the Netflix (NFLX) versus pay-per-view business model. What has worked out better in the long term? One that promotes binge-watching, or the one that leaves the customer with a large bill for using your service?

The Bottom Line

Given these considerations, I believe it would be wise for investors to avoid C3.ai as it heads into its earnings results. While the company has a compelling narrative and a solid balance sheet, the current valuation leaves little room for error. At 7x forward sales, the stock is priced for perfection, despite its modest revenue beats and the ongoing challenges in transitioning to a consumption-based pricing model.

In short, the “I” in AI might just stand for “Inflated” expectations.