Young777

Paradigm Shifts

Like humans, businesses experience a lifecycle in which they find themselves in infantile, juvenile, adult, and elderly stages.

When a business is recently born, or launched, it requires an inordinate amount of time and attention to nurture it. Then, finally, it can stand on its own two feet, as is the case for human beings when they are born.

Over time, businesses evolve and mature, through which the perception of those businesses shifts, as is also the case for humans, in that the world’s perception of us as children shifts as we age and enter adulthood.

With every business you own, there have been notable “paradigm shifts” that have followed approximately the same course I described above:

The business started out infantile and precarious, during which time much attention and care needed to be paid to it; then, it matured and developed a relative sturdiness to it, though perhaps it experienced growing pains or an ugly duckling phase; then, it reached peak productivity years, contributing to society and its shareholders at maximum levels.

And, in the same way your businesses experienced this lifecycle, we ourselves have experienced it throughout our lives.

Let’s consider a couple of examples to further bring this concept to life; then, we will apply it to Tesla, Inc. (NASDAQ:TSLA) with a few pieces of very notable data that, I believe, will shift your Tesla paradigm, i.e., your perception of Tesla.

In 2007, Apple (AAPL) offered a series of hardware products and scantly much else. To this end, it was often considered a business that lacked a moat, as building a replica of the iPhone or MacBook seemed to be rather easy.

What the market missed was that the software in the iPhone would create profound moats for the business over time.

The iPhone’s transition from a hardware product to a software platform was its “Paradigm Shift,” and an appreciation of this shift would have given investors greater confidence in the company’s prospects.

The developer-operating system-consumer network effects for Apple’s App Marketplace has served to create a virtuous cycle that gravitationally pulls the world into the Apple ecosystem. Apple’s iCloud storage acts as memory augmentation for humans and creates a formidable embedding moat. Apple’s blue text boxes status signal and create network effects.

In short, the paradigm shift for Apple over the last decade has been our collective perception shifting from seeing Apple as a hardware producer to seeing Apple as a hardware ecosystem. Atop of this ecosystem and within which it has embedded software products that are highly valuable.

This is just one example of a paradigm shift.

I could share with you an endless list of companies who have experienced paradigm shifts. Many of them you can read about via my profile and past ideas. I would invite you to think about the businesses you own through this lens, as well as your life and the lives of your children or spouse.

For the sake of brevity, let’s now transition this discussion to a focus on Tesla’s paradigm shift.

Tesla’s Paradigm Shift

The argument could be made that Tesla has undergone one or two major paradigm shifts already; however, I believe it’s currently in the midst of its most significant shift in the company’s history, which will poise it to generate exceptional shareholder returns in the decades ahead.

I would characterize the business as roughly being a teenager or early 20s adult, and, as Blink 182’s wisdom reminds us, “nobody likes you when you’re 23.”

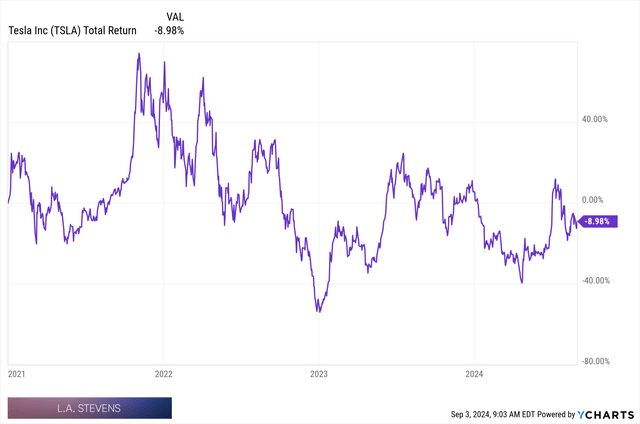

The Market Has Not Liked Tesla For Almost Four Years Now

It’s currently transitioning from the way its high school and college classmates saw it to the way the world will see it as a peak productivity adult, so the analogy goes.

To put this into more concrete terms, Tesla is transitioning from a hardware electric vehicle producer, prone to commoditization over time, to an EV plus AI and Energy business.

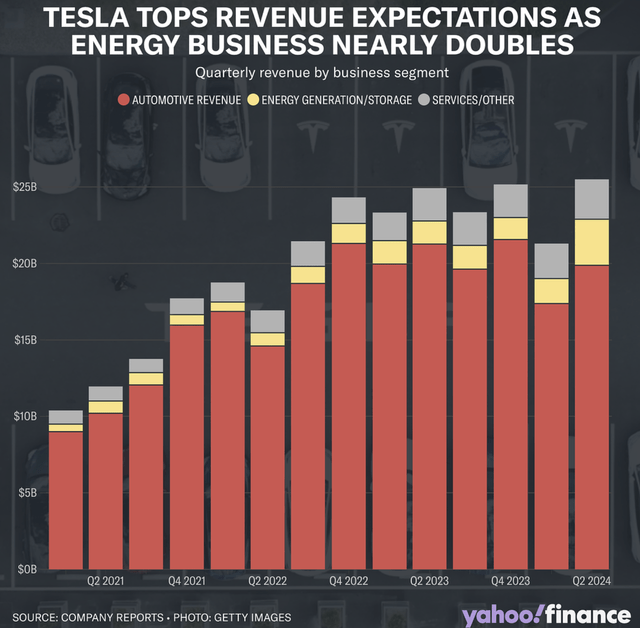

To provide concrete data illustrating this evolution, let’s start with Tesla’s Energy business, without which Tesla’s sales would have declined in Q2 ’24, instead of eking out a meager 2.3% gain year over year.

Tesla Energy Now Contributes Very Meaningfully To Tesla’s Overall Sales ($3B Out Of ~$25B In Q2 ’24, Up From $1.5B Out Of ~$25B In Q2 ’23)

Irrespective of how you feel about my thoughts today, you cannot deny the indisputable and concrete data presented above, in which we can see that Tesla’s Energy business now operates at $12B in annualized sales scale, while growing at ~100%.

This is the reality, and it represents the business evolving from an EV pure play to an EV business that now offers genuine energy infrastructure globally as well, and materially benefits from that offering in a way investors should acknowledge.

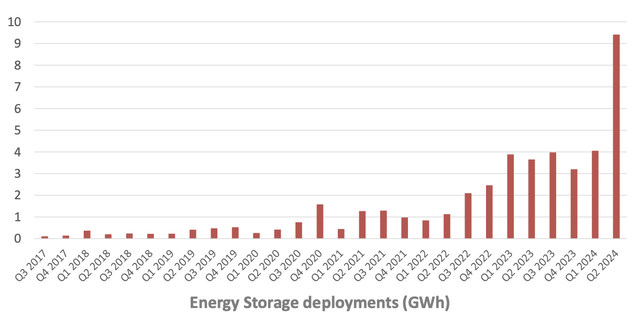

Tesla’s Energy business growth has been driven by the growth of Tesla Megapack deployments specifically, the growth of which is measured in GWh, and this can be seen below.

Tesla’s Energy Business Growth Through The Lens Of GWh Deployments

Tesla Q2’24 Earnings Presentation

In 2023, I shared a series of notes with you illustrating that this line of business was, in some sense (don’t take it so literally), Tesla’s “AWS.”

I did so in this article.

To a large degree, my writing to you today is just an update to that article, though with a little twist that we’ve already covered.

As we can see via the concrete data above, Tesla must now be considered both an EV business and a rapidly growing Energy business.

To further quantify this Energy business before we transition to Tesla’s AI work and concluding thoughts, Tesla has set a goal to achieve 1,500 GWh of storage deployment by 2030. While I think this may be too ambitious, the goal seems more attainable in light of the data presented above. As shown, Tesla grew GWh deployments at 100%+ year over year and now deploys nearly 40 GWh on an annualized basis, up from just 10-15 a year or two ago.

Should it maintain this growth, then 1.5K GWh of annual deployments maybe attainable, if still very, very ambitious.

At 1.5K GWh of annual storage deployment, using the current ratio of 9 GWh/$3B in quarterly revenue, on which Tesla generates ~25% gross margins, Tesla would generate ~$500B in energy sales.

At $500B in energy sales, with ~25% gross margins, which is where Tesla’s Energy margins stood in Q2 ’24, I believe the company could generate between $50B and $75B in free cash flow, i.e., 10-15% free cash flow margins.

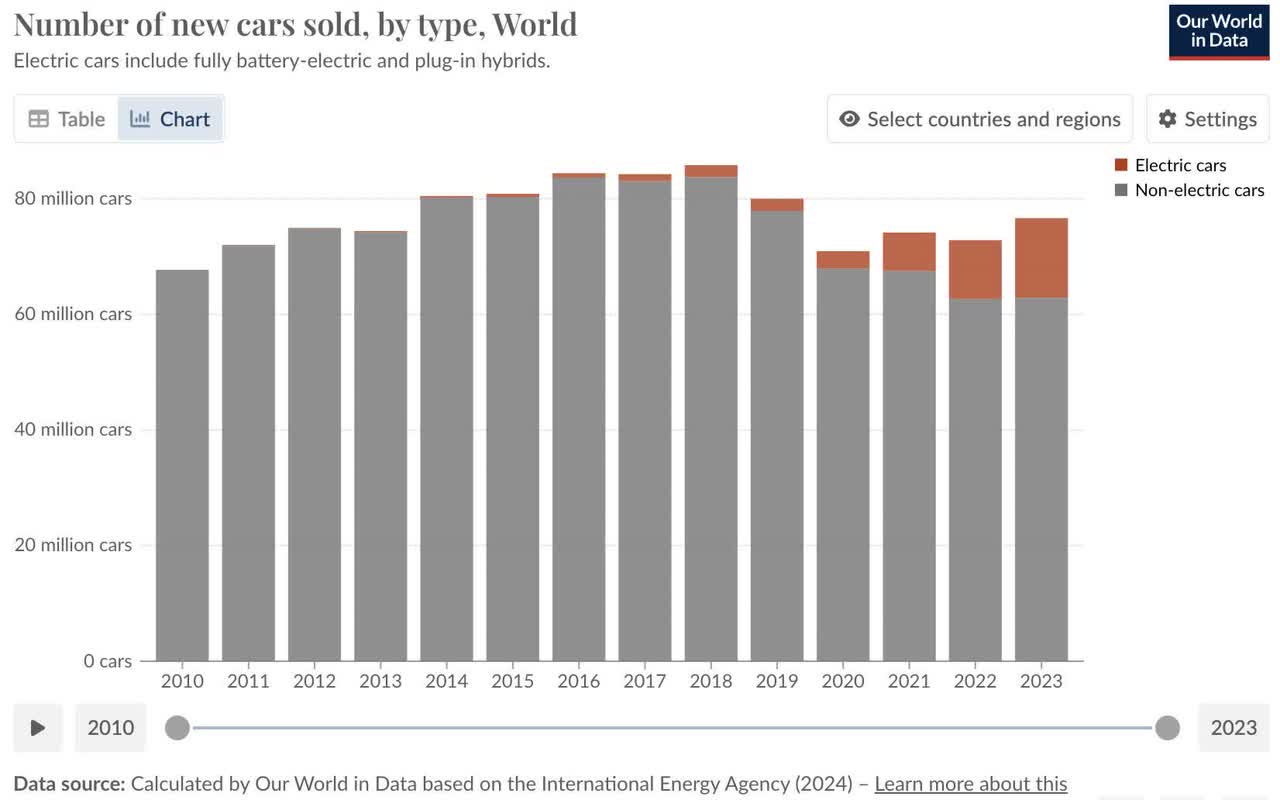

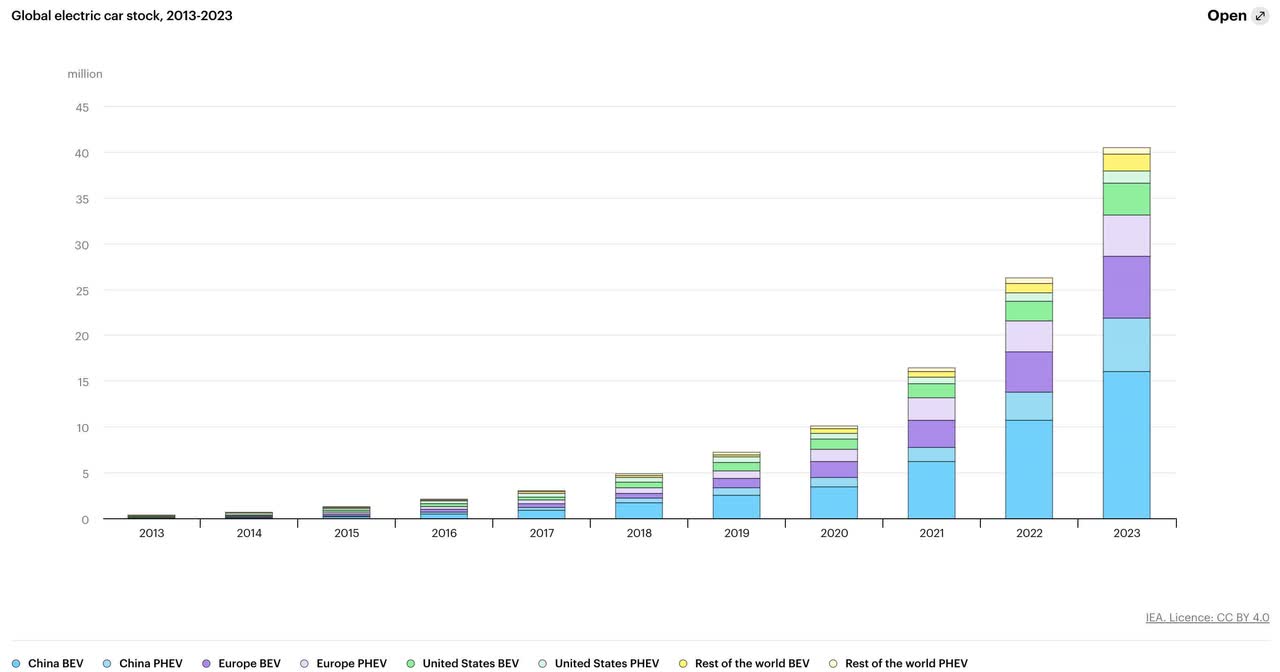

Considering the transition to an alternative energy and electric vehicle future is still in its very, very early innings, I believe that not only is this achievable, but also there will be further runway for growth after achieving it.

EV Adoption Is Still In Its Early Innings

But It Has Been Growing Rapidly

This is the first paradigm shift that is purely a matter of data. Don’t shoot the messenger. Note that I use this language because I’ve gotten push back on highlighting Tesla’s evolution, though I do not know how someone could invest in growth stocks without leveraging some forecasting of the evolution of a company’s business model. There would be no sense in even commenting on Tesla today without acknowledging the possible paradigm shift underway for the business, and the same could be said for every great investment of the last 100 years:

- Apple from a computer company to an iPhone and software company.

- Amazon from a books company to a cloud computing giant

- Axon from a Taser company to a global security and software vendor

- Palantir from a government software vendor to a commercial software vendor

- Meta from Facebook company to a diversified social media conglomerate (which is now becoming a compelling AI company).

There are many, many examples of “paradigm shifts,” and they are always underway in the market. It is the process of “being” and “becoming,” and it’s worth considering businesses through this lens, even if we don’t get them right all the time.

Let’s now turn to a consideration of Tesla “becoming” an AI company, then we will wrap up this review.

Tesla Is Becoming An AI Company

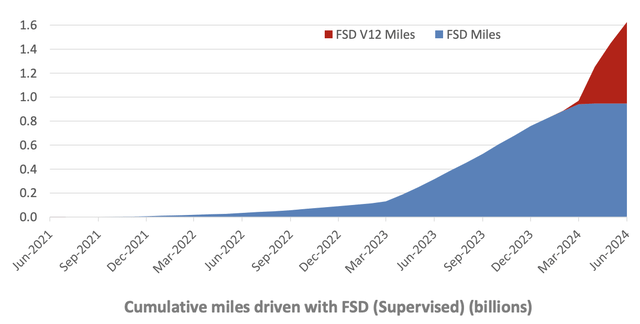

Full self-driving, or FSD, should be understood as the creation of an AI that is as smart as its biological AIs who operate vehicles on the road currently.

Tesla’s FSD represents building a genuine intelligence that can reason, infer, and predict just as a human would, and, for those that use the software, and I am one of those people, you will very deeply understand this: The software interprets the movements of pedestrians, the actions of other cars, and road signs, by which it ultimately makes decisions about its maneuvers and speed.

It seems like magic, but it’s actually a hardcore AI problem, which involves building genuine intelligence that is just like the biological intelligences currently on the road (over time, it will likely be better because it will not be prone to distraction or malfunction such as drunk driving).

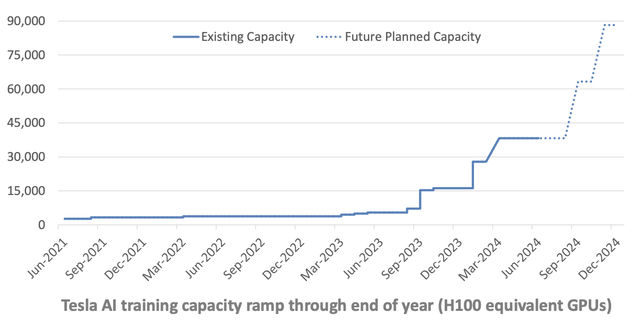

With these ideas in mind, Tesla’s FSD AI must ingest massive quantities of data, and Tesla must feed that data into giant AI compute clusters, and this Tesla has been doing.

This is similar to a child ingesting data in its early years, and developing a framework for interaction with the world over time, which allows it to survive and thrive.

Tesla FSD Miles Driven Continues To Reach New Heights

Tesla Q2’24 Earnings Presentation

Tesla’s AI Compute Capacity Continues To Aggressively Build

Tesla Q2’24 Earnings Presentation

While Tesla’s revenue generation from this business is objectively more nebulous than the concrete data we have on its Energy business, the training data above illustrates that there is progress being made.

Tesla’s Robotaxi event will be one worth paying attention to for investors and prospective investors alike.

Risks

The concept of “Paradigm Shifts” is also synonymous with the ongoing process that we all experience of “being” and “becoming.”

At any given time, we’re constantly torn between these two spectrum ends, which is a paradox of life. We’re simultaneously in a state of being and becoming.

And there’s risk associated with this process.

There was risk associated with Apple being a hardware produce and becoming a software producer.

There was risk associated with Amazon being a books retailer on the internet and becoming one of the most important cloud computing businesses on earth.

And, there was risk associated with Axon Enterprise (AXON) being a body cam and Taser vendor and becoming a global security and software vendor.

Risk lies in competition, execution, and an almost infinite series of other variables, and this could unequivocally be said for Tesla as well.

Concluding Thoughts

Whatever your perspective is on Tesla, I believe these ideas are worth pondering.

In a similar vein to my most recent Affirm article, even if you don’t agree, it’s worth taking time to assess these possible paradigm shifts. Consider the process of being and becoming for your own companies and for your own life.

Thank you for reading, and remember to follow for more insights such as these.