Morsa Images/DigitalVision via Getty Images

Summary

Following my coverage on American Eagle Outfitters (NYSE:AEO) in June 2024, in which I recommended a hold rating due to my expectation that the stock will remain under pressure given the visible margin headwinds and that the valuation was not attractive, this post is to provide an update on my thoughts on the business and stock. I am upgrading my rating from hold to buy as I see a tactical opportunity to make ~7% returns over the next few months if AEO can continue to drive strong SSSG (which seems to be the case so far).

Investment Thesis

On 29-08-24, AEO released its 2Q24 earnings, which saw total net sales of $1.29 billion, gross profit of $499 million, EBIT of $101 million, and net income of $77 million. On a y/y growth and margin basis, net sales grew 7.5%, gross margin saw 38.6%, EBIT margin saw 7.8%, and net margin 5.9%. Relative to consensus estimates, margins were pretty much in line, but revenue growth disappointed by 160 bps.

Looking at AEO 2Q24 performance, it seems like same-store sales growth (SSSG) strength remained very strong, and I see the potential for topline growth to see a strong acceleration in 2H24. SSSG in 2Q24 came in solidly at 4%, which was in line with management’s target of mid-single-digit percentage growth. While this represented a deceleration from 1Q24 both on a 1-year (7% SSSG in 1Q24) and two-year stack basis (6% in 1Q24), this comparison is partially flawed because July was impacted by poor weather conditions. Normalizing from the weather conditions, I don’t think it is unreasonable to assume that 2Q24 SSSG could come in at >5% as management noted outperformance in May and June, and given that Aerie brand ex-weather impact SSSG was 300 bps higher than reported SSSG.

Importantly, SSSG strength was seen across both key brands. American Eagle (AE) saw SSSG of 5%, or 3% on a two-year stack basis, which was in line with 1Q24, driven by continuous strength in Women’s. 2Q24 marked the 6th consecutive quarter of growth for the Women’s sub-segment, clearly indicating that the current set of product assortments is well-liked by consumers. While Men’s sub-segment is still seeing negative growth, there are signs of improving trends in certain product lines, which is very encouraging. As for the Aerie brand, SSSG was also robust at 4% on a reported basis and even better when adjusted for the weather impact, which management noted SSSG was 7% without the weather-impacted Swim sub-segment. There appear to be no signs of a slowdown in momentum, as management cited a strong customer response to soft apparel as well as strength in activewear, with both categories growing double digits in 2Q24.

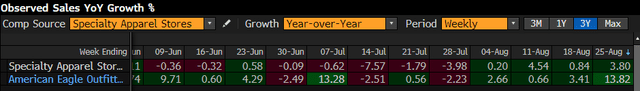

The SSSG outlook for 3Q24 also looks really promising based on management comments and alternative data. To start off, management noted during the call that quarter-to-date trends (i.e., the month of August) were up 5% for the AE brand and 7% for the Aerie brand, with positive traffic across both digital and in-stores. Comparing against the observed sales data that Bloomberg provides, the weekly growth trends have accelerated through the month, which suggests that the momentum may continue into September.

Granted that August is the peak selling season due to the back-to-school shopping season, management did note that this back-to-school buying occasion has elongated over the years to past Labor Day and into early September. Assuming this trend persists, I believe management’s 3Q24 SSSG guidance of 3-4% may be too conservative. Furthermore, 3Q24 benefits from a recent category expansion (which 3Q23 did not have), such as AE expansion into sleepwear, fleece, and leggings and AE expansion into denim and social casual, which all received positive demand trends since launch.

Our soft dressing categories and the expansion into activewear with OFFLINE has been simply incredible. The second quarter marked yet another record for Aerie, with revenue up 9% to last year, fueled by a 4% increase in comps.

And as we look ahead, very excited about the acceleration into back-to-school. As you know, when we think about denim, it’s our mainstay. Jeans are a rite of passage for American Eagle. We have an incredible denim business.

Denim is our mainstay, I’m going to reiterate. And we love the new trends that are emerging. We are not just a one-fit brand anymore. Women’s is so nimble these days, and we are leaning into all the new silhouettes.

We have seen a great response to new looks, targeting social casual occasions and our widening age demo, both of which are key growth opportunities. In men’s, we were very pleased with improving trends in tops and strength in twill bottoms.

So we’re leaning into social casual. I think we’re going to own this category. We’re doing it better than other competition out there and this is what we do best, right? Quality and value. And I want to highlight quality for our brands.

Given this topline strength, I now see a better chance for AEO to meet its FY24 implied guide of ~8.5% EBIT margin guidance (using management’s previous guide for 5% topline growth CAGR from FY24-FY26 and an EBIT target of $465 million). So far into the year, AEO reported ~7.4% EBIT margin, and in order to meet the 8.5% EBIT margin, 2H24 needs to come in at least an average of 9.6%. With SSSG showing very strong performance in August, which is likely to persist into 3Q24, the business should see strong incremental margins (given the fixed-cost nature of the business). Hence, I think the EBIT margin can follow a similar seasonality trend like previous years (2H EBIT margin is generally higher than 1H by 1.3x to 1.8x). Assuming 1.3x, 2H24 margin could potentially come in at 9.6%. Management has also reiterated their focus on driving operation efficiencies, which should translate to lower SG&A as a percentage of sales.

Valuation

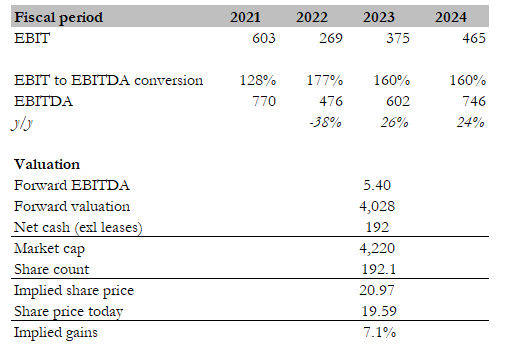

Own calculation

My target price for AEO based on my model is ~$21. My model assumptions are that AEO can hit management FY24 EBIT guidance of $465 million (or $746 million in EBITDA after applying the historical EBIT to EBITDA conversion ratio) and the stock to trade at its historical (10-year period) average of 5.4x forward EBITDA.

Unlike the last time I wrote about AEO, where the stock was trading at 5.8x forward EBITDA (above the average), the stock is cheaper today at 5x forward EBITDA. And I think this presents a situation where investors can take advantage of the current demand momentum that AEO is seeing to make ~7% returns over the next few months. The way I see this playing out is that AEO continues to drive very strong SSSG in 3Q24, with EBIT margin expanding to 9+%, in which this would convince the market that 2H24 EBIT margin can be in the range of 9.6%, which makes the implied full-year EBIT margin target seem plausible. At that point, the stock should re-rate upwards immediately to at least be in line with the historical average.

Risk

I may have overestimated the demand momentum as consumer preference could change overnight, and there is virtually no way to track it in real-time (comments from management would be backward looking too). If this is the case, it will be challenging for AEO to grow topline fast enough to drive strong incremental margins in 2H24, resulting in a potential miss in guidance.

Conclusion

In conclusion, my rating for AEO is a buy. I see a stronger case for AEO to meet its FY24 EBIT target now given the strong sales momentum, driven by robust SSSG across its key brand, expansion into new categories, and continued focus on operational efficiencies. The key catalyst to drive the stock up is the 3Q24 earnings, which, if played out as I expected, should convince the market that the EBIT target is achievable, resulting in valuation moving upwards.