HeliRy

Note:

I have covered KNOT Offshore Partners LP (NYSE:KNOP) previously, so investors should view this as an update to my earlier articles on the company.

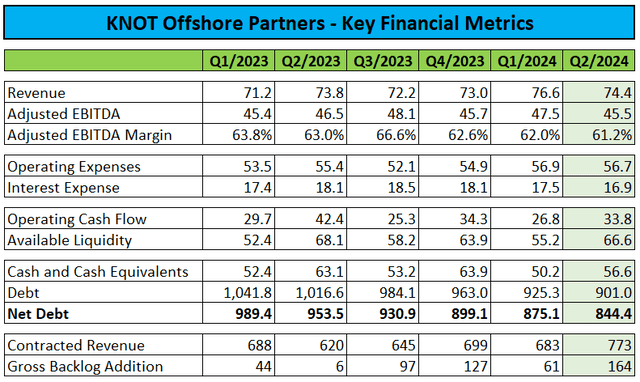

On Tuesday, leading shuttle tanker operator KNOT Offshore Partners LP, or “KNOP,” reported Q2 2024 results very much in line with recent quarters:

Please note that numbers have been adjusted for an aggregate of $16.4 million in non-cash impairment charges related to the MR shuttle tankers Dan Cisne and Dan Sabia.

The company generated $33.8 million in cash from operations and finished the quarter with $56.6 million in cash and cash equivalents and $901.0 million in debt.

After cutting common unit distributions by 95% in January 2023, net debt decreased for a sixth consecutive quarter to approximately $845 million.

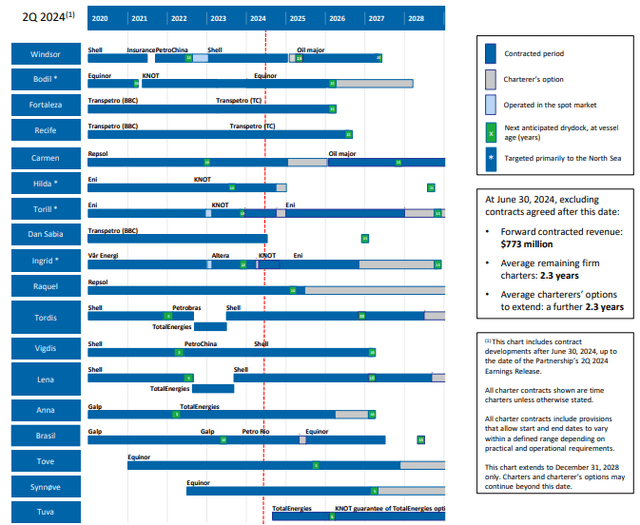

During the quarter, the company added $164 million in gross backlog and ended Q1 with $773 million in contracted revenues.

Backlog benefited from a previously announced four-year time charter agreement for the shuttle tanker Carmen Knutsen.

After quarter-end, customer Shell plc (SHEL) extended the charters for Tordis Knutsen and Lena Knutsen by one year, with options for further extensions.

While contracting activity wasn’t great, the company managed to negotiate a favorable transaction with parent Knutsen NYK Offshore Tankers (“Knutsen NYK”). This was announced in a separate press release:

The Partnership announced today that its wholly owned subsidiary, KNOT Shuttle Tankers AS, has entered into agreements with our Sponsor, Knutsen NYK Offshore Tankers AS (“KNOT”), to simultaneously:

- acquire from KNOT the shuttle tanker, Tuva Knutsen (the “Tuva Knutsen Acquisition”); and

- sell to KNOT the shuttle tanker, Dan Cisne (the “Dan Cisne Sale” and, together with the Tuva Knutsen Acquisition, the “Transaction”).

(…) The purchase price for the Tuva Knutsen Acquisition is $97.5 million less $69.0 million of outstanding debt plus $0.4 million of capitalized fees related to the credit facility secured by the Tuva Knutsen. The sale price for the Dan Cisne Sale is $30 million. These purchase and sale prices are due to be set off, with the result that a net payment of $1.1 million is due to be paid by KNOT to the Partnership (…).

The Tuva Knutsen, a 153,000-deadweight ton DP2 Suezmax class shuttle tanker, was built by COSCO Shipping Heavy Industry and delivered in 2021. The vessel is operating in Brazil on a charter contract with TotalEnergies, for which the current fixed period expires in February 2026, and for which the charterer holds options for a further 10 years.

As a term of the Transaction, KNOT has effectively guaranteed the hire rate for the vessel until August 2031 on the same basis as if TotalEnergies had exercised its options through such date, thus providing the Partnership with 7 years of fixed employment for Tuva Knutsen.

In layman’s terms, parent Knutsen NYK is swapping a modern Suezmax shuttle tanker with guaranteed employment for seven years for a much smaller vessel not really suited for today’s shuttle tanker market requirements in Brazil anymore.

However, the deal does not come for free, as KNOP will have to assume $69 million in debt.

In sum, the transaction should be considered positive for a handful of reasons:

- Increased free cash flow.

- Increased backlog, thus resulting in higher earnings visibility.

- Decreased average vessel age.

- Increased exposure to the expanding Brazil market.

- Removal of the Dan Cisne drag on earnings and cash flow.

Please note that sister vessel Dan Sabia has also been redelivered to the company by a subsidiary of Petróleo Brasileiro S.A. – Petrobras (PBR) in July. Based on the statements in the press release, parent Knutsen NYK is not likely to acquire the vessel in the near future:

On July 10, 2024, the Partnership received the Dan Sabia back via redelivery, following expiry of its bareboat charter party to Transpetro. The Dan Sabia is being marketed for shuttle tanker operation principally in Brazil and remains available also for charter to Knutsen NYK (subject to negotiation and approvals) and short-term conventional tanker contracts.

While investors are likely betting on higher cash flows resulting in increased distributions to common unit holders, I consider this a highly unlikely outcome as debt levels have moved back up.

At least in my opinion, the old business model of attracting income-oriented investors with high distributions to finance growth is not likely to be resumed anytime soon, if ever.

Moreover, the asset swap with parent Knutsen NYK makes a near-term going private proposal highly unlikely, as there would have been no need for the transaction otherwise.

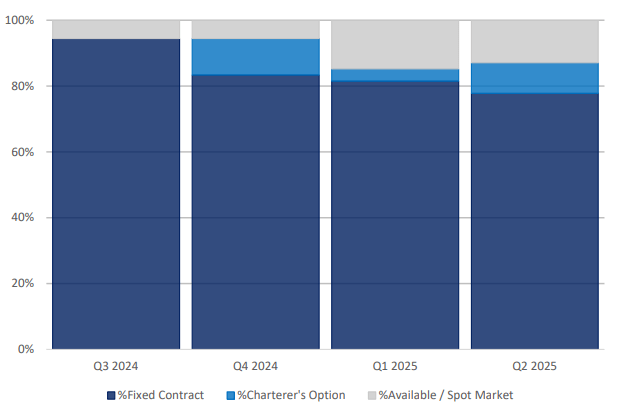

Market commentary regarding the company’s core Brazil market remained positive, while near-term prospects for the North Sea market continue to be weak.

In Brazil, the main offshore oil market where we operate, the outlook is continuing to improve, with robust demand and increasing charter rates. Driven by Petrobras’ continued high production levels and FPSO start-ups in the pre-salt fields that rely upon shuttle tankers, we believe the world’s biggest shuttle tanker market is tightening materially. Our secondary geography, in the North Sea, is taking longer to re-balance, but we welcome the recent news of the long-anticipated Johan Castberg FPSO having recently set sail for the Barents Sea, where it is scheduled to begin production later this year.

(…)

We continue to believe that growth of offshore oil production in shuttle tanker-serviced fields across both Brazil and the North Sea is on track to outpace shuttle tanker supply growth in the coming years, particularly as increasing numbers of shuttle tankers reach or exceed typical retirement age.

Management remains confident in the company’s long-term prospects. However, a recent series of newbuild orders by parent Knutsen NYK and several competitors might result in KNOP’s Aframax-size vessels Fortaleza Knutsen and Recife Knutsen being crowded out of the Brazil market by larger and more efficient Suezmax newbuilds in 2026.

In the short term, the company will have to find a solution for the Dan Sabia and secure follow-on work for the North Sea shuttle tanker Hilda Knutsen to close near-term gaps in KNOP’s fleet employment schedule:

Company Presentation

Bottom Line

Adjusted for a $16.4 million non-cash impairment charge related to its MR shuttle tankers, KNOT Offshore Partners delivered solid Q2/2024 results.

While yesterday’s asset swap with parent Knutsen NYK is a positive development from an operational perspective, the transaction makes a near-term going private proposal highly unlikely.

With the North Sea market still weak and common unit distributions likely to remain at current levels for now, I don’t see any compelling reason for opening new or adding to existing positions here.

As a result, I am reiterating my “Hold” rating on KNOT Offshore Partners’ common units.