JamesBrey

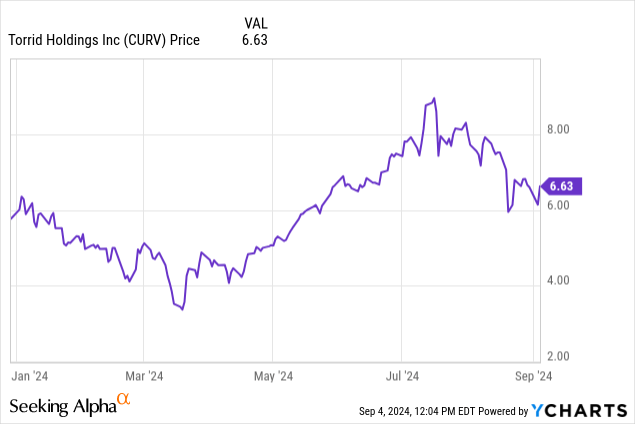

Torrid Holdings Inc. (NYSE:CURV) stock had bled out last year, but found a bottom in late fall of 2023. Since then, the stock has clawed back. Brave investors who came in at $2-3 have seen some strong gains, but the company is not out of the woods yet.

We have been following this stock for some time, and have had several successful trades going back to January 2022. The sentiment around the stock has certainly improved from the doldrums a year ago, but there remains a long road ahead. After the just reported earnings, we resume coverage, as the stock has now round-tripped to nearly where we started following the story. Wise traders could have gotten in and achieved some solid gains. The same goes for tactical shorts. The stock actually was over $8 just a few weeks ago.

It is a tough investment. We are traders, and that is what this stock is good for. It is great for swing trading. Currently, we think the stock can make its way back to the mid-$7s, barring market malaise. However, if things turn nasty for the consumer and the economy, we could retrace below $5. This is an interesting risk-reward situation. The company is in better shape than a year ago, and the stock has responded in kind.

So things are in better shape as the company has made tough decisions on stores, labor, and inventory. However, it remains a tough investment because Torrid is a specialty retailer with literally no protective moat and faces tough competition come so many other retailers. Their niche is the average to plus-size women, with their products ranging in sizes 10 to 30, though has branched out to some degree into other goods. But plenty of other companies are targeting this demographic too. The valuation receives an “F” rating from Seeking Alpha. However, performance has rebounded, so whereas growth used to be “F” rated, it is now “C+” rated. The stock no longer has a high short interest, which is good for longs, but there remains work to be done. However, things are moving in a better direction.

Sales are still falling and margins are being squeezed

In Q2, sales fell 1.6% from Q2 2023 to $284.6 million, but was a slight beat against estimates of $1.67 million. What do we always watch for retailers? Comparable sales. Comparable sales, which were falling double-digits in the past, fell just 0.8% compared to Q2 2023. However, margins expanded.

Margins have been hit by promotional activity in the past. But in this quarter, there was a 50% decrease in markdown comps. This is actually a positive in many ways, and it led to margin expansion. Gross profit margin was 38.7% versus 35.5% a year ago. This is also 150 basis points higher than the 37.2% in Q2 2022. Much of this was from selling more of its regular-priced goods. Translation? The company is being less promotional here.

Earnings expanded

So revenues were down slightly, but margins expanded almost 320 basis points. Adjusted EBITDA came in at $34.6 million, or 12.2% of net sales. This is a nice increase from the $32.2 million, or 11.1% of the net sales in Q2 2023. Net income was just $8.3 million, or $0.08 per share vs. net income of $6.6 million or $0.06 per share last year, beating estimates by $0.02. The company has seemingly seen a near-term bottom in performance, which is positive.

Balance sheet is getting worse

For a long time, there was a balance sheet that reflected strength, but it had been getting worse nearly every quarter for several years. Here we now see since the start of the year, cash and cash equivalents are $53.9 million compared to $11.7 million to start the year. Total liquidity at the end of Q2, including available borrowing capacity on its revolving credit agreement, was $153.8 million. Cash flow improved from a year ago, too. Cash flow from operations was $68.4 million, more than doubling last year’s Q2’s $31.7 million. This was also better than the $44.3 million for Q2 2022.

Looking ahead

Things are much better here now, but the company is not out of the woods yet, but is near an inflection point. As we look ahead to the full year, sales will be $1.135-$1.145 billion per the guidance in the release. Assuming margins in the high 30% range, adjusted EBITDA should be between $110 and $116 million for the year. As for EPS, we see $0.18 to $0.22 as likely. At $6.60 this puts the stock at 33X FWD EPS, which is actually much pricier than it was a year ago at $2 per share, on lower earnings power. As such, the stock is a little ahead of itself. Perhaps the most important result is that inventory was down 19%, suggesting management is moving products.

Overall, for the long-term investor we rate Torrid Holdings Inc. a hold, but both traders long and short have reason to place some near-term bets. Overall, we think some corrective behavior with seasonal weakness is likely, but err on the side that shares are likely to appreciate some from here provided future quarters show continued improvement.