Melpomenem

Stocks struggled for direction yesterday after falling sharply on the first trading day in September, as growth concerns continue to mount with intense scrutiny over every high-frequency economic reports. These concerns are accelerating the selloff in expensive technology names, led by the Magnificent 7, and weighing on more cyclical sectors like energy, industrials, and materials. Naturally, the more defensive ones have been the beneficiaries, with utilities, real estate, and consumer staples managing to eke out gains over the past week. In a positive feedback loop, which is hardly positive for the market, this rotation is fueling the perception that the economy is losing steam at a rapid rate. I think investors need to keep perspective, as reality rarely swings as rapidly as sentiment in either direction.

Finviz

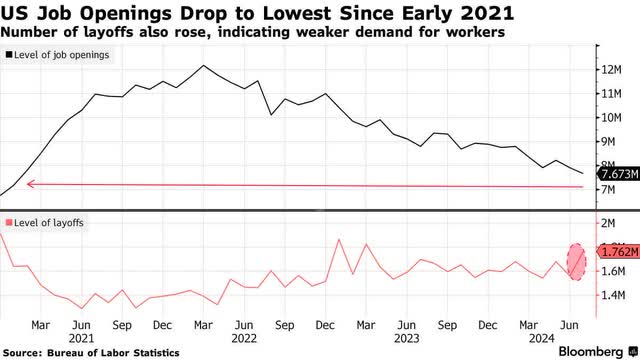

Yesterday’s concern centered on job openings in the US falling to their lowest level since early 2021, while the number of workers being let go increased. A few months ago, this would have been welcome news, as the uncertainty then was when and if the Fed would start lowering interest rates. The Bureau of Labor Statistics estimates that the number of open positions fell to 7.67 million in July, which was lower than all estimates. The number of layoffs increased to 1.76 million, which was the highest since March 2023 and led by the leisure and hospitality sector. The number of job openings per unemployed worker has now fallen to a rate of 1.1, which is its lowest in three years. Is this really bad news? Let us take a different perspective.

Bloomberg

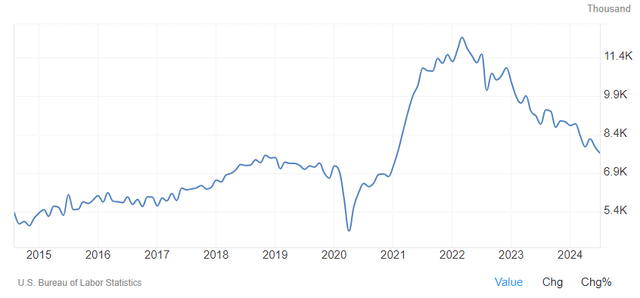

The number of job openings has fallen, as we have wanted to see to slow wage growth, which was necessary to contain inflation. Yet the number of openings is still well above the averages we saw before the pandemic. This is far from an unhealthy labor market. The chart below is a far more optimistic picture than the one above highlighting that openings have fallen to the lowest level since 2021.

TradingEcnomics

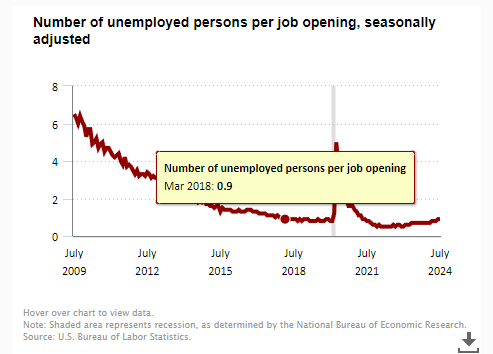

With respect to the number of job openings per unemployed worker falling to 1.1, which is down from a peak of 2.0 in 2022, that is exactly what Chairman Powell has wanted to see to bring the labor market back into balance. In a similar calculation, the number of unemployed per job opening at 0.9 is back to pre-pandemic levels we saw as far back as 2018. This is a mission accomplished rather than a reason for panic.

BLS

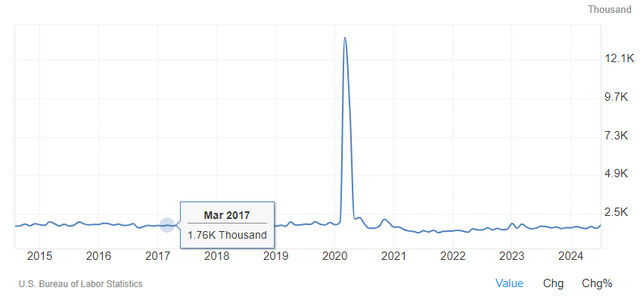

Lastly, the increase in the number of layoffs to 1.76 million is not a reason for concern either, as the chart below shows. This is a figure consistent with what we saw year in and year out prior to the pandemic. In fact, we saw the exact same number in March 2017.

TradingEconomics

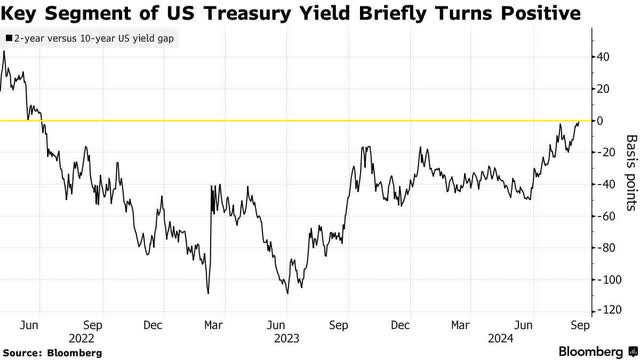

The perception that the labor market is weakening too rapidly has investors anticipating a far more aggressive rate-cut cycle by the Fed, which has brought short-term rates (2-year yields) down to long-term yields (10-year). The yield curve is now flat. For two years, I have argued that the inversion of the yield curve, regardless of which short- and long-term rates we compare, was sending a false positive that a recession was on the horizon. That didn’t discourage an army of economists and market pundits from repeatedly forecasting one. At one point yesterday, the yield curve un-inverted when the 10-year Treasury yield rose above the 2-year yield, which briefly normalized the curve. That is inevitable in the months ahead, as the Fed begins to lower short-term interest rates. Yet now many of the same lot who inaccurately forecasted before are claiming that the normalization of the curve is also a sign of impending recession.

Bloomberg

They come to this conclusion on the basis that the Fed will have to lower short-term rates far more rapidly than expected, which will steepen the curve, to stave off an economic downturn. Again, I am taking the other side of that bet. According to Dow Jones Market Data, the average return for the S&P 500 in the 12 months that followed the six instances when the curve un-inverted since 1980 was 12.2%. I think we will exceed that in the coming 12 months.