Dimensions/E+ via Getty Images

Thesis

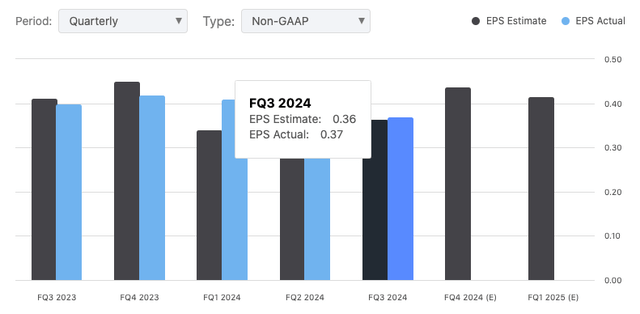

Hormel Foods Corporation (NYSE:HRL) beat fiscal Q3 earnings, which came in at $0.37 per share, passing expectations of $0.36, but only by a penny.

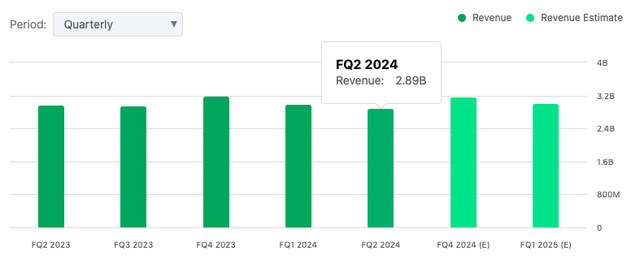

Revenue? Not so good. They reported revenue of $2.90B, which was short by $65M and down 2.19% from last year.

My thesis argues that while they’ve won some international dinner plates, and their “transform and modernize” plan sounds good, they’re busy eating the dust of the S&P 500 (SP500), earnings growth is slow, and the turkeys and commodities are not their friends. The future? I’ve got concerns.

About Hormel Foods Corp

Hormel Foods, an American iconic food company established in Austin, Minnesota in 1891 by George A. Hormel, is the country’s oldest continuously operated meat processor. The company’s earliest product was fresh pork; they started making processed meats a few years later, and in 1926, introduced the first canned ham. Spam, another Hormel product, arrived in 1937 and became a dietary staple for U.S. troops during the Second World War and remains popular.

Hormel kept expanding its product lines into the 21st century. After the company purchased the Jennie-O turkey business in the 1980s, it added Dinty Moore beef stew and Hormel chili to the roster. The leadership of the company moved from George Hormel to his son, Jay C. Hormel, who championed employee profit-sharing. In the 1980s, the company found itself embroiled in labor strikes but came out stronger for it, focusing more on processed and convenience foods.

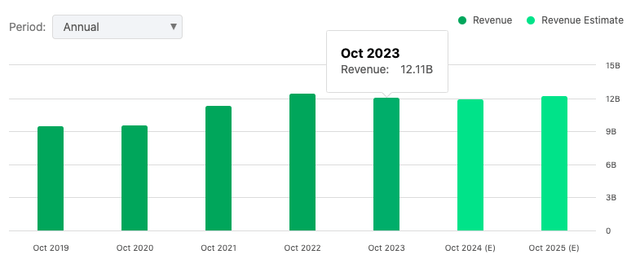

HRL’s annual revenues. (Seeking Alpha)

Today, Hormel operates in more than 80 countries, and its array of brands includes Planters, Skippy, Applegate, and Wholly Guacamole. The firm is still a mammoth in the food industry, generating revenues of more than $12 billion annually.

Hormel Foods Market Performance

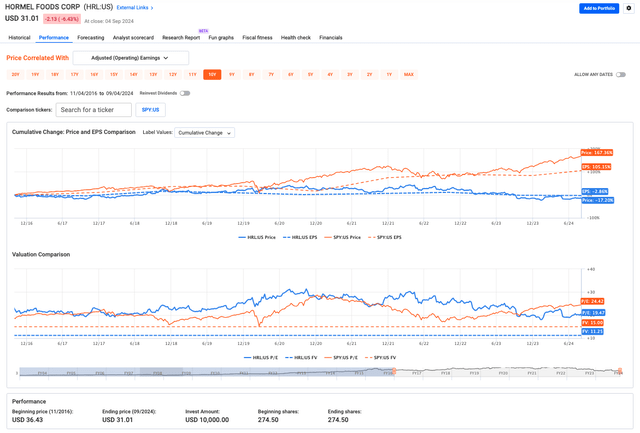

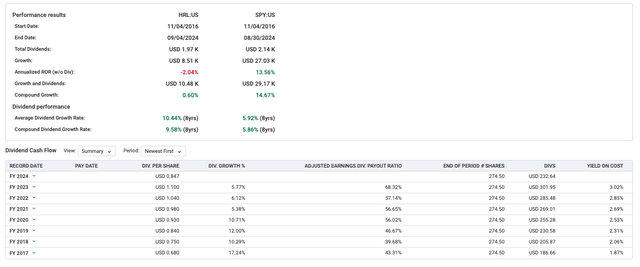

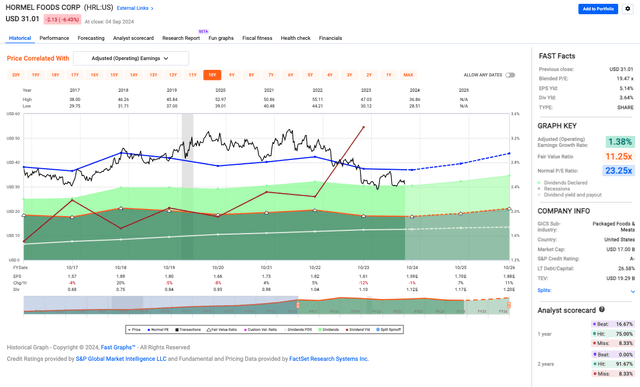

Let’s go back to HRL from 2016 to 2024 and be blunt: it’s not good, especially relative to the S&P 500. Over eight years, Hormel actually went nowhere, achieving an annual return of -2.04%. The S&P 500, meanwhile, logged 13.56% annually. Before diving into the fundamentals that I present below, I am left to wonder: can Hormel, the American icon, still play the game and create value for shareholders?

Even with dividends added in, Hormel’s total return is a puny 0.60%. Compare that with the S&P’s healthy 14.67%. The dividends helped, but only a bit. It didn’t make up for the price drop. Hormel has had good dividend growth, at least, cranking dividends up by more than 10% per year over the past eight years. That might appeal to some income investors. To me, however, the 3.02% yield last year was too little to make up for the weak stock performance.

Hormel Foods Q3 2024 Earnings Highlights

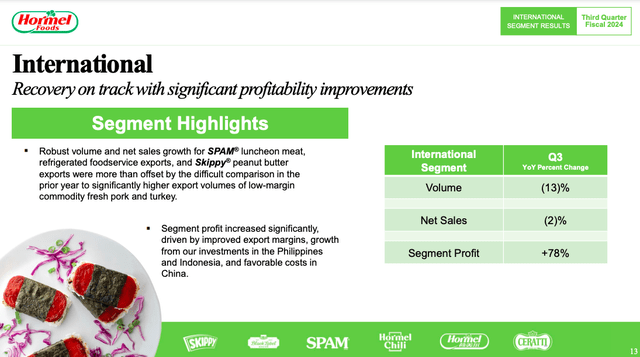

Hormel Foods beat earnings expectations and posted $0.32 net earnings per share and $0.37 adjusted diluted EPS. The good news is that the international business posted profits up 78% from last year (despite a 13% drop in volume and a 2% dip in net sales).

Hormel Q3 Investor Presentation

Better export margins and canny investments in the Philippines and Indonesia produced a profit lift. So did lower costs in China. Foodservice and exports were a real boon for both SPAM and Skippy. Even with smaller volumes, Hormel is moving away from overseas “commodity” merchandise (pork and turkey) with lower margins and towards higher-priced, branded products, making their international business leaner and more profitable. This is actually setting up Hormel for additional growth as they keep trimming margins and expanding key markets, and the drop in volume could be worth it for the long-term gains.

Looking ahead, Hormel expects solid growth in its foodservice business with higher sales of bacon, turkey, pizza toppings, and premium proteins, and they also see a big profit boost from their international segment next quarter. According to management, Hormel’s “transform and modernize” plan is set to save a lot of money, with most savings hitting in the fourth quarter, potentially boosting overall earnings.

For new investors, Hormel Foods is in the middle of a three-year program to “transform and modernize,” with the goal of boosting operating income by $250 million a year by 2026. This follows a period of supply chain crises, labor shortages, and rising costs. The idea is to increase profits by restructuring, cutting laggard products, and focusing on those that are more profitable.

They’re streamlining production by eliminating products that aren’t earning their keep-like certain varieties of Hormel chili and cutting expenses and routines. They’re also using new technology, such as AI, to boost accurate demand forecasting and to avoid overproducing and ending up with too much inventory to sell.

Hormel plans to reinvest the savings into its higher-margin brands like Planters and Skippy, while also experimenting with new flavors. As supply chain and inflation pressures ease, Hormel can focus on growth rather than survival.

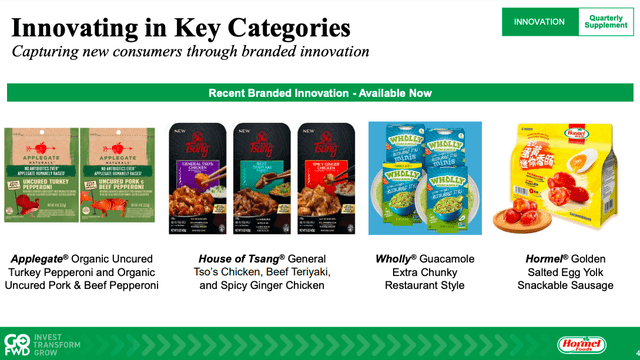

Regarding innovation, it has been a major driver of Hormel’s growth. New products like SPAM Korean BBQ and Hormel Flash 180 sous vide chicken helped boost their success.

Hormel’s Golden Salted Egg Yolk Snackable Sausage and House of Tsang’s General Tso’s Chicken cater to the growing demand for global flavors and convenient, ready-to-eat meals. And Applegate’s Organic Uncured Turkey Pepperoni and Pork & Beef Pepperoni both fit in with the same movement toward healthier, organic alternatives-proof that Hormel is in the game with trends where people are looking for minimally processed, clean-label foods.

Health trends aside, bacon still represented a high percentage of the company’s business, and the growth rates for Black Label bacon were up in sales, and more households buying it. Other core brands like Jennie-O, Skippy, Applegate, and SPAM have all performed well, and Q4 looks set to keep that momentum going.

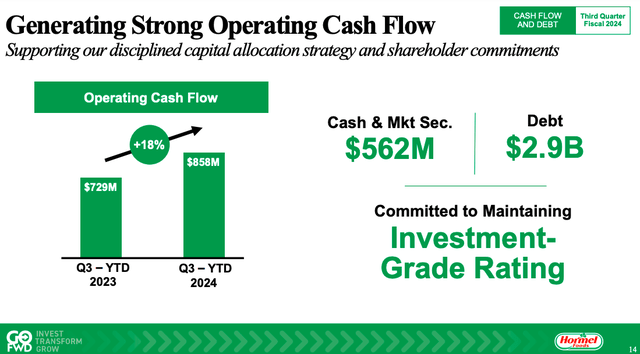

Lastly, Hormel boasted a healthy cash flow story, as year-to-date operational cash flow increased 18% to $858 million. The company continued to ensure its shareholders were well taken care of, paying its 384th consecutive quarterly dividend and maintaining the annual dividend rate at $1.13 per share. Hormel’s gross margin was maintained at 16.8%, thanks to the aforementioned smart cost management under their “transform and modernize” plan, offsetting lower turkey prices and weaker Planters sales.

Hormel Foods’ Valuation

What HRL’s blended P/E of 19.47x compared to a fair value ratio of 11.25x tells me is that it isn’t exactly lighting it up in the growth department. Its earnings growth is crawling at 1.38%, and inflation is only going to put more pressure on its margins.

As I brought up earlier, the dividend yield of 3.64% is not enough to make up for the slow earnings growth. The 5.14% EPS yield offers some stability, but without stronger earnings, there’s not much room for the stock to grow in price.

Hormel’s credit situation is solid, with a reasonable long-term debt-to-capital ratio of 26.58%. With a total enterprise value of $19.29 billion, Hormel’s valuation reflects its place as a safe bet during shaky markets. However, even though packaged food stocks are usually considered recession-proof, Hormel’s weak earnings growth doesn’t offer much excitement or potential for big returns. Bottom line: the normal P/E ratio of 23.25x suggests the stock could climb higher in better times. However, until (or if) the company’s “transform and modernize” plan works out over the next couple of years, the way it looks from the valuation story alone, investors might sit this one out.

Hormel Food’s Risks & Headwinds

Despite some positive factors, Hormel faced a few obstacles in its third-quarter performance. Ongoing issues in the turkey market, including lower volumes and prices for whole bird turkeys, hurt earnings. Growth in the Jennie-O brand wasn’t enough to make up for these challenges. Turkey-related problems remain a big deal, with a $0.15 EPS hit expected for FY 2024 and uncertainty around supply and demand possibly extending into FY 2025.

Production issues also hit Hormel’s earnings, with the Suffolk facility disruption cutting Q3 earnings by $0.03 per share. They expect the same impact in Q4. The contract manufacturing business stayed weak, which hurt top-line results. Early in Q4, storm damage at their Papillion, Nebraska facility added another challenge, but production is fully back online without affecting sales and management pointed out that they have backup capacity in place to reduce future risks.

Hormel also ran into some commodity issues, with lower pork costs leading to weaker top-line growth in Q3. Add to that higher salary expenses, normalized employee costs, and more spending on ads that could squeeze margins going forward. Their MegaMex joint venture took a hit too, as higher avocado costs cut into earnings. Plus, adjusted SG&A expenses rose 4% due to higher employee costs (but overall SG&A saw a year-over-year dip).

Finally, Hormel has tightened its earnings guidance for the year, now expecting diluted EPS between $1.45 and $1.51 and adjusted EPS from $1.57 to $1.63. This revised forecast reflects anticipated production disruptions and other challenges the company sees on the horizon.

Hormel Food Corp’s Rating

Overall, I’d put Hormel at a “hold.” While it just beat earnings expectations, and the international business is promising, it’s facing the same headwinds it’s struggled with for years, including weak stock performance relative to the S&P 500 and challenges in key areas like turkey and commodity costs. While the ‘transform and modernize’ plan is supposed to lead to long-term improvement, the slow earnings growth and current valuation don’t make it an attractive buy at the moment.