mgkaya/E+ via Getty Images

Introduction

On June 5, I wrote an article titled “From Scrap To Riches – Copart Is An Amazing American Growth Story.” Nonetheless, I gave the stock a Neutral rating.

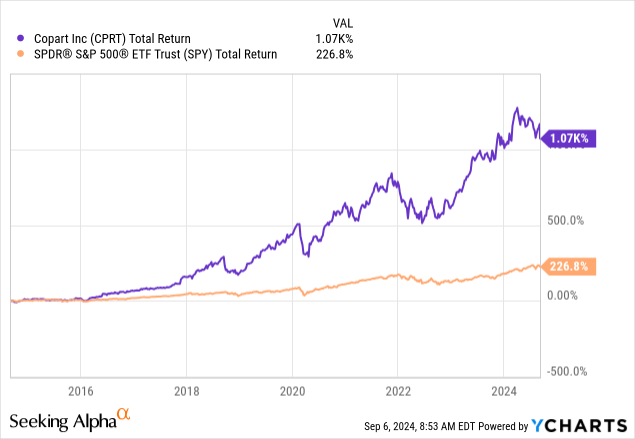

As the title suggests, in that article, I discussed the Copart’s (NASDAQ:CPRT) fascinating business model, which has resulted in a total return of roughly 1,070% over the past ten years, making it one of the best-performing stocks I have discussed in recent years.

This performance includes its recent post-earnings sell-off, when the stock dropped roughly 7%.

In this article, I’ll take a detour from covering dividend stocks and macro events to update my thesis on Copart.

So, let’s keep this intro short and get right to it!

Why Copart Is So Special

However, before we dive into the details, I want to briefly discuss what makes Copart so special. It helps when we assess its financial numbers.

As I wrote in my prior article, the company is headquartered in Dallas. It generates more than 80% of its revenue in the United States, with 20% exposure coming from Canada, the United Kingdom, Brazil, Ireland, Germany, Finland, and others.

Initially, this company started with a junkyard. This has become a corporation with a market cap of roughly $47 billion, which is a leading provider of online auctions and vehicle remarketing services.

Essentially, this means the company has become a critical player in the global recycling and reuse of vehicles, parts, and raw materials. This makes sustainability a major secular tailwind.

When a vehicle enters the company’s “system,” it is often restored, dismantled for parts, or scrapped for raw materials. Copart makes money on all of this.

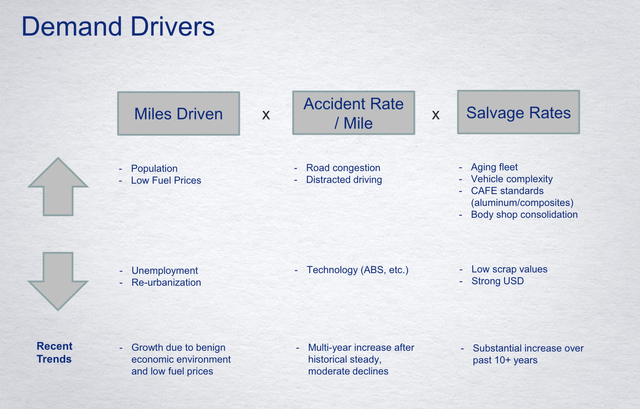

If we ignore secular growth, demand is usually driven by at least three major factors:

- Total miles driven: impacted by population growth, fuel prices, employment, and urbanization.

- Accident rate: the more accidents, the more need for scrap services and new parts.

- Salvage rates: impacted by fleet ages, vehicle complexities, and related factors.

Roughly eight years ago, in 2016, Copart used the following chart to visualize these demand drivers and their influencing factors. Although macroeconomic variables have changed since then, population growth, road congestion, distracted driving (smartphones!), aging fleets, and vehicle complexities are still very much valid.

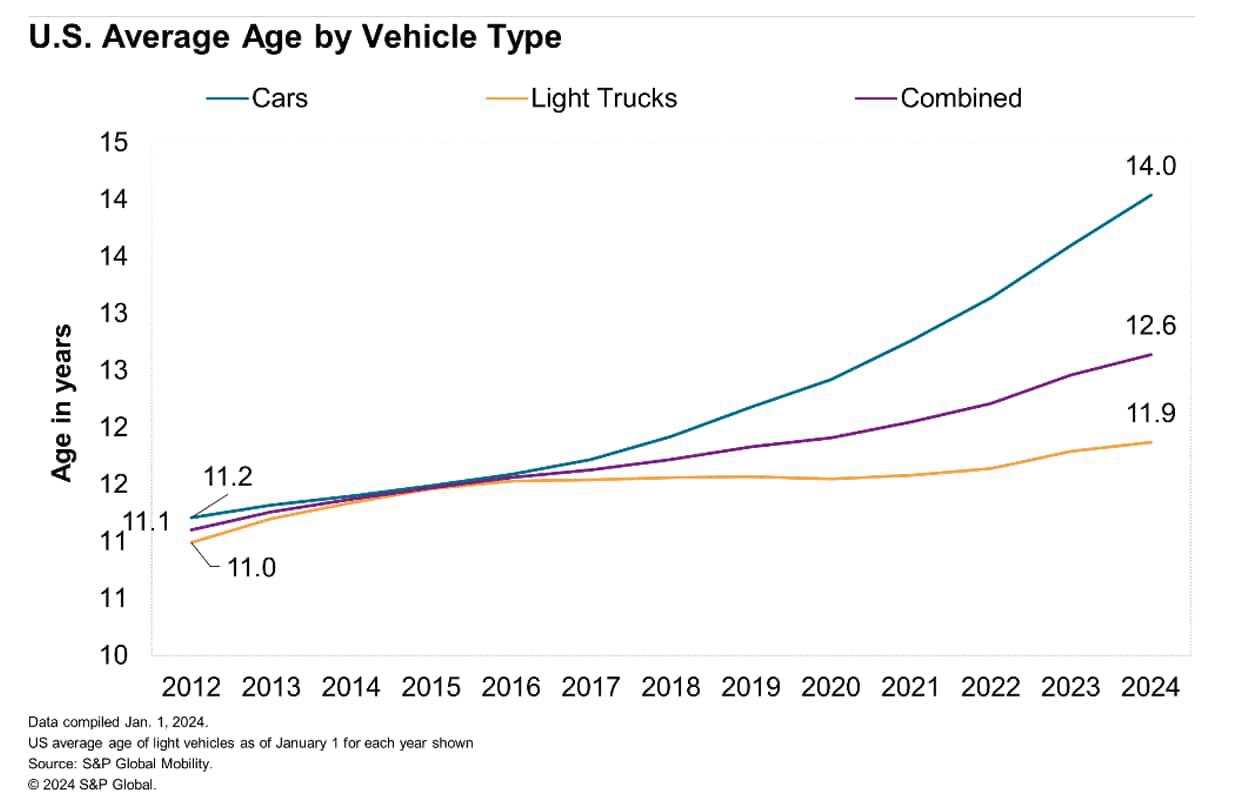

Especially, the tailwind from aging cars has gotten stronger, as inflation and post-pandemic supply challenges have caused the average age to soar.

I also used the quote below in my prior article, as it explains why we’re dealing with such a favorable tailwind for aftermarket services.

This continues to improve business opportunities for companies in the aftermarket and vehicle service sector in the US, as repair opportunities are expected to grow alongside vehicle age.

“With average age growth, more vehicles are entering the prime range for aftermarket service, typically from 6 to 14 years of age,” said Todd Campau, aftermarket practice lead at S&P Global Mobility. “With more than 110 million vehicles in that sweet spot — reflecting nearly 38 percent of the fleet on the road — we expect continued growth in the volume of vehicles in that age range to rise to an estimated 40 percent through 2028.” – S&P Global

S&P Global

Based on this context, most of the company’s services are for vehicle sellers. This mainly includes insurance companies looking to get rid of vehicles damaged by accidents or natural disasters. Copart also caters to banking clients, charities, and individuals.

The buyers on its platform are usually vehicle dismantlers, rebuilders, and used vehicle dealers/exporters.

With all of this in mind, let’s take a closer look at its fourth quarter of fiscal year 2024.

Some Great News For Investors

Let’s start with the good news. On a full-year basis, the company’s global unit sales increased by almost 10%. This was driven by an increase in the total loss frequency and market share gains.

The company’s U.S. business saw unit growth of more than 6% in 4Q24 and almost 8% full-year growth. This includes fee unit growth of more than 7% and purchase unit growth of almost 14%. Especially non-insurance unit volumes and dealer units did well.

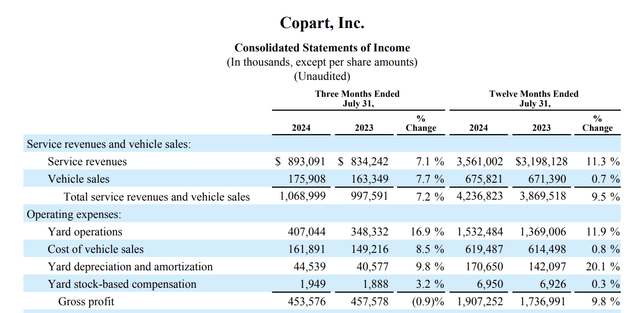

In the fourth quarter, global saws increased to almost $1.1 billion. As we can see below, this translates to roughly 7% growth, slightly below the full-year growth rate of nearly 10%.

Moreover, service revenue was strong, with growth above 7% in 4Q24 and 11% on a full-year basis.

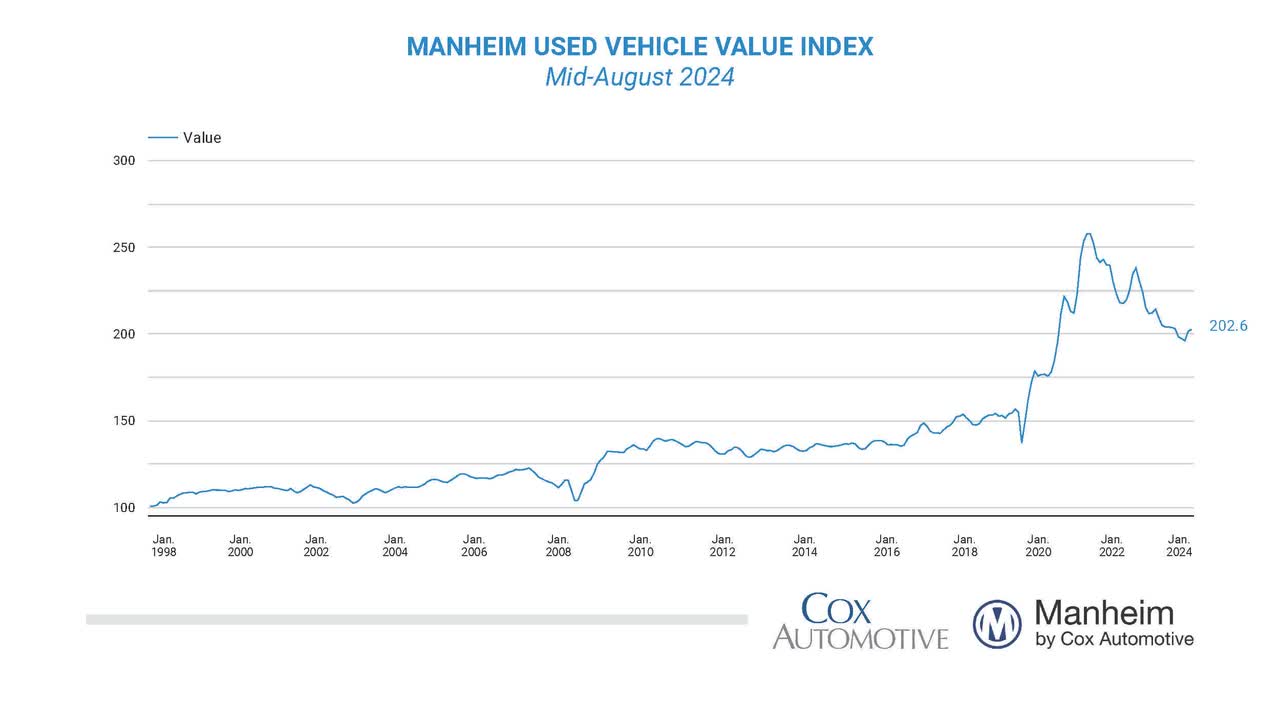

Moreover, before I get to the bad news you may already have seen in the table above, the company also saw strong pricing. While the Manheim Used Vehicle Price Index was down almost 9%, Copart’s U.S. insurance average selling price (“ASP”) was down less than 4%.

The chart below shows the Manheim Used Vehicle Index going back to the late-1990s.

The company also reported strong cash flows, generating $962 million in free cash flow in its 2024 fiscal year. This is after it invested $511 million in capital. This includes an expansion of yard infrastructure (1,100 acres of new land), enhanced physical assets like 370 transportation vehicles, and investments in technology to further improve its business.

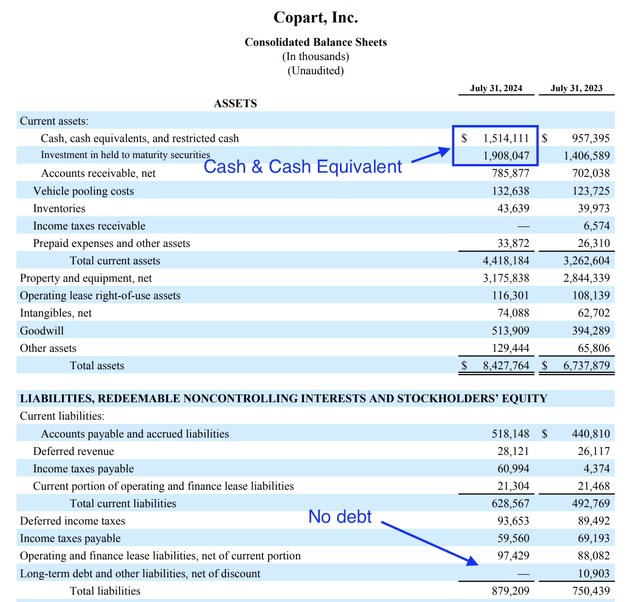

It also maintains roughly $4.6 billion in liquidity. This includes $3.4 billion in cash and cash equivalents. To make things better, the company has no long-term debt. This means, the company, which pays no dividend, has currently more than 7% of its market cap in cash, excluding available liquidity.

Now comes the part that explains why the CPRT stock price hasn’t been doing so well lately.

Some Bad News For Investors

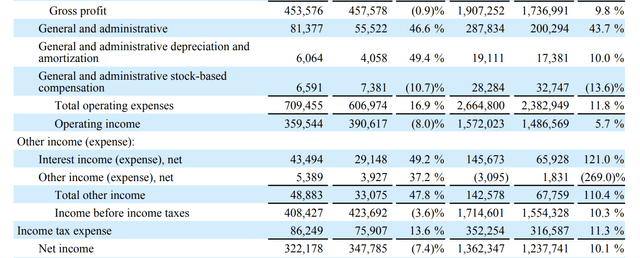

As you may have noticed in the table that displayed revenue growth, the company’s gross profit was down roughly 1% in 4Q24. On a full-year basis, it was up 9.8%.

According to the company, the gross margin dropped by roughly 340 basis points to 42.4%. This was driven by increased costs, including $12 million in out-of-period expenses and higher salaries.

Moving down the income statement, operating expenses rose by 16.9%, driven by nearly 50% growth in G&A costs.

The good news is that while inflation is obviously a factor, higher costs were mainly tied to investments in growth.

As we highlighted last quarter, our year-over-year G&A increase continues to reflect our investments in organic product development, our platform functions, the financial consolidation of Purple Wave into our results as well as an increase in third-party project-related costs associated with system implementations.

Across our organization, and as we are investing in expanding our whole card heavy equipment sales functions, our teams are simultaneously focused on deploying emerging technologies to enhance our business processes and systems in pursuit of scalability and operating leverage over the long term. – CPRT 4Q24 Earnings Call (emphasis added)

These investments are needed, as the company is not only scaling its business but also focusing on better responses to natural disasters like hurricanes. Although these events are good for business, it is not always easy to establish efficient supply chains. This requires more land and transportation assets. This comes with higher employment costs and a wide range of related expenses.

So, what does it mean for its valuation?

Valuation

The company’s fourth quarter wasn’t horrible. Although I would have liked better margins, Copart is performing quite well in light of economic challenges.

I believe one of the reasons why the stock price is selling off is because higher economic risks and lower margins happen at a time when the stock price valuation is quite lofty.

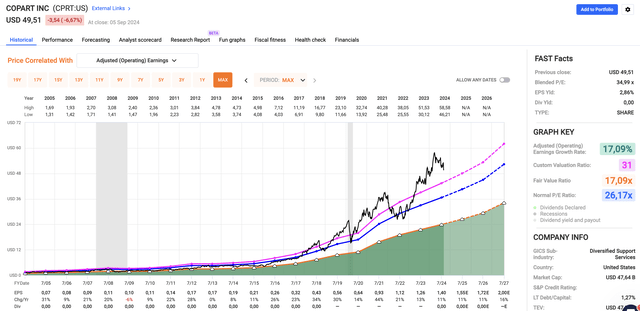

As we can see below, the stock has a blended P/E ratio of 35.0x, roughly ten points above its long-term average. Although CPRT has strong secular growth, this is not a valuation to write home about.

Using the FactSet data from the chart below, analysts expect 11% growth in the fiscal years 2025 and 2026. The 2027 fiscal year is expected to see 16% growth.

Although all of these numbers are subject to change, I believe they reflect the company’s potential, expanding its history of very consistent double-digit growth.

If we use the company’s two-decade P/E average of 26x, we get a fair stock price of $52, roughly 4% above the current price.

Its ten-year average P/E ratio is 31.0x, implying a fair stock price of $62.

However, I wouldn’t apply a multiple that high, as expected growth rates are not high enough, especially in light of elevated economic risks.

Hence, I will stick to a Neutral rating, ready to upgrade on more stock price weakness. In general, I believe we’re dealing with a fantastic business model here. I just don’t like the risk/reward.

Takeaway

Copart remains an impressive growth story, driven by its unique business model and strong market position.

However, despite a solid performance in fiscal 2024, including significant sales growth and healthy cash flow, the company faces challenges. Rising costs and pressure on margins have impacted profitability, and the stock’s valuation seems stretched given ongoing economic headwinds.

While Copart’s long-term opportunities remain strong, the current risk/reward balance doesn’t justify a Buy rating.

Hence, I maintain my Hold rating, but I’ll be watching closely for better buying opportunities if the stock price weakens further.