FreshSplash

Investment Thesis

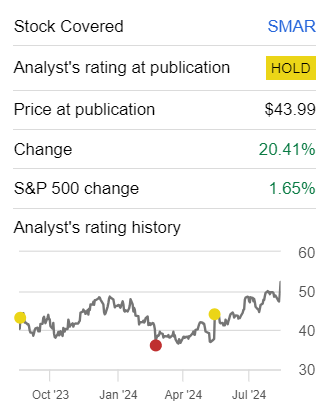

Smartsheet Inc. (NYSE:SMAR) delivered fiscal Q2 2025 earnings results that investors welcomed. The reaction wasn’t overwhelmingly strong, but given that investors were running for cover in the rest of the market, this was a welcome surprise to shareholders.

This business carries about 10% of its market cap as cash. What’s more, it’s now delivering ”stable and consistent” mid-teens growth rates. I believe that the combination of calmer investors’ expectations together with its outlook pointing to more stable growth rates going forward, bodes well for the stock.

Paying approximately 23x next year’s non-GAAP operating profits for SMAR now strikes me as more compelling. Therefore, I now upgrade my rating to a buy.

Rapid Recap

Back in June, I said,

I’ve seen this type of setup before many times. The company is working off small numbers and has a couple of good quarters, and it appears that the stock is off to the races.

Ultimately, I question whether paying around 31x forward non-GAAP operating profits is all that enticing.

Author’s work on SMAR

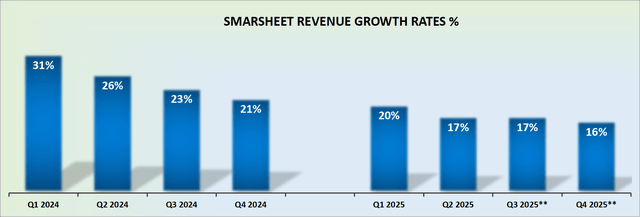

This is a stock that I’ve been largely neutral on given that Smartsheet’s revenue growth rates have been consistently decelerating. However, I now believe that its prospects have stabilized, and this business could be more enticing.

Smartsheet’s Near-Term Prospects

Smartsheet is a software platform designed to help organizations manage and automate work. It enables teams to collaborate on projects, track progress, and handle complex workflows more efficiently. Users can create customizable dashboards, automate repetitive tasks, and gain insights into their work. Smartsheet is especially popular in large enterprises where teams need tools to scale projects, improve collaboration, and increase productivity.

Smartsheet competes with Asana, Inc. (ASAN), which also offers tools for project collaboration and task management. Both platforms are popular for their ease of use, but Asana tends to focus more on task-based workflows, whereas Smartsheet emphasizes more on scalability.

Next, Smartsheet’s customer base is growing, especially among large enterprises. Case in point, in fiscal Q2 2025, Smartsheet saw a 17% year-over-year increase in annual recurring revenue and significant customer expansions. The company now has 77 customers with ARR over $1 million, up 50% from the previous year. This growth is driven by a new pricing model and increased adoption of their AI-powered tools, which help customers save time and improve work efficiency.

And yet, despite strong enterprise growth, Smartsheet faces challenges in customer retention, especially among smaller clients. The company reported a slight increase in churn rates in smaller segments.

Here’s a quote from the earnings call:

[…] Our domain average ARR grew 16% year-over-year to $10,291. We ended the quarter with a dollar-based net retention rate inclusive of all our customers at 113%. The full churn rate increased slightly due to elevated churn rates in our smaller customer segments and is now around 4.5%.

Given this context, let’s now discuss its fundamentals.

Revenue Growth Rates Reiterated

Smartsheet pleasantly surprised investors by raising its revenue forecast for fiscal 2025 by about 5% at the high end. For a company with only moderate growth, this is definitely good news.

In practical terms, fiscal Q2 2025 might be the 9th straight quarter of slowing growth, but from now on, its growth rates have stabilized.

This means the outlook should improve, as investors tend to avoid companies when they’re unsure about when their growth will stabilize.

Keep in mind, that stable and predictable growth without negative surprises usually leads to higher stock valuations. If the company also has a strong narrative, its valuation could rise even higher than expected.

SMAR Stock Valuation – 23x next year’s non-GAAP operating profits

As an inflection investor, you must always think about a company’s balance sheet. The company’s balance sheet provides the company with the financial means to invest in its future prospects. On this front, SMAR is well positioned with nearly 10% of its market cap made up of cash.

What’s more, its fiscal Q3 2025 guidance now points to around 16% non-GAAP operating margins. This is an 800 basis points expansion relative to the same period a year ago. Clearly, a strong improvement relative to last year’s fiscal Q3, even if relatively flat progress sequentially.

That being said, I suspect that management is being somewhat conservative with its guidance. As such, I’m inclined to believe that by fiscal 2026, which starts in February 2025, SMAR could consistently deliver 19% non-GAAP operating margins.

Consequently, if we presume that next year SMAR’s revenues grow by 15% y/y, this would mean that around $265 million of non-GAAP operating profits could be on the cards.

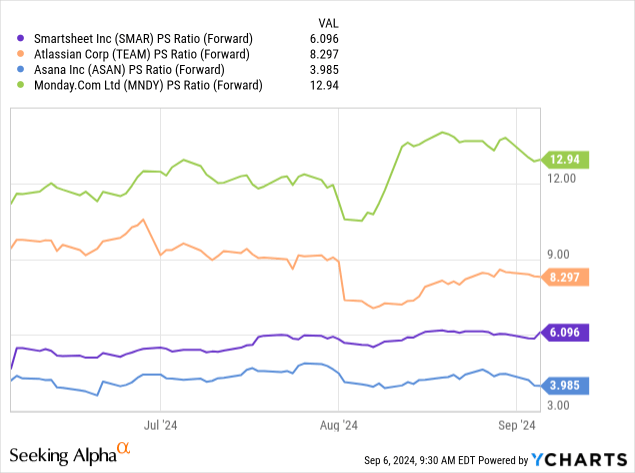

Thus, investors are asked to pay 23x next year’s non-GAAP operating profits, which makes this stock one of the cheapest in its peer group.

As a reference point, consider the following peers.

I recognize that some investors may make the case that Atlassian Corporation (TEAM) is a much bigger business, so it should trade at a higher multiple than SMAR. But I’m not convinced that SMAR’s prospects are only ”slightly” better than Asana’s. Indeed, as you may know, Asana is still some time away from being profitable.

The Bottom Line

Paying 23x next year’s non-GAAP operating profits for SMAR makes sense when considering its strong balance sheet and improving profit margins.

With approximately 10% of its market cap in cash, Smartsheet is in a solid financial position to invest in future growth.

Additionally, stable mid-teens revenue growth and expanding non-GAAP operating margins indicate the company is moving towards sustained profitability.

Given these factors, along with the company’s ability to scale within enterprise clients, SMAR presents a compelling buy opportunity.

Smartsheet is proving to be a “smart” choice for a stronger financial future!