Martin Barraud/OJO Images via Getty Images

Recovery Not Here Yet

The Toro Company (NYSE:TTC) stock continues to trade in the $80-$100 range it has been in since badly missing estimates and lowering guidance one year ago when it reported Q3 2023 earnings. That was the quarter we first started hearing about a pullback in consumer demand for mowers and landscaping equipment. While the share price recovered to the top of the range a couple of times, it has not stayed there for long, knocked down by unimpressive earnings reports or short seller reports like the one I mentioned in my article last quarter when I downgraded Toro to Hold. That call looked questionable for a little while, as the stock again recovered to near $100 as it became clear Toro was working down the high dealer channel inventories discussed in the short report. Following the 3Q 2024 earnings release, it appears it was right to avoid the stock, as the company again experienced a larger than expected slowdown in lawn care product sales, taking the stock back down near the $80 level.

Toro also lowered full-year guidance, though not as severely as the revision this time last year. The company also continues to make progress on dealer channel destocking. Additionally, Toro’s free cash flow regeneration is getting back to normal, enabling debt reduction and share buybacks. However, growth remains negligible, in contrast to the high single digit sales growth we saw in much of the 2010s. While there are no red flags suggesting further declines, it appears the stock will be stuck in the same trading range for the next few quarters. Watching the chart for a breakout will be like watching grass grow. Toro remains a Hold.

3Q Results And Outlook

Toro delivered $1.18 of adjusted EPS in 3Q 2024. This was a nice improvement from the $0.95 a year ago, but the company did not achieve the hopes of management stated last quarter to surpass the 3Q record of $1.19/share set in 2022. Toro also revised down its guidance for FY 2024. The company now expects sales growth of only 1% and slightly lower operating margin. As a result, EPS is now expected to be in the range of $4.15-$4.20, down from last year’s actual result of $4.21.

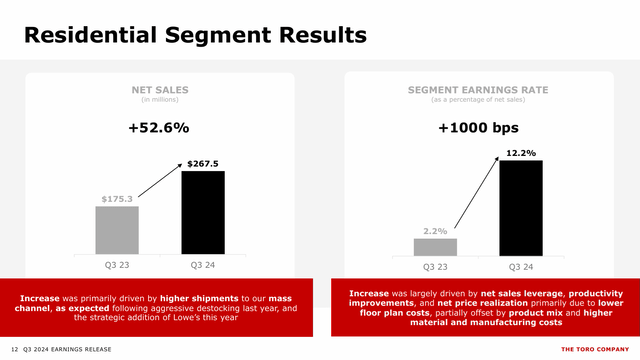

The residential segment was again the strong point of the results, with sales up 52.6% and operating margin back to healthy levels of 12.2%. The company explains this growth by pointing to “aggressive destocking” last year. This was the start of the dropoff in lawn care equipment demand and may also have been related to the start of the phase out of product from Home Depot (HD). I remain concerned about the sustainability of this growth going forward, as it is not clear how much of this represents initial stocking of product at Lowe’s (LOW) vs. ongoing sell-through.

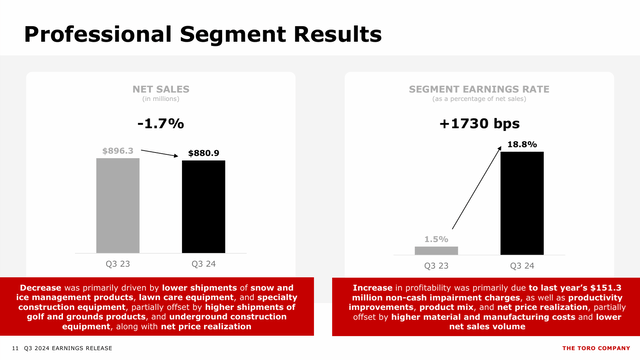

The Professional segment, which is about 75% of the company’s sales, again saw a slight decline year-on-year, but not as much of a decline as in last quarter’s results. Still, it is discouraging to hear management tout strong golf and grounds and underground construction sales quarter after quarter and not see this segment do better. Landscaping and snow removal equipment is still the main business in this segment, and it remains slow. Specialty construction equipment was also cited as slowing down this quarter. Toro continues to have a high backlog of orders in the golf and grounds and underground construction markets, although it is working off backlog in other areas. In hindsight, Toro would have benefitted from adding production capacity for these products rather than buying another landscaping equipment manufacturer like Intimidator Group, which resulted in an impairment charge in 2023. The absence of the impairment charge this year was responsible for the nice recovery in segment operating margin.

Longer term, I believe Toro can improve from the near zero growth shown this year. The lawn care equipment market is cyclical, and consumer demand should resume in the next up cycle. As I have mentioned in prior quarters, electrification could also be a demand driver. It will still be a challenge to grow as quickly as the company did last decade. Growth by M&A will be more difficult to achieve than it was in the 2010s due to the larger size of the company.

Dealer Channel Update

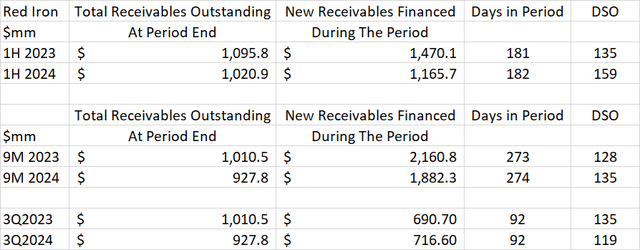

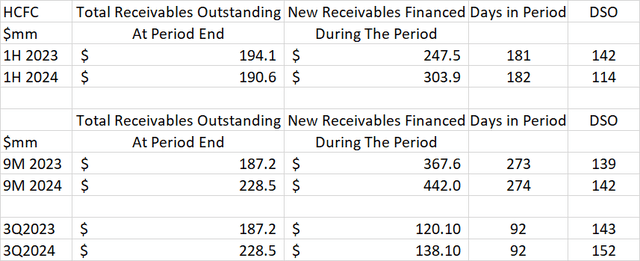

Last quarter, I noted that Toro was making progress in clearing the high inventories in the dealer channel. As a reminder, Toro books sales when they ship product to dealers. The dealers hold the product and pay for it through floor plan financing from JVs between Toro and Huntington (HBAN) called Red Iron, or HCFC in Canada. Earlier this year, short sellers became concerned that inventory was growing at these dealers, which would require Toro to reduce future sales, so the dealers could work off this product. During the worst of the problem, at the end of FY 2023, dealers who financed through Red Iron had 200 days of sales outstanding, about twice as much as normal. I showed last quarter that this had been reduced to 159, consistent with management comments that they were 40% of the way through working off the excess inventory.

In the latest 10-Q, we find that the fiscal year to date receivables from dealers financed through Red Iron amounted to 135 days of sales. However if we isolate 3Q results, we see the positive trend with DSO down to 119, consistent with management comments in this quarter’s earnings call that they were 80% of the way back to normal inventory levels.

Toro’s 10-Q also shows these metrics for Huntington Commercial Finance Canada (HCFC). While these sales are a fraction of those financed through Red Iron, DSO remains higher and is not coming down from last year’s levels. It may be that inventory in Canada consists of more snow removal products, and we will have to wait another quarter or two to see this inventory worked down.

While I still think this dealer destocking is not the huge headwind suggested in the short seller’s report, it will still be ongoing for another quarter or two. I expect to wait at least that long before we see accelerating sales growth that will move the stock.

Capital Management

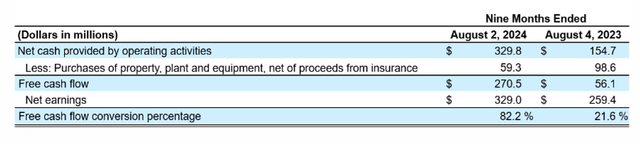

As expected, Toro’s free cash flow is improving in the second half of the year and year to date FCF conversion now stands at 82% of net income. For the full year, Toro still expects to achieve at least 100% FCF conversion.

Given the new EPS guidance, Toro is therefore expected to have FCF of $428.4 million. The company paid off $40 million of debt in its revolving credit facility. It also bought back $109 million of stock and paid $113 million in dividends so far this year. The 4Q dividend will use another $37 million of cash. That leaves room for another $169 million of buybacks in 4Q if desired.

Valuation

At $81.76, Toro is now trading at a PE of 19.6 times 2024 earnings. On a trailing basis, 20 PE has been near the bottom of the 10-year historical range for the stock.

Given the slowdown in growth and reduced guidance, the 20 PE level now looks fair. Using the $4.175 midpoint of company guidance, my price target for Toro is now $83.50.

Conclusion

While Toro is addressing the problem of high dealer inventories raised by short sellers, the company is still subject to macroeconomic cycles, especially in its core lawn care and landscaping businesses. The company has also been a successful grower by acquisition in the past, but its size now makes it difficult to find good opportunities that move the needle. The purchase of the Intimidator group, a manufacturer of high-end mowers for the Professional segment, was poorly timed in 2022. The capital could have been better applied to manufacturing facilities for golf & grounds and underground construction equipment, markets that Toro has been identifying as strong for a few years.

I don’t see any big issues that will drive the share price considerably lower, but there are also not enough positives to break it out of the existing trading range anytime soon. Without a large dividend to pay investors while they watch the stock trade sideways, I would not commit any new funds to Toro at this time.