julos/iStock via Getty Images

Investment Thesis

UiPath Inc. (NYSE:PATH) is a stock that has been profusely beaten down since its IPO.

Further, despite all its narrative over its superior AI bots, its growth prospects have nearly fully fizzled out. However, so, too, have investors’ expectations.

On the back of its fiscal Q2 2025 earnings results and guidance, as we look out to the next fiscal year starting in 6 months, I estimate that PATH is priced at 20x next year’s non-GAAP operating profits.

What’s more, the business is debt-free, with more than 20% of its market cap made up of cash.

Yes, the business cannot deliver strong and consistent growth rates, but what it lacks in growth, it more than makes up with its growing profitability.

Rapid Recap

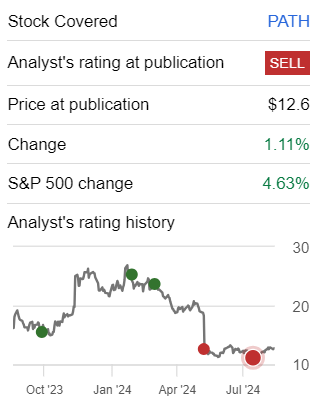

Back in August, in my previous analysis, I said:

[…] investors getting involved with UiPath right now, will have to navigate a challenging macro environment, while its stock’s valuation is doomed to see its premium compress.

Author’s work on PATH

As the graphic above reminds readers, UiPath’s stock has been highly volatile. Its multiple has compressed. Simply put, this has not been a stock for the faint-hearted. Indeed, even now, UiPath’s stock is still down more than 75% since its IPO price.

However, I’m now more bullish that investors’ expectations have been reset. Therefore, I’m slightly less bearish. Here’s why.

UiPath’s Near-Term Prospects

UiPath provides software to help businesses automate repetitive tasks. Its platform, enables companies to streamline processes like data entry and customer service by using software robots, or “bots.” These bots perform tasks that humans would normally do, reducing the time spent on mundane work and improving operational efficiency. UiPath’s automation solutions are used across various industries to improve productivity and cut costs.

In the near term, UiPath’s prospects look promising as it continues to exceed financial expectations. The company reported fair growth (discussed more soon), with ARR rising to $1.551 billion.

Leadership is focused on driving more efficiency by streamlining operations and targeting high-potential growth products, especially as demand for AI and automation grows. UiPath’s deepening partnerships, such as those with SAP and Deloitte, along with product innovations like its Autopilot for developers, position it to maintain solid performance.

However, UiPath faces some challenges. These include potential confusion in the market about the distinction between traditional robotic process automation and AI-powered agent automation, which has led to slow customer adoption.

Here’s a quote from the earnings call supporting this contention:

And to me, an AI agent is basically a robot, if you want, that has some more new skills. And I think there will be multiple type of agents.

For instance, there will be agents that are capable of extracting information from long and complex documents. And users, human users will be capable of interacting with these agents asking questions. And in turn, they can ask the agents to perform actions for them. There will be agents that can make more intelligent decisions based on data, and they can route a process in a more dynamic way. As you can — as you know, for sure. Robotic means that the series, the steps in the process are stitched together in a fixed way. And agentic workflow might have dynamic routine as part of the process.

Given this background, let’s now discuss its fundamentals.

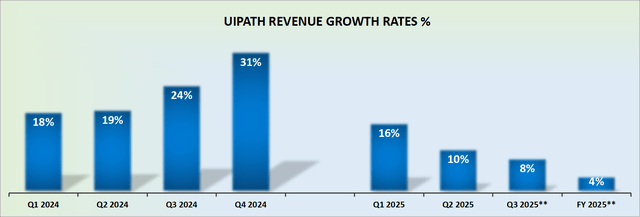

UiPath Upward Revises Its Revenue Growth Rates

UiPath upward revised its fiscal 2025 revenue growth rates from around 8% to perhaps as much as 10% being on the cards.

For a business that many had left for dead, this is a positive surprise. A positive surprise at a time when the market has decidedly soured up on many AI-themes companies.

Moreover, think about the overall context. Last quarter, UiPath’s fiscal Q2 2025 guidance implied that it was perhaps going to deliver 8% y/y revenue growth if all went well. And when its figures actually came out, its reported revenues actually hit 10% y/y growth this quarter.

What’s more, this means that UiPath has 2 more quarters of really tough comparisons before its quarterly comparables suddenly substantially ease up.

Consequently, I estimate that given its near-term momentum, UiPath could deliver around 11% topline. Given this reasoning, let’s now discuss its valuation.

PATH Stock Valuation – 20x Next Year’s Non-GAAP Operating Profits

As an inflection investor, you must always think about a company’s balance sheet. UiPath holds approximately $1.7 billion of cash and no debt. This means that slightly more than 20% of its market cap is made up of cash. For a business to inflect higher and see a strong re-rating on its stock, it makes a big difference if the balance sheet is in pristine condition. This provides UiPath with opportunities. Either to repurchase its stock or to make a large needle-moving acquisition.

Next, UiPath’s fiscal Q3 2025 guidance suggests that approximately 8.5% is on the cards. This non-GAAP operating profit margin is down from 500 basis points y/y from the same period a year ago.

And yet, its full-year fiscal 2025 is guided for approximately 12%. This means that its non-GAAP operating margin will have compressed by approximately 730 basis points compared with fiscal 2024, but this is clearly better than the approximate 10% non-GAAP operating margin that investors were pricing in as we headed into this earnings report. In short, it now appears that UiPath’s fiscal 2025 may stabilize and grow its profitability by approximately 150 basis points relative to the guidance investors got last quarter. This is a dramatic improvement in profitability in a short period of time.

I estimate that UiPath’s non-GAAP operating margin for fiscal Q4 2025 will be around 21%. Here’s how the numbers break down: UiPath’s revenue for fiscal 2025 is expected to be about $1.425 billion, and for fiscal Q3 2025, it’s guided to $350 million. This means fiscal Q4 should bring in approximately $425 million.

If we assume UiPath improves its profit margins to about 23% in fiscal 2026 (slightly lower than the 27% margin from fiscal 2024), that would translate to around $365 million in non-GAAP operating profits. This estimate is based on expected revenue growth of around 11% next year.

The Bottom Line

UiPath’s balance sheet is in a strong position, with $1.7 billion in cash and no debt, providing flexibility for potential stock buybacks or acquisitions.

Despite slower growth, the company has shown improving profitability, with non-GAAP operating margins expected to expand significantly in the coming quarters.

Valued at 20x next year’s non-GAAP operating profits, UiPath now offers a fair investment opportunity as expectations have reset. With increasing efficiency and profitability, it’s time to chart a new course-this PATH now looks more promising.