Douglas Rissing

By Zain Vawda

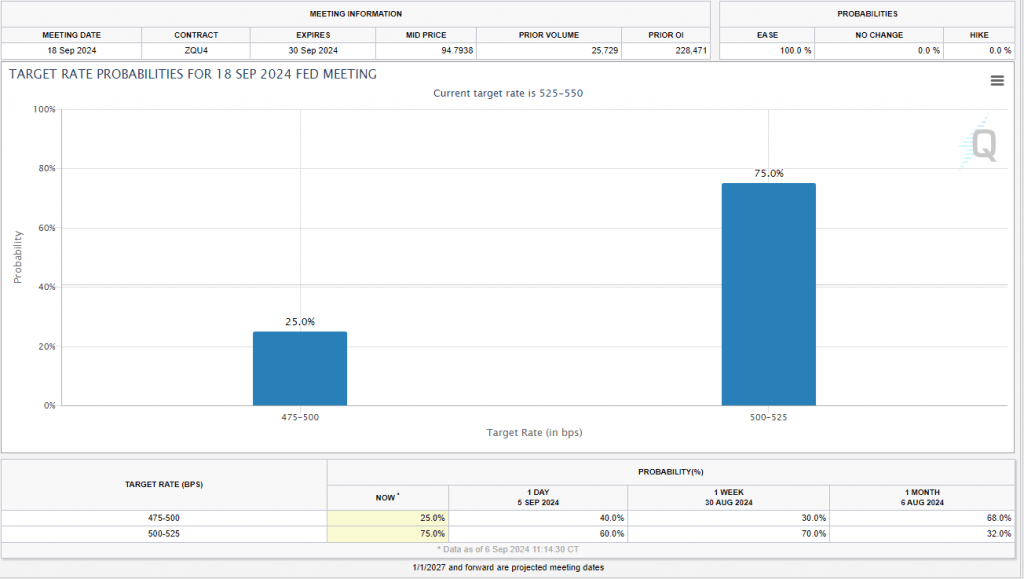

As the week draws to a close, US jobs data failed to provide clarity on whether the US Federal Reserve will deliver a 25 or 50 bps cut at the September 18 meeting. Although the number of jobs created missed estimates, there was enough in the report to keep markets on edge for a little while longer.

In August, the non-farm payrolls increased by 142,000, which was below the expected 165,000. Moreover, the previous two months saw a reduction of 86,000 in their initial estimates. This pattern of revising numbers downward is ongoing and doesn’t account for recent benchmark revisions that indicated the Bureau of Labor Statistics overestimated payroll growth by an average of 78,000 per month for the year leading up to March 2024. For instance, June’s job growth was first reported as 206,000, then adjusted to 179,000, and is now just 118,000. Similarly, July’s figures dropped from 114,000 to 89,000.

It looks as if the apparent weakness in the labor market may finally be showing itself. Given that, is it possible to rule out a 50 bps cut. My take is not especially with the improvement we witnessed in the unemployment rate, which improved to 4.2% from last month’s surprise print of 4.3%.

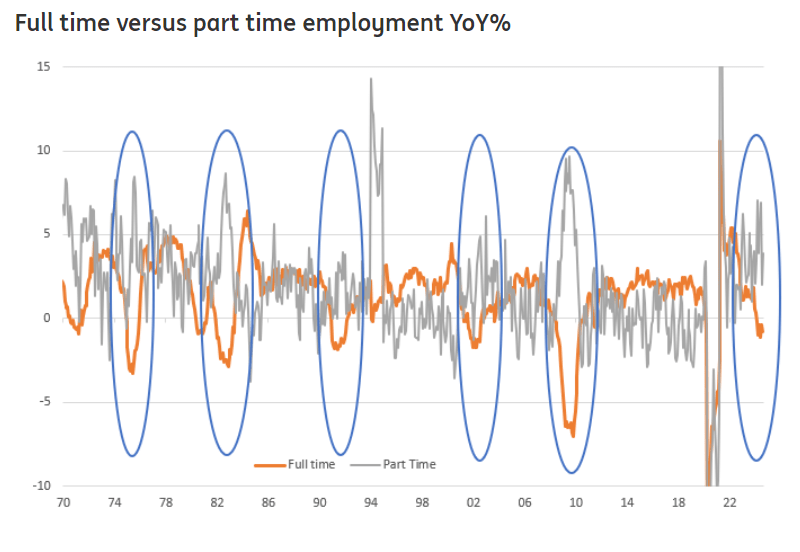

Another point that may concern the Federal Reserve, and cited by ING Think Research, is the growing divide between full-time and part-time employment. According to ING, this tallies with the idea that the US is adding largely lower-paid, part-time jobs and is losing full-time, well-paid jobs, primarily through attrition – not replacing retiring or quitting workers.

Source: ING Think

Every recession starts this way, unfortunately. The easiest way to cut costs is not to replace workers, but if everyone is doing that, then the economy slows, and companies start making actual cuts down the line.

As for performance this week, US Equities have continued their September blues, as historic seasonality suggested. Leading Wall Street indexes were all red for the week, with the Nasdaq down around 5.6%, the S&P down 4% and the DJIA down around 2.84%.

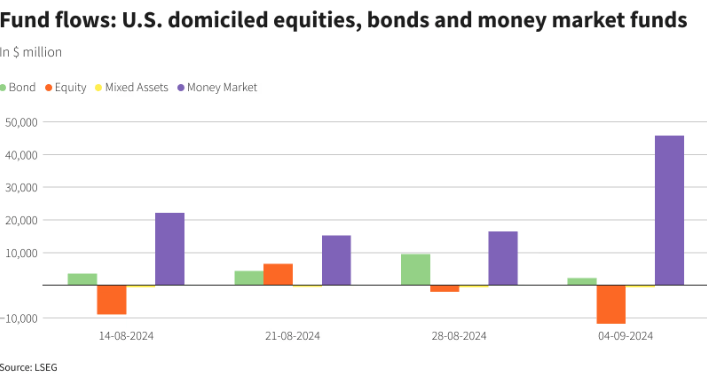

The downturn is reflected in US equity funds flows, which experienced their largest weekly outflow in 12 weeks by September 4. This is in line with growing concern around the health of the global economy. According to LSEG data, investors disposed of a net $11.37 billion worth of US equity funds during the week. This was also the fourth weekly outflow in five weeks.

Source: LSEG Workspace

Oil prices suffered from concern around the economy as well. Word that OPEC + will defer production increases which were scheduled to start in October was not enough to rescue the selloff. This leaves oil in a precarious position heading into the new week as it looks set to end the week around 8% down.

Gold did not manage to break its all-time high despite recessionary concerns and part of this may be down to the amount of rate cuts already priced in by market participants. The US Dollar Index (DXY) saw a similar reaction and strengthened following the release of the jobs data to finish the week on a high.

The market’s reaction was similar to the swings in rate cut expectations. Initially, 65% of participants anticipated a 50 basis point cut right after the data was released. However, as the trading session progressed, expectations were adjusted significantly. The latest pricing now suggests a 75% likelihood of a 25 basis point cut.

Source: CME FedWatch Tool

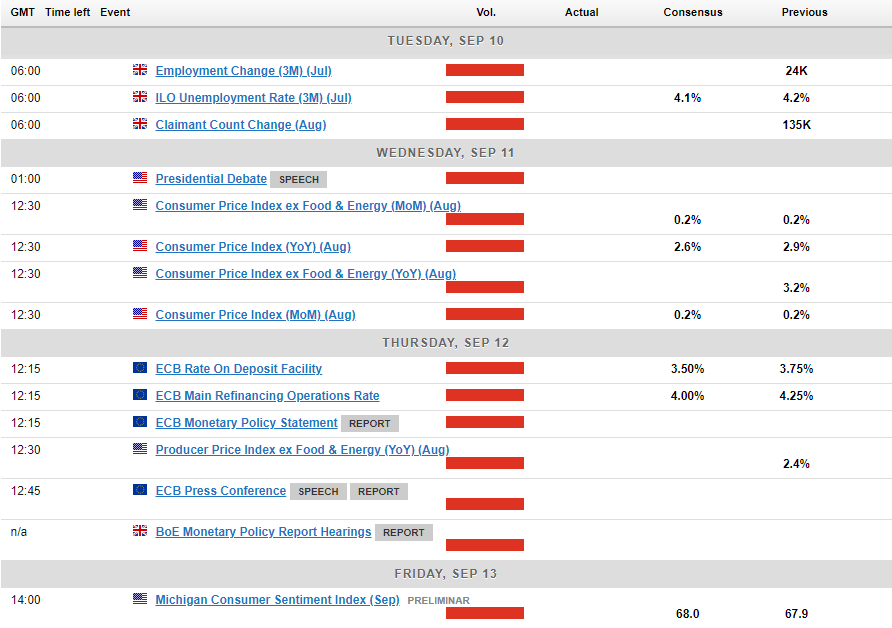

The Week Ahead: ECB to Cut Rates, Trump-Harris Debate

The week ahead is not expected to be as chaotic as last week, particularly from a data point of view. The US gets a reprieve on the data front as the US election comes into focus with the Presidential debate between Kamala Harris and Donald Trump. The debate itself should not have a huge impact on markets, barring any significant surprises.

Asia Pacific Markets

In Asia, the upcoming week puts focus on Chinese data, which has been a point of contention of late. Deteriorating data has been one of the signs that the global economy is slowing, particularly from a demand perspective.

China is about to release its trade, inflation, and credit data next week. We expect that trade growth in August continued to slow, with exports increasing by about 5% compared to last year and imports by about 3%. It’s important to keep an eye on car exports, which have been under pressure and are likely to slow down more. If car exports go from helping to hurting, it could weaken China’s overall export performance. Inflation is expected to rise slightly in August.

Europe + UK + US

In Europe and the US, it’s still a heavy data week but more so from the UK and Euro Area.

The European Central Bank (ECB) meeting being the biggest event, with the ECB expected to deliver another 25 bps cut. Current inflation is nearing 2%, and longer-term forecasts are stable at about 2%, giving the ECB good reasons to ease up on strict monetary policies. Couple this with the struggles faced by the German economy, and it would seem to be a no-brainer.

The UK focus will be jobs data in the week ahead. Last month, there was a sudden and unusual drop in UK unemployment from 1.5 million to 1.2 million in just one month. Since the unemployment rate is calculated as a moving average, we might see it decrease further, possibly reaching 4.0% from a recent high of 4.4%. This could happen even if the number of unemployed people rises again in the most recent monthly figures. The data is, however, unlikely to have any long-lasting impact on rate expectations as it relates to the Bank of England.

The highlights from the US, with the exception of the Presidential debate, will come in the form of US CPI and PPI data. The data which markets had been glued to over the last 24 months suddenly does not hold the same sway. Barring any crazy figure, this should not sway rate cut expectations all that much, with labor data now holding the key. Short-term volatility and fluctuations should still be expected, however.

Chart of the Week

This week’s focus is on the US Dollar Index, which continues to be intriguing and surprising. The main question on my mind is how much of the expected rate cuts are already reflected in the Dollar’s value. After Friday’s data release, the Dollar initially dropped but then rose sharply, suggesting that a lot of the rate cut expectations might already be factored in.

The DXY continues to find support around the 100.50 handle and keeping a retest of the 100.00 psychological mark at bay, for now. The weekly and daily candle are, however, sending mixed signals. The weekly candle is set to close as a hanging man, while the daily candle is on course for a hammer candlestick close, hinting at a move higher on Monday. The only positive around the weekly candle is that a hanging man candle at support is not a high conviction print, as it is best when it appears following a significant upside rally at an area of resistance.

There remains many hurdles on the upside, with initial resistance at 101.80 and 102.16 before the 103.00 handle comes into focus.

A move back to the downside now needs to navigate support at 101.17 before the 100.50 level. The psychological 100.00 remains untested yet and remains a massive barrier if bulls are to seize control.

US Dollar Index (DXY) Daily Chart – August 30, 2024

Source:TradingView.ComDXY) Daily Chart – August 30, 2024″ contenteditable=”false” loading=”lazy”>

Key Levels to Consider:

Support:

Resistance:

- 101.80

- 102.16

- 103.00

- 104.00 (200-day MA)