john shepherd/iStock via Getty Images

This week’s inflation report could reshape the market’s thinking about monetary policy, especially following the less-than-stellar job report. It could also spark an unexpected reaction, hurting the yen carry trade and the stock market technology sector, specifically technology and semiconductor stocks.

Following weak economic data this past week, the market is assessing the odds of a 25- or 50-bps rate cut at the September FOMC. The CPI report is likely to play a heavy role in that process.

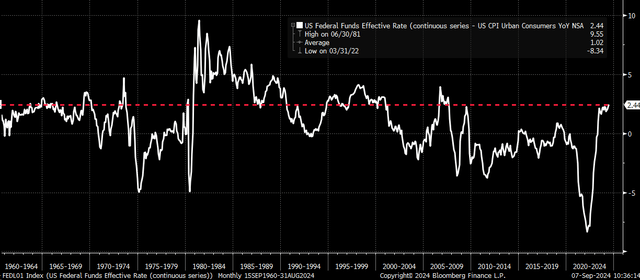

The Fed is under pressure from a softening labor market and a slowing inflation rate. The challenge the Fed faces is about how restrictive its policy is. If the Fed doesn’t cut rates and inflation rates continue to slow, the Fed’s inaction will lead to more restrictive monetary policy, which is measured as the spread between the overnight Fed Funds rate and the inflation rate, potentially weakening the labor market further.

Inherently, though, rate cuts from the Fed will cause the yield curve to steepen, a signal often associated with risk aversion. This steepening could cause US Treasury spreads to contract with other sovereign rates, further strengthening the Japanese yen and causing more pain for the already-battered U.S. technology sector.

Weaker Than Expected CPI

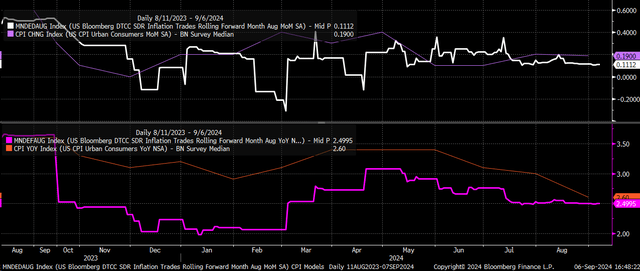

Analysts expect the headline and core CPI to have increased by 0.2% m/m in August, both in line with July’s report. Meanwhile, headline CPI is expected to fall to 2.6% y/y from 2.9%, while core CPI is expected to remain at 3.2%, in line with last month.

The CPI swap market sees things differently and expects headline CPI to rise by just 0.11% m/m and 2.49% y/y. Based on swap market pricing, both headline CPI measures would miss analysts’ estimates by 0.1%.

Pricing In Rate Cuts

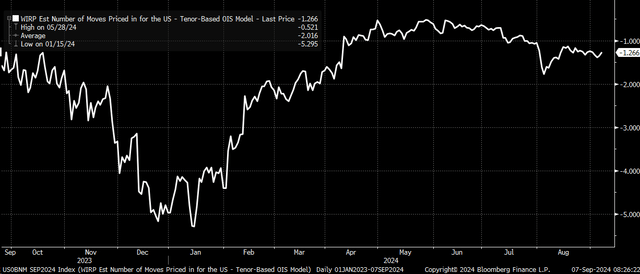

But following the job report, which showed that the non-farm payroll rose less than expected, a marginal shift in the unemployment rate due to rounding, the swaps market now sees the potential for the Fed to cut rates by just 25 bps at 70%, which is almost unchanged from the past few days.

This is where a weaker-than-expected CPI report, as predicted by the swaps market, would probably give the rates market the green light to price in a 50-bps rate cut at the September rate meeting. A CPI report 0.1% below expectations and an inline PPI report would probably signal another subdued PCE report, potentially indicating that nominal GDP growth is slowing.

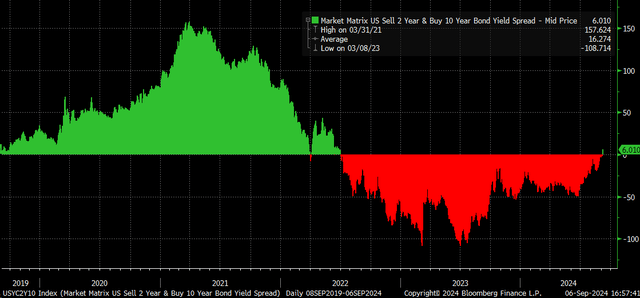

The impacts of a 50 bps rate cut would drive rates at the front of the curve sharply lower, including the 2-year rate. A falling 2-year rate would steepen the yield curve even further, which finished the trading day at six bps following the weaker-than-expected non-farm payroll report on September 6.

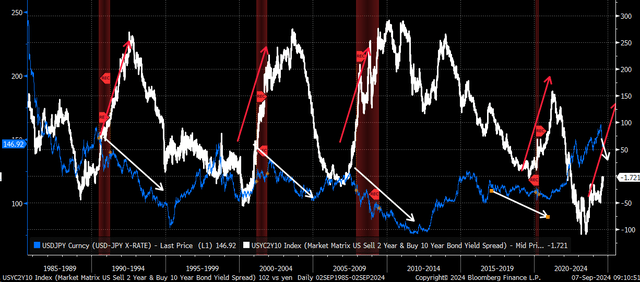

But overall, and perhaps more importantly, as rate drops and rate cuts are priced in, sovereign interest rate spreads will begin to contract, which is only likely to weaken the dollar versus the Japanese yen, leading to a further unwinding of the carry trade, as returns diminish. The yen has been closely tied to changes in spreads and, more importantly, to the US 10-year Treasury rate, since most of the widening of the spreads over the past few years has been driven by higher US interest rates. Historically, this would continue the trend of risk aversion in the market when the yield curve steepens, with a flight to safety out of the dollar and into the yen.

Risk Asset Impacts

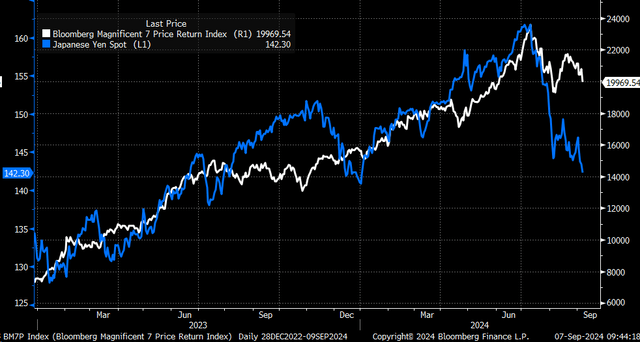

This could be a key development because the stock market’s recent performance appears tied to fluctuation in yen currency pairs. Given the low rate environment and the widening interest rate differentials, it is possible that the yen was used as a source of funds, especially in the Magnificent 7 stocks, as noted by the relationship between the Bloomberg Magnificent 7 Price Return index and the USD/JPY.

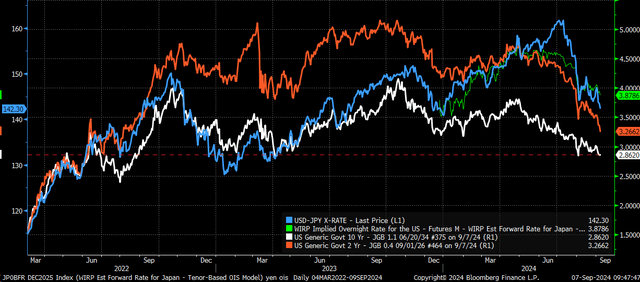

Now that the Fed signaled its plans to cut rates, perhaps aggressively, interest rate spreads are collapsing, making a yen short a less profitable trade. This is especially true now that the US 10-year and the 10-year JGB are very close to breaking below a critical level of support in the 2.85 to 2.9% range, which could further accelerate the unwind of the carry trade.

If the CPI report comes in weaker than expected, as the swaps market projects, it will likely increase the odds that the Fed will cut 50 bps at the September FOMC meeting.

On the margin, a rate cut would be positive for the US economy, and likely help ease some of the pressure on the labor market. However, it carries unintended consequences, which revolve around how global markets have used interest rate differentials to fuel risk assets.

As the carry trade unwinds, liquidity is withdrawn and implied volatility increases. Where the dust settles is yet to be determined.