Pgiam/iStock via Getty Images

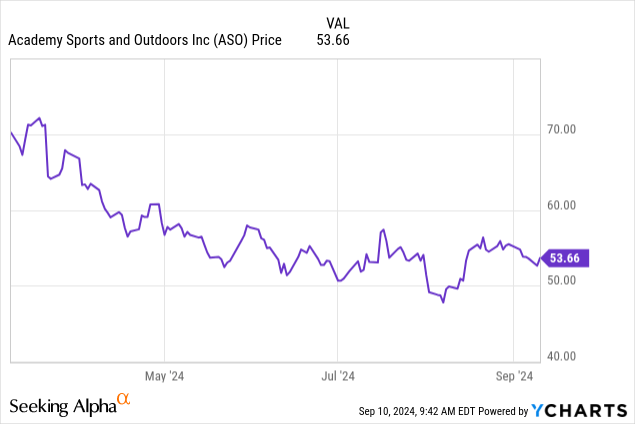

Academy Sports and Outdoors, Inc. (NASDAQ:ASO) is rising slightly after just-reported Q2 earnings. The report was mixed, all things considered, and the stock still has about 10% short interest. This one has certainly been a short target many times in the last few years. This time, as we head toward Q4, with the stock down for the year, it could be one for tax loss harvesting, which suggests a better price may be in store. Below, we are setting up a new ‘sample’ trade for new money once again, similar to the conviction trades we lay out in our service.

What we like here is that the company continues its expansion at a reasonable pace, and the company has been working through inventory while controlling expenses. Moving forward, we are looking for comparable sales to improve from here. We rate ASO a buy, but be prepared to scale in.

The gap up from $50 looks like it will close on this action, and it is an ok buy here at $53, but a good buy in the high $40s. Here is a suggested play.

The suggested play for new money

Target entry 1: $51.75-$52.00 (30% of position)

Target entry 2: $49.50-$49.75 (33% of position)

Target entry 3: $47.00-$47.25 (37% of position)

Short-term target: $58

Medium term target: $66.

Stop: $44

This is the type of trade we lay out at our service for our highest conviction plays. The above is an example proposed play of how a trade can be considered.

Q2 performance discussion

The just-reported quarter was mixed. We were looking for comparable sales to start to stabilize, and they were a bit more negative than we expected, leading to a slight guidance revision lower. Yet, the stock is not getting crushed on the lower income, as GAAP profitability was actually revised higher. Chief Executive Officer Steve Lawrence stated in the release:

Academy continues to make progress against our strategic initiatives demonstrated by the opening of nine new stores this upcoming quarter, new omni-channel enhancements, such as Door Dash, and leveraging customer excitement around the launch of our new loyalty program. In addition, our inventory discipline drove gross margin expansion of 50 basis points and a 5% reduction in units per store. For the remainder of the year, we will focus on increasing traffic and conversion for our stores and website, by leveraging our improved targeted marketing capabilities, and expanding our new loyalty program. We will also continue to use our strong cash generation to fund the investments that will drive our long-term growth and increase shareholder value.”

Competition is tough in this space, and the consumer is definitely under pressure in this macro environment, but the company did a nice job moving inventory and improving margins. The new loyalty program, which may seem gimmicky, should lead to better customer retention and help drive sales. It is remarkable what consumers will spend just to earn a coupon. We see this model with competitor DICK’S Sporting Goods (DKS) work well.

But the macro pressure is real. We have high interest rates which have made housing, including rent, and other related costs surge. Food inflation persists compared to two years ago. Consumer debt is at all-time highs. Student loans are being paid back. Gas prices have offered some relief as oil prices have come down, one positive. What we like long-term is that there remains a lot of room for expansion. Academy Sports stores are only in 19 states, with just 285 stores.

Further, the balance sheet is healthy, and the management is shareholder-friendly. $107 million year-to-date has been returned to shareholders this year, and so far, compared to last year, free cash flow is up 60%. That is huge. But the quarter was mixed. Academy has a growing online business and reaches customers with multiple distribution centers that it operates. But sales fell on the top line, missing estimates slightly. Net sales in the quarter were $1.549 billion, which actually fell 2.2% from last year, compared to $1.583 billion. This was due to comparable sales falling 6.6%. It is worth noting the declines were better than the 7.5% decline from last year, but we were looking for 4% declines.

Margins had been pressured for several quarters, but started stabilizing this year in the 34.0% to 35% range. Gross margins in Q2 year-to-date are $1.015 billion, or 34.8% of the total net sales. This is up from 34.7% last year in the same period. Before taxes, income was $186.5 million, which dipped from $203.3 million last year. This was largely due to the decline in sales, of course. On a per-share basis, we saw $2.03 in EPS compared to $2.08 per share, beating by $0.01. Declining earnings is not growth, obviously, and this is a big reason shares have reset and started hugging that $50 mark.

However, we see it as a dip short-term and growth will resume as the company expands. The plan is to open another 100 stores in the next 5 years, growing the company by more than 30%. While the near-term outlook is still pressured, we like the long-term prospects. We think it is important to note that guidance was largely reiterated, thought margins are to be better and GAAP profitability will be as well.

For this fiscal year, net sales were revised lower and are now seen at $5.895 billion to $6.075 billion, down from the prior view of $6.07 billion to $6.350 billion. This will be because comps will be down 3%-6%, whereas previously comps were thought to be down 4% to even positive 1%. We have been surprised by the comp weakness, but this is why shorts keep pressing their bets. We had previously seen comps of -2 to -3% as likely, and now think they will come in -4% to -5.5%. The company sees EPS of $5.75 to $6.50 adjusted, versus $5.90 to $6.90 in earnings for the year seen prior. So this year is a year of no growth. But this is a $52 stock, and despite the lack of growth, the valuation is quite attractive when you consider the balance sheet and store footprint expansion. Further, you are paid dividends and there is a nice buyback in place to go with the balance sheet which is healthy.

Academy has $325 million in cash with just with $484 million in long-term debt. The company paid down $100 million in debt over the last year. The company is using that debt to expand is store footprint and grow. Adjusted free cash flow remains strong and is seen at about $320 million this year at the midpoint. In Q2 alone, Academy repurchased $98 million in stock, and also paid $8 million in dividends.

Final thoughts

This is a trader’s stock. We may see some tax loss harvesting later this year, so keep that in mind. However, as we are in a tough period for stocks, you may once again get a chance to buy sub $50. We outlined a sample trade, but if you want high conviction trades with a high win rate, take a look at our service.

As a firm focused on helping investors learn to trade more and ramp their income, there is value in Academy Sports and Outdoors, Inc. shares. The company is managing inventory well, and margins are improving. The company will likely expand its store base by 30% in the upcoming years, there is a buyback in place, and dividends are paid.