Brett_Hondow

Summary

I am neutral on Bath & Body Works Inc. (NYSE:BBWI). My summarized thesis is that the near-term outlook is bleak with no positive catalysts that I foresee will drive a strong growth recovery. The reason I am not assigning a sell rating to the stock is because valuation has already suffered greatly, dropping from 14x to 8x forward PE in just two months. At 8x, it is at the low end of BBWI 10-year trading history, suggesting little room for further decline.

Company overview

BBWI is a specialty retailer of body care, home fragrance products, soaps, and sanitizers. It operates multiple brands, with the key brands including Bath & Body Works, White Barn, and C.O. Bigelow. BBWI products are sold across both brick & mortar and digital. As of 2Q24, BBWI operates 1,872 owned stores in the US and Canada and has 497 franchised stores in international markets.

Earnings results update

In the latest quarter (2Q24) reported, BBWI saw its revenue fell by 2.1% y/y, missing consensus expectation of -1% y/y growth. By category, BBWI’s largest segments, Home Fragrance [HF] and Body Care [BC] (collectively 80% of FY23 sales), declined by a low-single-digit percentage. As for soaps & sanitizers, 15% of FY23 sales declined by a mid-single-digit percentage. Overall, total revenue saw $1.53 billion; gross margin saw 110 bps expansion to 41%; and SG&A expanded 130 bps to be 29.1% of total revenue. Consequently, EBIT came in at $183 million, higher than consensus of $174.2 million, with a margin of 12%.

Growth outlook is negative

While margin expansion was a pleasant surprise (more on this later), I expect BBWI share price to stay under pressure because of the poor growth outlook. The 2.1% y/y decline seen in 2Q24 marked a 6% decline on a two-year stack basis, which is an acceleration from the 4.6% decline seen in 1Q24 (1Q24 decline was also an acceleration from the 3.8% decline seen in 4Q23). I am especially worried because the weakness was driven by a decline in transactions as traffic remained pressured. This is despite 2Q24 having the benefit of the June semi-annual sale (which underperformed vs. management expectations). All of these suggest that the BBWI core customer group continues to be cautious in their spending.

Relating to the macro situation, I have no positive view on the consumer spending situation. My core view is that discretionary spending stays weak for the foreseeable future as consumers remain under pressure from the high interest rates and post-inflation environment. With this in mind, I don’t expect BBWI to see strong growth recovery as I believe it belongs nearer to the discretionary category (i.e., you can find cheaper alternatives for body care products at value shops, and not every need home fragrance product).

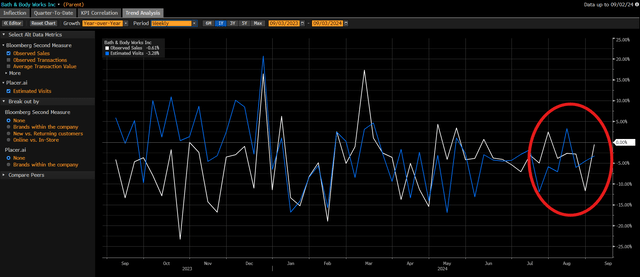

What could prove me wrong is the strength behind BBWI’s new product innovation. So far, management noted that traffic improved toward the end of the quarter (in line with what Placer.ai data shows per below), as consumers reacted positively to the new products from the Stranger Things collaboration and rollout of the lip assortment. They also noted that the improving traffic trends have sustained into August (again, in line with what Placer.ai data shows below). That said, while this improvement in traffic is positive, it doesn’t seem to have translated into sales, as the observed sales data (per Bloomberg below) for August and the first week of September are still negative. In fact, the entire of August saw negative y/y sales growth despite an improving traffic trend. Hence, I am not so confident to believe that this new product innovation strategy is going to drive a growth recovery as well.

Margin outlook

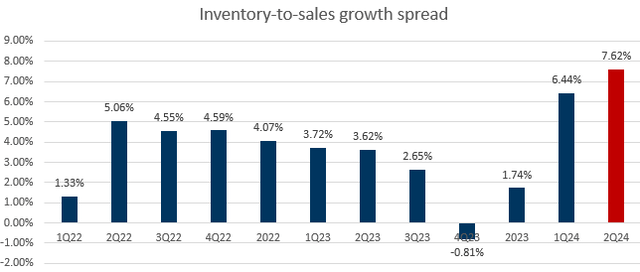

Regarding margin, 2Q24 gross margin expansion was a pleasant surprise. However, I see downside risk to EBIT margin in 2H24 given the growing inventory levels. Total inventories grew by 6% y/y in 2Q24, resulting in an inventory-to-revenue growth spread of 7.6% (~130bps higher than 1Q24) and inventory as a percentage of last-twelve-month sales reaching 11.7% (highest over the past 7 quarters). Management commented that this inventory level is to prepare for 2H24 demand, which my guess is for the upcoming holiday season, new product launches, and store openings. This is a valid reason to stock up inventories, but as I noted above, I don’t have a positive view on near-term growth.

- Macro conditions remain uncertain, and it is unlikely that consumers will suddenly accelerate their discretionary spending; and

- New product innovations are driving in traffic, but it appears they are not being converted to sales so far. Points 1 and 2 should continue to weigh on top-line performance, which puts pressure on margin; and lastly,

- New store openings take time to ramp up to maturity. Given the poor spending environment, this may take longer than expected to ramp up, and with the fixed cost associated, it will put pressure on near-term margins.

Valuation

Taking a step back and looking at BBWI 10-year trading history, the stock has generally traded within a range of 8x to 16x forward PE. Given the poor outlook, BBWI multiple has traded down significantly from ~14x in 1H24 to just 8x today, which I think is a justified move as the market is likely concerned about near-term performance (just like I do). My sense is that multiples are going to stay rangebound for the foreseeable near-term as:

- There are no major growth catalysts in sight (new products innovation strategy don’t seem to be working).

- The macro situation is not likely to turn for the better, at great magnitude, in the near term. In fact, there is a risk of recession that may tip BBWI to see a larger sales decline.

- The uncertainty of the upcoming election is going to prevent consumers from spending more.

Conclusion

My neutral view on BBWI is because the near-term outlook is soft, and that valuation has already traded down to the low-end of its historical trading range. Looking ahead, I believe BBWI will experience weak sales performance given a cautious consumer base and little traction from its new product launches. Moreover, the growing inventory levels point to potential future markdowns or margin pressures if demand doesn’t pick up. Considering the lack of clear growth catalysts, a potentially worsening macro environment, and election uncertainty further dampening consumer spending, I am staying on the sidelines.