Jacob Wackerhausen/iStock via Getty Images

Last week, I published, “If I Had to Retire Today With 10 REITs – Part 3.”

Obviously, it was the culmination of a short series – and a pretty well-received short series at that. I got some solid comments on all three articles, including this one from a subscriber:

“Hi, Brad. Another great analysis. You opened my eyes to REITs a while ago. Have you ever considered a similar analysis to this but geared towards an age range that’s maybe 10 years (and/or 20 years) from retirement? “If I was going to retire in 10 years, here are my X# of REITs?”

So that’s precisely what this new series is going to do: explore the world of real estate investment trusts that might be right for pre-retirees with another 10 or 20 years left to their career.

But first, I do want to acknowledge the second part to the question, which went like this:

“Also, in terms of diversification, if holding 10-20 REITs, plus other stocks, as others have pointed out, that could mean 40-60 picks in a portfolio. In thinking of Buffett’s ‘punch card advice’ he doled out several years ago (i.e. paraphrasing: ‘in your lifetime, if you only got 20 investments… what would those be? You’d really think hard’), would you stay with this many REITs?

“For those who really do their [due diligence] on select companies but tend to think the marginal returns/safety of diversification really start to minimize after more than 10-20 holdings, the number may be 3-5 to hold.

“Would love to hear your thoughts on if your strategy would shift. Great work. Love reading your thoughts!”

And a great comment all around! Let’s see if I can help you out…

Buffett and Diversification – It’s More Complicated Than That Quote

For those who don’t know about Buffett’s “punch card” rule, you might recognize it under the “20 slot” name instead.

Regardless, according to his late business partner Charlie Munger, Buffett likes to advise business school students to imagine a 20-slot “punch card.” Each slot is assigned to one single investment asset – and once it’s taken up, it’s taken up.

Moreover, you don’t get another punch card after a set amount of time. And you can’t simply sell one asset to free up a spot.

“Under those rules,” Munger (and therefore presumably Buffett) explained, “you’d really think carefully about what you did. And you’d be forced to load up on what you’d really thought about. So you’d do so much better.”

It’s an interesting mental exercise, but that’s all it’s supposed to be. Truly.

Yes, Buffett has made some famously (and infamously) negative comments about diversification in the past. For instance:

“Diversification is protection against ignorance. It makes little sense if you know what you are doing.”

And, let’s face it: That mentality seems to work for him, considering how he’s one of the world’s richest men with one of the most successful investing operations ever.

Moreover, it could work for you too. I don’t know.

But I wouldn’t bet on it, considering how almost every other successful trader out there – including almost every other very, very, very successful one – has taken the diversification route in order to succeed.

More Where That Came From

To quote a Nasdaq article from earlier this year, Warren Buffett’s:

“… logic is pretty simple here. If you pick a small number of good stocks, you can quickly compound your wealth. That’s just math, since every new stock you add to your portfolio risks diluting the overall return if it isn’t a huge winner. And there are only just so many big winners on Wall Street.

“The problem is that most people probably won’t be able to pick just the winners, which is why diversification is so important. It limits the pain from the inevitable investment mistakes that everyone makes (even Warren Buffett).”

Moreover:

“… Buffett has said that most investors would be better off buying a broad-based index fund. So his somewhat caustic words about diversification should be taken with a grain of salt. He’s most likely speaking about professionals that spend all of their time investing, not small do-it-yourself investors that are trying to balance a job, family life, and investing.”

The rest of the article is equally interesting, but I’ll stop there to simply stress my main point… that diversification is, much more often than not, extremely important. You don’t want to go overboard, of course, in buying up every company under the sun.

And, to return to the basis of Buffett’s “punch card advice,” yes, you want to carefully consider every asset you purchase. Make sure it:

- Can stand up in both good and bad economic conditions

- Isn’t overpriced

- Complements your other holdings and general investment goals.

You also need to have the money to purchase it in the first place. Obviously. But as I write in my book:

“Six REITs would provide a minimally acceptable level of sector diversification (perhaps one in each major subsector – apartments, retail, office, and industrial – and one each in two small subsectors). But eight or 10 would probably be better.

“The more available investment funds you have, the more you can consider expanding into subsectors. Or you could just as easily widen your geographic focus within each subsector, perhaps adding an apartment REIT focused on the West Coast – as admittedly speculative play, as of this writing – on top of one that’s nation in scope.”

So bottom line on the subject: I’m a big fan of diversification and will continue to preach its benefits. You know yourself much better than I do, however, which is why you need to decide for yourself.

With that established, let’s talk about those pre-retirement REITs I think look best…

W. P. Carey (WPC)

WPC is a real estate investment trust (“REIT”) and a leading owner of commercial properties that are net leased to businesses located in the U.S. and across Northern and Western Europe.

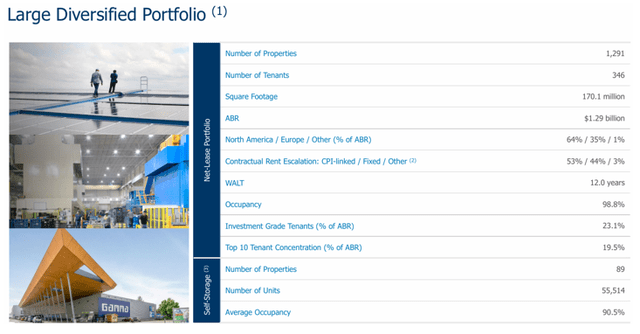

W. P. Carey has a market cap of approximately $13.2 billion and a 170.0 million SF portfolio comprising 1,291 net lease properties. In addition to its net lease portfolio, the company has a portfolio of 89 self-storage properties that contain 55,514 storage units with an average occupancy of 90.5%.

The company specializes in the acquisition and management of a diversified portfolio of net lease properties subject to long-term leases with built-in escalators. Its portfolio is primarily diversified across industrial and retail properties, with some office remaining after the spin-off from a year ago.

At the end of the second quarter, WPC’s portfolio was 64% industrial and warehouse, 21% retail, and 15% “other”, which the company describes as net-lease self-storage, laboratory, hotel, land, and office properties.

The company’s net lease portfolio has 346 tenants and generated $1.29 billion in annualized base rent (“ABR”) as of the end of the second quarter. 64% of its ABR is derived from North America, 35% comes from Europe, and 1% comes from other regions.

At the end of 2Q-2024, WPC reported a net lease portfolio occupancy of 98.8% with a weighted average lease term (“WALT”) of 12.0 years.

In September of 2023, the company announced its plan to exit its office assets within its net lease portfolio by spinning-off 59 properties to Net Lease Office Properties (NLOP) and starting an asset sale program to dispose of the remaining 87 office properties kept by the company.

This was a fairly drastic move as the dispositions created a drag on AFFO per share growth due to the lower asset base generating less rent. At the same time, however, the move improved the quality of WPC’s portfolio, which should benefit the company over the long term.

When discussing the spin-off, the company’s CEO, Jason Fox, made the following statement:

“We believe exiting our remaining office assets will enhance the overall quality of our portfolio with warehouse and industrial assets expected to generate over 60% of our remaining ABR. Accordingly, the quality and stability of our earnings and cash flows will be improved through better end-of-lease outcomes, including higher re-leasing spreads and lower CapEx requirements. It will also incrementally benefit W. P. Carey’s credit profile without meaningfully impacting our leverage metrics.”

Essentially, short-term pain to improve the quality and long-term performance of its net lease portfolio. However, in connection with the spin-off, WPC “reset” the dividend due to the reduction of its asset base and rental income.

During a special conference call in September 2023, Toni Sanzone, Chief Financial Officer, stated that:

Moving now to our dividend. After spinning off NLOP, we intend to reset our dividend, reflecting both the reductions to our AFFO that I just discussed and a lower targeted AFFO payout ratio, which we expect to be in the low to mid-70% range. This will enable us to retain higher cash flow going forward, which can be accretively reinvested to further drive AFFO growth.

The news was not well received by the market, as one might expect, and the stock sold off sharply. While it makes sense that WPC would need to adjust its dividend to compensate for the lost cash flow, communication by management could have been better, not to mention the company was on the door step of becoming a Dividend Aristocrat right before the dividend cut.

While it’s understandable how investors might have felt blindsided by the news, I think the sell-off was overdone, seeing how this should ultimately be a net positive for its portfolio health over the long term.

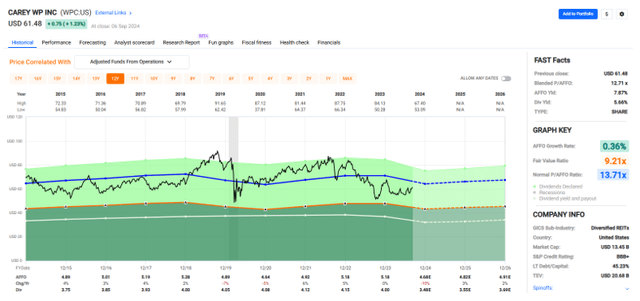

This has presented an opportunity to get into WPC at a discounted P/AFFO of 12.71x, compared to its average AFFO multiple of 13.71x.

While the stock is not priced as attractively as it was in September 2023, when it was trading around $51.50 per share, it is still a bargain in my view given that WPC is a premier net lease REIT that is very well capitalized and has been in the business since 1971.

Not to mention that the majority of its portfolio is industrial, which is priced somewhere around an FFO multiple of 20x to 22x (or more) for pure play industrial REITs.

WPC had an excellent dividend track record prior to the recent cut and has delivered consistent results for shareholders for decades. Its portfolio has improved and should set the company up well for forward growth. I think the poor communication regarding its dividend cut by management was a hiccup and not an overall reflection of the company.

WPC has several near-term headwinds, primarily the dividend cut that left a sour taste for many investors and expectations that AFFO per share will fall by -10% in 2024. No one likes to see AFFO per share fall by -10%; however, this is a designed part of the company’s office disposal plan and not a reflection of poor operational execution.

The company is expected to return to growth in 2025 with AFFO per share expected to increase by 3% that year and by 2% in 2026.

One thing to keep in mind, while growth in 2025 and 2026 is nothing to write home about, remember that WPC is mostly industrial, yet it has the lease duration of net lease REITs with a WALT of 12.0 years.

The company should see very nice releasing spreads once rents roll, it will just take time for this to fall to the bottom line, but nevertheless, there is unrealized value embedded in WPC’s leases which should materialize as leases are repriced to market rates.

Currently, the stock pays a 5.66% dividend yield that is well covered by an AFFO yield of 7.87%.

We rate W. P. Carey a Buy.

Brixmor Property (BRX)

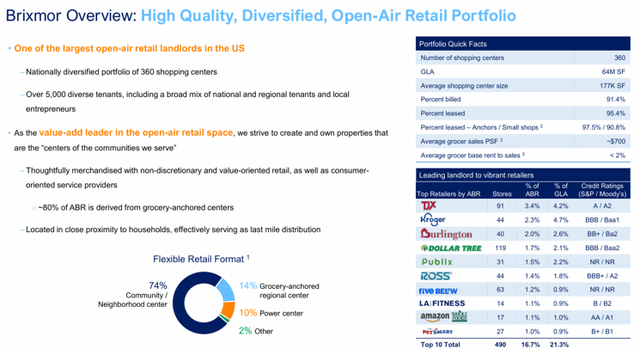

BRX is a REIT that owns and manages high-quality, open-air shopping centers across the U.S. that are leased to more than 5,000 tenants consisting of regional and national tenants, as well as local entrepreneurs.

The company has a market cap of roughly $8.2 billion and 64.0 million SF portfolio comprising 360 shopping centers averaging 177,000 SF in size that are 95.4% leased.

Brixmor partners with leading retailers and grocers and has a tenant list filled with familiar names such as TJX, Kroger, Burlington, Dollar Tree, Publix, and Whole Foods. Additionally, roughly 80% of its ABR is generated by grocery-anchored shopping centers.

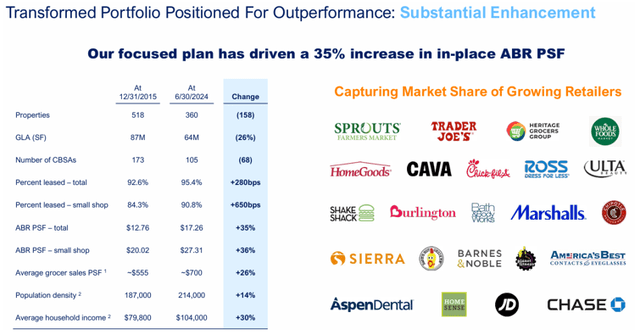

Since 2015, the company transformed its portfolio, which has resulted in a 35% increase in in-place annualized base rent (“ABR”) per square foot.

BRX began to overhaul its portfolio in 2015 in order to achieve critical mass in attractive, high-growth markets. It requires less resources to manage properties in close proximity where a single property manager can watch over multiple assets.

Additionally, as BRX becomes more concentrated in a particular region, as opposed to being too spread out, it should benefit the company as it will become more familiar with the local markets they are concentrated in.

The company has been engaged in capital recycling in order to achieve this goal and has completed $2.7 billion of dispositions, translating into 34% of its 2015 portfolio sold by property count. Additionally, the company has exited 69 single-asset markets in order to increase its efficiency and condense its portfolio.

At the end of 2015, BRX had an 87.0 million SF portfolio made up of 518 properties, compared to the end of 2Q-24, with its current portfolio consisting of 360 properties totaling 64.0 million SF.

The company’s more focused approach has achieved a 14% improvement in the average population density of its portfolio, a 30% improvement in household income surrounding its properties, and a 280 basis points increase in the portfolio leased rate, which improved to 95.4% as of 2Q-24, compared to a portfolio leased rate of 92.6% at the end of 2015.

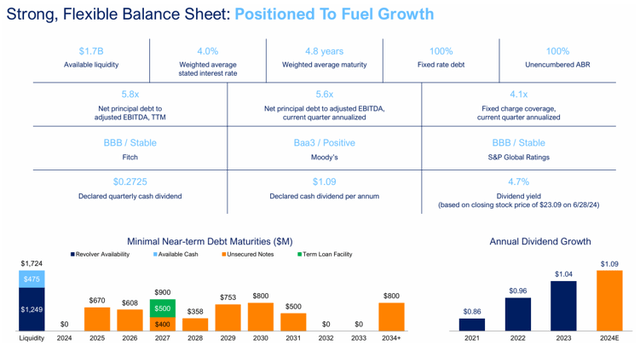

The company has an investment grade balance sheet with a BBB credit rating from S&P Global. BRX has excellent debt metrics, including a net debt to adjusted EBITDA of 5.8x and a fixed charge coverage ratio of 4.1x.

BRX’s debt is 100% fixed rate with a weighted average interest rate of 4.0% and a weighted average term to maturity of 4.8 years.

Plus, the company has minimal near-term debt maturities and $1.7 billion of available liquidity as of its latest update.

Since 2015, the company has had an average AFFO growth rate of 2.98%. AFFO growth was flat in 2017 and then fell by -9% in 2018. Some of its reduced cash flow can be attributed to property sales, which resulted in a smaller asset base.

AFFO fell during Covid by -12% but rebounded in 2021 with 12% growth in AFFO per share. AFFO growth was moderate in both 2022 and 2023, but analysts expect AFFO per share to increase by 6% in 2024, increase by 4% in 2025, and then increase by 6% in 2026.

I believe Brixmor’s revamped portfolio is positioned well for forward growth. Strip center supply dropped off a cliff after the Great Recession and has yet to recover. This has resulted in improved landlord pricing power and lower vacancy rates.

During the second quarter, BRX executed 1.4 million SF of new and renewal leases and achieved record rent spreads of 27.7% on comparable space. Included in that number is 0.6 million SF of new leases with rent spreads of 50.2% on comparable spaces.

BRX currently pays a 4.01% dividend yield and trades at a P/AFFO of 18.51x, compared to its average AFFO multiple of 15.74x. The stock is trading above its historical average P/AFFO ratio, however, given its improved portfolio as well as the structural tailwinds related to shopping center supply, we believe multiple expansion is warranted.

We rate Brixmor Property a Buy.

Alexandria Real Estate (ARE)

ARE is a life science REIT that pioneered the life science real estate niche upon its formation in 1994. The company is the unquestioned leader in the space, as it is the only publicly traded REIT with an exclusive focus on life science properties.

Alexandria specializes in the development, ownership, and operation of collaborative life science campuses located in key markets for healthcare discovery including Boston, San Francisco, San Diego, Seattle, New York City, Maryland, and the Research Triangle.

The life science REIT develops properties in high-end innovation cluster locations that support a collaborative environment and improves the ability to attract and retain top talent while promoting creativity and improved efficiency.

The company has a market cap of approximately $20.8 billion and an asset base in North America comprising 42.1 million SF of operating properties and 5.3 million SF of properties in development or under construction.

Alexandria caters to leading multinational pharmaceutical and biotechnology companies, as well as top medical and academic institutions. The company has around 800 tenants and its top tenants include names such as Eli Lilly, Roche, Novartis AG, Bristol-Myers Squibb, Harvard University, and Pfizer.

The company’s top tenant is Moderna, which has a remaining lease term of 12.9 years and makes up 5.7% of ARE’s annual rental revenue. ARE’s top 20 tenants combined make up 36.5% of its annual rental revenue and have a WALT of 9.4 years. Plus, 15 out of its top 20 tenants have investment grade credit ratings by S&P Global.

Ever since the stay at home movement picked up steam, there has been a lot of debate over whether ARE is an office REIT or a life science REIT. The company is technically categorized as an office REIT, the buildings provide work space for employees, and there is actual office space along with the core laboratory space in ARE’s properties.

That being said, ARE is nothing like a traditional office REIT and the tasks being performed at its laboratories cannot be done from home. Not only would it be nearly impossible to maintain a clinical environment at home, but government regulators would never allow drug research and production to be conducted in an unregulated environment.

A quick look at ARE’s leasing numbers shows the company is continuing to grow. During the second quarter, the company had strong leasing volume and rental rate increases. During 2Q-24, the company’s leasing volume totaled 1.1 million SF with GAAP rental rate increases of 7.4%, or 3.7% on a cash basis.

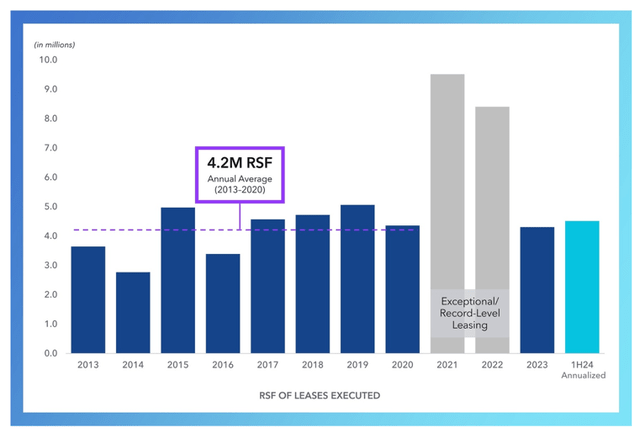

For the first half of 2024, the company had total leasing volume of 2.3 million SF. The company’s 1H24 leasing volume annualized exceeds that of its annual average of 4.2 million SF from 2013 to 2020.

To support the company’s continued growth, it has an investment grade balance sheet and a BBB+ credit rating from S&P Global. ARE has excellent debt metrics, including a net debt + preferred stock to adjusted EBITDA of 5.4x and a fixed charge coverage ratio of 4.5x.

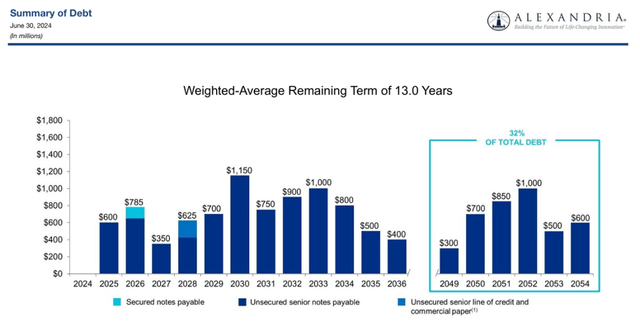

97.3% of its debt is fixed rate and its debt has a W.A. interest rate of 3.89%. Plus the company has $5.6 billion of liquidity, its debt has a W.A. term to maturity of 13.0 years, and 32.0% of its debt matures after 2049.

Over the last 10 years, ARE has delivered an average AFFO growth rate of 5.87% and an average dividend growth rate of 6.64%. Analysts expect AFFO per share to remain flat in 2024, but then to increase by 3% and 6% in the years 2025 and 2026, respectively.

The company pays a 4.47% dividend yield that is well covered with a 2023 AFFO payout ratio of 64.92%. The stock is currently trading at a P/AFFO of 15.26x, compared to its 10-year average AFFO multiple of 25.11x.

We rate Alexandria Real Estate a Buy.

In Closing

W. P. Carey, Brixmor Property Group and Alexandria Real Estate are my first three picks for those of you who are targeting retirement in the next decade or so and are building your retirement-ready portfolio now.

Keep your eye out for Part 2, coming soon.

Thank you for reading and commenting!