Just_Super

Investment summary

My previous investment thought on Nutanix (NASDAQ:NTNX) (published on the 4th of June) was a buy rating because I believed the demand momentum was still strong and that it was sustainable given NTNX’s streak of winning large deals. My recommendation is still a buy rating for NTNX as the growth outlook remains robust, especially with NTNX now showing signs of it capturing share from VMware.

4Q24 results update

NTNX reported 4Q24 adj revenue of $548 million (11% y/y growth), which saw sharp deceleration from 1Q24 growth of 16.9%. That said, readers should note that 4Q23 was a very tough comp base, where revenue grew 28% and ACV (annual contract value) billings grew 44%. On the other hand, adj gross margins did really well, coming in at 86.9%, 110 bps expansion from 4Q23, and 40 bps sequential expansion. This helped to sustain the adj EBIT margin at 12.9% (flat vs. 4Q23).

Growth outlook remains bright

Redfox Capital Ideas

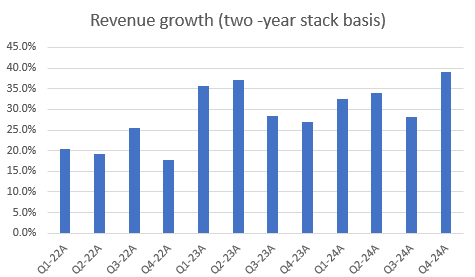

As I said earlier, the growth slowdown reported on a headline basis is not indicative of a poor underlying demand; rather, it is due to a tough comp base last year. On a two-year stack basis, 4Q24 growth was an all-time high over the past 12 quarters. Two better leading indicators of growth are ACV billings and annual recurring revenue [ARR]. For the former, ACV billings growth saw y/y growth acceleration from 20% in 3Q24 to 21% in 4Q24; and for the latter, ARR growth remains stable at >20%, in line with last quarter performance. Combining these together, I believe it paints a vastly different growth strength vs. the ~11% headline revenue growth figure.

For those that are worried about the drop in net retention rate [NRR] (fell by 900 bps from 123% in 4Q23 to 114% in 4Q24), I don’t think this represents a surge in churn. As management noted, this was primarily due to a higher mix of large deals in pipeline that generally take longer to close, so on a comparison basis, this showed up as a downtick in NRR. The right way to view this data is by comparing against the 22% y/y ARR growth, which indicates that net-new ARR growth from new customers has contributed strongly to ARR growth, which is in line with the strong performance in net-new logo adds that saw 34% y/y growth (added 670 in 4Q23 vs. 500 in 4Q23).

Looking ahead, the growth opportunity remains robust as NTNX has finally shown signs of winning share from VMware. For context, Broadcom acquired VMware last year, and because of Broadcom’s strategy to raise prices, this made a lot of customers unhappy, causing them to search for alternative solutions—and this is where NTNX gets to win share as it is considered one of the best alternatives in the market. A rudimentary Google search will show up multiple incidents of unhappy customers. For instance, you can find them here, here, and here. Of all the reports that I have read, this interview with Jim Kavanaugh probably paints the best picture of what’s happening now. For those that don’t know, Jim is the CEO of World Wide Technology ($20 billion in revenue). In case some of you cannot access the link, I highlight some of the key quotes from it:

“There’s a lot of unhappy customers out there just in regards to the approach that VMware-Broadcom has taken,” said Kavanaugh, WWT’s CEO and channel stalwart in an interview with CRN.

[Broadcom’s] been an incredibly successful company. They have a strategy and approach that they take. But I can tell you, it’s not sitting well with the majority of the customers—a very large majority,” said WWT’s CEO. “Customers are looking for alternatives.”

“WWT is now helping customers who want to work with the new VMware by Broadcom, but also moving many clients off VMware into either the public cloud or VMware alternatives such as Nutanix.”

The reason why this has not surfaced up in NTNX P&L is because it takes time for customers to decide when they want to switch, the timing of hardware refresh, and also the macro environment forces some of them to defer large capex investments. But we can see growing evidence that these are flowing into NTNX, as management mentioned the pipeline has now a larger mix of large deals, and notably, many of which were winning from competitors (mentioned in the call).

So we’ve talked about, in general, we are happy with our pipeline generation overall. We have talked about the growing pipeline and the fact that the pipeline from larger deals is growing faster. 4Q24 earnings transcript

In addition, I think one important mention during the call was that NTNX is not seeing any change to its win rates (on the VMware opportunities) despite Broadcom offering pricing flexibility to its larger customers (NTNX mentioned this in the 3Q24 earnings call). This tells me that VMware customers are either: (1) really unhappy to the point that they don’t want to deal with VMware anymore, or (2) the price flexibility is just not enough to overcome the substantial price increase. Either way, it works well for NTNX, in my opinion.

Valuation

Redfox Capital Ideas

I model NTNX using a forward revenue approach, and using my assumptions, I believe NTNX is worth $79. My growth assumptions remained the same at 15% for the next three years. I believe this is easily achievable considering that FY24 grew 15% and NTNX has yet to fully reap the benefits from share loss from VMware. As the large deals in the pipeline translate to ARR and eventually revenue growth, NTNX could see growth faster than what I had modeled. Importantly, I believe the market recognizes this opportunity as valuation shot up from ~5.5x to 6.2x post the earnings despite a slow 4Q24 headline revenue growth. Assuming this multiple stays at 6.2x, the upside remains attractive.

Risk

Depending on how long this elongated-sale cycle situation persists, growth could slow further as the mix of large deals increases in the pipeline, since NTNX is going to compete against a base that has deals with a shorter sale cycle. At the headline, we may see another round of sharp deceleration in growth in between quarters. Moreover, NTNX is likely to allocate more resources to capture these large deal opportunities, which means the mix of larger deals could increase at a much faster pace, leading to a higher frequency of slow headline growth.

Conclusion

My view for NTNX is a buy rating. NTNX fundamentals remain strong, as evidenced by the strong ARR, ACV billings, and revenue (two-year stack) growth. Importantly, the growth opportunity set from the VMware potential share loss remains huge, and NTNX has shown signs of capturing them. The market appears to recognize this opportunity given how the stock multiple has moved post-results, and at the current valuation, the upside is still attractive.