Hillenbrand HI reported adjusted earnings per share (EPS) of $1.01 in fourth-quarter fiscal 2024 (ended Sept. 30, 2024), which beat the Zacks Consensus Estimate of 93 cents. The bottom line declined 11% year over year due to cost inflation, lower volume and higher interest expense. This was partially offset by the Schenck Process Food and Performance Materials (“FPM”) acquisition, favorable pricing and savings from the previously announced restructuring.

Including one-time items, HI reported earnings of 17 cents per share compared with 24 cents in the year-ago quarter.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

Hillenbrand’s quarterly revenues rose 10% year over year to $838 million attributed to the FPM acquisition. The top line beat the Zacks Consensus Estimate of $797 million.

Organic revenues decreased 1% year over year as favorable pricing and higher aftermarket parts and service revenues were offset by lower capital equipment volume.

Hillenbrand’s Operational Update

The cost of sales climbed 10.9% year over year to $549 million. The gross profit rose 8% year over year to $288.4 million. The gross margin expanded to 48.7% from the year-ago quarter’s 33.5%. Operating expenses rose 26% year over year to $193 million.

Adjusted EBITDA dipped 2% from the year-ago quarter to $143.8 million. Adjusted EBITDA margin was 17.2% in the fiscal fourth quarter , which marked a 210-basis point contraction from the year-ago quarter.

HI’s Segment Performances in Q4

Revenues from the Advanced Process Solutions segment were $591 million. The 15% year-over-year increase was attributed to the FPM acquisition. Organic revenues decreased 2% year over year as favorable pricing and higher aftermarket parts and service revenues were offset by lower capital equipment volume.

Adjusted EBITDA was $117 million, flat compared with the year-ago quarter. Cost inflation and lower volume were offset by favorable pricing and cost actions. Adjusted EBITDA margin was 19.8%, which declined 300 basis points from the fourth quarter of fiscal 2023.

The Molding Technology Solutions segment’s revenues were $247 million, which were in line with the year-ago quarter. Adjusted EBITDA was $42 million, which declined 8% year over year due to cost inflation and unfavorable product mix. This was partially offset by savings from the previously announced restructuring actions. Adjusted EBITDA margin was 17%, which marked a 150-basis point year-over-year contraction.

Hillenbrand’s Cash & Debt Position

The company had cash and cash equivalents of $199 million at the end of fiscal 2024, down from $243 million at fiscal 2023-end. Liquidity was around $799 million, including $243 million of cash in hand and the remaining capacity under its revolving credit facility.

Cash flow from operating activities was $191 million compared with $207 million in the last fiscal year. Hillenbrand returned $62.5 million to shareholders through dividends in fiscal 2024.

HI’s long-term debt was $1.87 billion as of Sept. 30, 2024, compared with $1.99 billion as of Dec. 31, 2023.

HI’s 2024 Results

Hillenbrand’s adjusted EPS declined 6% year over year to $3.32 in fiscal 2024, which beat the Zacks Consensus Estimate of $3.23. Including one-time items, the company reported a loss of $3.03 per share against earnings of $1.53 per share in fiscal 2023.

HI’s revenues rose 13% year over year to $3.2 billion, which surpassed the Zacks Consensus Estimate of $3.14 billion.

Hillenbrand Initiates Fiscal 2025 Outlook

The company expects revenues to be in the range of $2.925 – $3.090 billion. Adjusted EBITDA is expected to be in the band of $452-$488 million . HI expects adjusted EPS to be between $2.80 and $3.15 .

First-quarter 2025 revenues are expected to be between $685 million and $705 million. Adjusted EPS is projected to be in the band of 52-57 cents.

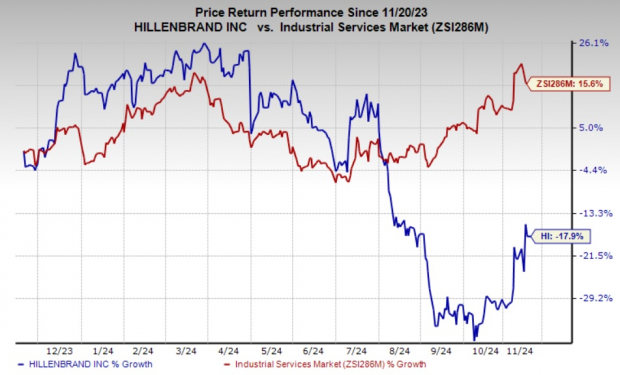

HI’s Price Performance & Zacks Rank

In the past year, Hillenbrand’s shares have lost 17.9% against the industry’s 15.6% growth.

Image Source: Zacks Investment Research

Hillenbrand currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Industrial Services Stocks

ScanSource (SCSC – Free Report) reported adjusted EPS of 84 cents in the first quarter of fiscal 2025 (ended Sept. 30, 2025), which beat the Zacks Consensus Estimate of 77 cents . Earnings improved 13.5% from the year-ago quarter’s figure of 74 cents per share.

SCSC posted revenues of $775.58 million , which missed the Zacks Consensus Estimate of $799 million. This compares with year-ago revenues of $876.31 million.

SiteOne Landscape Supply, Inc. (SITE – Free Report) recorded adjusted EPS of 97 cents in the third quarter, which missed the Zacks Consensus Estimate of $1.18. The company posted earnings of $1.25 per share in the third quarter of 2023.

SITE registered revenues of $1.21 billion , which surpassed the Zacks Consensus Estimate of $1.18 billion. The top line rose 2.4% year over year.

W.W. Grainger, Inc. (GWW – Free Report) reported EPS of $9.87 in third-quarter 2024, which missed the Zacks Consensus Estimate of $9.98. However, the bottom line improved 4.7% year over year, aided by the strong performances of the High-Touch Solutions N.A. and Endless Assortment segments.

Grainger’s quarterly revenues rose 4.3% year over year to $4.39 billion. The top line, however, missed the Zacks Consensus Estimate of $4.41 billion. Daily sales increased 2.6% from the prior-year quarter. We had predicted daily sales growth of 2.8%.