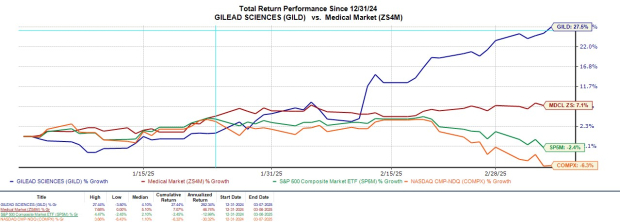

Medical pioneer Gilead Sciences (GILD – Free Report) has seen its stock etch out new 52-week highs as the broader market pulled back sharply in recent weeks. Gilead has joined Johnson & Johnson (JNJ – Free Report) , and a cluster of healthcare stocks that have risen to fresh peaks.

This makes it a worthy topic of whether Gilead’s stock can reach higher highs with investors scoping out exposure to the medical sector amid economic uncertainty. Trading at $117 a share, GILD has spiked nearly +30% year to date with the broader market indexes in negative territory.

Image Source: Zacks Investment Research

Gilead’s Industry Leadership

Engaged in the advancement of medicines to prevent and treat life-threatening diseases, Gilead is the leader in developing drugs for the treatment of HIV . The pharmaceutical giant also has an extensive portfolio of drugs for liver diseases, inflammation/respiratory diseases and hematology/oncology.

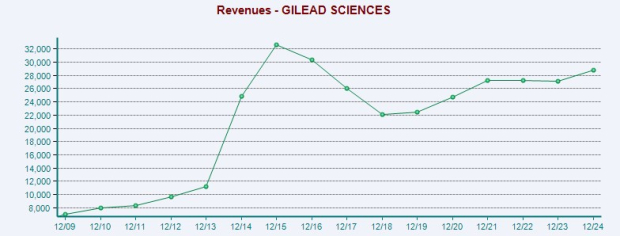

Bringing in $28.75 billion in 2024, Gilead’s top line is expected to dip 1% this year but is projected to rebound and rise 4% in fiscal 2026 to $29.7 billion.

Image Source: Zacks Investment Research

Gilead’s EPS Growth

More intriguing, Gilead’s operational efficiency has led the company and its stock back to prominence. Gilead’s annual earnings are expected to soar 70% in FY25 to $7.87 per share compared to EPS of $4.62 last year. Plus, FY26 EPS is projected to increase another 5%.

Image Source: Zacks Investment Research

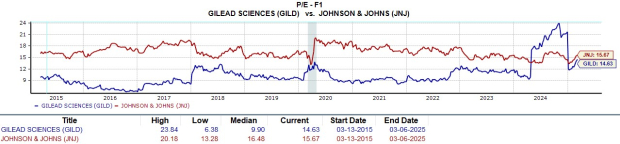

Monitoring Gilead’s P/E Valuation

At current levels, GILD still trades at a very reasonable 14.6X forward earnings multiple which is slightly beneath Johnson & Johnson’s 15.6X. GILD also trades at a noticeable discount to its Zacks Medical-Biomedical and Genetics Industry average of 19.1X with the benchmark S&P 500 at 21.6X.

Image Source: Zacks Investment Research

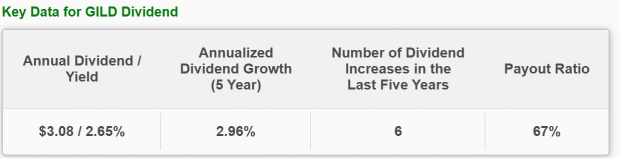

Gilead’s Generous Dividend

Furthering keeping investors engaged in Gilead’s stock as a defensive hedge is its 2.65% annual dividend yield. This tops the benchmark’s 1.27% average and its industry average of 1.49%.

Image Source: Zacks Investment Research

Bottom Line

Despite such a sharp YTD rally, Gilead Sciences stock sports a Zacks Rank #2 (Buy). At 52-week peaks there could still be more upside for GILD shares as FY25 and FY26 EPS estimates have trended higher in the last 30 days.

Furthermore, investors may still be compelled to buy GILD as a hedge against recent market volatility, especially considering Gilead’s EPS growth, industry leadership, and reasonable P/E valuation.