Black Hills Corp. (BKH – Free Report) announced that its electric utility subsidiary in Colorado received approval from the Colorado Public Utilities Commission for new rates. The new rates turned effective on March 22, 2025.

The approved new rates will provide for the recovery of nearly $370 million in system investments since the utility’s last general rate filing in 2016, as well as inflationary impacts on costs to serve customers.

The rates provide nearly $17 million of new annual revenues based on a weighted average cost of capital of 6.90% with a capital structure of 47-49% equity, 51-53% debt and a return on equity of 9.3-9.5%.

As part of the regulatory process, the company has the opportunity to file a request for rehearing, reargument or reconsideration with the commission by April 7, 2025.

Utilities’ Essential Rate Hike

Utility regulators in the United States are considering increases in electricity rates as electric utilities seek to cover the investments needed to maintain and expand their systems. Utilities requested rate increases in recent years to pay for improvements to transmission and distribution lines to withstand increasingly serious weather and fire events, prepare for increased electrification as state and federal clean energy legislation is implemented, and move more energy reliably, according to S&P Global Market Intelligence Capital IQ Pro.

Customers are undoubtedly burdened financially by the rate hikes, even though utilities need to revise rates on a regular basis. Infrastructure additions and maintenance are continuous processes. Rates hikes include upgrades to make the grid more resilient and shorten the duration of outages that help serve customers more efficiently. Rate hikes at regular intervals allow utilities to continue with infrastructure spending, as they have funds available.

Other Utilities’ Focus on Rate Hike

Along with BKH, other utility companies like National Grid Transco (NGG – Free Report) , Consolidated Edison (ED – Free Report) and Duke Energy (DUK – Free Report) are focused on improving their service reliability through rate hikes.

As of March 25, 2025, National Grid is seeking a 15-20% increase in electric and gas rates for residential customers in New York. The proposed rate reset is scheduled to begin in the spring of 2025. The company stated that the plan aims to maintain infrastructure, improve customer service, support economic growth and prepare networks for a transition to clean energy sources.

NGG’s long-term (three to five years) earnings growth rate is 2.34%. The Zacks Consensus Estimate for fiscal 2025 earnings per share (EPS) implies a year-over-year decline of 5.5%.

In January 2025, Consolidated Edison proposed rate hikes that would increase the average electric bill by nearly 11.5% more for electricity and nearly 13.5% more for natural gas. The proposed increase will take effect on Jan. 1, 2026. The state’s Public Service Commission made the final decision after an 11-month process.

ED’s long-term earnings growth rate is 5.57%. The Zacks Consensus Estimate for 2025 EPS implies year-over-year growth of 4.1%.

In July 2024, new rates were approved for Duke Energy Carolinas customers in South Carolina. Beginning Aug. 1, 2024, a typical residential customer using 1,000 kilowatt-hours (kWh) witnessed an increase of about 8.7% or $12.06 per month. Beginning Aug. 1, 2026, residential rates will increase another 4.3%, resulting in an additional $6.42 per month for a typical residential customer using 1,000 kWh.

DUK’s long-term earnings growth rate is 6.33%. The Zacks Consensus Estimate for 2025 EPS implies a year-over-year increase of 7.1%.

BKH’s Stock Price Performance

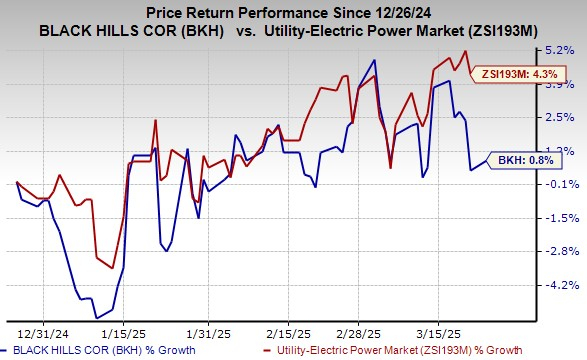

In the past three months, shares of Black Hills have risen 0.8% compared with the industry’s 4.3% growth.

Image Source: Zacks Investment Research

BKH’s Zacks Rank

The company currently carries a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.