Short-term rentals (STRs) have been a hot strategy for years. At one point, they felt like cheat codes: massive cash flow, manageable with automation, and relatively low vacancy. But in recent years, they’ve become less and less appealing, especially in urban areas.

If you’ve been trying to buy or run a profitable Airbnb lately, you know what I mean. Deals are getting harder and harder to pencil in due to increasing regulation, supply saturation, and shifting demand.

Let’s talk about what’s changed, why STRs don’t work as well as they used to, and the new cash flow strategy in town: co-living.

What’s Wrong With STRs Today

The first problem is regulations. According to Hospitable, New York, Dallas, San Diego, and Chicago have some of the tightest restrictions, but many other cities across the country have strict regulations as well.

The common regulations you’ll find are:

- Primary residence requirement

- Nights per year maximum

- A limited number of permits

- Taxation like hotels

- Total bans

Then, there is supply saturation. Those with the foresight (or luck) to buy STRs in the early days experienced a heyday: lots of demand with little supply. It’s the perfect mixture for incredible cash flow.

Now that the secret is out of the bag, investors have poured in. The increased supply has resulted in decreased occupancy and revenue for most investors.

Lastly, STR guests themselves are shifting. With increased inflation affecting many people’s disposable income, guests travel less, lowering demand for STR stays.

STRs can still be a great option in vacation markets with favorable regulations. But in metros? Not so much.

Co-Living is the Next Cash-Flow Strategy, and it Thrives in Metros

So, if STRs are fading, what’s your best option? Co-living.

It’s not new, but it’s becoming increasingly popular, especially in cities with high rents and tight incomes. The model is simple: Instead of renting your property as a whole, you rent a room with shared common spaces.

Here’s why it works.

Affordable for renters

Rents are wildly high in many cities. But most people don’t need an entire apartment; they just need a private bedroom in a nice space with good roommates. Co-living gives them precisely that, for much less than renting a studio, freeing up their income to save and invest more.

Profitable for owners

When you rent by the room, you almost always make way more than renting to a single family. Imagine generating 2-3x the income compared to traditional long-term rentals! They usually surpass the famously sought-after 1% rule, resulting in very high cash flow.

Co-Living Outperforms STRs: Here’s Why

Co-living isn’t just an alternative to STRs in cities; it is better in many ways, especially in urban markets.

It’s more stable and resilient

STR income is volatile. You’re banking on travel trends and seasonality and relying on a single guest at a time. If no one books next weekend, that income is gone.

With co-living, you have multiple residents paying rent. It’s no big deal if one room goes vacant; you’re still cash flowing. Two vacant rooms? It’s still probably OK. It’s the difference between having a single point of failure and spreading your income across five or six sources.

And while there’s still a little seasonality to co-living (more people move in the spring and summer), it’s nowhere near as extreme as STR.

It makes the same (or more) money

Most investors who bought STRs didn’t do it because they loved the increased turnover and dealing with cleaners; they did it because they wanted to be rewarded with high cash flow!

The same is true for co-living investors. You might be surprised, though, that co-living revenue often matches or exceeds STR revenue.

Take Colorado Springs, for example. According to Rabbu, a five-bedroom STR generates around $51,913 in revenue per year. My similarly sized co-living homes in this city generate that much and a little more.

It requires management, but it’s a different kind of work

Let’s be clear: Co-living isn’t passive. To earn that high cash flow, a lot of management is involved: managing residents, filling vacancies, and keeping the household running smoothly. But it’s different from STRs.

STRs involve constant turnover, cleaning, guest communication, and maintenance surprises. Co-living requires more effort upfront; filling multiple rooms in a new property can take time, but the work drops significantly once the situation is stable.

Will Co-Living Suffer the Same Fate as STR?

While there are many advantages to co-living, in five to 10 years, will it become less profitable than anticipated, as STRs have? Here are some points to consider.

It’s more legal (and more likely to stay that way)

If cities came after short-term rentals, what’s stopping them from coming after co-living next?

The short answer: Co-living solves a problem, while STRs create one.

STRs take long-term housing off the market. Co-living adds more housing back into it. It’s a fundamentally different dynamic. With co-living, you’re taking a single-family house and housing five or more people affordably—often those who couldn’t rent a unit independently.

That’s a public benefit, and cities know it. That’s why more local and state governments are protecting co-living, not banning it. Some are even rewriting occupancy laws that used to limit unrelated adults living together just to support shared housing.

While nothing in real estate is ever 100% risk-free, co-living is far more future-proof than STRs concerning legality in metro markets.

Demand isn’t going anywhere

Demand for rooms primarily hinges on one thing: rental unaffordability. And that’s not going away anytime soon.

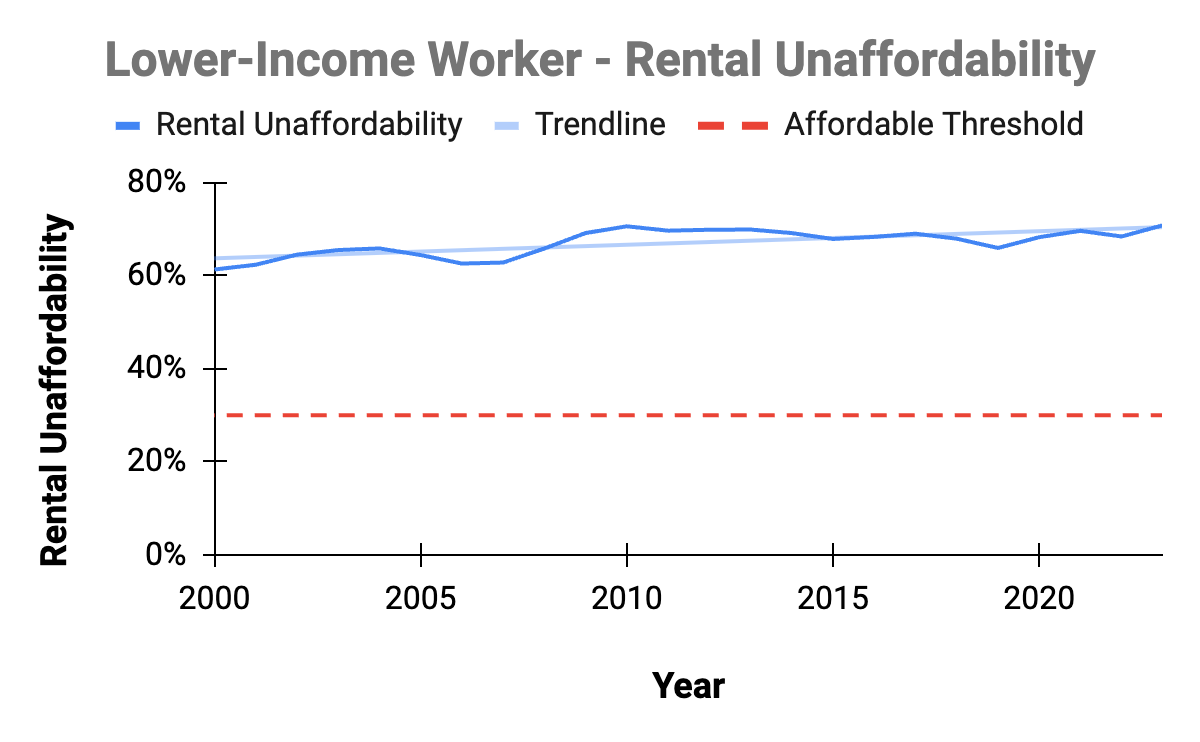

At its core, co-living solves a painful problem: Rent is too high for too many people. In most metro markets, even average-income individuals now spend well over 30% of their income on rent, which personal finance experts consider the upper limit for being financially healthy. But this isn’t just an average problem; it’s much worse for lower-income workers.

Let’s look at the numbers. A lower-income worker earning $21,500 annually must pay just $540/month to stay under the recommended 30% threshold. Good luck finding a studio apartment at that price in any city. That’s why room rentals fill such a critical gap at $500-$800/month.

Some might hope rising wages or dropping rents will solve this issue, but data says otherwise. Even if incomes continue to increase at their current pace, we’re decades away from affordability—70 years, in some cases. And rents? They haven’t dropped meaningfully since the Great Depression.

So what’s left? A new product altogether: room rentals.

Demand for this kind of housing isn’t speculative; it’s baked into the economic reality of most working Americans. As affordability continues to worsen, demand will only grow.

Will co-living get too crowded?

If co-living demand is strong, the next question is: What about supply?

I don’t want to paint an overly rosy picture; there are always risks with any investment. With co-living, it is possible that investors could flood the space and oversupply it, just like what happened with STRs; however, I don’t think this is very likely.

Currently, co-living looks especially attractive because cash flow is much higher than alternatives like traditional single-family rentals. With interest rates high, investors are avoiding long-term rentals that don’t cash flow positively and are looking for ways to make deals pencil. That’s leading more people to explore STRs and co-living.

But here’s the catch: If interest rates eventually drop, traditional rentals may become profitable again, and many investors who weren’t cut out for all the extra work these high cash flow strategies require will return to conventional rentals. They’re more straightforward, more familiar, and require less day-to-day involvement.

So, I think the co-living supply will likely drop as the macro environment shifts. That is a bet, but every investment has some degree of risk that you must weigh.

Regardless, if you are an early adopter of any strategy and become the best in town at it, you’ll have much better odds of continuing to receive incredible returns now and down the road.

Don’t Get Left Behind—Co-Living is Where We’re Headed

If you’re tired of chasing short-term rentals that don’t cash flow or, worse, aren’t even legal anymore, co-living offers a smarter path forward.

It’s better for renters. It’s better for cities. And it can be better for your bottom line.

This isn’t a hack or a loophole. Co-living is a scalable, long-term strategy that adapts to the realities of today’s housing market. When STRs are getting squeezed out of metro areas, co-living provides what cities need: affordable, quality housing for residents, not vacationers.

If you’re serious about staying in the game for the next decade, it’s time to look at what’s next, not what worked five years ago.

Want to dig deeper? Check out Co-Living Cash Flow, my new BiggerPockets book, launching April 29. It’s the complete guide to launching a high-cash-flow co-living rental, even in tight or expensive markets.