imagedepotpro/iStock via Getty Images

Thesis

Today, I wanted to cover Heritage Insurance Holdings, Inc. (HRTG), a somewhat speculative and controversial stock that has not had any analytical updates for over three months. However, there have been several catalysts of late. For starters, the “action” in this stock, based on both technicals and comments from readers, currently suggests categorizing this as a “trading” stock for many readers rather than a long-term investment for others. I want to be clear that I’m only looking at the long-term fundamentals here, not how much this will go up or down in the near term.

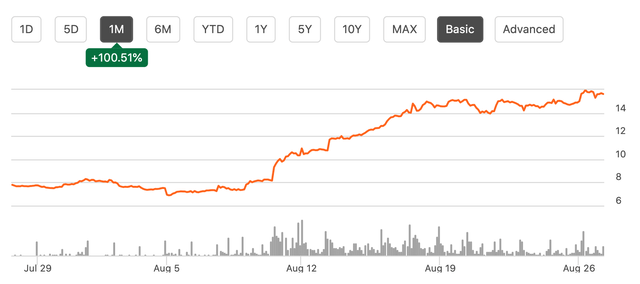

With that said, the one-month price action in this stock has seen a 100% upside move, most notably since its most recent Q2 earnings, which is long overdue for an update, followed by an “Overweight” upgrade from Piper. As an investor who currently does not own any shares of this company, my approach today will be directed at new investors looking to take a position in this company. Any feedback from current investors for more insights is always welcome.

Even with the stock’s recent price jump, I’m focusing on the long-term fundamentals here. In my analysis, I’ll argue that the company’s improving profits and smart strategies could drive growth, though there are some risks to consider.

About Heritage Insurance

Heritage Insurance Holdings, Inc. is a property and casualty insurance company based in Tampa, Florida. Started in 2012, Heritage Insurance works through subsidiaries like Heritage Property & Casualty Insurance, Narragansett Bay Insurance, and Zephyr Insurance specializing in residential insurance for individuals and businesses, with a strong focus on Florida.

They offer various insurance products, such as homeowners, condo, and dwelling fire policies, plus wind-only property insurance. They also handle restoration, emergency services, property management, and reinsurance.

Heritage Insurance went public on May 23, 2014, and by 2024, the company employed about 566 people. Most notably recently, in July, Heritage rejoined the Russell 3000® Index, a definite boost in their profile with investors (and prospective investors).

The company also announced a 3.3% rate drop for Florida homeowners insurance, which started on August 20, 2024. The rate cut is part of a trend in Florida’s insurance scene. Several insurers are dropping premiums as market conditions get better. Heritage’s CEO, Ernie Garateix, said this shows their commitment to keeping insurance affordable and highlights smart risk management and solid underwriting.

HRTG Ratings

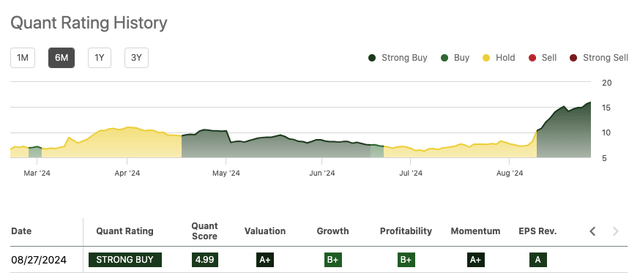

Current ratings in HRTG shows a positive lean to the buy side, with Wall Street rankings at an average ‘Buy’ indication. However, the price targets strongly contradict, suggesting a -20% downside, back toward $12.50 per share.

Yet across the board, Seeking Alpha’s Factor grades are overwhelmingly positive on the stock, showing back-to-back quarterly improvements.

Heritage Insurance Holdings Q2 2024 Earnings Highlights

Heritage Insurance Holdings displayed solid numbers in Q2 2024. The gross written premium jumped by $28 million, up 7.1% from last year. One of the big wins for the company this quarter is that they kept improving their pricing and risk assessment, which really boosted their profits. Net income shot up by $11 million, a 143% increase, showing stronger profits.

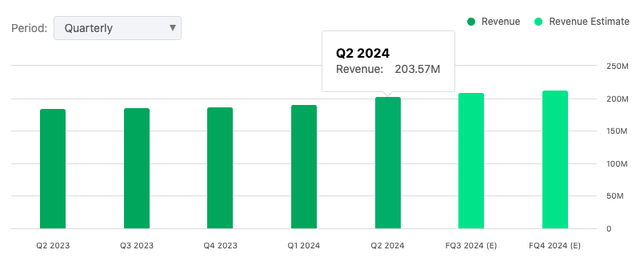

Total revenue hit $203.6 million, a 9.9% boost, thanks to solid premiums and better investment returns.

The commercial residential area of business, which is a bright spot, expanded solidly, with a gain in in-force premiums of 29.4% which contributed to the overall gross profit. The E&S (Excess & Surplus) segment also expanded, with premiums growing to almost $30 million, up 177% over last year, a reflection it seems of increased scale and operations in the company, particularly in states such as California, Florida, and South Carolina. CEO Ernie Garateix noted:

What makes this business so attractive, is that we can more nimbly adjust our rates and coverages to the changing dynamics state-by-state, to ensure that we continue to earn appropriate risk adjusted returns.

They’re planning to keep looking at other states for new opportunities in their E&S business, but they’ll do it carefully to grow in a controlled way. They’re also making sure they don’t rely too much on any one state—no single state accounts for more than 27.3% of their total coverage. This approach helps them avoid big ups and downs in performance and keeps the company stable eventually, which they believe will increase the company’s value over time.

CEO Garateix was asked on the conference call about the growth in the E&S market and how it compares to the regular (admitted) insurance market, especially with rate changes in different states. He responded that the E&S market is still growing (btw, the company is in 16 different markets), particularly in states like California, Florida, and South Carolina. He mentioned that they see E&S as a tool to address not just pricing but also coverage issues. And even though some admitted markets are seeing adequate rates, E&S continues to grow in select areas. And the general trend for rate increases over the next year, focusing on Florida, is that the situation is improving thanks to legislative changes, so rate increases will likely be modest, not as high as in previous years.

If you want to do a deeper dive into the legislative changes, I recommend reading “Briefing: Florida’s Property Insurance Market” to get up to date. In a nutshell, Florida recently reformed its property insurance laws to help rescue its troubled market. It curbed litigation that drives up costs via caps on attorney fees and bans on some legal practices, and adding new consumer protections that require insurers to provide customers with clearer information and treat claims more equitably. The state has further incentivized more private-market companies to do business in Florida to drive down costs and wean the state from its state-run backstop insurer, Citizens Property Insurance.

Moving on, back to the Q2, Heritage’s net loss ratio improved to 55.7%, down from 60.3% last year, showing better underwriting and fewer weather-related losses. Shareholder equity jumped, with the book value per share rising to $8.32, up 32.7% from the previous year. Return on equity also increased to 30.8%, compared to 19.7% before.

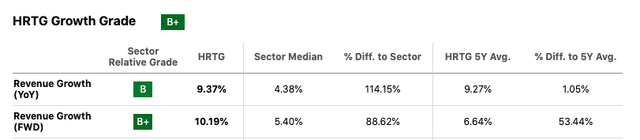

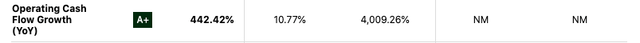

Looking at Seeking Alpha’s growth metrics (see below), HRTG’s revenue growth, both year-over-year and forward-looking, looks strong. The company’s YoY revenue is up 9.37%, blowing past the sector by 114.15%. The forward revenue growth of 10.19% also suggests they’re on track to keep this momentum going.

The YoY EBITDA growth is quite exceptional at 542.87%, including EBIT.

The operating cash flow growth of 442.42% backs this up, showing they’re generating serious cash, which could fuel more growth or cushion them against rough patches.

Finally, on the conference call, management reported that the company made solid progress in optimizing its reinsurance program, which should lower the ceded premium ratio and boost future profits. Investment income jumped, thanks to higher yields on shorter-term investments. They plan to keep this momentum by gradually extending investment durations as interest rates are expected to drop.

HRTG Valuation

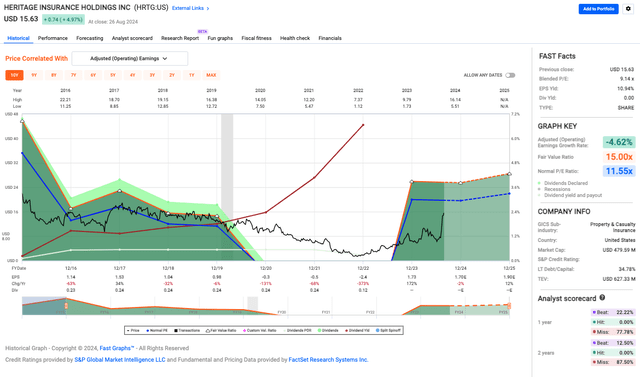

HRTG’s (blended) P/E ratio is 9.14x, lower than its usual 11.37x suggests to me that it’s undervalued and could be considered a buying opportunity if they can keep earnings steady. With that said, their earnings growth rate is down by -0.68%, which raises some red flags; however, with an earnings yield sitting at 10.94%, it’s pretty appealing in today’s market. Keep in mind no dividends here since the company is focusing on investments and cutting down debt instead of rewarding shareholders directly. And with a debt-to-capital ratio of 34.78%, that’s not a bad move, but it does add pressure on management to continue hitting home runs on smart investments.

Furthermore, the fair value ratio of 15.00x compared to the current P/E shows the stock might be trading below its true value, and that means there’s potential for upside. Bottom line, in my opinion, while the stock’s price is gaining and some financials look good, there are still big questions about earnings growth and how they’re managing their money. This explains why the stock seems to be attracting more risk-adverse-takers, but conservative investors should think twice with no dividends.

Risks & Headwinds

There are some bearish signs that could dampen this optimistic outlook. A glass-half-full perspective would say that Heritage is being picky and strategic about new business, aiming for steady growth instead of going big. So while this careful approach reduces risk, it might slow down short-term growth that’s needed to keep that undervalued thesis in check. The company’s ongoing legacy claims, especially from Hurricane Irma, needed more reserves this quarter, which could hurt profits even though most of these claims are nearly settled. Furthermore, while Florida’s rate moderation helps with stability, it might make it harder for the company to pass on higher costs, potentially tightening margins.

Speaking of margins, the net expense ratio jumped to 36.8% from 34.8% last year due to higher acquisition costs and general expenses, squeezing margins. Heritage’s careful strategy in Florida’s Tri-County area, despite potential opportunities, could limit its market share in this tough region. And while the company is starting to extend its investment durations, the short portfolio might limit returns if interest rates stay high longer than expected.

Heritage cut its policy count by over 69,000, or 14.1%, compared to Q2 2023. But in their defense, the company is cutting back in areas where it’s too invested or not making money, while focusing more on profitable places and products. CEO Garateix said:

Through our risk-based management of policy count in total insured value and proactive engagement with our reinsurance partners, we have maintained a stable supply of indemnity-based reinsurance at manageable costs. Importantly, we expect the headwind from declining policies to begin to moderate, as we look forward over the next few quarters.

The financial hit from Hurricane Ian was clear (although, already baked into the stock price, in my view), with reinstatement premiums hitting $18.7 million in the first half of 2024, showing the ongoing risk from major events, but that’s a given yet needs to be said for potential new investors. And finally, as alluded to in its “valuation”, the Board decided to keep the quarterly dividend suspended, which might disappoint income-focused investors. Moreover, that money is being used to increase spending on tech, cybersecurity, and infrastructure. So while that’s crucial for long-term growth, it could hurt short-term profits.

Rating

I’m rating HRTG as a “Buy.” They had a great Q2 with solid profit growth and better risk management and in my analysis, even with the recent price jump, the stock’s still undervalued. Furthermore, they’re smartly expanding in profitable areas and optimizing reinsurance, which points to more growth ahead.