SJPailkar

Introduction

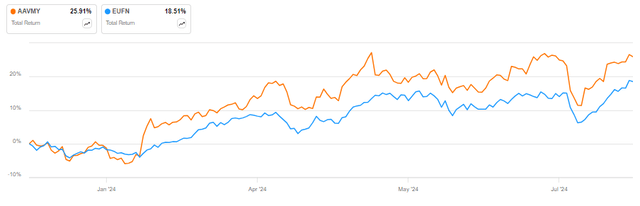

ABN AMRO (OTCPK:AAVMY) has outperformed the iShares MSCI Europe Financials ETF (EUFN) so far in 2024, delivering a total return of almost 26% against the circa 19% gain for the benchmark ETF:

I also covered the shares back in March 2024 arguing they were cheap relative to the largest Dutch peer ING Groep (ING). While I still see ABN AMRO as the better pick among the two banks, I reckon that currently there are better opportunities in the European financial sector, especially outside the Netherlands. As such, taking into account my expectations for a reduction in profitability to the bank’s 2026 target on the back of ECB rate cuts and normalizing credit costs, I think a Hold rating is appropriate for the shares, and instead recommend selling covered calls to generate extra current income.

Company Overview

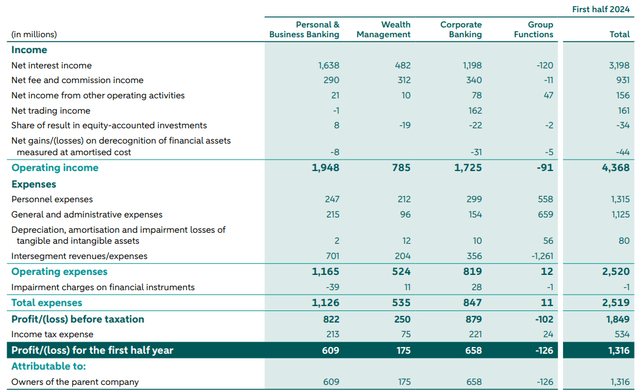

You can access all company results here. ABN AMRO is a Dutch bank reporting results in three operating segments, namely Personal & Business Banking at 44% of H1 2024 operating income, Wealth Management at 17%, and Corporate Banking at 39% of H1 2024 operating income:

Segment results (ABN AMRO Q2 2024 Financial Report)

Net interest income, or NII, accounts for 73% of H1 2024 operating income, in line with the contribution in 2023 and 2022, but marginally ahead of the 69% NII contribution in 2021 before the ECB raised interest rates.

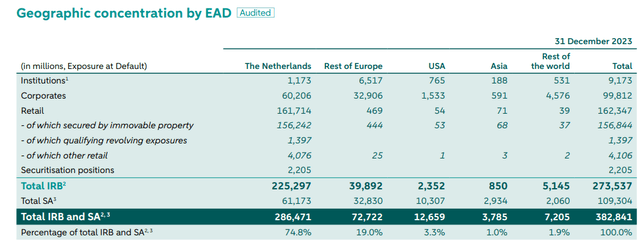

The bank is heavily concentrated in the Netherlands, which accounted for 74.8% of its exposure at default, or EAD, at the end of 2023, followed by the Rest of Europe at 19%:

Geographic concentration (ABN AMRO 2023 Annual Report)

Operational Overview

Personal & Business Banking delivered 3% lower Y/Y operating income in Q2 2024, impacted by declines in NII and other operating income. At the same time, operating expenses were flat Y/Y, which together with provision releases (although smaller than the prior-year quarter) resulted in a 10% Y/Y decline in segment profit in Q2 2024.

Wealth Management also saw a 6% lower operating income Y/Y, again impacted by lower NII. Operating expenses shot up 9% Y/Y while the cost of risk normalized (the prior-year quarter saw provision releases). This resulted in the segment’s Q2 2024 profit plunging 42% Y/Y.

Corporate Banking recorded a 1% decline in operating income Y/Y, impacted by lower other operating income (driven by derecognition losses). Operating expenses surged 30% Y/Y as the prior-year quarter benefited from lower regulatory levies and a release of an accrued contribution. This drove segment profit 28% lower Y/Y in Q2 2024.

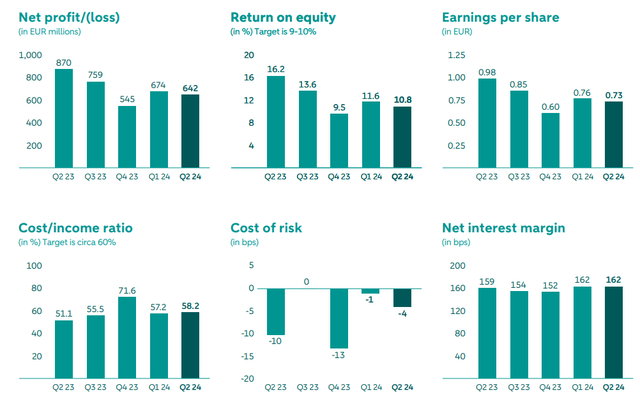

On a consolidated level, operating income dropped 2% Y/Y in Q2 2024, while operating expenses rose 11% Y/Y. The bank still benefitted from provision releases (cost of risk -4 basis points). Earnings per share stood at €0.73/share, down 26% Y/Y, while the return on equity was 10.8% in the quarter. The tangible book value per share stood at about €26.65/share. Net interest income was 1% lower Y/Y, while net fee and commission income rose 4% Y/Y in Q2 2024.

Result highlights (ABN AMRO Q2 2024 Financial Report)

Capital Position

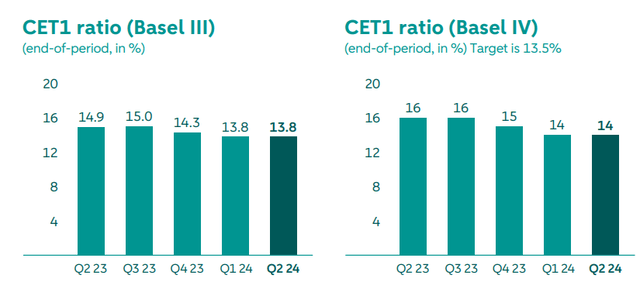

ABN AMRO ended Q2 2024 with a CET1 ratio of 13.8%, flat Q/Q. The bank still expects a small boost to capital from the implementation of Basel IV regulations next year, as the Basel IV CET1 ratio stands at 14%, also flat Q/Q:

Capital position (ABN AMRO Q2 2024 Financial Report)

At a CET1 ratio of 14%, the bank has a 2.8% buffer relative to its maximum distributable amount, or MDA, requirement. It also has a 0.5% buffer relative to its internal 13.5% target.

Updated Outlook

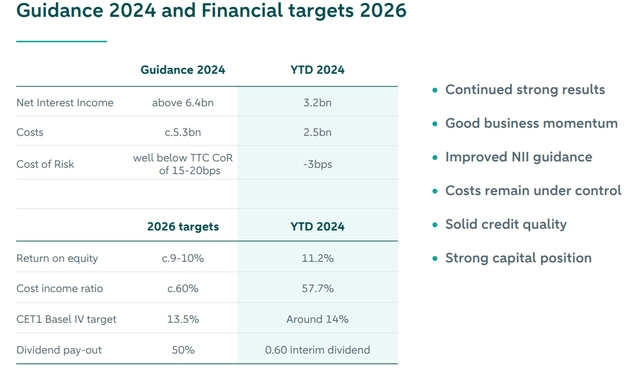

Despite the substantial normalization in operating performance relative to an exceptional prior-year quarter, the company marginally increased its NII guidance to above €6.4 billion:

Updated outlook and progress to 2026 targets (ABN AMRO Q2 2024 Q2 2024 Results Presentation)

Overall, ABN AMRO will likely exceed its 2026 return on equity target of 9-10% this year, helped by a benign credit environment and lingering benefits from higher NII, which I expect to fade as the ECB cuts interest rates.

Valuation and prospects

ABN AMRO is currently trading at an earnings yield to tangible equity of about 19.4%, which is quite attractive. However, I expect the cost of risk to normalize and NII to decline; hence I estimate the longer-term earnings yield to tangible equity is closer to 16%, which is still decent.

Overall, I still think ABN AMRO is a better pick compared to ING, largely due to a higher earnings yield and the potential of a larger bank acquiring ABN AMRO at a premium (which is absent in the case of ING in my opinion). That said, I think ABN AMRO has realized some of its valuation potential relative to non-Dutch peers, as evidenced by its year-to-date outperformance; hence I reckon a Hold rating is appropriate for the shares.

In the paragraph below, I will highlight a covered call strategy that may help you navigate the coming profitability decline as the ECB cuts rates and credit costs normalize.

Income generation with covered calls

I should note my covered call idea on ING in January 2024 proved to be way too early, with the strategy substantially underperforming a buy-and-hold approach. I would bet the timing for ABN AMRO is more appropriate, as the stock has already had a nice return in 2024, although not as good as ING.

In the table below, I highlight two strike prices you may find interesting:

| Option Expiration\Annualized option return at the strike price | €16 | €17 |

| December 2024 | 15.3% | 6.9% |

| June 2025 | 10.7% | 7% |

Source: Author calculations

ABN AMRO pays dividends twice a year (the next payment is in September, but the ex-dividend date has already passed); hence it is quite likely you may collect some dividends in addition to your options income. The current yield stands at 9.4%, and I think it is well covered in light of the bank’s capital position and long-term earnings generation potential.

I would also note that returns do not include any capital gains, and you may generate extra income on the option premium that you receive upfront.

Risks

The main risk of a covered call strategy is that it limits your upside while exposing you to full downside risks. This may prove especially painful if a larger bank decides to acquire ABN AMRO at a premium (I have no indication of this happening at the moment). At the same time, the strategy may mitigate losses during a market downturn.

Turning back to ABN AMRO, the main risk in holding the shares is that the bank generates 73% of its operating income from NII, hence is likely to be severely affected by ECB rate cuts. As a result, reaching its 9-10% profitability target is not guaranteed, especially if the ECB drops interest rates to below 1.5-2%.

Conclusion

ABN AMRO reported weaker Y/Y results in Q2 2024 (although the return on equity is still running above the bank’s 2026 target), and I expect profitability to continue dropping in the next few years as the ECB cuts interest rates, impacting NII. I also think credit costs will normalize, as the recent provision releases are not sustainable long-term.

While the bank may provide further upside relative to ING, I reckon ABN AMRO has less upside relative to non-Dutch European peers. As such, I think it is prudent to downgrade the shares to a Hold and focus on an income-generating strategy such as selling covered calls.

Thank you for reading.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.