Violka08

Finding clarity in complexity: Fixed income outlook for 2025

As 2024 closes, the fixed income market faces familiar challenges: monetary policy shifts, fiscal pressures and persistent inflation concerns— complexities that have shaped the landscape since 2020. While the short-term backdrop may appear daunting, it doesn’t detract from Oakmark’s ability to uncover compelling opportunities for our investors. Rooted in fundamental value, our investments are intended to grow over the long term and provide steadiness in a world too often focused on short-term gains.

Heading into 2025, fixed income investors seem focused on three key themes:

- Implications of growing fiscal deficits

- The Federal Reserve’s next moves

- Strategies for finding value amid complexity

Is this the year fiscal deficits make fixed income uninvestable?

The size and scale of U.S. fiscal deficits are becoming harder to ignore. Debt-to-GDP ratios are nearing 120%, according to the Congressional Budget Office, and Treasury issuance is projected to exceed $2 trillion in 2025. This surge in supply, coupled with fears about how markets will absorb it, has fueled concerns that bonds are losing their place as a viable investment.

However, as we outlined in our second-quarter commentary, “Don’t let them scare you out of bonds,” these concerns often overlook the market’s resilience, which is driven by a number of structural realities.

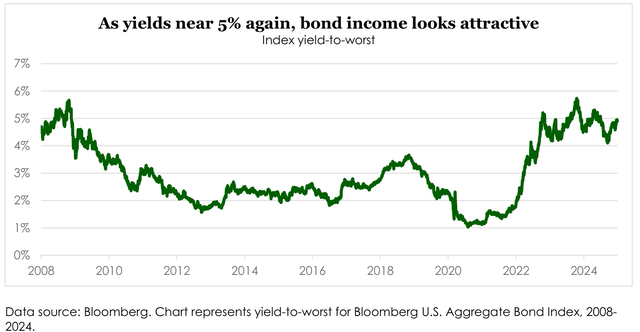

Fiscal deficits and heavy Treasury issuance might seem intimidating, but the bond market’s historical resilience tells a more balanced story. Demand tends to rise as value improves— elasticity that is evident as real and nominal yields reach attractive levels. Structural buyers, like pensions and insurers, continue to provide critical support, even as some sovereign demand softens. With yields once again compensating investors for inflation risks and offering long-term stability, bonds remain a cornerstone for thoughtful, income-focused portfolios.

- Attractive all-in nominal and after-inflation yields: The Bloomberg U.S. Aggregate Bond Index yield is once again near 5% due to the very large backup in rates during the fourth quarter, fundamentally improving the value proposition of fixed income investments.

- Elasticity of demand: So much focus has been on the supply side of the story that we like to remind folks that bonds, just like most liquid investment products, have elastic demand curves. That means when value goes up, demand tends to go up. Historically, real yields on 10-year Treasurys (US10Y), which now exceed 2%, have made longer duration assets more compelling, attracting both domestic and international buyers.

- Liquidity from money markets: The sheer scale of money market and front-end paper— currently over $6 trillion in assets—represent a reservoir of demand potential that we believe will eventually flow back into longer duration securities as rate volatility stabilizes.

- Treasurys as the global reserve currency: Treasurys remain the financial world’s comfort food, steadfast in demand regardless of market mood swings. Although recently there has been decreased demand from several major sovereign governments, structural demand from pensions, insurers and the institutional money management business continues to underpin the market.

- Historical resilience: Supply concerns are not new. Treasury issuance exceeded $1.8 trillion in 2023, yet bond markets absorbed the issuance without long-term disruption. Historically, shifts in yield curves and real rates have prompted reallocation into duration, providing critical support to the bond market even during periods of heavy issuance.

How will the Fed react to fiscal or geopolitical risks that could reignite inflation?

Inflation has cooled significantly, falling from its mid-2022 peak of 9.1% to 3.1%. However, the path to sustained price stability is not guaranteed. Fiscal policies aimed at reshaping the U.S. economy—such as reshoring initiatives, tariffs and restrictions on low-cost immigrant labor—carry long-term risks. These policies disrupt supply chains, elevate production costs and could embed structural inflationary pressures into the economy. Geopolitical factors, such as energy price shocks or supply chain disruptions stemming from conflicts, further complicate the inflation outlook.

The Fed’s challenge in 2025 lies in navigating these uncertainties while maintaining its hard-won credibility. Fed Chair Jerome Powell and his colleagues understand the stakes: Cutting rates too quickly could undo years of painstaking effort to restore price stability. Despite benign inflation data in recent months, the Fed remains cautious and well aware that fiscal and geopolitical factors could reignite inflationary pressures. As I noted in a recent Making Markets podcast:

“The Fed’s credibility is its most important asset. Moving too quickly to cut rates, even in the face of benign inflation prints, risks an abrupt reversal if fiscal or geopolitical factors reintroduce inflationary pressures. A return to rate hikes would destabilize markets and erode trust in the Fed’s ability to manage long-term price stability.”

This deliberate approach is shaped by the Fed’s lessons from the 1970s and 1980s when premature easing allowed inflation to resurge, forcing more aggressive tightening. Powell’s Fed seems determined to avoid repeating those mistakes, even if it means holding rates higher for longer. The bar for rate cuts is set high. Absent a severe recession or significant risk-off event, the Fed is likely to maintain its current posture well into 2025.

For fixed income investors, the implications are clear. A measured Fed reinforces income as the primary driver of returns in the current environment. Rate-driven capital appreciation, while possible in isolated instances, will likely take a backseat to steady, reliable income streams. This backdrop mirrors the dynamics of 2024 when cautious monetary policy, coupled with tight financial conditions, limited the scope for rate cuts but provided consistent opportunities for yield-seeking investors.

The Fed’s stance also underscores the importance of duration positioning and credit selection. Investors who align their portfolios with the Fed’s cautious trajectory are better positioned to weather potential volatility. Longer dated Treasurys, for example, benefit from the stability of anchored inflation expectations while select credit instruments continue to offer opportunities to capture yield without taking on excessive risk. For investors willing to adapt to a Fed that prioritizes credibility over short-term market appeasement, the fixed income market in 2025 offers fertile ground for thoughtful, income-driven strategies.

How do we invest amid today’s complexity?

Volatility and noise are unavoidable, but they also create fertile ground for disciplined investors. Below are four noteworthy aspects of the current fixed income backdrop.

- Recognize the extraordinary rate environment. Over the past three months, 10- and 30- year U.S. Treasury yields (US30Y) have surged nearly 1%, a move that represents almost two standard deviations from historical norms. Such significant shifts are rare. For those confident that the Fed will meet its 2% inflation mandate within the next three to five years, today’s market offers compelling opportunities. Real yields now exceed 2.5% above long-term inflation expectations, providing an attractive foundation for income- focused portfolios—without requiring exposure to credit risk.

- Draw on the advantages of active management. Credit spreads near historic lows leave little room for error in evaluating default risks. Success hinges less on aggressively pursuing high-yielding opportunities and more on avoiding poor risk-reward dynamics. Managers with the flexibility to bypass overpriced segments of the market—such as specific areas of corporate credit or leveraged loans—are better positioned to deliver sustainable returns. In this context, avoiding losses while earning a consistent 5%+ income stream creates a compounding advantage that passive strategies often fail to achieve.

- Look for opportunities in key asset classes. Leveraged loans, with their floating-rate structures, offer protection against further rate volatility while providing attractive yields that compensate for inherent risks. Similarly, agency mortgage-backed securities present significant value. Spreads relative to corporate credit remain historically wide, and as rate volatility stabilizes, the convexity challenges that have weighed on MBS are likely to ease, making these instruments particularly appealing to income-focused investors. High-quality credit instruments, which offer predictable cash flows and robust enterprise value coverage, also stand out. These assets emphasize the importance of disciplined credit selection to avoid overvalued names while focusing on resilience and durability in volatile markets.

- Focus on individual credit stories. Consistently outperforming in fixed income doesn’t require macroeconomic predictions or attempts to time sector trends. Instead, it’s about identifying opportunities where markets misprice credit relative to its default risks. This approach emphasizes deep, bottom-up research to uncover businesses with strong capital allocation, companies enduring temporary challenges but maintaining operational strength, or hard assets undervalued in current market conditions. By concentrating on fundamentals, we reduce reliance on unpredictable macroeconomic outcomes and enhance potential returns.

The road ahead

The fixed income market in 2025 remains complicated, but not uninvestable. Concerns about the deficit, rate volatility and other economic factors are counterbalanced by what we feel is a growing value case for fixed income assets as real yields climb.

We see opportunities for those willing to dig deeper. Leveraged loans stand out for their compelling yields, and MBS agency paper offers compelling relative value for long-term investors, especially compared to corporate benchmark paper and U.S. Treasurys. Across the board, we recommend focusing on high-quality issuers that continue to provide durable cash flows and resilience against potential market shocks—an antidote to the temptation of chasing yield at any price when index credit spread levels are still near historical lows.

At Oakmark, we don’t view complexity as a barrier; it’s a feature of markets that rewards thoughtful, active management. The guiding principles discussed here—focusing on long-term value, avoiding unnecessary risks and embracing the discipline of individual credit analysis— remain as relevant as ever in navigating the challenges of today’s bond market.

Happy New Year to you and your families! Here’s to another year of thoughtful investing and uncovering value.

Adam D. Abbas

Portfolio Manager

|

The information, data, analyses, and opinions presented herein (including current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) are for informational purposes only and represent the investments and views of the portfolio managers and Harris Associates L.P. as of the date written and are subject to change and may change based on market and other conditions and without notice. This content is not a recommendation of or an offer to buy or sell a security and is not warranted to be correct, complete or accurate. Certain comments herein are based on current expectations and are considered “forward-looking statements.” These forward-looking statements reflect assumptions and analyses made by the portfolio managers and Harris Associates L.P. based on their experience and perception of historical trends, current conditions, expected future developments, and other factors they believe are relevant. Actual future results are subject to a number of investment and other risks and may prove to be different from expectations. Readers are cautioned not to place undue reliance on the forward-looking statements. This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell or hold a security or an investment strategy, and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her financial professionals. Yield is the annual rate of return of an investment paid in dividends or interest, expressed as a percentage. A snapshot of a fund’s interest and dividend income, yield is expressed as a percentage of a fund’s net asset value, is based on income earned over a certain time period and is annualized, or projected, for the coming year. The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasurys, government- related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid ARM pass- throughs), asset-backed securities and commercial mortgage-backed securities (agency and non- agency). This index is unmanaged and investors cannot invest directly in this index. The Oakmark Bond Fund invests primarily in a diversified portfolio of bonds and other fixed-income securities. These include, but are not limited to, investment grade corporate bonds; U.S. or non-U.S.- government and government-related obligations (such as, U.S. Treasury securities); below investment- grade corporate bonds; agency mortgage backed-securities; commercial mortgage- and asset-backed securities; senior loans (such as, leveraged loans, bank loans, covenant lite loans, and/or floating rate loans); assignments; restricted securities (e.g., Rule 144A securities); and other fixed and floating rate instruments. The Fund may invest up to 20% of its assets in equity securities, such as common stocks and preferred stocks. The Fund may also hold cash or short-term debt securities from time to time and for temporary defensive purposes. Under normal market conditions, the Fund invests at least 25% of its assets in investment-grade fixed- income securities and may invest up to 35% of its assets in below investment-grade fixed-income securities (commonly known as “high-yield” or “junk bonds”). Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. Bond values fluctuate in price so the value of your investment can go down depending on market conditions. All information provided is as of 12/31/2024 unless otherwise specified. Before investing in any Oakmark Fund, you should carefully consider the Fund’s investment objectives, risks, management fees and other expenses. This and other important information is contained in a Fund’s prospectus and summary prospectus. Please read the prospectus and summary prospectus carefully before investing. For more information, please visit Oakmark.com or call 1-800-OAKMARK (1-800-625-6275). Natixis Distribution, LLC (Member FINRA | SIPC), a limited purpose broker-dealer and the distributor of various registered investment companies for which advisory services are provided by affiliates of Natixis Investment Managers, is a marketing agent for the Oakmark Funds. Harris Associates Securities L.P., Distributor, Member FINRA. Date of first use: 01/08/2025 QCM-4132ADA-04/25 OPINION PIECE. PLEASE SEE ENDNOTES FOR IMPORTANT DISCLOSURES. Harris Associates | 111 South Wacker Drive, Suite 4600 | Chicago, IL 60606 | 312.646.3600 |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.