Klaus Vedfelt

Recap and Q2 Earnings

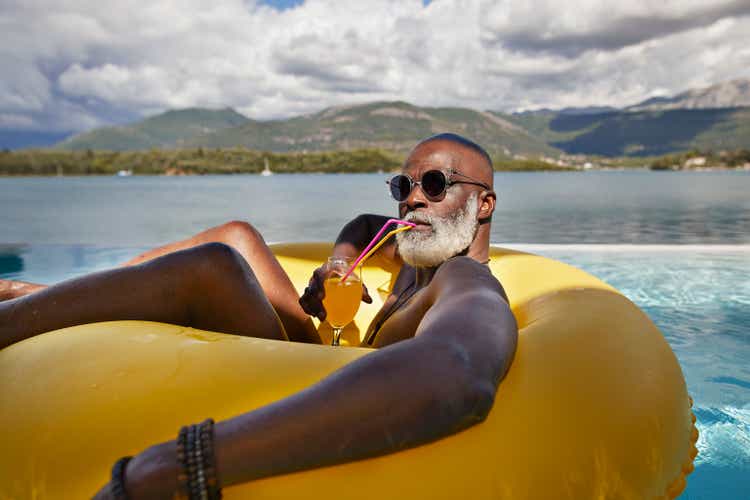

We last covered Trip.com (NASDAQ:TCOM) (OTCPK:TRPCF) back in Nov 2023.

Coverage history (Seeking Alpha)

We noted that the management was cautious about the company’s potential for short-term margin expansion because it has increased marketing spending to compete with other nearby businesses like Meituan (OTCPK:MPNGF) and Douyin, the parent company of TikTok. With a strategic alliance with Booking (BKNG) and an edge in the supply chain, management was enthusiastic about the company’s international expansion. Booking shares its enormous hotel inventory with Trip, enabling Trip to provide a wider selection for customers than its competitors. Trip reported that their outbound hotel and flight ticket booking volume returned to 2019 levels this quarter, significantly above the industry average by 20–30%, suggesting that the strategy is working very well. This implies that Trip is probably growing its market share and expanding its geographic distribution network.

Customer Base and Product Reception

Trip reported that its new products are well received by both its younger and older customers and that there is no indication that spending will slow down as their average GMV per customer statistic is unchanged from the previous year. We credit Trip’s apparent immunity from the struggling Chinese economy to the company’s devoted customer base. Trip said that 65–70% of all orders are placed using mobile devices, indicating that most users access the site directly rather than via price comparison meta-searches. Trip’s new product offers therefore have a higher chance of receiving good feedback from clients.

Focus on Senior Customers

Trip stated that its Old Friends Club offerings, which target elderly customers, are one of the growth drivers. Since launching last quarter, it has generated approximately RMB1.6 billion in revenue. Trip stated that these clients are becoming more and more interested in customized travel powered by AI technologies. With the introduction of AI helper, Trip can now more easily customize products for customers. Trip’s revenues from packaged tours increased by 42% during the periods, demonstrating this. This aligns with the insights gained by New Oriental Education’s (NYSE:EDU) emphasis on senior customer market opportunities. These clients are already retired, have funds, and should be less affected by the state of the Chinese economy.

Inbound Travel Boom

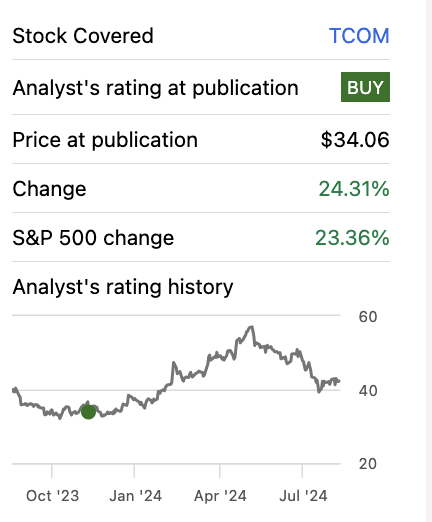

Moreover, management reported that inbound travel bookings increased by 200% during the quarter and now make up more than 25% of total revenue—a bigger percentage than pre-pandemic. This indicates that the demand for inward travel is probably overestimated. We believe that this is most likely because travel expenses in China are now very low when compared to those in Western countries. China came in at number 79 on the World Travel Index for the cost of travel. As an FYI, Japan, which is renowned for having inexpensive travel expenses, was placed 128th on the ranking. Thus, aside from geopolitical considerations, budget-conscious travelers likely find China’s trip appealing.

Travel cost ranking (World travel index)

Valuation

Over the last few quarters, Trip’s earnings growth velocity has maintained double digits despite a downturn trend. (see below chart) As a result, the current retreat probably reflects the worry.

Earnings history (Seeking Alpha) Stock Chart (Seeking Alpha)

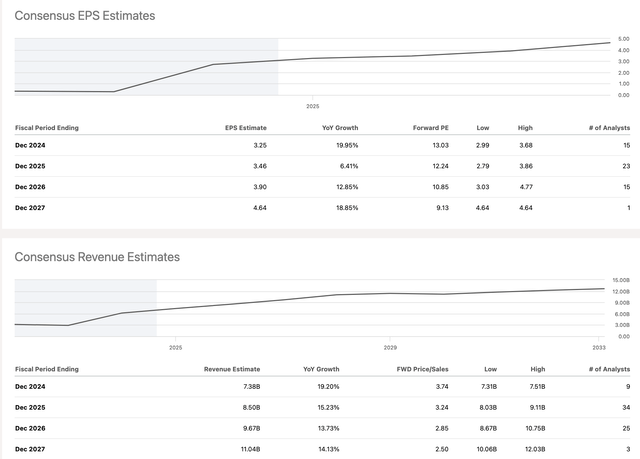

Nonetheless, analysts see double-digit topline growth over the following three years. (see below chart) Its growing momentum should be supported, in our opinion, by robust international business growth and resilient senior customer spending. The company maintains a dominant market share and a devoted clientele; as such, it should continue to generate substantial profits to maintain the pace for bottom-line growth. Consequently, we conclude that the 13x projected P/E ratio is not particularly expensive for investors seeking exposure to Chinese stocks.

Earnings forecast (Seeking Alpha)

Challenges and Risks

The management stated that the rise in supply is putting short-term pressure on prices. The company also plans to increase its marketing expenditures to boost its international business. As a result, we continue to observe the upward pressure on margin expansion, which limits its valuation multiples upside. The company’s focus on Chinese consumers raises concerns, as the management has noted that the surge in international travel has led to a cannibalization of domestic travel. If China’s economy continues to deteriorate, spending by senior group customers may eventually reach a plateau. However, we do not consider it to be a short-term concern. Having said that, investors should keep an eye out for macro-related risks in the general Chinese economy.

Conclusion

The company maintains its leadership because of its edge in the supply chain and its industry-leading margin. The company’s customer base is devoted, and they responded well to its new product offering. As such, we anticipate that the company will outperform its competitors in the medium run. The company should continue to build on the short-term momentum of its expansion provided by senior economy and international travel. As a result, we continue to recommend buying the stock.