knowlesgallery/iStock via Getty Images

This article was coproduced with Kody Kester.

It’s not a secret that there are thousands of dividend-paying stocks in the investment universe. There are probably only several hundred that are qualitative enough to be worth thinking about buying and holding for the long haul, though.

That’s because many of these dividend payers are unsustainable. They may have deteriorating growth prospects, elevated payout ratios, a junk-rated and worsening balance sheet, or a significantly unfavorable risk profile overall.

On the flip side, I tend to think that a majority of Dividend Kings, Dividend Aristocrats, Dividend Champions, and Dividend Contenders could justify further due diligence. After all, it’s rather difficult to navigate at least 10 years and deliver consistent dividend growth without at least some things going a company’s way. That’s because a full business cycle from peak to trough is around a decade or so.

Idacorp (NYSE:IDA) is a company that meets my quality requirements and warrants my coverage.

When I last covered the electric utility with a buy rating in May, I appreciated its economic development efforts. I thought this could lead to decent future growth for the utility. IDA was also in respectable condition financially. Not to mention that the stock’s share price at the time offered some upside value.

On Aug. 1, IDA released its financial results for the second quarter ended June 30.

Today, I’m going to be reiterating my buy rating. Recent economic development milestones reinforce my bullish thesis toward future growth. IDA’s interest coverage ratio in the first half of 2024 was solid. Finally, shares are still trading at a valuation that could produce strong total returns through 2026.

An Excellent Second Quarter And Raised 2024 Guidance

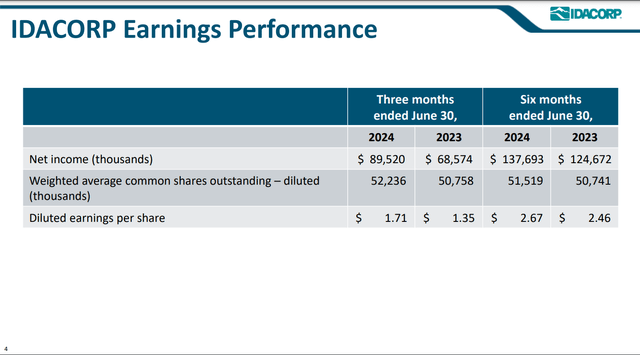

IDA Q2 2024 Earnings Presentation

IDA put up a strong second quarter for its shareholders. The company’s operating revenue grew by 9% over the year-ago period to $451 million during the quarter. For context, this was $10.9 million ahead of Seeking Alpha’s analyst consensus for the quarter.

This topline growth was driven by multiple elements. The company’s higher average customer rates accounted for the majority of this uptick in operating revenue. That was because of the 2023 Settlement Stipulation from the Idaho Public Utilities Commission that went into effect on Jan. 1.

Another catalyst for IDA was its total customer count rising by 2.6% year-over-year to top 640,000 as of June 30. This was due to the vigorous economic growth that IDA’s service territories are experiencing, which is positively impacting its migration trends.

Usage per customer was also higher in all customer classes. That was led by a 17% increase in energy usage per irrigation customer to run irrigation pumps. Warmer weather in June also helped lead to an increase in energy usage per residential customer.

IDA’s diluted EPS surged 26.7% over the year-ago period to $1.71 in the second quarter. That was a whopping $0.33 beat vs. Seeking Alpha’s analyst consensus during the quarter.

Disciplined cost management caused IDA’s operating expenses to grow by just 4.9% to $347.8 million for the second quarter. Coupled with a lower income tax expense, this resulted in diluted EPS growth exceeding operating revenue growth in the quarter.

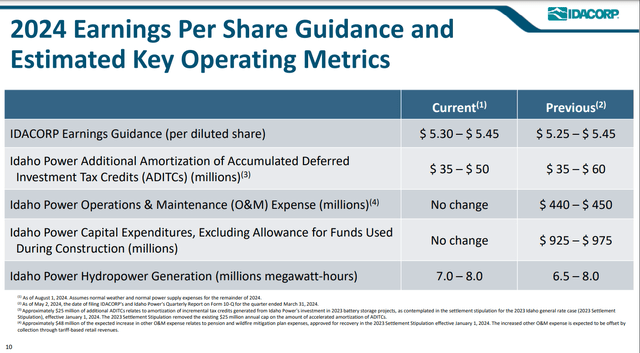

IDA Q2 2024 Earnings Presentation

IDA’s blowout quarter for diluted EPS prompted management to raise the low end of its guidance from $5.25 to $5.30 for 2024. That increased the diluted EPS midpoint from $5.35 ($5.25 to $5.45) to $5.375 ($5.30 to $5.45). This is in line with the 2024 FAST Graphs analyst consensus of $5.38. That would represent a 4.7% growth rate over the 2023 base of $5.14.

Looking out beyond this year, the future is just as bright for a few reasons.

In Idaho, IDA has filed for an increase of $99 million to its annual operating revenue per CEO Lisa Grow’s opening remarks during the Q2 2024 earnings call. That would be a 7.3% lift in the Idaho operating revenue base. This is aimed at recovering infrastructure investment and labor expenses not included in its last general rate case. Management anticipates that proceedings for this limited-scope case could start in late September or early October.

In Oregon, IDA reached a settlement with the Oregon Public Utility Commission for a $6.7 million overall rate increase. This would be a 12% increase in the Oregon operating revenue base that could become effective this October.

Beyond the encouraging regulatory developments, economic development has also been working in IDA’s favor. In July, Lamb Weston completed its $415 million expansion at its facility in American Falls. This will be a benefit to IDA’s electric load in the quarters ahead.

Grow also indicated that the company remains ahead of schedule in construction of the Meta data center in Kuna and the Micron expansion in Boise. She added that the first 15-acre chip substation being built for Micron arrived at the end of June.

For these reasons, the FAST Graphs analyst consensus is that diluted EPS will climb by another 7.6% in 2025 to $5.79. For 2026, another 4.5% growth in diluted EPS to $6.05 is projected.

IDA should have the financial ability to make the necessary investments to support the upcoming growth in its electrical load. The utility’s interest coverage ratio in the first half of 2024 was 3.1. Since regulated utilities come with more visibility than most other companies, that’s an ideal interest coverage ratio for my money.

(Unless otherwise sourced or hyperlinked, all details in this subhead were according to IDA’s Q2 2024 Earnings Press Release, IDA’s Q2 2024 10-Q Filing, and IDA’s Q2 2024 Earnings Presentation.)

Fair Value Is Nearing $115 A Share

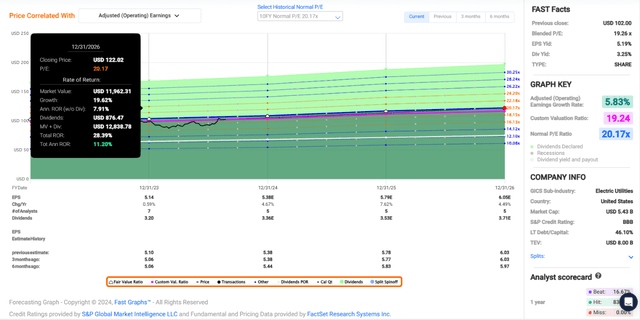

FAST Graphs, FactSet

Since my previous article, shares of IDA have matched the 5% gains of the S&P 500 index. However, I would contend that share valuation is still about as attractive now as three months ago.

IDA’s current-year P/E ratio of 18.9 remains less than the 10-year normal P/E ratio of 20.2 according to FAST Graphs. Moving forward, I believe that a return to a valuation multiple of around 20 is realistic.

This is a bit above my previous fair value estimate of 19.2. At that time, I expected interest rates to be a bit above the 10-year average in the years to come. Fortunately, Morningstar anticipates that the federal funds rate will decrease to between 1.75% and 2% by year-end 2026. This would be in line with the 10-year average federal funds rate of 1.8% per data from Macrotrends.

IDA’s annual forward diluted EPS growth potential of 5.8% is similar to the 5.6% mark when I last covered it. This is much better than the 10-year average of 3.8% per FAST Graphs.

In a few days, the calendar year 2024 will be 67% complete. That means another 33% of 2024 and 67% of 2025 lies ahead in the next 12 months. This is how I arrive at a 12-month forward diluted EPS input of $5.66.

Applying my fair value multiple of 20.2, I compute a fair value of $114 a share. That suggests shares of IDA are priced 10% below fair value from the current $102 share price (as of Aug. 26, 2024).

If the utility matches the growth consensus and returns to fair value, it could generate 28% cumulative total returns through 2026.

A Secure Dividend That Can Keep Rising

Dividend Kings Zen Research Terminal

IDA’s 3.3% forward dividend yield registers under the utility sector median forward yield of 3.7%. This accounts for the C- grade from Seeking Alpha’s Quant System for forward dividend yield.

Everywhere else, though, IDA scores high marks. The company’s dividend payout ratio is poised to come in around the low 60% range in 2024. That’s comfortably below the 75% payout ratio that rating agencies view as safe for the industry, per our research terminal. This lies behind the A- grade from the Quant System for dividend safety.

That also puts IDA in a great position to extend its 12-year dividend growth streak. This is better than the sector median of 10.1 years. That’s enough for the Quant System to issue an A- grade to the utility for dividend consistency.

IDA also won’t be just barely raising its payout to keep its dividend growth track record alive, either. The company’s five-year annual dividend growth rate of 5.7% is above the sector median of 5.2%. This growth is sufficient for a B+ grade from the Quant System for overall dividend growth.

Considering the manageable payout ratio and steady growth prospects, similar dividend growth should continue in the years ahead.

Risks To Consider

IDA’s fundamental outlook is positive, but it still has risks that are worth mentioning. In the company’s Q2 2024 10-Q Filing, no new risks are outlined. So, I’ll take this as an opportunity to again touch on risks from prior articles.

The first risk to IDA is the potential for a cyber breach. As a utility, the company is frequently the target of attempted breaches. If any are successful on a large scale, that could disrupt IDA’s operations. It could also compromise sensitive customer information, which could open the utility up to sizable lawsuits. That could weigh on the investment thesis.

Another risk to IDA is that 65% of the company’s year-to-date total system generation consisted of hydropower generation (IDA’s Q2 2024 10-Q filing). That makes the utility vulnerable to water management problems like droughts and a shortage of water. That could interrupt IDA’s operations or force it to turn to more costly power supply sources for its customers.

As I noted in my previous article, IDA operates entirely in Idaho and Oregon. If the company experiences any regulatory setbacks with rate case outcomes, that could harm its fundamentals.

Additionally, the company’s concentration makes it vulnerable to natural disasters such as wildfires. If severe enough, this could inflict damage to IDA’s infrastructure above its commercial insurance coverage. That could diminish the company’s earnings capacity.

Summary: Buy For Double-Digit Annual Total Return Potential

IDA is a quality utility with appealing features. Economic development bodes well for the company’s growth potential. The BBB credit rating from S&P on a stable outlook is another plus.

IDA’s 10% discount to fair value means that 11% annual total returns in the next couple of years are a high probability, in my opinion. I’m maintaining my buy rating here.

Author’s Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed to assist in research while providing a forum for second-level thinking.