pingingz

August 28th ended up being a really bad day for shareholders of nCino, Inc. (NASDAQ:NCNO). This is because, the day prior, after the market closed, the management team at the business announced financial results covering the second quarter of the company’s 2025 fiscal year. Even though revenue and adjusted earnings per share came in higher than anticipated, GAAP earnings fell short of expectations. Revenue guidance for the third quarter of 2025 indicates slower top-line expansion in the near term than what analysts were hoping to see. These factors sent shares plummeting roughly 13% in midday trading.

This might seem like an overreaction considering how the company did on the whole for the quarter. But this is the problem with investing in expensive firms that are still having trouble achieving profitability. This was my concern when I reaffirmed my “sell” rating on the stock in an article published in March of this year. Even though the company had achieved stellar results for the final quarter of its 2024 fiscal year, shares looked “drastically overvalued.” Since then, the “sell” rating has worked out quite well. Shares are down 15.8% while the S&P 500 (SP500) is up only 6.5%. The return disparity is even more drastic when you consider my original “sell” rating on the stock from September 2022. Since then, shares are down 16.5% while the S&P 500 is up 36.8%.

Even though the company continues to grow at a nice rate, I don’t see the picture changing enough to justify an upgrade. Because of this, I am keeping my rating on the firm as it stands.

Mixed results are a problem for growth stocks

For those not familiar with nCino, the company operates a software-as-a-service (or SaaS) platform dedicated to servicing financial institutions of all sizes. The native cloud platform focuses on the banking sector, and it is dedicated to facilitating things like client onboarding, deposit account opening, loan origination, and more. It provides customers with data analytics and even provides those customers with an end-to-end mortgage suite of solutions. In March of this year, the business even acquired a firm called DocFox in exchange for $75 million. This solution helps to automate onboarding experiences for commercial and business banking firms.

Even recently, the kind of growth the company has exhibited has been impressive. Take the most recent quarter as an example. Revenue for the second quarter of the 2025 fiscal year came in at $132.4 million. This is 13% above the $117.2 million generated just one year earlier. While the company did enjoy a slight increase in professional services and other revenue, most of this upside came from its subscription services. Sales jumped 14% from $99.9 million to $113.9 million. This increase was driven mostly by higher revenue from existing customers as they increased their exposure to the solutions that nCino provides. However, 48% of the increase in subscription revenue came from customers who did not contribute to subscription revenues at the same time last year. This means new customers, for the most part.

Much to my chagrin, management does not provide any details on a quarter-to-quarter basis regarding the number of customers that the business has. I don’t think it would be useful to rehash the details from my prior article mentioned above. But in it, I did provide a breakdown of the firm’s total customers. In particular, I noted the number per solution that the company offers and the share of them that represent over $100,000 and those that represent over $1 million, individually, in revenue for the firm.

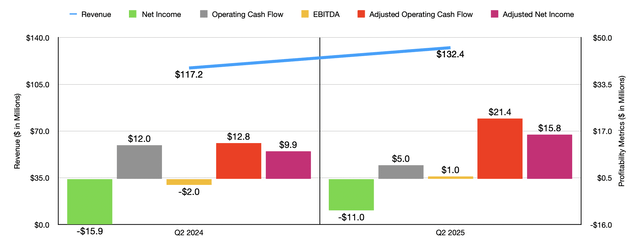

On the bottom line, management also achieved improved results. The company went from generating a net loss of $0.14 per share in the second quarter of 2024 to generating a net loss of $0.10 per share the same time this year. This improved the company’s net loss from $15.9 million last year to $11 million this year. It is worth noting that official earnings per share did come in $0.02 worse than what analysts were hoping to see. On an adjusted basis, the improvement was from a profit of $0.09 to a profit of $0.14. That took adjusted net income from $9.9 million to $15.8 million. The adjusted earnings per share reported by management did manage to come in $0.01 above what analysts were anticipating.

To be honest with you, I am not a huge fan of using these adjusted figures. For some companies, I am fine with that, but for this one I’m not because of the large amount of stock-based compensation added back. When you include stock-based compensation (“SBC”) that is of a significant amount to adjusted results, you are no longer reflecting what results might be if not for reasonable adjustments required. Instead, you are focused on trying to get something closer to cash flow. In that case, just looking at cash flows makes more sense.

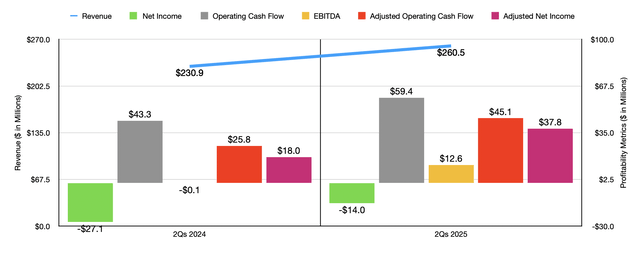

Speaking of cash flows, the firm did see a decline year over year from $12 million to only $5 million. But if we adjust for changes in working capital, we get a near doubling from $12.8 million last year to $21.4 million this year. Meanwhile, EBITDA for the company improved from negative $2 million to positive $1 million. In the chart above, you can also see financial results covering the first half of 2025 compared to the same time of 2024. As was the case for the second quarter on its own, the first half of this year looks meaningfully better than it did for the 2024 fiscal year.

In addition to falling short compared to expectations when it came to GAAP earnings, the company also provided guidance for the third quarter of the 2025 fiscal year that is lower than what professionals were hoping to see. Management currently anticipates revenue for that quarter of between $136 million and $138 million. This compares to estimates of $138.7 million. There is also a chance that earnings per share could come in lower than what analysts were hoping to see. Management is currently guiding for adjusted profits per share of between $0.15 and $0.16. However, analysts were expecting to see at least $0.16 in adjusted per share earnings.

As disappointing as third quarter guidance is, there was some positive news when it came to expectations for 2025 in its entirety. Adjusted earnings per share should come in at between $0.66 and $0.69 At the midpoint, that is slightly above the $0.67 that analysts anticipate. However, this will be based on revenue of between $538.5 million and $544.5 million, with a midpoint of $541.5 million. Analysts, meanwhile, were forecasting revenue of $541.7 million for the year.

These might seem like rounding errors. And fundamentally, I would agree with that assessment. However, this is the problem when it comes to growth investing. Don’t get me wrong. Growth investing can result in tremendous upside. But when things don’t go exactly as the market wants, significant downside can result.

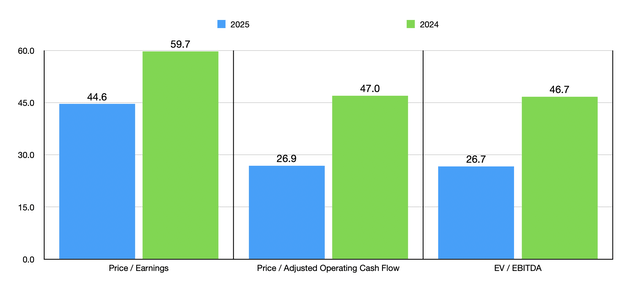

I refer to nCino as a growth candidate not only because of its attractive revenue expansion, but also because of how shares are priced because of it. If we take management’s estimate for adjusted earnings for this year, at the midpoint, we should anticipate adjusted net income of $77.7 million. Annualizing adjusted operating cash flow should result in a reading of about $128.8 million this year. And even if we give management slack and add back stock-based compensation, EBITDA for this year should be around $129.2 million.

Using these estimates, as well as historical figures for 2024, we can see how shares of the company are valued in the chart above. Thanks to the anticipated growth and the fact that the company has net cash on hand of $18.7 million, the forward EV to EBITDA multiple is no longer at atmospheric levels. The same holds true of the price to adjusted operating cash flow figure. But even on this basis, shares are very pricey.

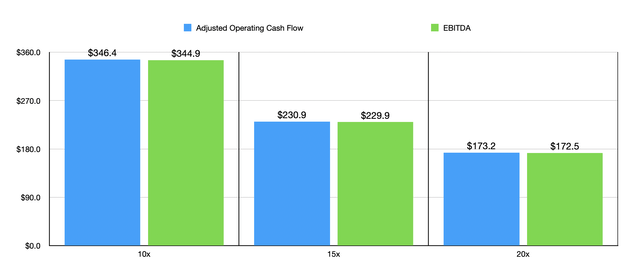

To put in perspective how much cash flow NCNO would need to generate to be fairly valued at a price to adjusted operating cash flow multiple of either 10, 15, or 20, or fairly valued at an EV to EBITDA multiple of between 10, 15, or 20, I created the chart below. Even if we use the more aggressive assumptions, shares are still quite a bit away from being fairly valued, let alone being undervalued.

Takeaway

I can honestly appreciate the continued growth that the management team at nCino is achieving. Long term, I fully expect this trend to continue. Having said that, this recent plunge in price further illustrates how fickle the market can be. Some investors might view this as a buying opportunity. But to me, nCino, Inc. shares are still very pricey. Given this, I’ve decided to keep the company rated a “sell” for now.