Thomas Barwick

Summary

I am neutral on Choice Hotels International (NYSE:CHH). My summarized thesis is that CHH will continue to suffer from macro pressure in the near term, and the stock will trade at a discount to peers because of the relative underperformance.

Company overview

CHH is a hotel franchisor with franchise agreements and owned hotels under various brands that has presence across the economy, midscale, upper midscale, and upscale chain scale hotels. As of 2Q24, CHH has a total room capacity of ~630k, split between 78% domestic (US) and 22% international. Operationally, royalty fees and other revenues from franchised & managed properties systems are the largest revenue segments, at 33% and ~50%, respectively. In the latest quarter (2Q24) reported, CHH reported total revenue of $435.2 million, a growth of 1.8% vs. last year. Supporting the minimal growth was ~1% royalty fee growth and ~40bps growth in other revenues from franchised & managed properties systems. The improved EBITDA margin helped drive the total EBITDA growth of 5.6%, resulting in a total adj. EBITDA of $161.7 million, but this was still below consensus estimates of $171 million.

Poor industry outlook

Based on the multiple macro data points and comments by players in the broader industry (travel and leisure), my view is that demand for hotels is going to worsen in 2H24. The positive data points that bulls will point out are that inflation has tapered and the Fed is likely to cut rates soon. These are true; however, all these take time before they translate into positive impacts on consumers’ balance sheets.

The reality today is that consumers are not spending a lot on discretionary items, and this is already showing up in the books of adjacent industry players. For example:

- Airbnb noted signs of slow demand from US guests.

- Disney noted moderation in consumer demand.

- Hilton management noted the market is definitely softening.

Even retailers are facing the pressure of weak consumer spending, and all this paints a negative picture for the hotel industry. Indeed, according to CBRE estimates, the industry is expecting to see a further step down in RevPAR growth in 2H24 because of the weaker demand outlook.

Relative underperformer in the industry

Within the industry, there is one particular player that is underperforming by a huge margin, and that is CHH. In my opinion, this should cause the stock to continue trading at a discount to its peers.

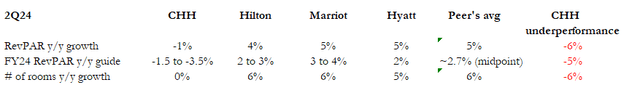

There are two key attributes in the growth equation for hotel operators: RevPAR (revenue per average room) and the number of rooms growth. As you can see from the comparison table above, CHH has severely underperformed peers in both aspects by a large margin. The main concern is RevPAR. This underperformance is likely to persist for the next few months because of the macro headwinds noted above. While this impacts all players, CHH’s poor relative performance is further highlighted here as it is the only player that is guiding negative RevPAR growth for FY24. This tells us that CHH either has very poor pricing power, which points to lower revenue quality (in that it is not as resilient as its peers during a demand downturn) or CHH does not have the same exposure to higher RevPAR growth markets. Both are bad.

(Note the “# of rooms y/y growth” refers to actual number of rooms operating as of 2Q24. 2Q24: 631,063 vs. 2Q23: 628,901, which is almost 0% growth)

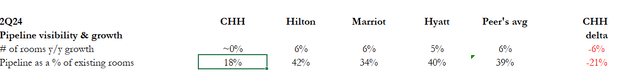

As for the poorer pipeline quality, this not only reduces the visibility of room growth but also means that CHH has less room to fail when construction gets delayed (due to the tough funding environment for hotel construction). In other words, other players have more rooms in the pipeline so that they can continue to grow the number of rooms if a portion of the pipeline gets impacted (18% in the chart is derived from dividing the ~115k pipeline rooms by total number of rooms). This is not the same for CHH, given the lower percentage.

Poor FCF conversion profile

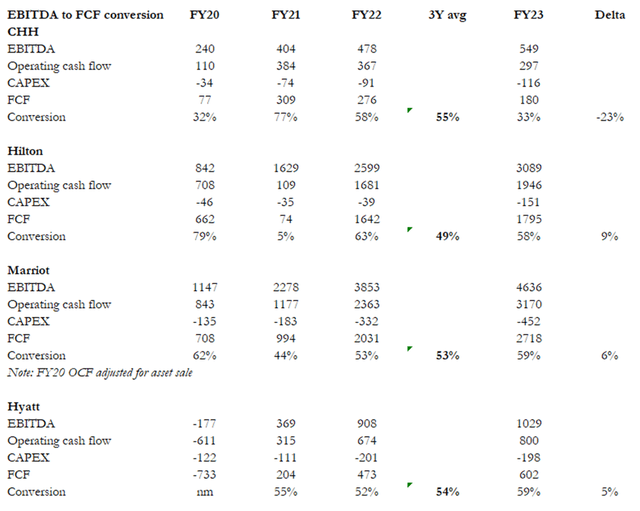

Ultimately, what matters most to investors is the free cash flow, and even in this aspect, CHH underperforms. Unlike other peers, CHH is the only player that has seen worsened FCF conversion trends. The bigger implication from this is that it may impact the capital return story for investing in hotel operators. The common characteristics among all peers are that they are very cash flow-generating (asset-light nature), and the companies typically buy back a lot of shares per year.

With RevPAR being heavily pressured, the number of rooms (the actual number of rooms operating as of 2Q24) not growing (and having the potential to stay weak in the near term given where rates are), and a poor FCF conversion rate (a step-up in CAPEX investments), this increases the risk of lower capital returns, which makes CHH screens even less attractive vs. peers.

Valuation

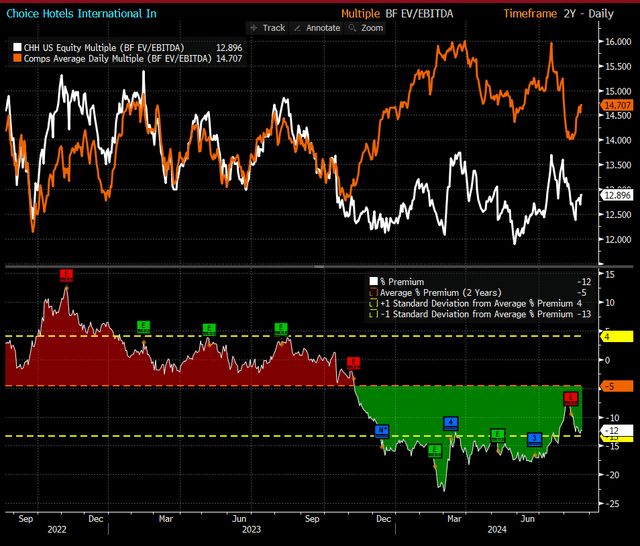

As an investor who is allocating capital to an industry, it makes very little sense to invest in an operator that is relatively underperforming. While the CHH valuation gap vs. peers has widened and is now trading at a big discount, I believe the fundamental dynamics I have laid out above will cause CHH to continue trading at a discount to peers for the foreseeable future.

At this rate, I expect CHH to continue trading at ~13x forward EBITDA and has the potential to fall further if performance comes in weaker than expected (which can be due to a worsening macro situation or more underperformance relative to peers).

Risk

The uncertain aspect is when will the overall consumer spending environment recover. If it does, it will surely benefit CHH, and this may drive better than RevPAR improvements, and better rooms growth as cost of funding comes down for hotel developers. Given that valuation is trading way below peers, this leaves a lot of room for an upside re-rating. Moreover, while the number of rooms is not growing, CHH has managed to accelerate its pipeline growth from low-teens percentage to ~22% in 2Q24. If all of these translates to room growth eventually (well executed), rooms growth may accelerate.

Conclusion

My hold rating on CHH is because of the macro headwinds and CHH relative underperformance within the industry. My belief is that the industry will face near-term headwinds and perform badly, and coupled with CHH’s weaker RevPAR growth and room pipeline, it is very likely that the stock will continue to trade at a discount to its peers. Furthermore, the company’s poor free cash flow conversion profile makes me worried about its ability to continue buying back shares. While CHH may benefit from a potential improvement in the macroeconomic environment, its current fundamentals and outlook warrant a hold rating.