Images By Tang Ming Tung/DigitalVision via Getty Images

Introduction

ScanSource, Inc. (NASDAQ:SCSC) recently reported its FY24 numbers, which the market seems to like, so I wanted to go over these and give some thoughts on the company’s outlook and look at some valuation assumptions to match the potential outlook. I would like to see top-line growth return and margins improve before considering it a good investment. Therefore, I am initiating with a hold rating for now.

Briefly on the Company

ScanSource is a value-added distributor or VAD of specialty technology products. What this means is that the company partners with many different manufacturers of products such as barcode scanners, RFID devices, point-of-sale terminals, software, and peripherals and connects them with potential clients that are looking for such products, particularly in retail and hospitality areas but are not limited to these areas specifically. The company is essentially a middleman that connects manufacturers and resellers of such products.

Key suppliers include AT&T Inc. (T), Cisco Systems, Inc. (CSCO), Honeywell International Inc. (HON), Fortinet, Inc. (FTNT), Dell Technologies Inc. (DELL), and many others.

Q4 Results

The company’s top line was $746.11M, -21.2% y/y, and a miss of $87.19M. Non-GAAP EPS came in at $0.80, +5% y/y, and in line with consensus.

The company saw a 14% decline in the top line, y/y for the full year, and a decline in non-GAAP EPS of -20% y/y. In terms of profitability and efficiency, the company’s gross margins took a hit of around -10% y/y.

The management is happy with the performance for the quarter, which was helped by an “improved favorable mix, higher concentration of recurring revenues from Intelisys, and a significant reduction in working capital from lower sales”, and other various working capital efficiency improvements. In other words, it could have been much worse than it turned out.

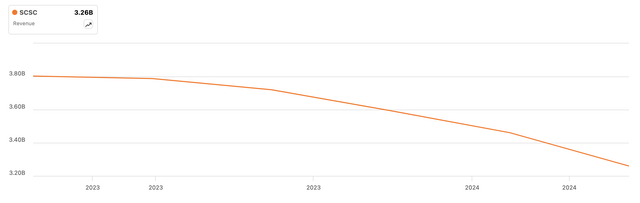

It is quite a big drop in the top line in my opinion. Over the last year, the decline has accelerated. Management did not provide a forecast for the next quarter, however, for FY25, they expect the top line to come in at $3.1B to $3.5B, which is in line with the analysts’ midpoint estimates. However, it is a bit of a wide range, and I would expect it to narrow over time. There doesn’t seem to be much growth expected for the upcoming year but, as I said, that may change. Let’s look at the rest of the financials to see how the company performed over the last while.

Financials

We can see a revenue decline over the last year, which, as I mentioned before, seems to be accelerating. However, if the company’s sales come in above estimates, we may see a turnaround, but I would like to see a couple more quarters before coming to that conclusion.

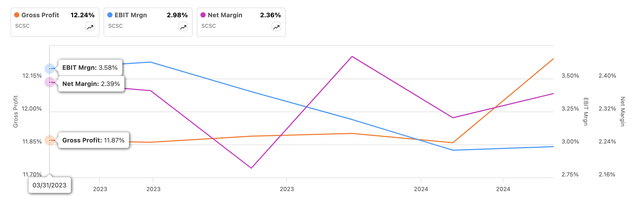

The company operates in a very tight-margin business, so any improvements here will be very positive in the long run and will affect the company’s valuation significantly. Here, we can see that margins across the board have started to improve since the last quarter, but since the beginning of 2023, these are still worse. I am hopeful though that future efficiency strategies will bring it back to better profitability or at least match that of the beginning of 2023. Gross margins look like they have improved over 2023, which is a very good start.

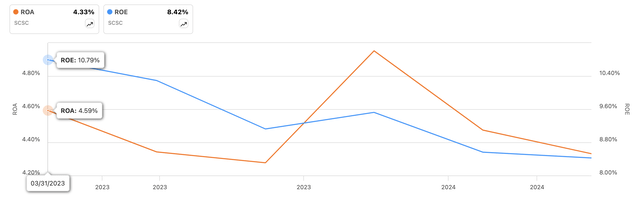

Continuing with efficiency and profitability, the company’s ROA and ROE have been trending down recently, and even at the beginning of 2023, these weren’t very impressive. I am looking for at least 5% on ROA and 10% for ROE. It seems that over the last year, the company’s efficiency and profitability have gone down. Management was unable to offset the declines in the top line as efficiently as possible, leading to a decrease in efficiency in the company’s assets and shareholder capital. However, if we do see further improvements trickle down to the bottom line over the next while, the metrics below will see an improvement as well.

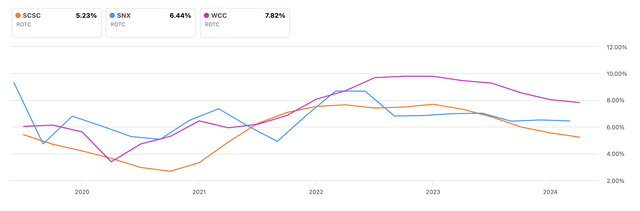

In terms of competitive advantage, I like to look at the company’s ROTC and compare it to its peers. The graph below shows us a couple of its peers that I got from the most recent 10-K report, which was filed on August 27. We can see that the sizes of these companies vary quite a bit, so the comparison won’t be as ideal, however, what we can see is that the industry seems to exhibit quite low ROTC overall, which is not what I like in my investment. I am usually looking for at least a 10% return here, and we can see that SCSC is the lowest out of the three. That tells me that the company may not have a competitive advantage or a moat.

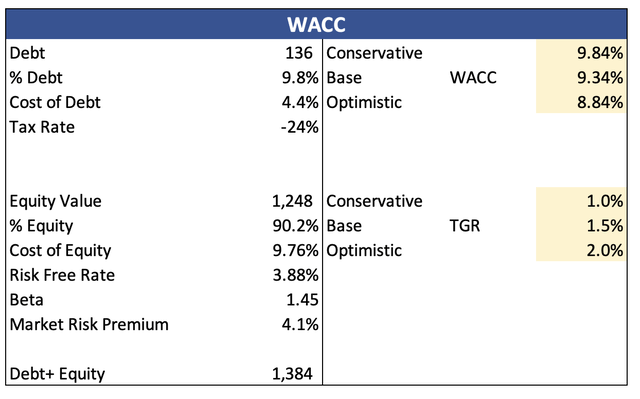

In terms of the company’s financial position, as of FY24, the company had around $185m in cash and equivalents, against $136m in long-term debt. The debt outstanding is not a problem in my opinion. It is easily covered by cash, and on top of that, the company’s interest coverage ratio is around 7x, meaning its EBIT can easily cover annual interest expense on debt. Many analysts say that 2x is healthy. Therefore, the company is at no risk of insolvency.

Overall, I don’t like where the company is headed. It is not completely unsurprising that the company has performed this way over the last year. We are in a tough economic situation, where high interest rates dictate how the consumer behaves. In this case, too high of an interest rate means customers are holding off from purchasing new equipment, especially if they have the time and are not in a rush.

Comments on the Outlook

Will AI help its Top-line Growth?

So, many companies have been jumping on this AI hype. The Intelisys part of the Modern Communication & Cloud Segment was the only one that achieved positive returns y/y. I like the segment’s recurring revenue model. It provides the company with a more predictable revenue stream, there may be some economies of scale in the long run, if there are a lot of customers. Back in July, Ken Mills was appointed as President of Intelisys, so it will be interesting to see how he will perform in this post over the next year or so. Is he going to turn this segment into the main catalyst that will propel the company’s top-line growth? Only time will tell, but with further investments in 5G and AI technologies within the segment, I could see some rejuvenation happening over the coming years, as long as management doesn’t drop the ball.

Margins

This leads me to talk about margins. Intelisys’ recurring revenue model should translate into higher margins, as this type of revenue usually comes with higher efficiency. Once the customer has been onboarded, there should be no more, or very little costs to manage said customer.

ScanSource also hopes that the latest two acquisitions will play a decent role in improving the company’s efficiency and profitability. The acquisition of Resourcive and Advantix should help its margin profile because both of these are high-margin, recurring revenue businesses, and according to management are capital-light. Since both of these have just been finalized, it will be interesting to see how ScanSource’s margin profile will change over the next few quarters, but I think it will be in the positive direction.

Let’s look at a hypothetical valuation model.

Valuation

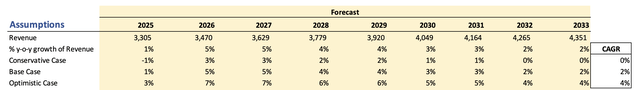

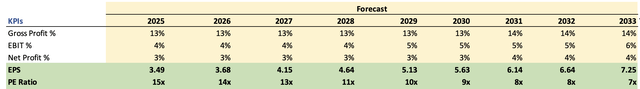

Analysts (three of them) estimate around 1% growth in revenues in FY25 and around 5% in FY26. I decided to take these at face value, which may change over the coming quarters, but it doesn’t seem unreasonable. The economy will improve, the demand will pick back up and so the company’s top-line growth should return. However, I will keep it conservative, and for the next decade, I went with around 2% growth. For reference, the company’s 10-year CAGR is flat, the 5-year CAGR is 1.7%, and the 3-year CAGR is -3.9% because of FY24 numbers. Without the disastrous FY24 numbers, these would have been positive, and I don’t see why the future won’t start to improve.

In terms of margins, with the recent acquisitions and a focus on Intelisys, I decided to improve margins slightly across the board. Nothing too optimistic since the company will continue to operate in a tight-margin business, but let’s say these higher-margin segments do improve profitability slightly.

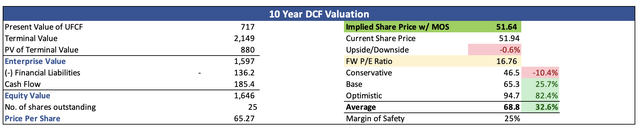

For the DCF model, I went with the company’s WACC of 9.3% as my discount and a 1.5% terminal growth rate.

Additionally, I wanted to give myself more room for error in my estimates, so I added another 25% discount to the final intrinsic value calculation. With that said, ScanSource’s intrinsic value is around $52 a share, meaning it is currently trading at its fair value.

Closing Comments

I am assigning ScanSource a hold rating, to begin with. The reason is I want to see the next couple of quarters of improvements on the top line and efficiency metrics. I would like to see how Intelisys continues to perform and whether the new boss will take advantage of all the advanced technology like AI and 5G and incorporate them properly into the growth strategy. Furthermore, I would like to see how accretive the newest additions mentioned are to the overall business margin profile.

For now, I think there is a bit of uncertainty about how these will pan out, but if everything is executed correctly, I could see the value created over the long term. I will revisit the company in the following few quarters and decide whether I want to invest or not, until then, I will keep an eye out for any other developments.