NoDerog

I have been very skeptical of The J. M. Smucker Company (NYSE:SJM) stock for quite a while, as the management has adopted a rather unpopular approach to grow the business through large acquisitions.

It usually takes time before poor capital allocation decisions translate into the share price, and this did happen for SJM in calendar year 2023. Following the drop, I turned neutral on the stock in December, but also highlighted some ongoing risks for shareholders.

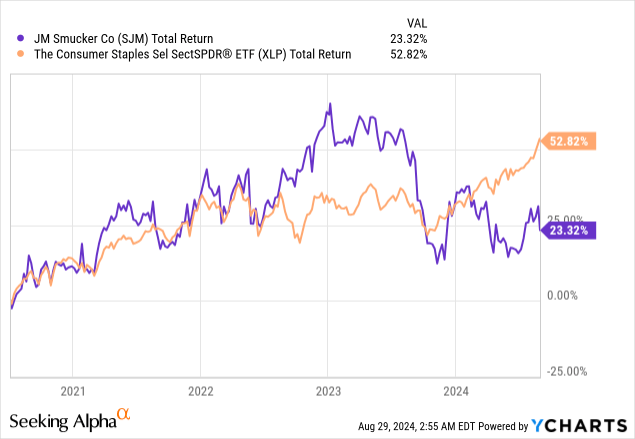

Since then, SJM stock continued to disappoint, and the gap between the Consumer Staples Select Sector SPDR® Fund ETF (XLP) has widened even further.

As a result, it now appears that SJM is becoming too cheap to ignore, but this could be very misleading as far as future returns are concerned.

A Mixed Picture

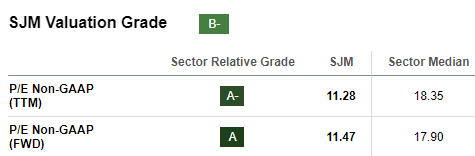

It is hard to make a case that the SJM stock is not very conservatively priced at the moment. Simply looking at the company’s forward price/earnings ratio relative to the sector median gives a good starting point.

Seeking Alpha

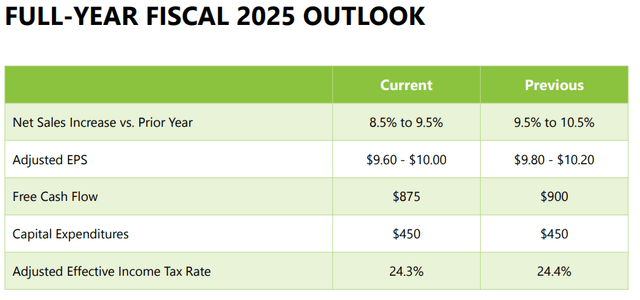

The multiple, however, is that low for a good reason. The current guidance for fiscal year 2025 assumes adjusted earnings per share to be within the range from $9.6 to $10, which was slightly lowered during the latest earnings release from the initial guidance provided a couple of months ago.

J. M. Smucker Investor Presentation

In comparison, however, SJM reported adjusted earnings per share of $9.94 in 2014, which means that growth in fiscal year 2025 would be essentially flat. When evaluating these numbers, we should keep in mind the small divestitures made recently and the acquisition of Hostess Brands, which I criticized back in December of last year.

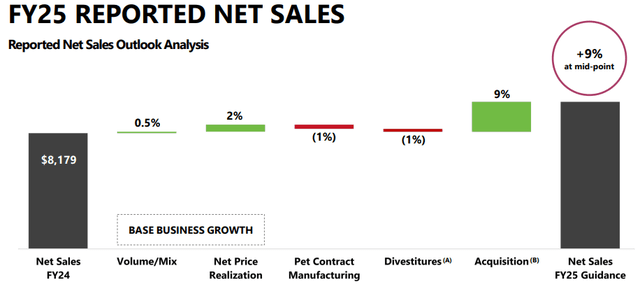

The acquisition is also the main reason why SJM would grow its topline in fiscal year 2025 with volume/mix and higher prices expected to contribute 0.5% and 2% respectively.

J. M. Smucker Investor Presentation

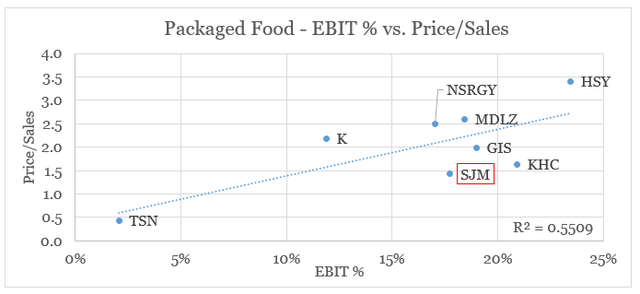

When compared to its major peers in the Packaged Food space, SJM appears to be very conservatively priced. As a matter of fact, once we factor in current operating margins (plotted on the x-axis on the graph below), the stock appears undervalued (below the trend-line below) based on its current price/sales multiple of 1.4.

Prepared by the author, using data from Seeking Alpha

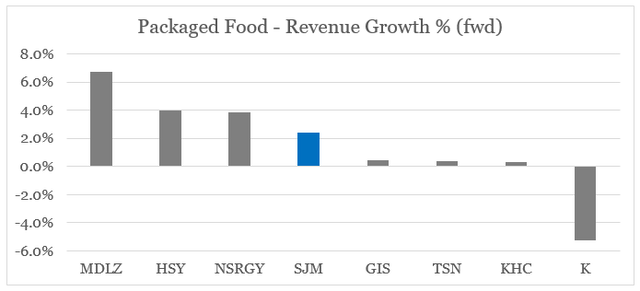

When incorporating expected revenue growth we could see why some peers, such as Mondelez (MDLZ), Nestlé (OTCPK:NSRGY) and Hershey (HSY), trade above the trend-line. Each one of them operates in the highly attractive snacking segment of the market, and they are also expected to be the highest-growth businesses within the peer group.

SJM comes fourth in terms of forward revenue growth, but this estimate is most likely influenced by the aforementioned acquisition.

Prepared by the author, using data from Seeking Alpha

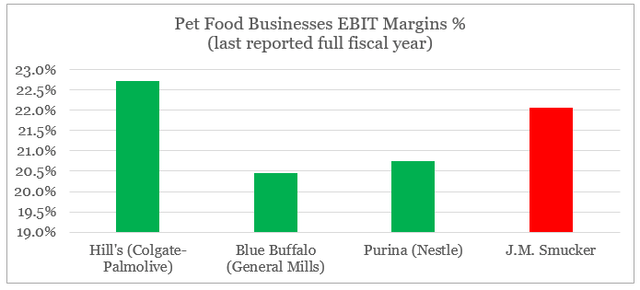

The good news is that following the recent divestiture of some pet food assets, SJM’s Pet Food segment is now highly profitable when compared to peers. On the graph below, we could see how SJM’s per food business compares to Colgate-Palmolive’s (CL) Hill’s business, General Mills’ (GIS) Blue Buffalo and Nestlé’s (OTCPK:NSRGY) pet food business in terms of operating profitability.

Prepared by the author, using data from SEC Filings

This is very different from the situation back in March 2021, when SJM’s pet food business was at the very bottom in terms of profitability.

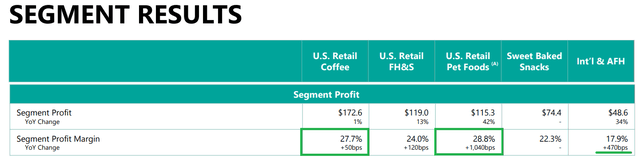

In addition to the Pet Food segment, we also saw margin improvements in the retail coffee and international business units, which is encouraging for long-term investors.

J. M. Smucker Investor Presentation

Long-Term Risks

Speaking about long-term investors in SJM, the main issue that I have with the company is capital allocation. In recent years, SJM’s management has been too aggressive in its M&A strategy, which has been a cause of concern to me for a number of years now.

The latest deal for Hostess Brands also gave the company exposure to areas where, in my view, synergies and economies of scale would be harder to realize. I just recently compared this strategy to the one utilized by Mondelez management, where the company focuses on acquiring smaller businesses in adjacent product segments which are highly complementary for existing product lines.

Another potential issue for long-term investors is related to the company’s dividend policy and leverage. So far, this does not appear to be a problem, but if the company stays on its current course, it could easily turn into a major issue.

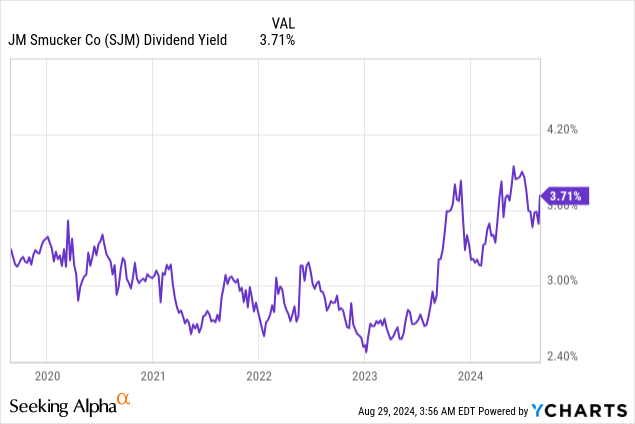

On the surface, SJM appears as a very attractive dividend opportunity, with current yield approaching 4% (see below).

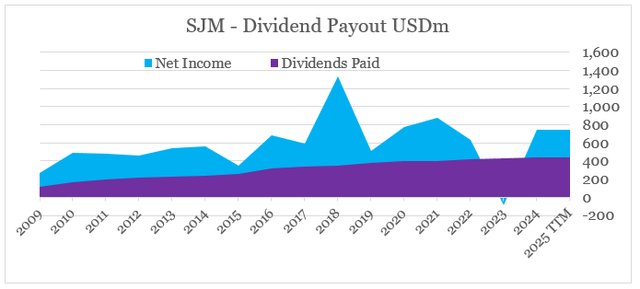

However, the gap between the company’s annual dividend payments and its net income has been gradually reduced over the past decade as earnings remained range-bound while dividends have been consistently increasing.

Prepared by the author, using data from SEC Filings

Just recently SJM’s management announced yet another dividend increase, albeit by a very small amount – from $1.06 to $1.08 per common share. The reason for that was likely to appease shareholders, while also being mindful of the risks ahead as far as SJM’s dividend payout ratio is concerned.

J. M. Smucker Website

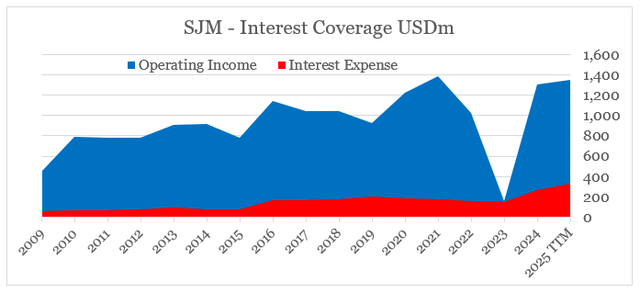

In the meantime, SJM also significantly increased its debt in recent years and the annual net interest expense is now at around $100m on a quarterly basis, compared to only $32m a year ago.

Once again, this is not an immediate issue, as the annual interest expense is still a relatively small proportion from the company’s operating income (see the graph below).

Prepared by the author, using data from SEC Filings

In combination with the higher dividend payout ratio and the lack of earnings growth in FY 2025, however, this could soon become a major problem. That is why, investors are rightfully punishing SJM with a lower multiple at the moment and are looking for stronger indications that the company could grow its earnings organically.

Conclusion

After significantly underperforming the sector, J. M. Smucker’s stock is now priced conservatively and is likely to attract more value-seeking investors. The current valuation, however, is low for a number of reasons – lack of organic growth opportunities, risky M&A-led growth strategy and potentially dividend-related issues. Based on all that, I’m wary of SJM’s prospects and retain my hold rating for the time being.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.