simonmayer

My Thesis Update

I initiated coverage of Petróleo Brasileiro S.A. – Petrobras (NYSE:PBR) here on Seeking Alpha about 3 months ago, giving the stock a “Hold” rating as it seemed cheap indeed (both on absolute and comparative basis), but I feared that the firing of the former CEO Jean Paul Prates could significantly increase risks, especially concerning the shareholder return policies. So far, those risks haven’t materialized, and the stock is doing quite well actually, being almost in line with the broader US market:

Seeking Alpha, Oakoff’s coverage of PBR stock

Maybe I’m too skeptical of PBR, but to this day, I think “Hold” is the most accurate rating for the stock.

My Reasoning

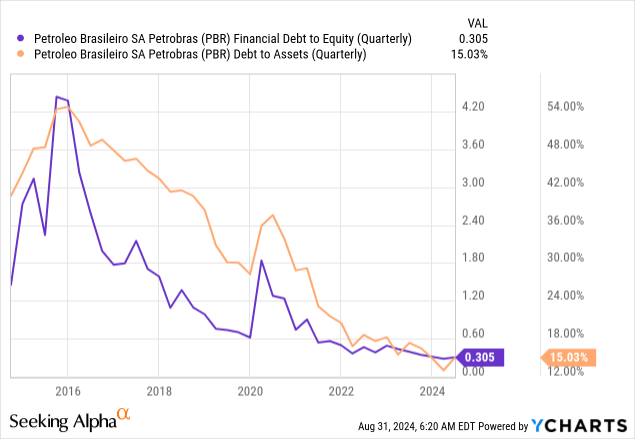

Petrobras, Brazil’s largest national oil company, operates as an integrated entity with significant government influence as the Brazilian state maintains control over >50% of voting rights and ~29% of total shares, ensuring a strong governmental presence in the company’s decision-making processes. In recent years, Petrobras has undergone a strategic transformation, scaling back its international presence and divesting mature assets to refocus its efforts. Thanks to the recovery in oil prices following the COVID crisis, those efforts have led to a stabilization of the company’s credit position: Both debt to equity and debt to assets continue to decline on a quarterly basis.

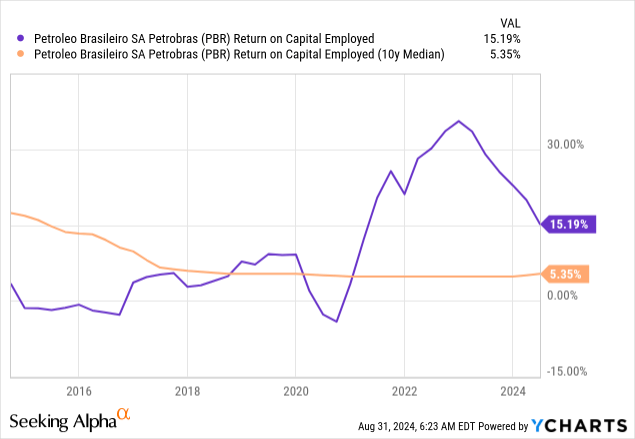

Also, as I mentioned in my previous article, PBR’s current strategy centers on developing its world-class pre-salt deepwater oil and gas resources within Brazilian waters. This pivotal shift has yielded impressive results, markedly enhancing Petrobras’s profitability and fortifying its financial position – the net positive impact of this strategic realignment is especially evident in the company’s improved return on capital employed, showcasing a remarkable turnaround in its operational and financial performance.

However, the ROCE ratio has fallen quite rapidly recently: it’s still around three times higher than the 10-year median, but the overall trend looks worrying.

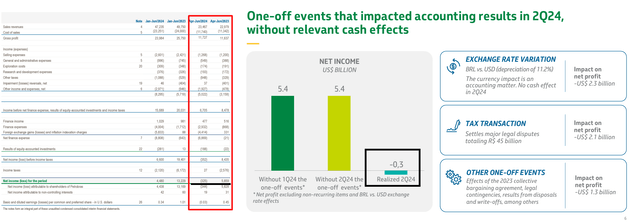

Indeed, the Q2 2024 results showed continued issues with the profitability, but it’s far from the only thing that makes me cautious. Although PBR’s operational performance remained robust, with oil and gas production climbing 2.4% YoY and an impressive 81% contribution from pre-salt fields, the consolidated revenue fell by over 8% YoY. The refining utilization factor held steady above 90%, which I think reflects strong domestic demand and efficient operations. Anyway, the gross profit margin declined by 74 basis points, according to Seeking Alpha data, which led to poorer EBIT (even though it looked solid overall). Despite generating a healthy EBITDA of $12 billion and free cash flow of ~$6.1 billion, Petrobras reported an adjusted net income of $5.4 billion (and an unadjusted net loss of $325 million), which we see was impacted by the $2.3 billion exchange rate hit and a $2.1 billion tax agreement expense.

PBR’s IR materials, financial statements, Oakoff’s notes added

[Source – IR materials]

Despite the current conflict in the Middle East and still strong consumer demand in the West – theoretically very bullish news for crude oil prices – WTI and Brent are largely stagnant and not rising as many (including myself) have predicted. As such, I’m a little concerned about how the company’s plans to increase CapEx in the foreseeable future, as stated on the last earnings call, can be justified. There’s a risk that these investments will not be worthwhile if oil prices continue to fall.

… our CapEx totaled $6.4 billion in the first half of 12% higher than in the first half of ’23. We project to end 2024 with investments ranging from USD 13.5 million to USD 14.5 billion, which is an increase of 7% to 15% compared to 2023. [the CEO comment]

What I can tell you is that we’re going to try to deliver a CapEx that’s realistic and that provides growth for the company. Our CapEx for this year is higher than the CapEx for last year. And certainly, the one for next year is going to be higher than this year’s CapEx. I can guarantee that to you. [Fernando Melgarejo, executive director]

So that’s why I believe the increased CapEx and ongoing challenges in obtaining environmental licenses could pose headwinds for future growth.

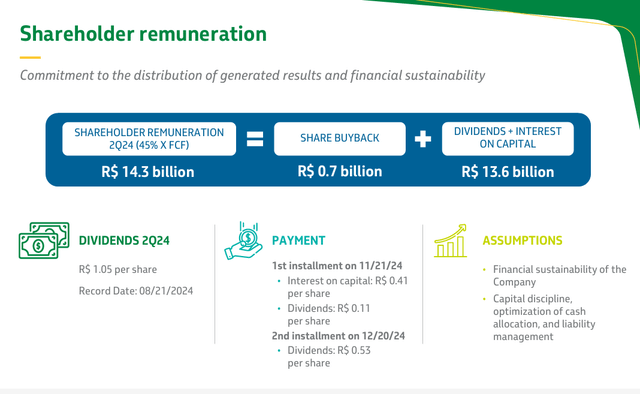

On the bright side, I’m particularly impressed by the company’s continued deleveraging efforts, with gross debt reduced to $59.6 billion and a robust cash position of >$13 billion. The announced dividend of BRL 1.05 per share, totaling BRL 14.3 billion, indeed signals management’s confidence in the company’s cash generation capabilities going forward.

In my last article, I mentioned that I was worried about the shareholder return policy after the new CEO took office, but as the last quarter results and the comments show, all has not been so terrible, actually. However, I think it’s very important to note here that too little time has passed and the situation in the O&G market for PBR has been more or less quiet, so management has had the ability to keep paying, so to speak. What will happen next and whether the risks I wrote about above will materialize is still very hard to say.

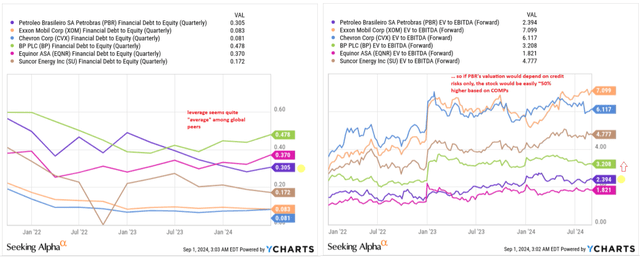

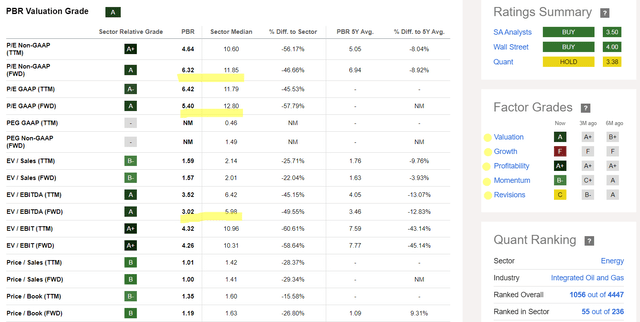

What hasn’t changed is Petrobras’s undervaluation. In absolute terms, however, it has become somewhat less attractive. Last time, I pointed out that looking at the EV/EBITDA ratio for next year, we’d see that Petrobras was trading at just 2x, while the market norm was ~4x at the time. Today, PBR is trading at 3x EV/EBITDA, which is still well below the industry median, but nevertheless, the valuation discount has narrowed somewhat. Seeking Alpha’s Quant Rating also takes note of this change and lowers PBR’s rating from “A+” to just “A” (which of course does not make Petrobras expensive in either case).

Seeking Alpha, Oakoff’s notes added

Given the fact that PBR has further deleveraged, current valuation multiples should still make the company one of the most attractive giants in the O&G sector globally. The company’s consistently robust margins, impressive free cash flow generation (after adjusting for one-off events), and recent success in deleveraging efforts paint a compelling picture. In my assessment, when compared to its global oil and gas peers, I think it’s reasonable to suggest that Petrobras stock could be trading at a level approximately 50% higher than its current price:

However, it’s crucial to remember that this potential upside exists in a vacuum. It’s unfortunate that Petrobras is under pressure from geographic and political risks – otherwise, today’s discount would be extremely attractive.

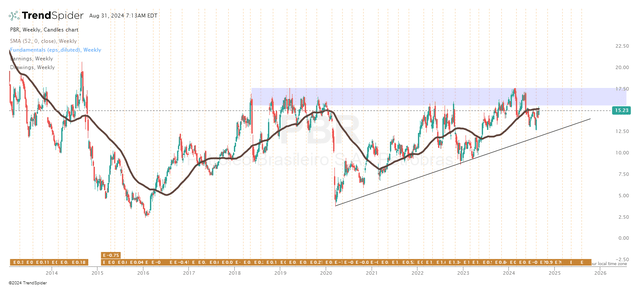

Talking about PBR’s technicals, I’d like to note that the stock may be under pressure in the next few weeks as it approaches the long-term resistance level formed back in 2018.

TrendSpider Software, PBR weekly, Oakoff’s notes

It may take longer for the stock to consolidate, or PBR may need a breakthrough quarterly result to grow out of its already discounted valuation and give the stock price a boost. However, given the company’s current CapEx plan and the risks of falling oil prices in 2025-2026, I think a strong catalyst is doubtful.

Your Takeaway

While Petrobras stock might appear undervalued by just looking at its multiples and solid FCF generation capacity, with potential upside exceeding 50% based on comparative valuations (based on SA Quant rating), I believe it’s crucial to consider the heightened political and geographical risks that still surround the company.

I believe there’s a real concern that if oil prices continue to fall or even remain flat, Petrobras’s substantial CapEx might not yield the expected returns, potentially straining the company’s financial position. Therefore, I believe that Petrobras’ valuation discount is likely to persist or even widen, possibly causing stock prices to stagnate or fall further. The technical picture partially confirms that it may be some time before PBR’s attempt to move higher from here bears fruit.

Consequently, I think it’s prudent for investors to either wait for more attractive entry points or just hold Petrobras stock if it was bought at way cheaper levels – I can’t upgrade it to “Buy” given the significantly elevated risk profile.

Good luck with your investments!